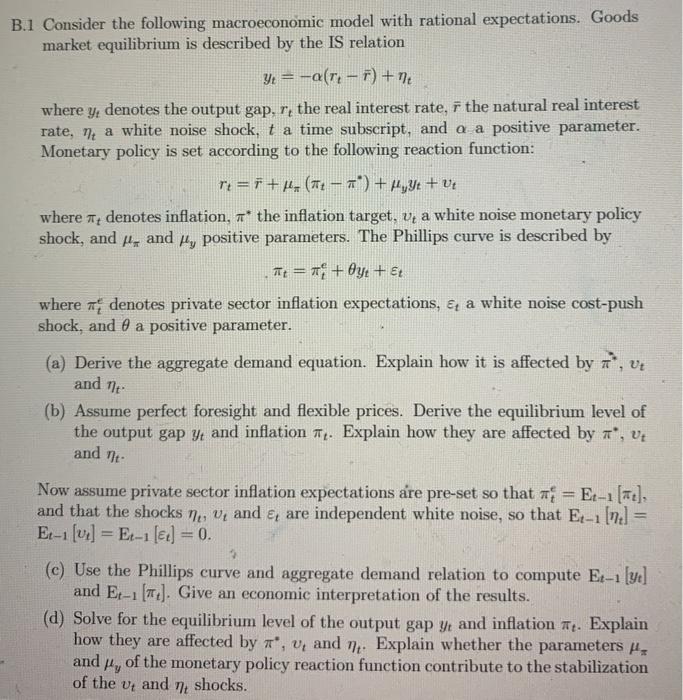

B.1 Consider the following macroeconomic model with rational expectations. Goods market equilibrium is described by the IS relation y = -ar- ) +me where y, denotes the output gap, r, the real interest rate, f the natural real interest rate, n a white noise shock, t a time subscript, and a a positive parameter. Monetary policy is set according to the following reaction function: r2 = + kr (TT - ") + MyYt + v where 4 denotes inflation, * the inflation target, V, a white noise monetary policy shock, and H, and y, positive parameters. The Phillips curve is described by T = x + 6+st where i denotes private sector inflation expectations, & a white noise cost-push shock, and 0 a positive parameter. (a) Derive the aggregate demand equation. Explain how it is affected by 7, and 1 (b) Assume perfect foresight and flexible prices. Derive the equilibrium level of the output gap y and inflation T. Explain how they are affected by T', vt and it 3 Now assume private sector inflation expectations are pre-set so that we = Et-1 [ne], and that the shocks ne, v, and are independent white noise, so that Ex-1 [ne] = El-1 [us] = Ex-1(e) = 0. (c) Use the Phillips curve and aggregate demand relation to compute Er-1 [y] and Et-1 (Mt). Give an economic interpretation of the results. (d) Solve for the equilibrium level of the output gap y: and inflation Tt. Explain how they are affected by T', V, and ne. Explain whether the parameters in and ty of the monetary policy reaction function contribute to the stabilization of the 7 shocks. Ve and B.1 Consider the following macroeconomic model with rational expectations. Goods market equilibrium is described by the IS relation y = -ar- ) +me where y, denotes the output gap, r, the real interest rate, f the natural real interest rate, n a white noise shock, t a time subscript, and a a positive parameter. Monetary policy is set according to the following reaction function: r2 = + kr (TT - ") + MyYt + v where 4 denotes inflation, * the inflation target, V, a white noise monetary policy shock, and H, and y, positive parameters. The Phillips curve is described by T = x + 6+st where i denotes private sector inflation expectations, & a white noise cost-push shock, and 0 a positive parameter. (a) Derive the aggregate demand equation. Explain how it is affected by 7, and 1 (b) Assume perfect foresight and flexible prices. Derive the equilibrium level of the output gap y and inflation T. Explain how they are affected by T', vt and it 3 Now assume private sector inflation expectations are pre-set so that we = Et-1 [ne], and that the shocks ne, v, and are independent white noise, so that Ex-1 [ne] = El-1 [us] = Ex-1(e) = 0. (c) Use the Phillips curve and aggregate demand relation to compute Er-1 [y] and Et-1 (Mt). Give an economic interpretation of the results. (d) Solve for the equilibrium level of the output gap y: and inflation Tt. Explain how they are affected by T', V, and ne. Explain whether the parameters in and ty of the monetary policy reaction function contribute to the stabilization of the 7 shocks. Ve and