(b) Which method should Victoria Textiles Limited apply to its investment in this subsidiary?

multiple choice

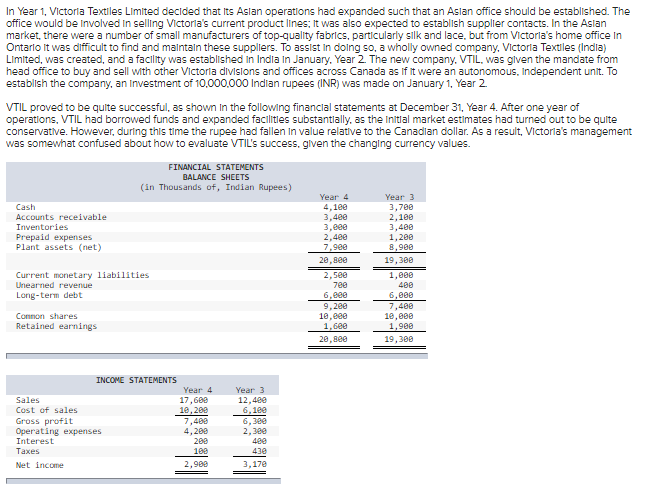

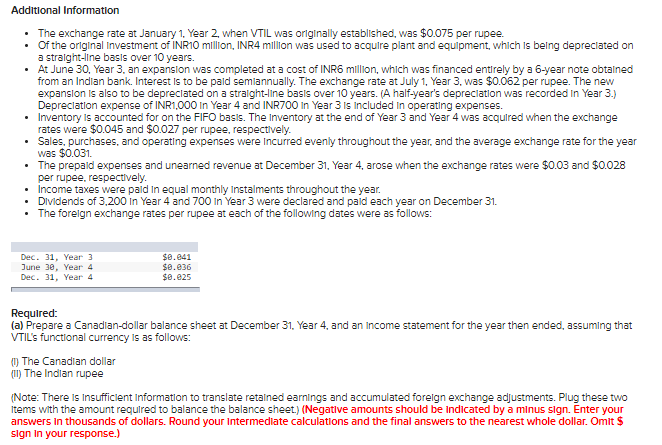

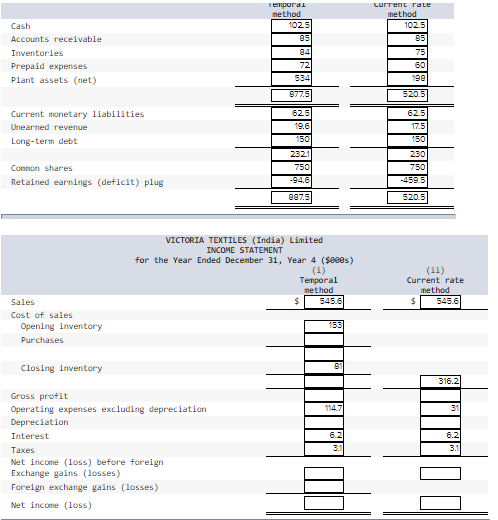

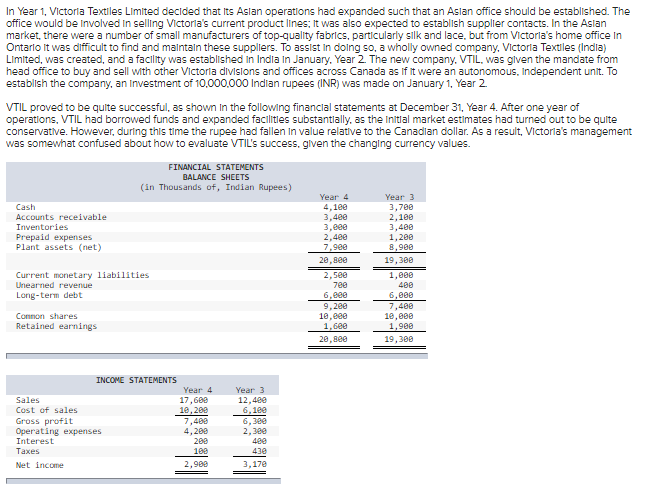

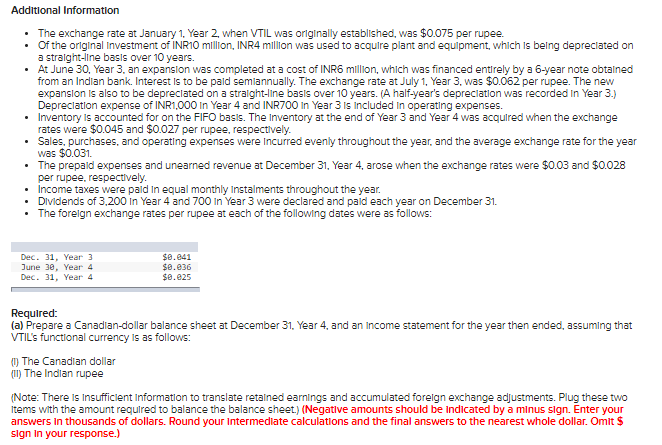

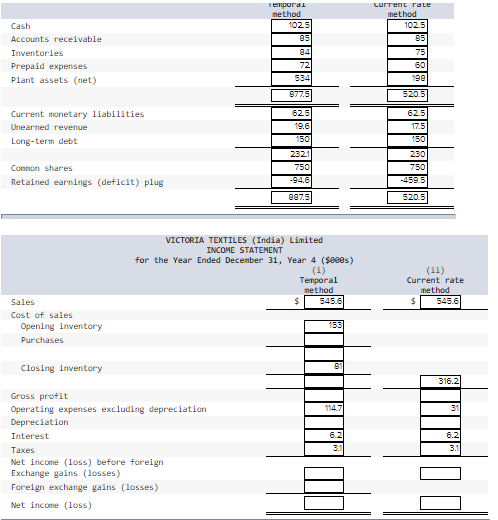

In Year 1, Victoria Textiles Limited decided that its Aslan operations had expanded such that an Aslan office should be established. The office would be involved in selling Victoria's current product lines: It was also expected to establish supplier contacts. In the Aslan market, there were a number of small manufacturers of top-quality fabrics, particularly silk and lace, but from Victoria's home office in Ontarlo it was difficult to find and maintain these suppliers. To assist in doing so, a wholly owned company, Victoria Textiles (India) Limited, was created, and a facility was established in India in January, Year 2. The new company. VTIL, was given the mandate from head office to buy and sell with other Victoria divisions and offices across Canada as if it were an autonomous, Independent unit. To establish the company, an investment of 10.000.000 Indian rupees (INR) was made on January 1, Year 2. VTIL proved to be quite successful, as shown in the following financial statements at December 31, Year 4. After one year of operations, VTIL had borrowed funds and expanded facilities substantially, as the initial market estimates had turned out to be quite conservative. However, during this time the rupee had fallen in value relative to the Canadian dollar. As a result, Victoria's management was somewhat confused about how to evaluate VTIL's success, given the changing currency values. FINANCIAL STATEMENTS BALANCE SHEETS (in Thousands of Indian Rupees) Cash Accounts receivable Inventories Prepaid expenses Plant assets (net) Year 4 4.100 3,400 3,800 2.4ee 7,9ee 20,800 2.500 7ee 6.ece 9. 200 10.ece 1.6ee 20,see Year 3 3,780 2,100 3,488 1,200 8.900 19,300 1.ee 400 6,600 7,480 10,000 1,900 19,300 Current monetary liabilities Unearned revenue Long-term debt Common shares Retained earnings INCOME STATEMENTS Year 4 Sales 17,600 Cost of sales 10,282 Gross profit 7,482 Operating expenses 4,280 Interest 200 Taxes 100 Net income 2,988 Year 3 12,40e 6.100 6,380 2,3ee 400 3,170 Additional Information The exchange rate at January 1. Year 2, when VTIL was originally established, was $0.075 per rupee. . Of the original Investment of INR10 million, INR4 million was used to acquire plant and equipment, which is being depreciated on a straight-line basis over 10 years. At June 30, Year 3. an expansion was completed at a cost of INR6 million, which was financed entirely by a 6-year note obtained from an Indian bank. Interest is to be paid semlannually. The exchange rate at July 1. Year 3. was $0.062 per rupee. The new expansion is also to be depreciated on a straight-line basis over 10 years. (A half-year's depreciation was recorded in Year 3.) Depreciation expense of INR1,000 in Year 4 and INR700 In Year 3 Is Included in operating expenses. Inventory is accounted for on the FIFO basis. The inventory at the end of Year 3 and Year 4 was acquired when the exchange rates were $0.045 and $0.027 per rupee, respectively. Sales, purchases, and operating expenses were incurred evenly throughout the year, and the average exchange rate for the year was $0.031. The prepaid expenses and unearned revenue at December 31, Year 4, arose when the exchange rates were $0.03 and $0.028 per rupee, respectively. Income taxes were paid in equal monthly Instalments throughout the year. Dividends of 3.200 In Year 4 and 700 in Year 3 were declared and paid each year on December 31. The foreign exchange rates per rupee at each of the following dates were as follows: Dec. 31, Year 3 June 30, Year 4 Dec. 31, Year 4 $0.041 $0.236 $0.925 Required: (a) Prepare a Canadian dollar balance sheet at December 31. Year 4, and an income statement for the year then ended, assuming that VTIL's functional currency is as follows: (1) The Canadian dollar (T) The Indian rupee (Note: There is insufficient Information to translate retained earnings and accumulated foreign exchange adjustments. Plug these two Items with the amount required to balance the balance sheet.) (Negative amounts should be indicated by a minus sign. Enter your answers in thousands of dollars. Round your intermediate calculations and the final answers to the nearest whole dollar.Omit $ Sign In your response.) Temporal method 102.5 es Cash Accounts receivable Inventories Prepaid expenses Plant assets (net) Lurrerit rate method 1025 85 75 60 198 84 72 534 977.5 520.5 625 Current monetary liabilities Unearned revenue Long-term debt 150 232.1 750 -946 62.5 17.5 150 230 750 -459.5 Common shares Retained earnings (deficit) plug 297.5 520.5 VICTORIA TEXTILES (India) Limited INCOME STATEMENT for the Year Ended December 31, Year 4 ($eces) Temporal method $ 5456 (11) Current rate method $ 545.6 Sales Cost of sales Opening inventory Purchases 153 Closing inventory 316.2 114.7 31 6.2 6.2 Gross profit Operating expenses excluding depreciation Depreciation Interest Taxes Net income (loss) before foreign Exchange gains (losses) Foreign exchange gains (losses) Net income (loss) ili In Year 1, Victoria Textiles Limited decided that its Aslan operations had expanded such that an Aslan office should be established. The office would be involved in selling Victoria's current product lines: It was also expected to establish supplier contacts. In the Aslan market, there were a number of small manufacturers of top-quality fabrics, particularly silk and lace, but from Victoria's home office in Ontarlo it was difficult to find and maintain these suppliers. To assist in doing so, a wholly owned company, Victoria Textiles (India) Limited, was created, and a facility was established in India in January, Year 2. The new company. VTIL, was given the mandate from head office to buy and sell with other Victoria divisions and offices across Canada as if it were an autonomous, Independent unit. To establish the company, an investment of 10.000.000 Indian rupees (INR) was made on January 1, Year 2. VTIL proved to be quite successful, as shown in the following financial statements at December 31, Year 4. After one year of operations, VTIL had borrowed funds and expanded facilities substantially, as the initial market estimates had turned out to be quite conservative. However, during this time the rupee had fallen in value relative to the Canadian dollar. As a result, Victoria's management was somewhat confused about how to evaluate VTIL's success, given the changing currency values. FINANCIAL STATEMENTS BALANCE SHEETS (in Thousands of Indian Rupees) Cash Accounts receivable Inventories Prepaid expenses Plant assets (net) Year 4 4.100 3,400 3,800 2.4ee 7,9ee 20,800 2.500 7ee 6.ece 9. 200 10.ece 1.6ee 20,see Year 3 3,780 2,100 3,488 1,200 8.900 19,300 1.ee 400 6,600 7,480 10,000 1,900 19,300 Current monetary liabilities Unearned revenue Long-term debt Common shares Retained earnings INCOME STATEMENTS Year 4 Sales 17,600 Cost of sales 10,282 Gross profit 7,482 Operating expenses 4,280 Interest 200 Taxes 100 Net income 2,988 Year 3 12,40e 6.100 6,380 2,3ee 400 3,170 Additional Information The exchange rate at January 1. Year 2, when VTIL was originally established, was $0.075 per rupee. . Of the original Investment of INR10 million, INR4 million was used to acquire plant and equipment, which is being depreciated on a straight-line basis over 10 years. At June 30, Year 3. an expansion was completed at a cost of INR6 million, which was financed entirely by a 6-year note obtained from an Indian bank. Interest is to be paid semlannually. The exchange rate at July 1. Year 3. was $0.062 per rupee. The new expansion is also to be depreciated on a straight-line basis over 10 years. (A half-year's depreciation was recorded in Year 3.) Depreciation expense of INR1,000 in Year 4 and INR700 In Year 3 Is Included in operating expenses. Inventory is accounted for on the FIFO basis. The inventory at the end of Year 3 and Year 4 was acquired when the exchange rates were $0.045 and $0.027 per rupee, respectively. Sales, purchases, and operating expenses were incurred evenly throughout the year, and the average exchange rate for the year was $0.031. The prepaid expenses and unearned revenue at December 31, Year 4, arose when the exchange rates were $0.03 and $0.028 per rupee, respectively. Income taxes were paid in equal monthly Instalments throughout the year. Dividends of 3.200 In Year 4 and 700 in Year 3 were declared and paid each year on December 31. The foreign exchange rates per rupee at each of the following dates were as follows: Dec. 31, Year 3 June 30, Year 4 Dec. 31, Year 4 $0.041 $0.236 $0.925 Required: (a) Prepare a Canadian dollar balance sheet at December 31. Year 4, and an income statement for the year then ended, assuming that VTIL's functional currency is as follows: (1) The Canadian dollar (T) The Indian rupee (Note: There is insufficient Information to translate retained earnings and accumulated foreign exchange adjustments. Plug these two Items with the amount required to balance the balance sheet.) (Negative amounts should be indicated by a minus sign. Enter your answers in thousands of dollars. Round your intermediate calculations and the final answers to the nearest whole dollar.Omit $ Sign In your response.) Temporal method 102.5 es Cash Accounts receivable Inventories Prepaid expenses Plant assets (net) Lurrerit rate method 1025 85 75 60 198 84 72 534 977.5 520.5 625 Current monetary liabilities Unearned revenue Long-term debt 150 232.1 750 -946 62.5 17.5 150 230 750 -459.5 Common shares Retained earnings (deficit) plug 297.5 520.5 VICTORIA TEXTILES (India) Limited INCOME STATEMENT for the Year Ended December 31, Year 4 ($eces) Temporal method $ 5456 (11) Current rate method $ 545.6 Sales Cost of sales Opening inventory Purchases 153 Closing inventory 316.2 114.7 31 6.2 6.2 Gross profit Operating expenses excluding depreciation Depreciation Interest Taxes Net income (loss) before foreign Exchange gains (losses) Foreign exchange gains (losses) Net income (loss) ili