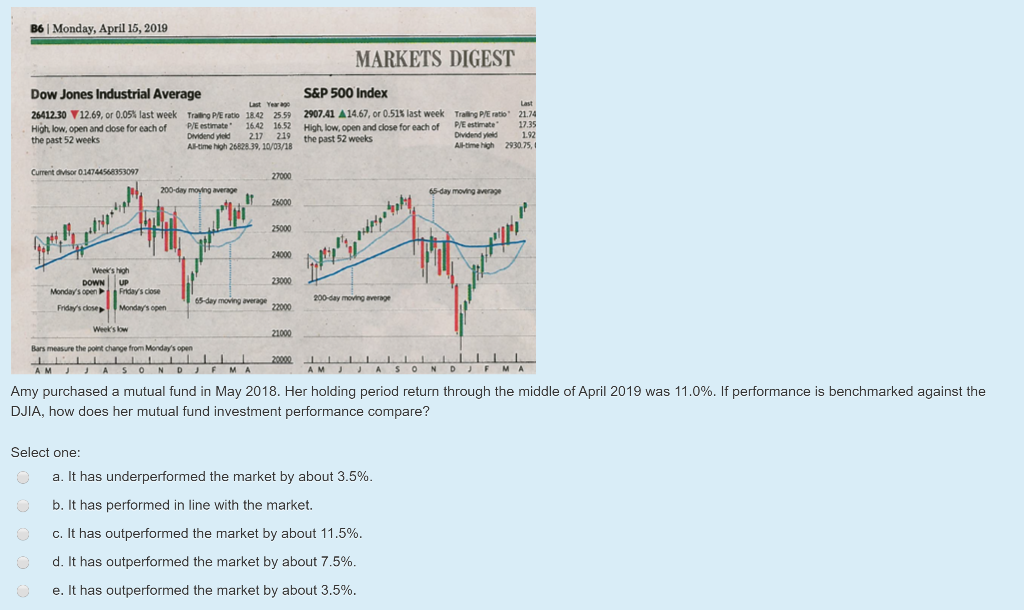

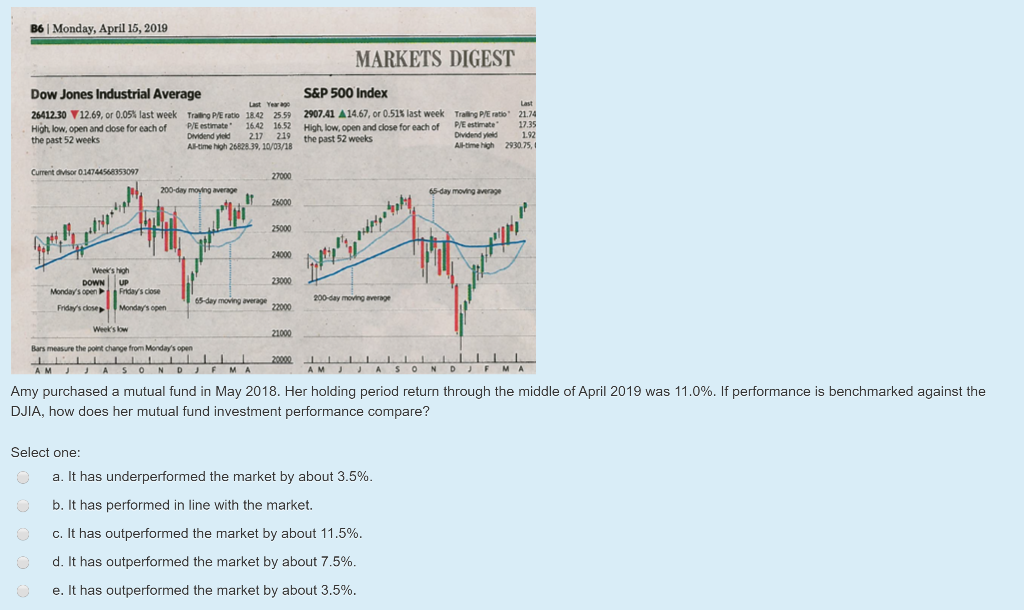

B6 Monday, April 15, 2019 MARKETS DIGEST Dow Jones Industrial Average Last year ago 26412.30 12.69, or 0.05% last week Trading PE ratio 18.42 25.59 Hloh low.open and close for each of P/E estimate 16.42 16.52 Dividend yield the past 52 weeks 217 219 Al-time high 26828.39, 10/03/18 S&P 500 Index 2907.41 A 14.67 or 0.51% last week High low.open and dose for each of the past 52 weeks Trading P atio 21.74 P/E estimate 17.35 Dividend 1.92 Al-time high 2930.75, Current Visor 014744568353097 27000 200-day moying average 65-day moving average 25000 25000 24000 Week's high DOWN Monday's open Friday's close Friday's close Monday's open 23000 65-day moving average 200-day moving average 22000 Week's low 21000 Bars measure the point change from Monday's open A M J J A S O N D S O N D Amy purchased a mutual fund in May 2018. Her holding period return through the middle of April 2019 was 11.0%. If performance is benchmarked against the DJIA, how does her mutual fund investment performance compare? Select one: O a. It has underperformed the market by about 3.5%. O b. It has performed in line with the market. o c. It has outperformed the market by about 11.5%. d. It has outperformed the market by about 7.5%. 0 O e. It has outperformed the market by about 3.5%. B6 Monday, April 15, 2019 MARKETS DIGEST Dow Jones Industrial Average Last year ago 26412.30 12.69, or 0.05% last week Trading PE ratio 18.42 25.59 Hloh low.open and close for each of P/E estimate 16.42 16.52 Dividend yield the past 52 weeks 217 219 Al-time high 26828.39, 10/03/18 S&P 500 Index 2907.41 A 14.67 or 0.51% last week High low.open and dose for each of the past 52 weeks Trading P atio 21.74 P/E estimate 17.35 Dividend 1.92 Al-time high 2930.75, Current Visor 014744568353097 27000 200-day moying average 65-day moving average 25000 25000 24000 Week's high DOWN Monday's open Friday's close Friday's close Monday's open 23000 65-day moving average 200-day moving average 22000 Week's low 21000 Bars measure the point change from Monday's open A M J J A S O N D S O N D Amy purchased a mutual fund in May 2018. Her holding period return through the middle of April 2019 was 11.0%. If performance is benchmarked against the DJIA, how does her mutual fund investment performance compare? Select one: O a. It has underperformed the market by about 3.5%. O b. It has performed in line with the market. o c. It has outperformed the market by about 11.5%. d. It has outperformed the market by about 7.5%. 0 O e. It has outperformed the market by about 3.5%