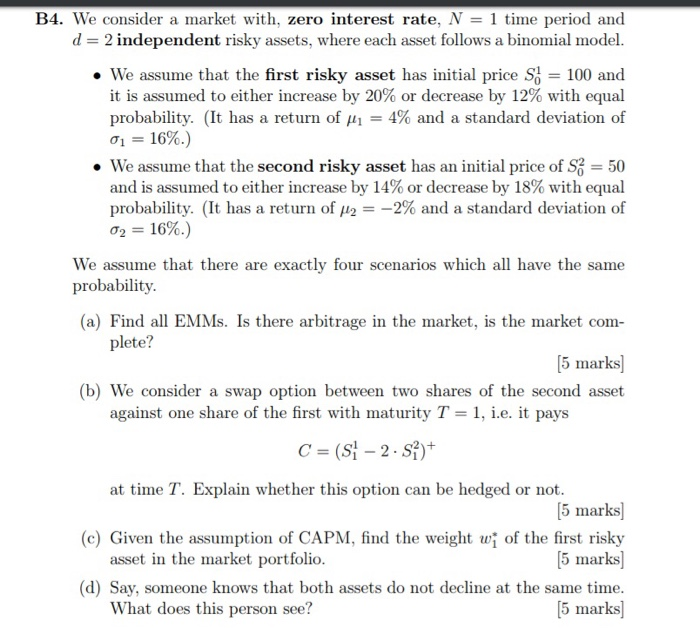

B4. We consider a market with, zero interest rate, N = 1 time period and d = 2 independent risky assets, where each asset follows a binomial model. We assume that the first risky asset has initial price S = 100 and it is assumed to either increase by 20% or decrease by 12% with equal probability. (It has a return of #1 = 4% and a standard deviation of 01 = 16%.) We assume that the second risky asset has an initial price of S3 = 50 and is assumed to either increase by 14% or decrease by 18% with equal probability. (It has a return of M2 = -2% and a standard deviation of 02 = 16%.) We assume that there are exactly four scenarios which all have the same probability. (a) Find all EMMs. Is there arbitrage in the market, is the market com- plete? (5 marks] (b) We consider a swap option between two shares of the second asset against one share of the first with maturity T = 1, i.e. it pays C = (S - 2.99) at time T. Explain whether this option can be hedged or not. (5 marks] (C) Given the assumption of CAPM, find the weight w; of the first risky asset in the market portfolio. (5 marks] (d) Say, someone knows that both assets do not decline at the same time. What does this person see? (5 marks] B4. We consider a market with, zero interest rate, N = 1 time period and d = 2 independent risky assets, where each asset follows a binomial model. We assume that the first risky asset has initial price S = 100 and it is assumed to either increase by 20% or decrease by 12% with equal probability. (It has a return of #1 = 4% and a standard deviation of 01 = 16%.) We assume that the second risky asset has an initial price of S3 = 50 and is assumed to either increase by 14% or decrease by 18% with equal probability. (It has a return of M2 = -2% and a standard deviation of 02 = 16%.) We assume that there are exactly four scenarios which all have the same probability. (a) Find all EMMs. Is there arbitrage in the market, is the market com- plete? (5 marks] (b) We consider a swap option between two shares of the second asset against one share of the first with maturity T = 1, i.e. it pays C = (S - 2.99) at time T. Explain whether this option can be hedged or not. (5 marks] (C) Given the assumption of CAPM, find the weight w; of the first risky asset in the market portfolio. (5 marks] (d) Say, someone knows that both assets do not decline at the same time. What does this person see? (5 marks]