Answered step by step

Verified Expert Solution

Question

1 Approved Answer

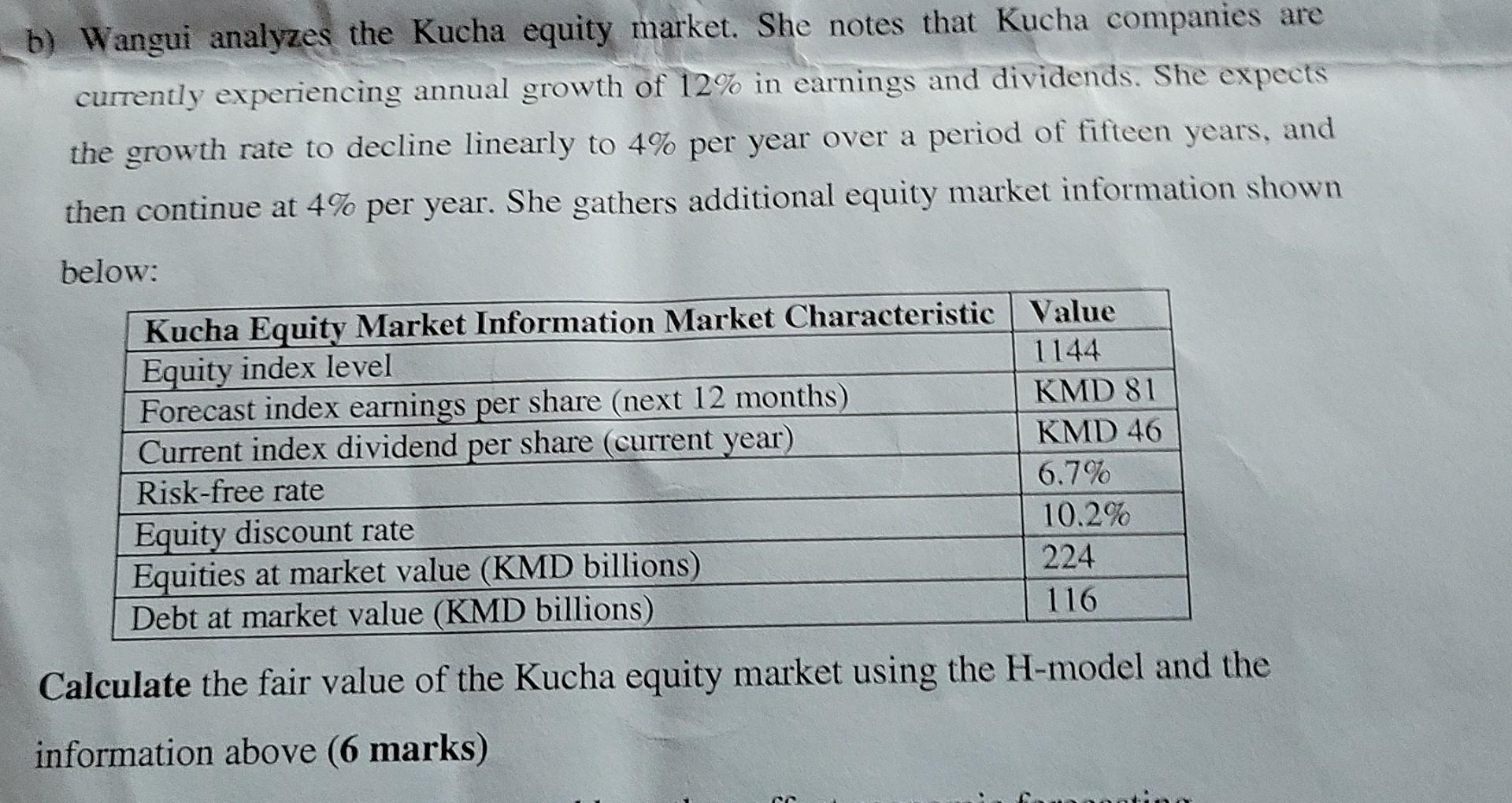

b) Wangui analyzes the Kucha equity market. She notes that Kucha companies are currently experiencing annual growth of 12% in earnings and dividends. She expects

b) Wangui analyzes the Kucha equity market. She notes that Kucha companies are currently experiencing annual growth of 12% in earnings and dividends. She expects the growth rate to decline linearly to 4% per year over a period of fifteen years, and then continue at 4% per year. She gathers additional equity market information shown below: Kucha Equity Market Information Market Characteristic Value Equity index level 1144 Forecast index earnings per share (next 12 months) KMD 81 Current index dividend per share (current year) KMD 46 Risk-free rate 6.7% Equity discount rate 10.2% Equities at market value (KMD billions) 224 Debt at market value (KMD billions) 116 Calculate the fair value of the Kucha equity market using the H-model and the information above (6 marks) b) Wangui analyzes the Kucha equity market. She notes that Kucha companies are currently experiencing annual growth of 12% in earnings and dividends. She expects the growth rate to decline linearly to 4% per year over a period of fifteen years, and then continue at 4% per year. She gathers additional equity market information shown below: Kucha Equity Market Information Market Characteristic Value Equity index level 1144 Forecast index earnings per share (next 12 months) KMD 81 Current index dividend per share (current year) KMD 46 Risk-free rate 6.7% Equity discount rate 10.2% Equities at market value (KMD billions) 224 Debt at market value (KMD billions) 116 Calculate the fair value of the Kucha equity market using the H-model and the information above (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started