Question

b. Why are intangible drilling costs expensed by most? taxpayers? Intangible drilling costs? (IDCs) are generally expensed because ? a. most companies don't have the

b. Why are intangible drilling costs expensed by most? taxpayers?

Intangible drilling costs? (IDCs) are generally expensed because

? a. most companies don't have the experience needed to capitalize and deduct the costs in future periods.

b. of the greater current tax benefit over capitalizing and deducting the costs in furture periods.

c. when companies use cost depletion they cannot capitalize and deduct the costs in future periods.

d. when companies use percentage depletion they cannot capitalized and deduct the costs in future periods.

If percentage depletion is expected to be

? a. greater than

b. less than

c. the same as

cost? depletion, it is more beneficial to deduct the IDCs. The capitalization and amortization of IDC

? a. has not effect on

b. merely decreases

c. merely increase

the cost depletion amount and produces limited or no tax benefit. Expensing IDCs

? a. has not effect on

b. increases

c. reduces

gross? income, thereby

? a. having no effect on

b. increasing

c. lowering

taxable income.

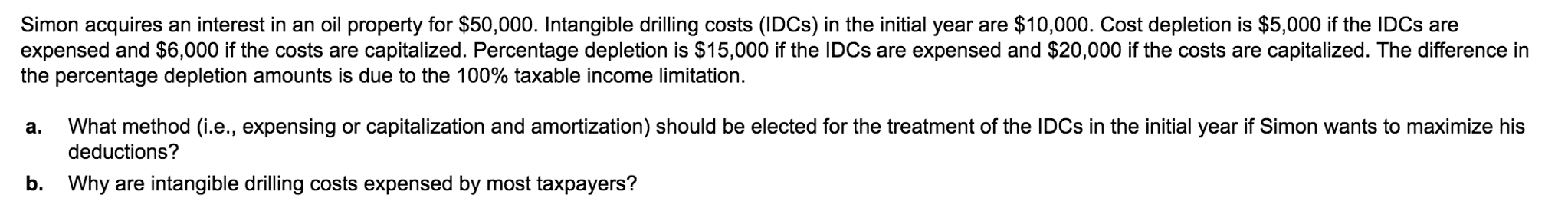

Simon acquires an interest in an oil property for $50,000. Intangible drilling costs (IDCs) in the initial year are $10,000. Cost depletion is $5,000 if the IDCs are expensed and $6,000 if the costs are capitalized. Percentage depletion is $15,000 if the IDCs are expensed and $20,000 if the costs are capitalized. The difference in the percentage depletion amounts is due to the 100% taxable income limitation a. What method (i.e., expensing or capitalization and amortization) should be elected for the treatment of the IDCs in the initial year if Simon wants to maximize his deductions? b. Why are intangible drilling costs expensed by most taxpayersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started