Question

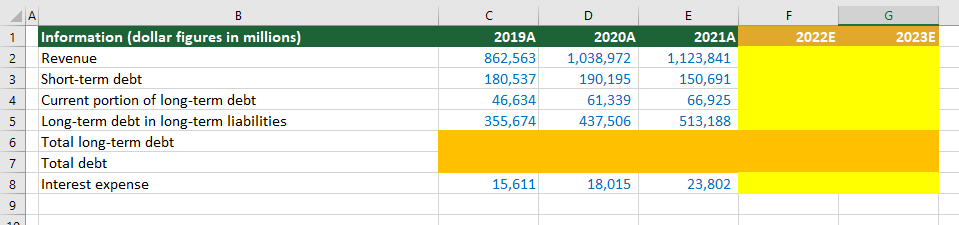

B1. Use the assumptions described in the table when modeling items that are not computed as totals or subtotals. Variable Modeling assumptions Revenue Annual revenue

B1. Use the assumptions described in the table when modeling items that are not computed as totals or subtotals.

| Variable | Modeling assumptions |

| Revenue | Annual revenue growth in each forecast year equals the compound annual revenue growth rate from the historical period |

| Short-term debt | Short-term debt to revenue in each forecast year is 1.11 percentage points greater than the ratio from the previous year |

| Current portion of long-term debt | Current portion of long-term debt to revenue in each forecast year is 0.24 percentage points less than the average ratio from the last 2 years of the historical period |

| Long-term debt in long-term liabilities | Long-term debt in long-term liabilities to sales in each forecast year equals the weighted average ratio of long-term debt in long-term liabilities to sales from the historical period, where the last year of the historical period is weighted at 60%, the year before that is weighted at 30%, and the year before that is weighted at 10% |

| Interest expense | The interest rate on debt in each forecast year is 0.18 percentage points greater than the average annual implied interest rate from the historical period |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started