Question

B, who is single and 60 years old, started receiving retirement benefits from an annuity he purchased for $108,500. The annuity will pay him

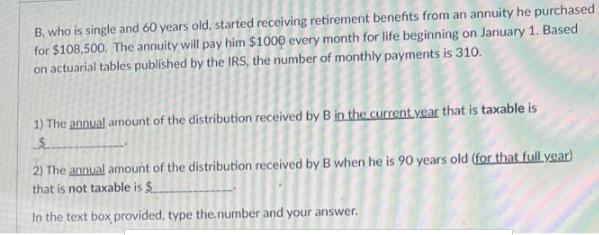

B, who is single and 60 years old, started receiving retirement benefits from an annuity he purchased for $108,500. The annuity will pay him $1000 every month for life beginning on January 1. Based on actuarial tables published by the IRS, the number of monthly payments is 310. 1) The annual amount of the distribution received by B in the current year that is taxable is 5 2) The annual amount of the distribution received by B when he is 90 years old (for that full year) that is not taxable is $ In the text box provided, type the number and your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

nswer Answer Workings The total amount of payments that will be received by B 310 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2016 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

29th Edition

134104374, 978-0134104379

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App