Question

B Use the following information about Rat Race Home Security, Inc. to answer the questions: Average selling price per unit $306. Variable cost per unit

B

Use the following information about Rat Race Home Security, Inc. to answer the questions:

Average selling price per unit $306.

Variable cost per unit $186

Units sold 423

Fixed costs $8,031

Interest expense $18,479

Based on the data above, what is the degree of financial leverage of Rat Race Home Security, Inc.?

Your Answer:

C

Haunted Forest, Inc.is selling fog machines.

Use the following information about Haunted Forest, Inc. to answer the following questions.

Average selling price per unit $320.

Variable cost per unit $198

Units sold 305

Fixed costs $16,345

Interest expense $3,001

Based on the data above, what will be the resulting percentage change in earnings per share if they expect units produced and sold to change 8.3 percent?

(You should calculate the degree of total (combined) leverage first).

(Write the percentage sign in the "units" box).

Round the answer to two decimals

Your Answer:

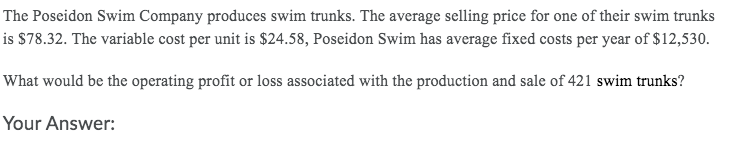

The Poseidon Swim Company produces swim trunks. The average selling price for one of their swim trunks is $78.32. The variable cost per unit is $24.58, Poseidon Swim has average fixed costs per year of $12,530. What would be the operating profit or loss associated with the production and sale of 421 swim trunks? YourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started