Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B WN 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the

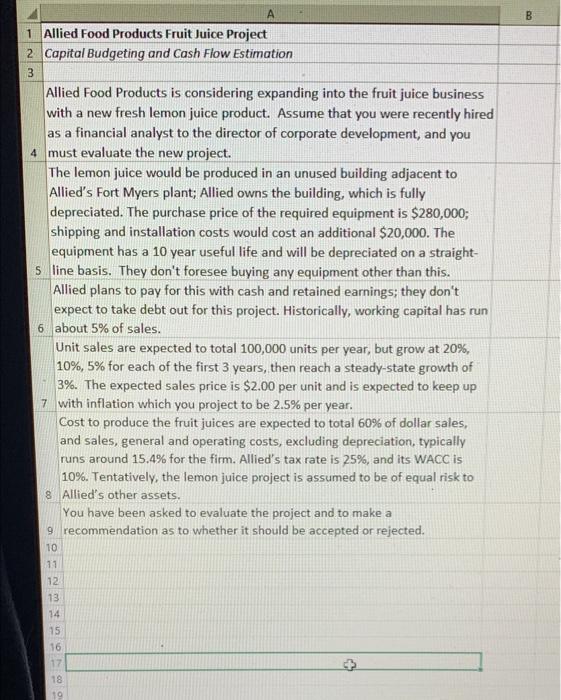

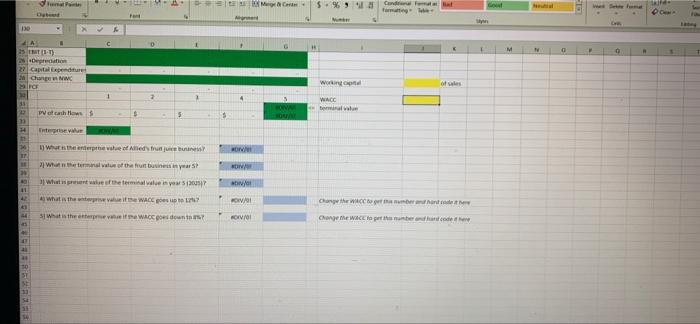

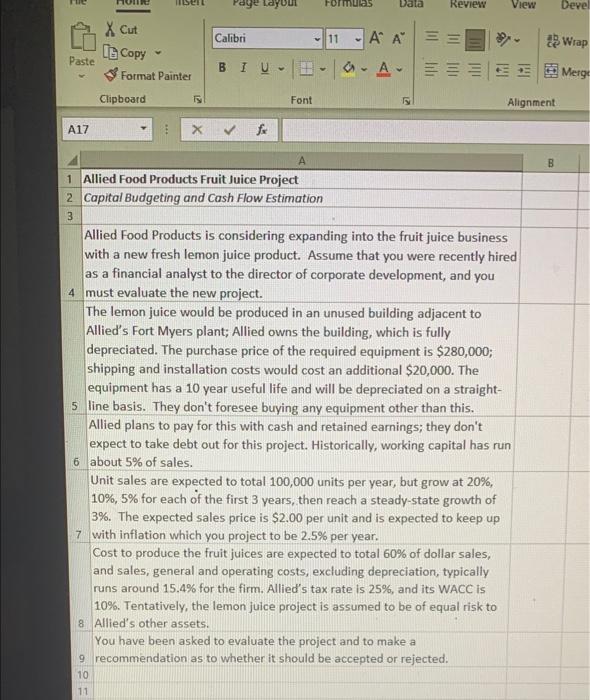

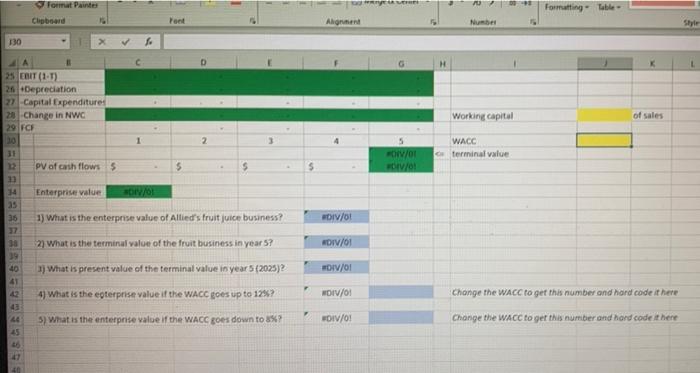

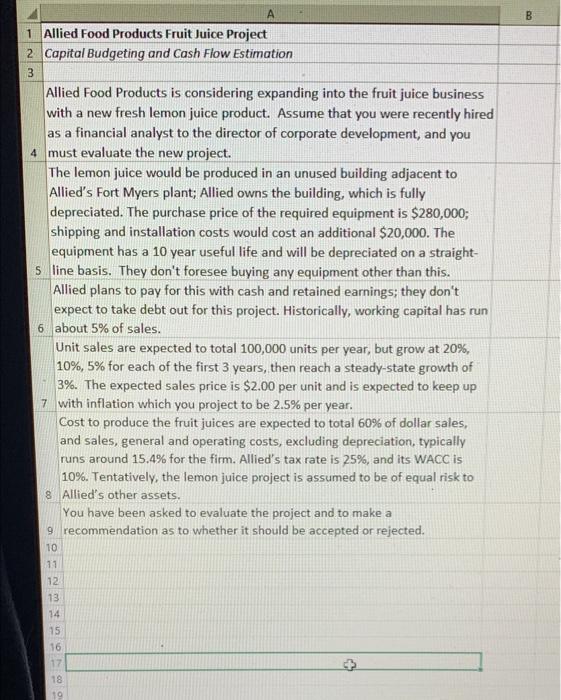

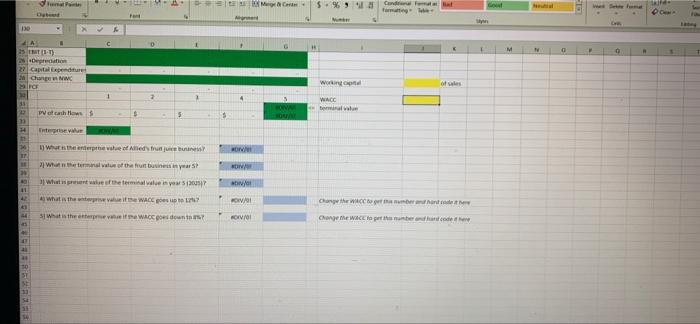

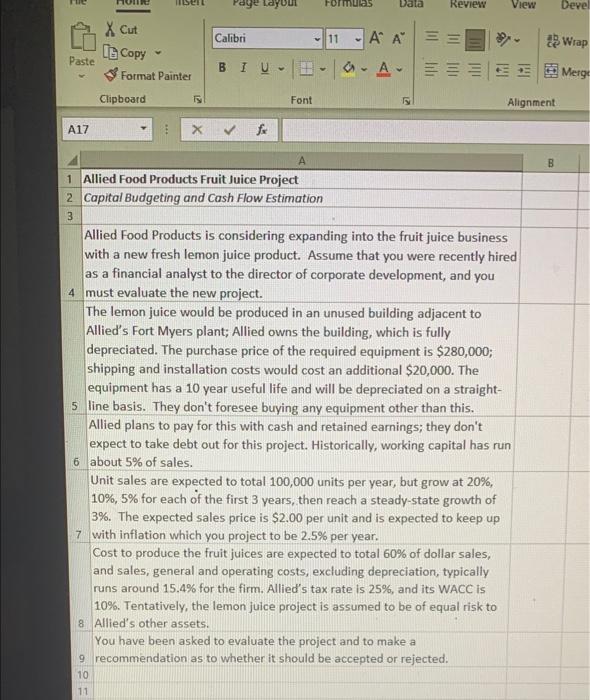

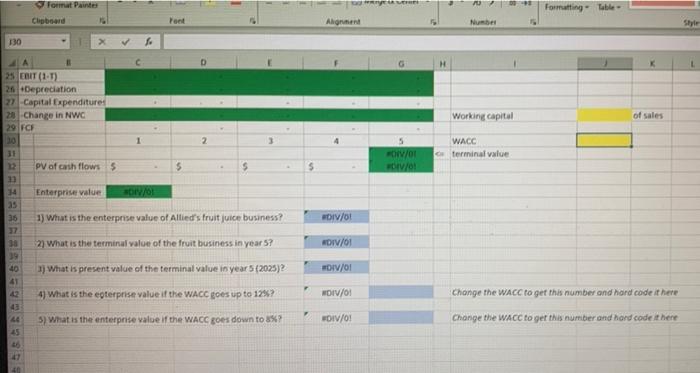

B WN 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as a financial analyst to the director of corporate development, and you 4 must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000; shipping and installation costs would cost an additional $20,000. The equipment has a 10 year useful life and will be depreciated on a straight- s line basis. They don't foresee buying any equipment other than this. Allied plans to pay for this with cash and retained earnings; they don't expect to take debt out for this project. Historically, working capital has run 6 about 5% of sales. Unit sales are expected to total 100,000 units per year, but grow at 20%, 10%, 5% for each of the first 3 years, then reach a steady-state growth of 3%. The expected sales price is $2.00 per unit and is expected to keep up 7 with inflation which you project to be 2.5% per year. Cost to produce the fruit juices are expected to total 60% of dollar sales, and sales, general and operating costs, excluding depreciation, typically runs around 15.4% for the firm. Allied's tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to 8 Allied's other assets. You have been asked to evaluate the project and to make a 9 recommendation as to whether it should be accepted or rejected. 10 11 12 13 14 15 16 17 18 19 Cando DO And 130 1 M o 0 12 (11) Ow 2 Captal Expenditures Change WC FCF World TE WA ber pochows 3 who 23 11 14 IT Wheerdere volue of ned free Wheten of the tube yuars 10 What is the female in yow 2007 What is the real wages NO Change the web and Change the water behande si What is the WACC goes down IVAN Page Layout Formulas Data Review View Devel Calibri Wrap X Cut L Copy Paste Format Painter - 11 - A A - AA a-A- BIU Merge Clipboard is Font Alignment A17 for B 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as a financial analyst to the director of corporate development, and you 4 must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000; shipping and installation costs would cost an additional $20,000. The equipment has a 10 year useful life and will be depreciated on a straight- 5 line basis. They don't foresee buying any equipment other than this. Allied plans to pay for this with cash and retained earnings; they don't expect to take debt out for this project. Historically, working capital has run 6 about 5% of sales. Unit sales are expected to total 100,000 units per year, but grow at 20%, 10%, 5% for each of the first 3 years, then reach a steady-state growth of 3%. The expected sales price is $2.00 per unit and is expected to keep up 7 with inflation which you project to be 2.5% per year. Cost to produce the fruit juices are expected to total 60% of dollar sales, and sales, general and operating costs, excluding depreciation, typically runs around 15.4% for the firm. Allied's tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to 8. Allied's other assets. You have been asked to evaluate the project and to make a 9 recommendation as to whether it should be accepted or rejected. 10 a 11 003 Format Painter Clipboard Formatting Table Foet Alge Nuse Style 130 D H 25 CIT (1-T) 26 Depreciation 27 Capital Expenditure 20 Change in NWC 29 FCF Working capital of sales 2 4 WACC terminal value IV/0! DIV/ PV of cash flows 5 5 $ $ 31 12 13 14 Enterprise value DIV/01 DIV/0! DIV/01 36 7 38 39 40 41 42 43 46 25 1) What is the enterprise value of Allied's fruit juice business? 2) What is the terminal value of the fruit business in year ? 1) What is present value of the terminal value in year 5 (2025) 4) What is the egterprise value if the WACC goes up to 12867 DIV/01 NDIV/01 Change the WACC to get this number and hard code it here 3) What is the enterprise value if the WACC goes down to ? NOIV/0! Change the WACC to get this number and hard code it here 40

B WN 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as a financial analyst to the director of corporate development, and you 4 must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000; shipping and installation costs would cost an additional $20,000. The equipment has a 10 year useful life and will be depreciated on a straight- s line basis. They don't foresee buying any equipment other than this. Allied plans to pay for this with cash and retained earnings; they don't expect to take debt out for this project. Historically, working capital has run 6 about 5% of sales. Unit sales are expected to total 100,000 units per year, but grow at 20%, 10%, 5% for each of the first 3 years, then reach a steady-state growth of 3%. The expected sales price is $2.00 per unit and is expected to keep up 7 with inflation which you project to be 2.5% per year. Cost to produce the fruit juices are expected to total 60% of dollar sales, and sales, general and operating costs, excluding depreciation, typically runs around 15.4% for the firm. Allied's tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to 8 Allied's other assets. You have been asked to evaluate the project and to make a 9 recommendation as to whether it should be accepted or rejected. 10 11 12 13 14 15 16 17 18 19 Cando DO And 130 1 M o 0 12 (11) Ow 2 Captal Expenditures Change WC FCF World TE WA ber pochows 3 who 23 11 14 IT Wheerdere volue of ned free Wheten of the tube yuars 10 What is the female in yow 2007 What is the real wages NO Change the web and Change the water behande si What is the WACC goes down IVAN Page Layout Formulas Data Review View Devel Calibri Wrap X Cut L Copy Paste Format Painter - 11 - A A - AA a-A- BIU Merge Clipboard is Font Alignment A17 for B 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as a financial analyst to the director of corporate development, and you 4 must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000; shipping and installation costs would cost an additional $20,000. The equipment has a 10 year useful life and will be depreciated on a straight- 5 line basis. They don't foresee buying any equipment other than this. Allied plans to pay for this with cash and retained earnings; they don't expect to take debt out for this project. Historically, working capital has run 6 about 5% of sales. Unit sales are expected to total 100,000 units per year, but grow at 20%, 10%, 5% for each of the first 3 years, then reach a steady-state growth of 3%. The expected sales price is $2.00 per unit and is expected to keep up 7 with inflation which you project to be 2.5% per year. Cost to produce the fruit juices are expected to total 60% of dollar sales, and sales, general and operating costs, excluding depreciation, typically runs around 15.4% for the firm. Allied's tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to 8. Allied's other assets. You have been asked to evaluate the project and to make a 9 recommendation as to whether it should be accepted or rejected. 10 a 11 003 Format Painter Clipboard Formatting Table Foet Alge Nuse Style 130 D H 25 CIT (1-T) 26 Depreciation 27 Capital Expenditure 20 Change in NWC 29 FCF Working capital of sales 2 4 WACC terminal value IV/0! DIV/ PV of cash flows 5 5 $ $ 31 12 13 14 Enterprise value DIV/01 DIV/0! DIV/01 36 7 38 39 40 41 42 43 46 25 1) What is the enterprise value of Allied's fruit juice business? 2) What is the terminal value of the fruit business in year ? 1) What is present value of the terminal value in year 5 (2025) 4) What is the egterprise value if the WACC goes up to 12867 DIV/01 NDIV/01 Change the WACC to get this number and hard code it here 3) What is the enterprise value if the WACC goes down to ? NOIV/0! Change the WACC to get this number and hard code it here 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started