Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) What is the firm's expected cash flow from the two-year zero-coupon bond now? Write your answer in unit of million dollars. (Remember to check

(b) What is the firm's expected cash flow from the two-year zero-coupon bond now? Write your answer in unit of million dollars. (Remember to check the hints if you need help.)

(c) What is the firm's expected cash flow from the one-year zero-coupon bond now? Write your answer in unit of million dollars. (Remember to check the hints if you need help.)

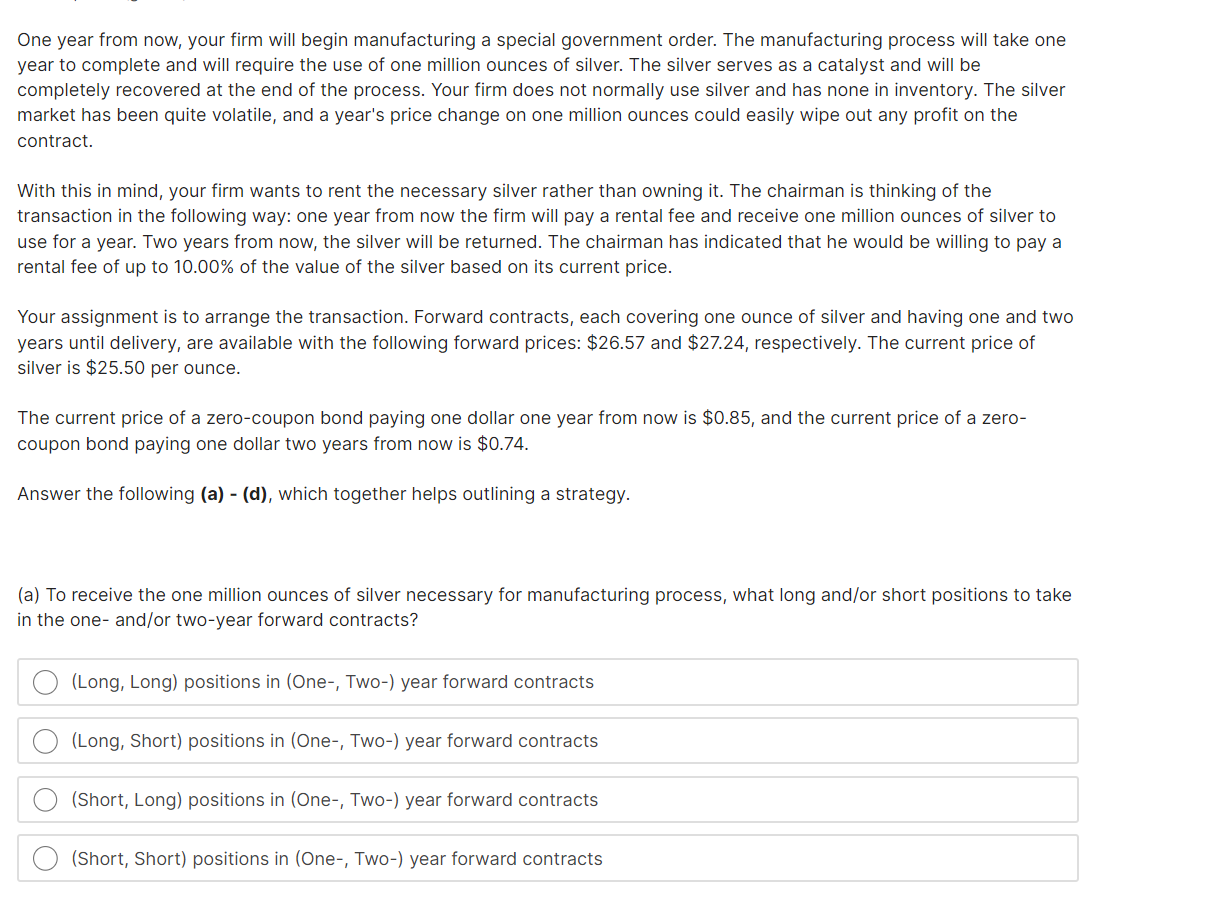

One year from now, your firm will begin manufacturing a special government order. The manufacturing process will take one year to complete and will require the use of one million ounces of silver. The silver serves as a catalyst and will be completely recovered at the end of the process. Your firm does not normally use silver and has none in inventory. The silver market has been quite volatile, and a year's price change on one million ounces could easily wipe out any profit on the contract. With this in mind, your firm wants to rent the necessary silver rather than owning it. The chairman is thinking of the transaction in the following way: one year from now the firm will pay a rental fee and receive one million ounces of silver to use for a year. Two years from now, the silver will be returned. The chairman has indicated that he would be willing to pay a rental fee of up to 10.00% of the value of the silver based on its current price. Your assignment is to arrange the transaction. Forward contracts, each covering one ounce of silver and having one and two years until delivery, are available with the following forward prices: $26.57 and $27.24, respectively. The current price of silver is $25.50 per ounce. The current price of a zero-coupon bond paying one dollar one year from now is $0.85, and the current price of a zerocoupon bond paying one dollar two years from now is $0.74. Answer the following (a) - (d), which together helps outlining a strategy. (a) To receive the one million ounces of silver necessary for manufacturing process, what long and/or short positions to take in the one- and/or two-year forward contracts? (Long, Long) positions in (One-, Two-) year forward contracts (Long, Short) positions in (One-, Two-) year forward contracts (Short, Long) positions in (One-, Two-) year forward contracts (Short, Short) positions in (One-, Two-) year forward contractsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started