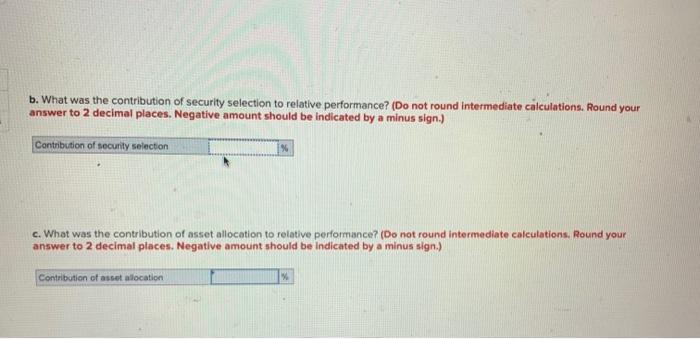

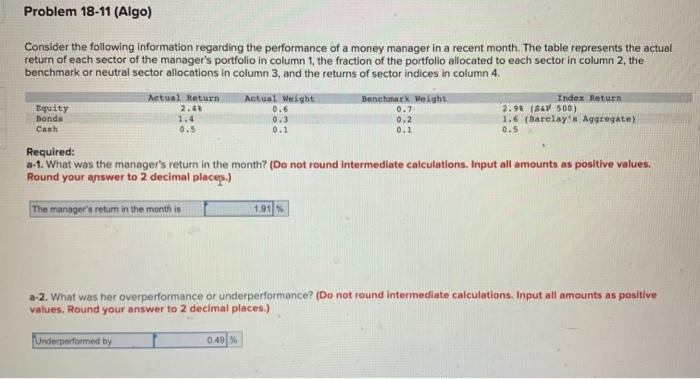

b. What was the contribution of security selection to relative performance? (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) c. What was the contribution of asset allocation to relative performance? (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Consider the following information regarding the performance of a money manager in a recent month. The table represents the actual return of each sector of the manager's portfolio in column 1 , the fraction of the portfolio allocated to each sector in column 2 , the benchmark or neutral sector allocations in column 3 , and the returns of sector indices in column 4. Required: a-1. What was the manager's return in the month? (Do not round intermediate calculations. Input all amounts as positive values. Round your answer to 2 decimal places.) a-2. What was her overperformance or underperformance? (Do not round intermediate calculations. Input all amounts as positive values. Round your answer to 2 decimal places.) b. What was the contribution of security selection to relative performance? (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) c. What was the contribution of asset allocation to relative performance? (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Consider the following information regarding the performance of a money manager in a recent month. The table represents the actual return of each sector of the manager's portfolio in column 1 , the fraction of the portfolio allocated to each sector in column 2 , the benchmark or neutral sector allocations in column 3 , and the returns of sector indices in column 4. Required: a-1. What was the manager's return in the month? (Do not round intermediate calculations. Input all amounts as positive values. Round your answer to 2 decimal places.) a-2. What was her overperformance or underperformance? (Do not round intermediate calculations. Input all amounts as positive values. Round your answer to 2 decimal places.)