Answered step by step

Verified Expert Solution

Question

1 Approved Answer

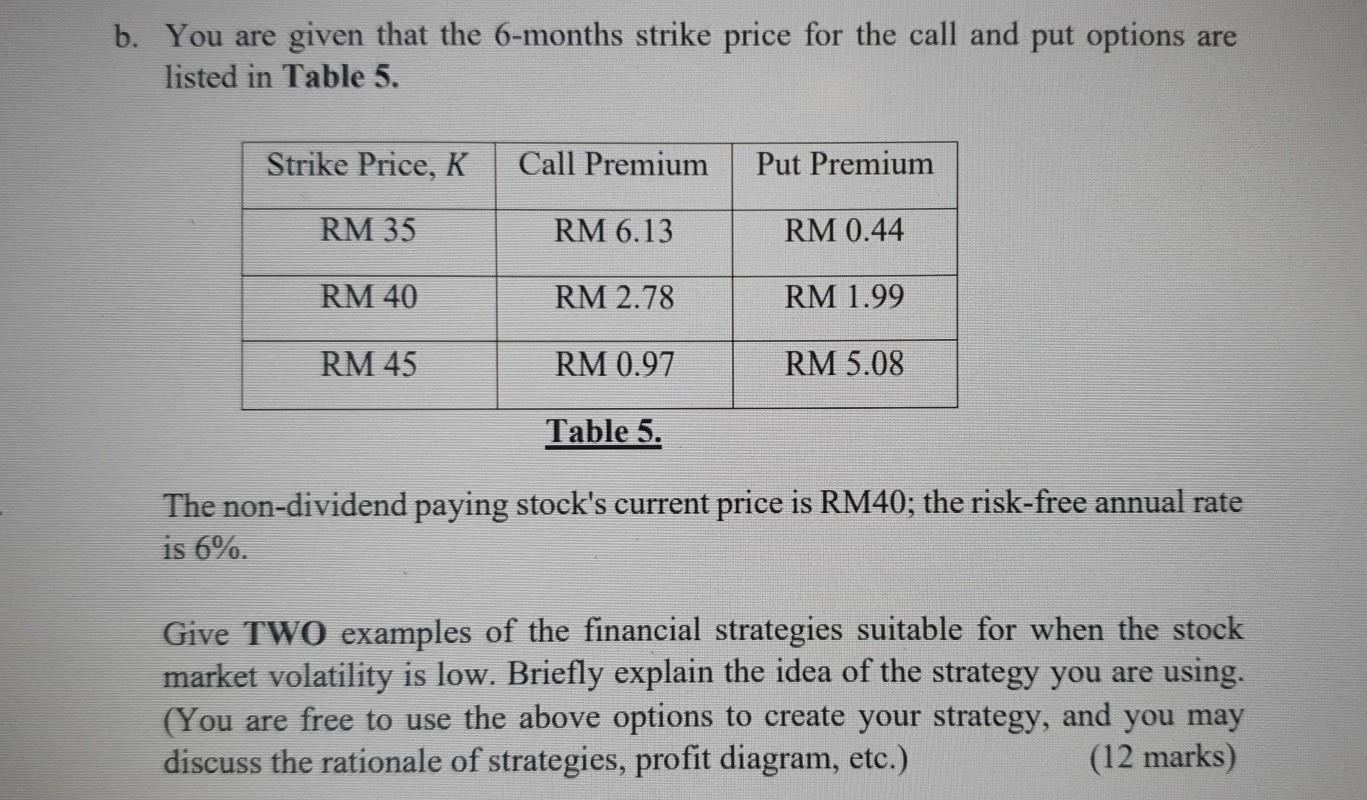

b. You are given that the 6-months strike price for the call and put options are listed in Table 5. Strike Price, K Call Premium

b. You are given that the 6-months strike price for the call and put options are listed in Table 5. Strike Price, K Call Premium Put Premium RM 35 RM 6.13 RM 0.44 RM 40 RM 2.78 RM 1.99 RM 45 RM 0.97 RM 5.08 Table 5. The non-dividend paying stock's current price is RM40; the risk-free annual rate is 6%. Give TWO examples of the financial strategies suitable for when the stock market volatility is low. Briefly explain the idea of the strategy you are using. (You are free to use the above options to create your strategy, and you may discuss the rationale of strategies, profit diagram, etc.) (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started