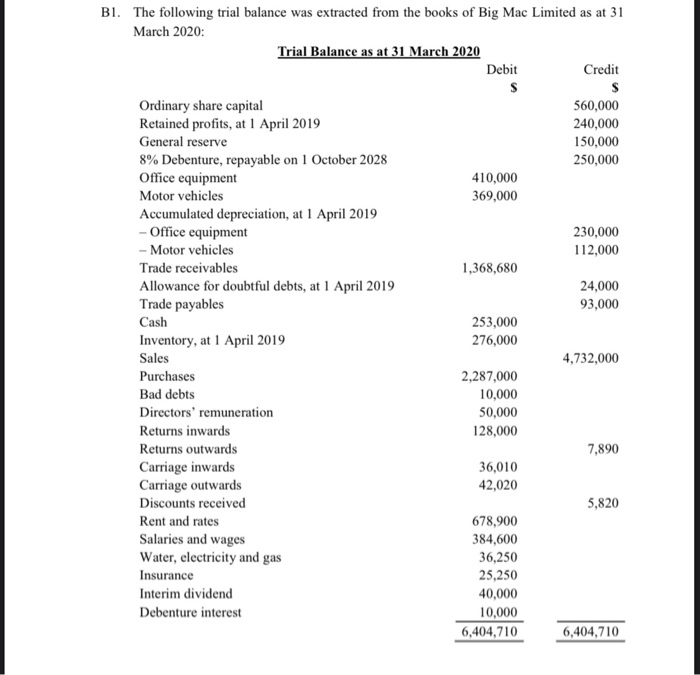

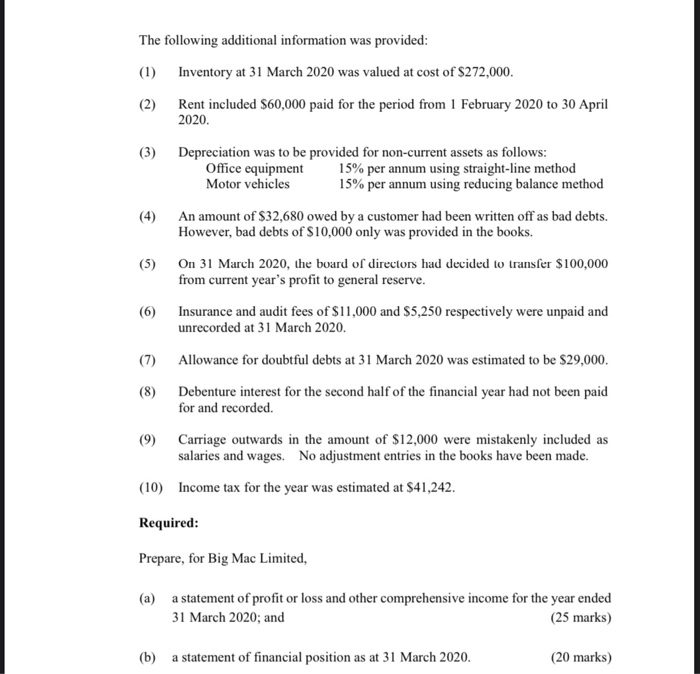

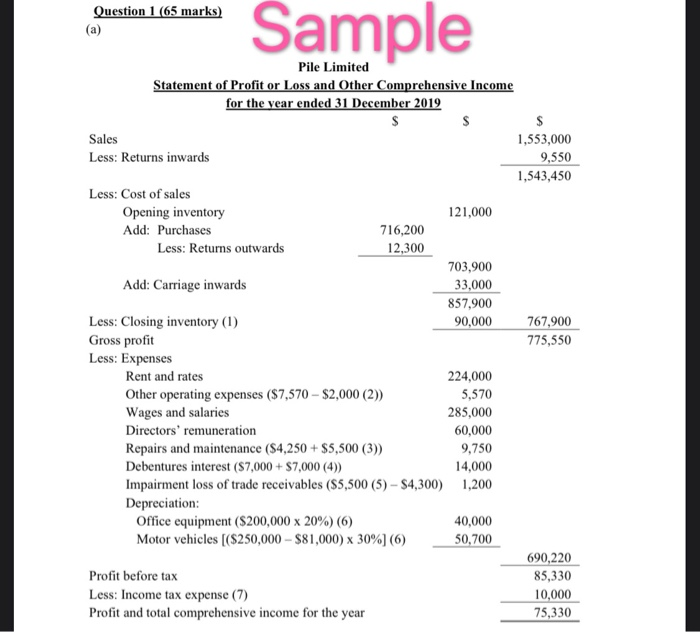

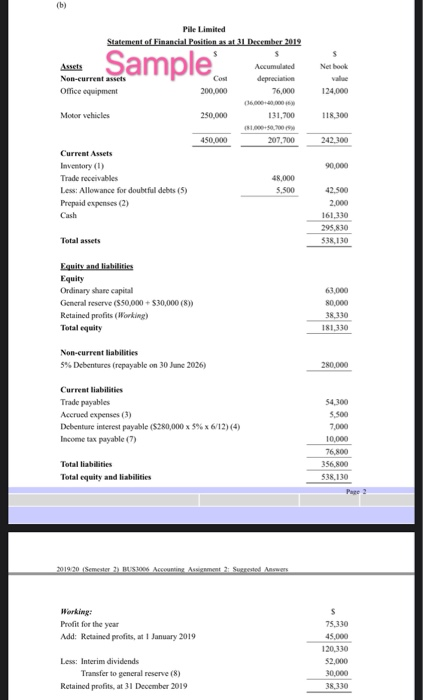

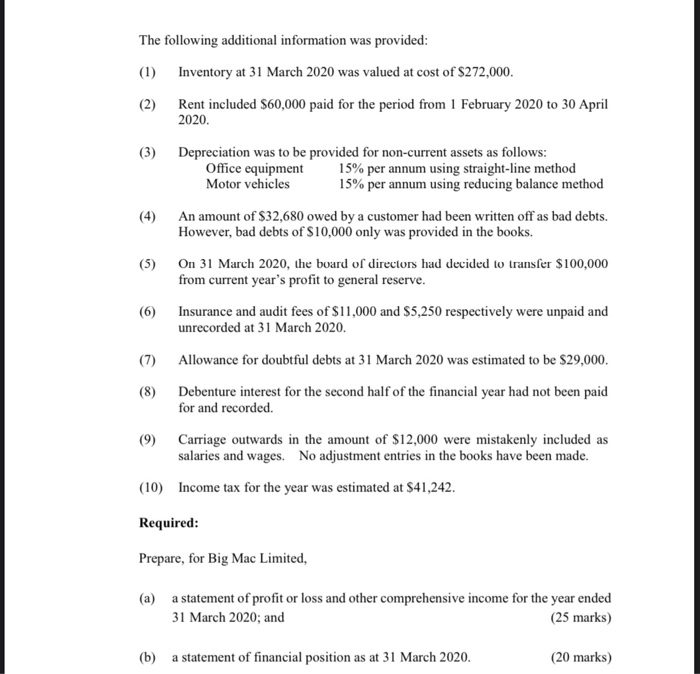

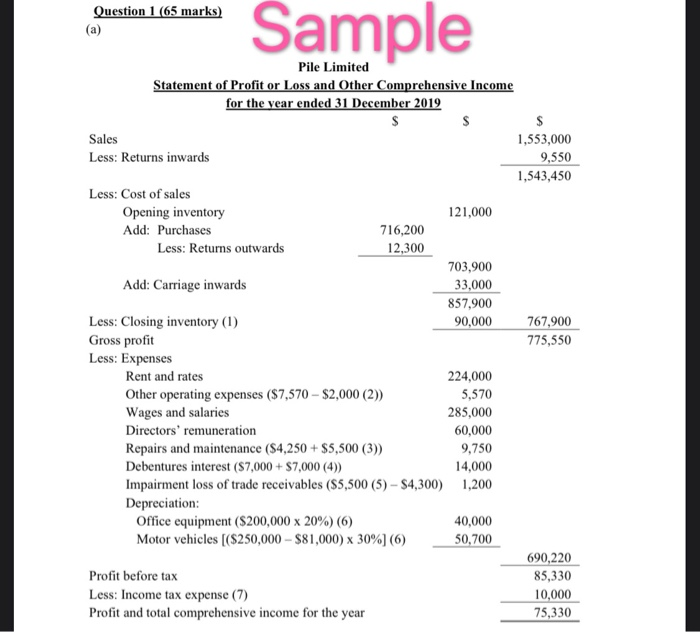

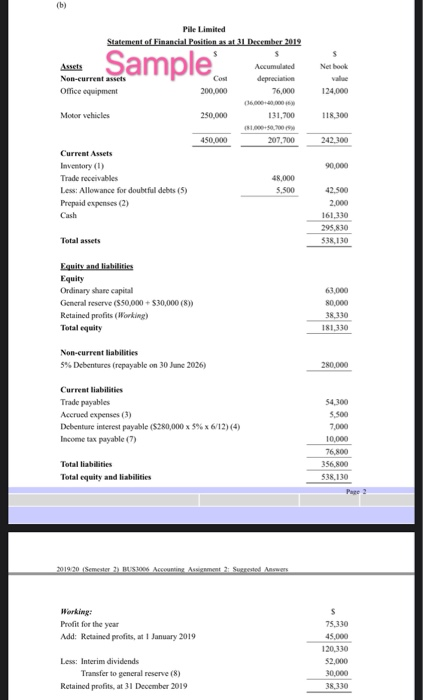

B1. The following trial balance was extracted from the books of Big Mac Limited as at 31 March 2020: Trial Balance as at 31 March 2020 Debit Credit 560,000 240,000 150,000 250,000 410,000 369,000 230,000 112,000 1,368,680 24,000 93,000 253,000 276,000 Ordinary share capital Retained profits, at 1 April 2019 General reserve 8% Debenture, repayable on 1 October 2028 Office equipment Motor vehicles Accumulated depreciation, at 1 April 2019 - Office equipment -Motor vehicles Trade receivables Allowance for doubtful debts, at 1 April 2019 Trade payables Cash Inventory, at 1 April 2019 Sales Purchases Bad debts Directors' remuneration Returns inwards Returns outwards Carriage inwards Carriage outwards Discounts received Rent and rates Salaries and wages Water, electricity and gas Insurance Interim dividend Debenture interest 4,732.000 2,287,000 10,000 50,000 128,000 7,890 36,010 42,020 5,820 678,900 384,600 36,250 25,250 40,000 10,000 6,404,710 6,404,710 The following additional information was provided: (1) Inventory at 31 March 2020 was valued at cost of $272,000. (2) Rent included $60,000 paid for the period from 1 February 2020 to 30 April 2020. (3) Depreciation was to be provided for non-current assets as follows: Office equipment 15% per annum using straight-line method Motor vehicles 15% per annum using reducing balance method An amount of $32,680 owed by a customer had been written off as bad debts. However, bad debts of $10,000 only was provided in the books. (5) On 31 March 2020, the board of directors had decided to transfer $100,000 from current year's profit to general reserve. (6) Insurance and audit fees of $11,000 and $5,250 respectively were unpaid and unrecorded at 31 March 2020. Allowance for doubtful debts at 31 March 2020 was estimated to be $29,000. Debenture interest for the second half of the financial year had not been paid for and recorded. Carriage outwards in the amount of $12,000 were mistakenly included as salaries and wages. No adjustment entries in the books have been made. (10) Income tax for the year was estimated at $41,242. Required: Prepare, for Big Mac Limited, (a) a statement of profit or loss and other comprehensive income for the year ended 31 March 2020; and (25 marks) (b) a statement of financial position as at 31 March 2020. (20 marks) Segundo o Sample Question 1 65 marks) Pile Limited Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019 Sales Less: Returns inwards 1,553,000 9,550 1,543,450 767,900 775,550 Less: Cost of sales Opening inventory 121,000 Add: Purchases 716,200 Less: Returns outwards 12,300 703,900 Add: Carriage inwards 33,000 857,900 Less: Closing inventory (1) 90,000 Gross profit Less: Expenses Rent and rates 224,000 Other operating expenses ($7,570 - $2,000 (2)) 5,570 Wages and salaries 285,000 Directors' remuneration 60,000 Repairs and maintenance ($4,250 + $5,500 (3)) 9,750 Debentures interest ($7,000+ $7,000 (4) 14,000 Impairment loss of trade receivables ($5,500 (5) - $4,300) 1,200 Depreciation: Office equipment ($200,000 x 20%) (6) 40,000 Motor vehicles [($250,000 - $81,000) x 30%] (6) 50,700 Profit before tax Less: Income tax expense (7) Profit and total comprehensive income for the year 690,220 85,330 10,000 75,330 Pie Limited Statement of Financial Position at Desember 2019 Assets Non-current assets Office equipment Sample Netbook Cost 200.000 Accumulated depreciation 76,000 124.000 Motor vehicles 250.000 131,700 118,300 450,000 207,700 242,300 90,000 Current Assets Inventory (1) Trade receivables Less: Allowance for doubtful debts (5) Prepaid expenses (2) Cash 42.500 2.000 161,330 295,830 $38,130 Total assets Equity and liabilities Equity Ordinary share capital General reserve (550.000 Retained profits (Working) Total equity $30,000 (8) 63.000 80,000 38 130 181.330 Non-current liabilities 5% Debentures (repayable on 30 June 2026) 280.000 Current liabilities Trade payables Accrued expenses (3) Debenture interest payable ($280,000 x 3% x612) (4) Income tax payable (7) 54300 5.500 10,000 76,800 356,800 538.130 Total liabilities Total equity and liabilities 201920 Seme ) BS Accounting Assignment Succeed Answ Working: Profit for the year Add: Retained profits, at 1 January 2019 75,330 45.000 120,330 $2.000 30.000 38110 Less: Interim dividends Transfer to general reserve (8) Retained profits, at 31 December 2019