Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) What is the net loss reported in 2020 on the income statement, given your response(s) above (please compute and show below)? c) Given that

b) What is the net loss reported in 2020 on the income statement, given your response(s) above (please compute and show below)?

c) Given that Madness has positive pretax income in 2021, what amount of taxable income would be shown for 2021? Assume that taxable income and pretax accounting income are the same except for the carryforward effects.

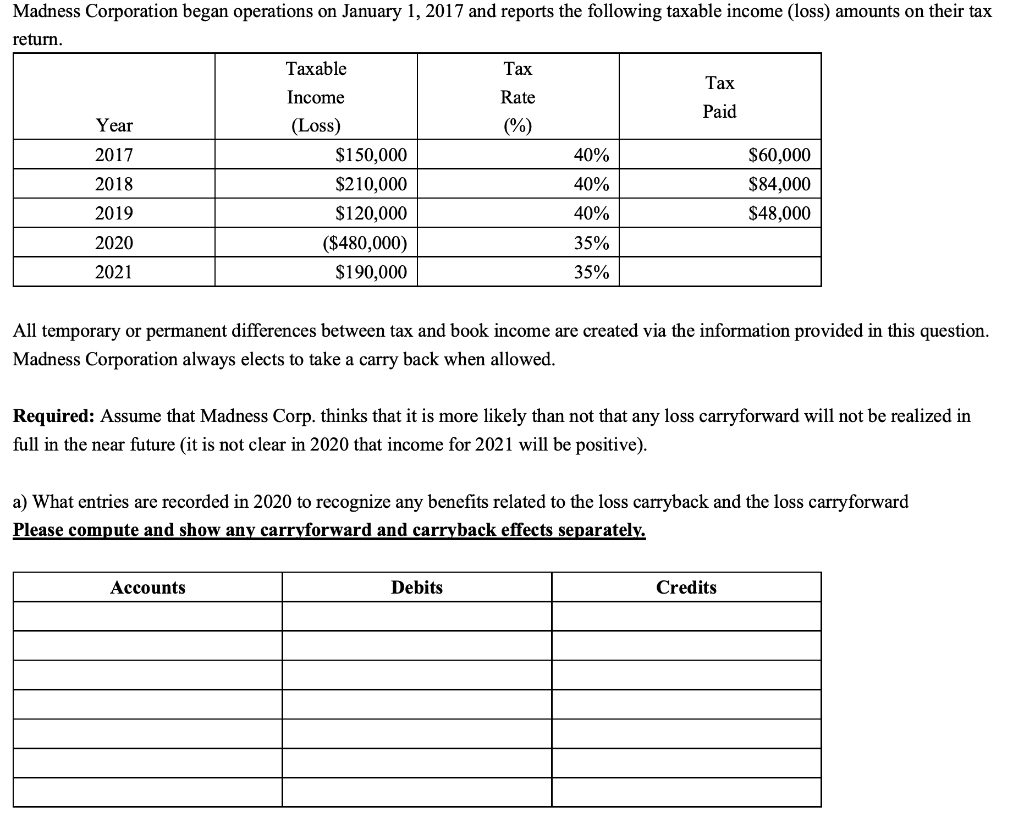

Madness Corporation began operations on January 1, 2017 and reports the following taxable income (loss) amounts on their tax return. Taxable Tax Tax Income Rate Paid Year (Loss) 2017 $150,000 40% $60,000 2018 $210,000 40% $84,000 2019 $120,000 40% $48,000 2020 ($ 480,000) 35% 2021 $190,000 35% All temporary or permanent differences between tax and book income are created via the information provided in this question. Madness Corporation always elects to take a carry back when allowed. Required: Assume that Madness Corp. thinks that it is more likely than not that any loss carryforward will not be realized in full in the near future (it is not clear in 2020 that income for 2021 will be positive). a) What entries are recorded in 2020 to recognize any benefits related to the loss carryback and the loss carryforward Please compute and show any carryforward and carryback effects separately. Accounts Debits CreditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started