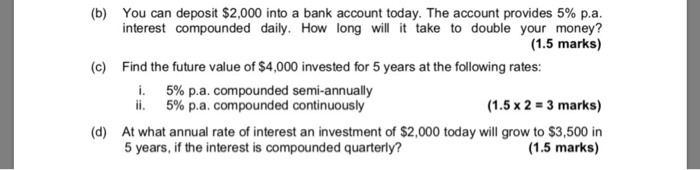

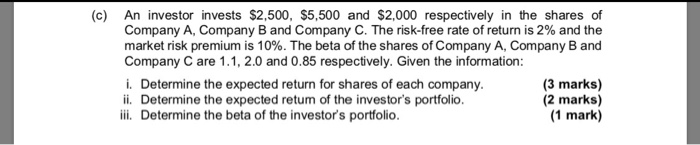

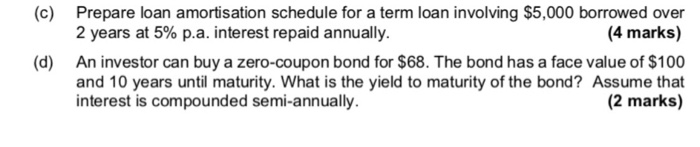

(b) You can deposit $2,000 into a bank account today. The account provides 5% p.a. interest compounded daily. How long will it take to double your money? (1.5 marks) Find the future value of $4,000 invested for 5 years at the following rates: i. 5% p.a. compounded semi-annually ii. 5% p.a. compounded continuously (1.5 x 2 = 3 marks) (c) (d) At what annual rate of interest an investment of $2,000 today will grow to $3,500 in 5 years, if the interest is compounded quarterly? (1.5 marks) (c) An investor invests $2,500, $5,500 and $2,000 respectively in the shares of Company A, Company B and Company C. The risk-free rate of return is 2% and the market risk premium is 10%. The beta of the shares of Company A, Company B and Company C are 1.1, 2.0 and 0.85 respectively. Given the information: i. Determine the expected return for shares of each company. (3 marks) ii. Determine the expected retum of the investor's portfolio. (2 marks) iii. Determine the beta of the investor's portfolio. (1 mark) (c) (d) Prepare loan amortisation schedule for a term loan involving $5,000 borrowed over 2 years at 5% p.a. interest repaid annually. (4 marks) An investor can buy a zero-coupon bond for $68. The bond has a face value of $100 and 10 years until maturity. What is the yield to maturity of the bond? Assume that interest is compounded semi-annually. (2 marks) (b) You can deposit $2,000 into a bank account today. The account provides 5% p.a. interest compounded daily. How long will it take to double your money? (1.5 marks) Find the future value of $4,000 invested for 5 years at the following rates: i. 5% p.a. compounded semi-annually ii. 5% p.a. compounded continuously (1.5 x 2 = 3 marks) (c) (d) At what annual rate of interest an investment of $2,000 today will grow to $3,500 in 5 years, if the interest is compounded quarterly? (1.5 marks) (c) An investor invests $2,500, $5,500 and $2,000 respectively in the shares of Company A, Company B and Company C. The risk-free rate of return is 2% and the market risk premium is 10%. The beta of the shares of Company A, Company B and Company C are 1.1, 2.0 and 0.85 respectively. Given the information: i. Determine the expected return for shares of each company. (3 marks) ii. Determine the expected retum of the investor's portfolio. (2 marks) iii. Determine the beta of the investor's portfolio. (1 mark) (c) (d) Prepare loan amortisation schedule for a term loan involving $5,000 borrowed over 2 years at 5% p.a. interest repaid annually. (4 marks) An investor can buy a zero-coupon bond for $68. The bond has a face value of $100 and 10 years until maturity. What is the yield to maturity of the bond? Assume that interest is compounded semi-annually. (2 marks)