Question

BA - Cost Benefit Analysis New Billing System Cost Benefit Analysis A new automated premium billing system has been recommended by outside consultants. The requirements

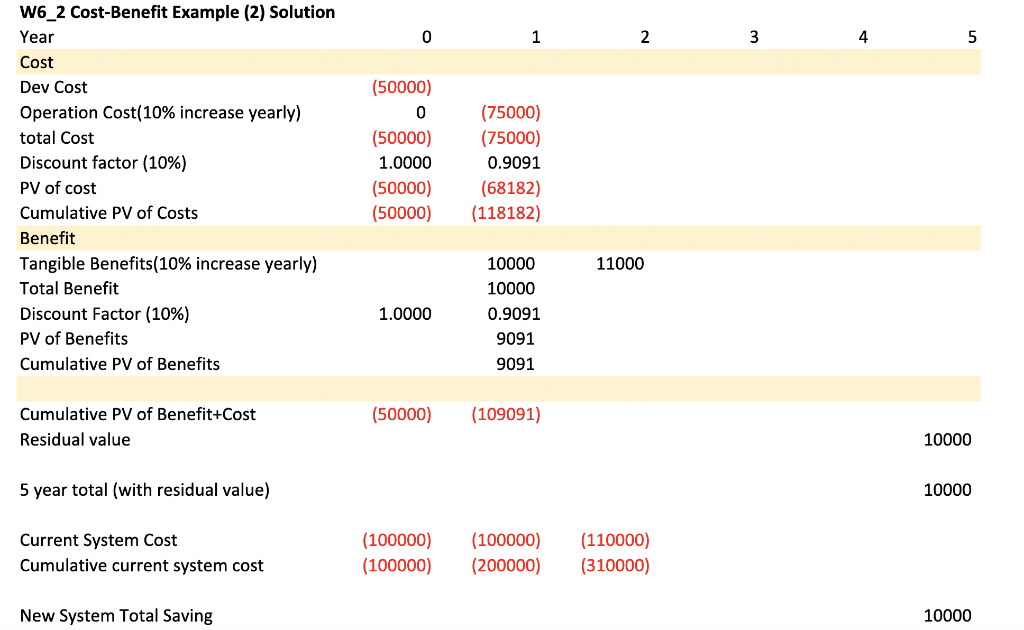

BA - Cost Benefit Analysis New Billing System Cost Benefit Analysis A new automated premium billing system has been recommended by outside consultants. The requirements have been defined and we are now ready to perform the cost benefit analysis. The system will cost $50,000 to build. It has been determined that the economic life of the new system will be 5 years, after its installation one year from now. At the end of the period, the data base can still be used in the replacement system, saving approximately $10,000. The current system's operating costs are estimated to be $100,000 per year but the operating costs for the new system are only $75,000 per year. The new system has additional intangible benefits of $10,000 per year. All estimates of costs and benefits are increasing at a rate of 10% per year for both the current and new systems. The required rate of return for the company is 15%. Use the Excel template to help you calculate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started