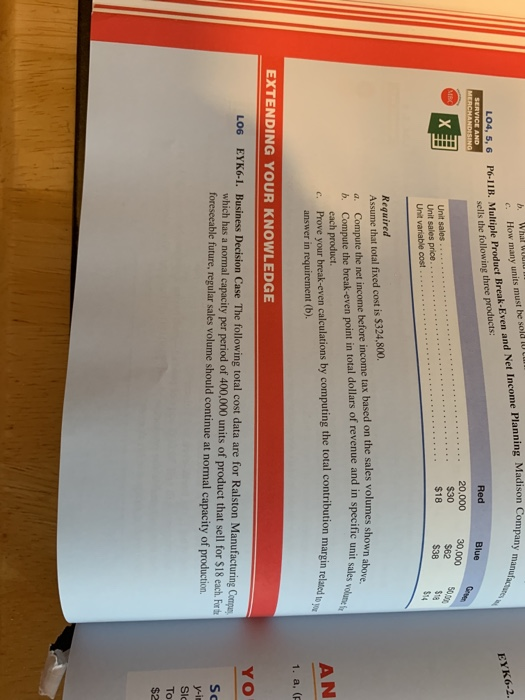

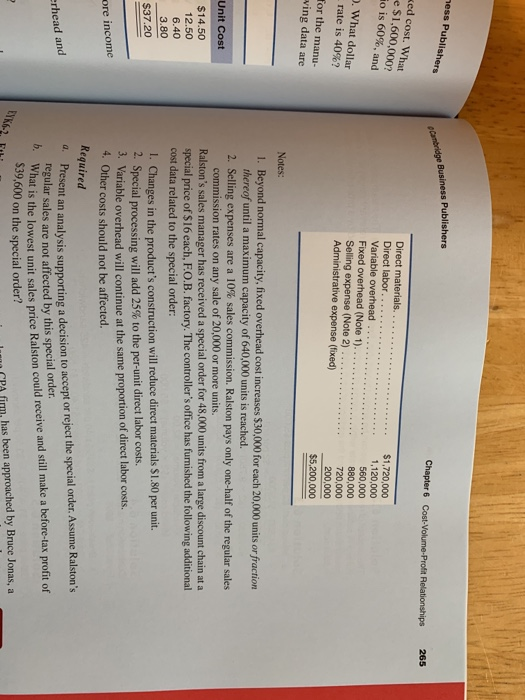

b. What we yn Company manufactu EYK6-2. LO4, 5, 6 c. How many units must be sold ULIN PC-IIB. Multiple Product Break-Even and Net Income Planning Madison Con sells the following three products: Red Blue 30,000 20,000 $30 $18 $62 $38 Unit sales. Unit sales price.. Unit variable cost sales volumes shown above. afic unit sales volumes Required Assume that total fixed cost is $324,800. a. Compute the net income before income tax based on the sales volumes shown b. Compute the break-even point in total dollars of revenue and in specific unit each product. c. Prove your break-even calculations by computing the total contribution margin rolu answer in requirement (b). margin related to you AN 1. a. EXTENDING YOUR KNOWLEDGE LOG YO EYK6-1. Business Decision Case The following total cost data are for Ralston Manufacturing Compu which has a normal capacity per period of 400,000 units of product that sell for $18 each. For the foreseeable future, regular sales volume should continue at normal capacity of production sc SIC mess Publishers pambridge Business Publishers Chapter 6 Cost-Volume-Profit Relationships 265 ked cost. What e $1,600,000? ho is 60%, and Direct materials Direct labor..... Variable overhead .. Fixed overhead (Note 1). Selling expense (Note 2) Administrative expense (fixed) 2. What dollar rate is 40%? for the manu- wing data are $1,720,000 1,120,000 560,000 880,000 720.000 200,000 $5,200,000 Notes: Unit Cost $14.50 12.50 6.40 3.80 $37.20 1. Beyond normal capacity, fixed overhead cost increases $30,000 for each 20,000 units or fraction thereof until a maximum capacity of 640,000 units is reached. 2. Selling expenses are a 10% sales commission. Ralston pays only one-half of the regular sales commission rates on any sale of 20,000 or more units. Ralston's sales manager has received a special order for 48,000 units from a large discount chain at a special price of $16 each, F.O.B.factory. The controller's office has furnished the following additional cost data related to the special order: 1. Changes in the product's construction will reduce direct materials $1.80 per unit. - Special processing will add 25% to the per-unit direct labor costs. Variable overhead will continue at the same proportion of direct labor costs. 4. Other costs should not be affected. Required 4. Present an analysis supporting a decisi scht an analysis supporting a decision to accept or reject the special order. Assume Ralston's regular sales are not affected by this special order. is the lowest unit sales price Ralston could receive and still make a before-tax profit of $39,600 on the special order? I CPA firm, has been approached by Bruce Jonas, a ore income erhead and b. What is the lowest K2 h b. What we yn Company manufactu EYK6-2. LO4, 5, 6 c. How many units must be sold ULIN PC-IIB. Multiple Product Break-Even and Net Income Planning Madison Con sells the following three products: Red Blue 30,000 20,000 $30 $18 $62 $38 Unit sales. Unit sales price.. Unit variable cost sales volumes shown above. afic unit sales volumes Required Assume that total fixed cost is $324,800. a. Compute the net income before income tax based on the sales volumes shown b. Compute the break-even point in total dollars of revenue and in specific unit each product. c. Prove your break-even calculations by computing the total contribution margin rolu answer in requirement (b). margin related to you AN 1. a. EXTENDING YOUR KNOWLEDGE LOG YO EYK6-1. Business Decision Case The following total cost data are for Ralston Manufacturing Compu which has a normal capacity per period of 400,000 units of product that sell for $18 each. For the foreseeable future, regular sales volume should continue at normal capacity of production sc SIC mess Publishers pambridge Business Publishers Chapter 6 Cost-Volume-Profit Relationships 265 ked cost. What e $1,600,000? ho is 60%, and Direct materials Direct labor..... Variable overhead .. Fixed overhead (Note 1). Selling expense (Note 2) Administrative expense (fixed) 2. What dollar rate is 40%? for the manu- wing data are $1,720,000 1,120,000 560,000 880,000 720.000 200,000 $5,200,000 Notes: Unit Cost $14.50 12.50 6.40 3.80 $37.20 1. Beyond normal capacity, fixed overhead cost increases $30,000 for each 20,000 units or fraction thereof until a maximum capacity of 640,000 units is reached. 2. Selling expenses are a 10% sales commission. Ralston pays only one-half of the regular sales commission rates on any sale of 20,000 or more units. Ralston's sales manager has received a special order for 48,000 units from a large discount chain at a special price of $16 each, F.O.B.factory. The controller's office has furnished the following additional cost data related to the special order: 1. Changes in the product's construction will reduce direct materials $1.80 per unit. - Special processing will add 25% to the per-unit direct labor costs. Variable overhead will continue at the same proportion of direct labor costs. 4. Other costs should not be affected. Required 4. Present an analysis supporting a decisi scht an analysis supporting a decision to accept or reject the special order. Assume Ralston's regular sales are not affected by this special order. is the lowest unit sales price Ralston could receive and still make a before-tax profit of $39,600 on the special order? I CPA firm, has been approached by Bruce Jonas, a ore income erhead and b. What is the lowest K2 h