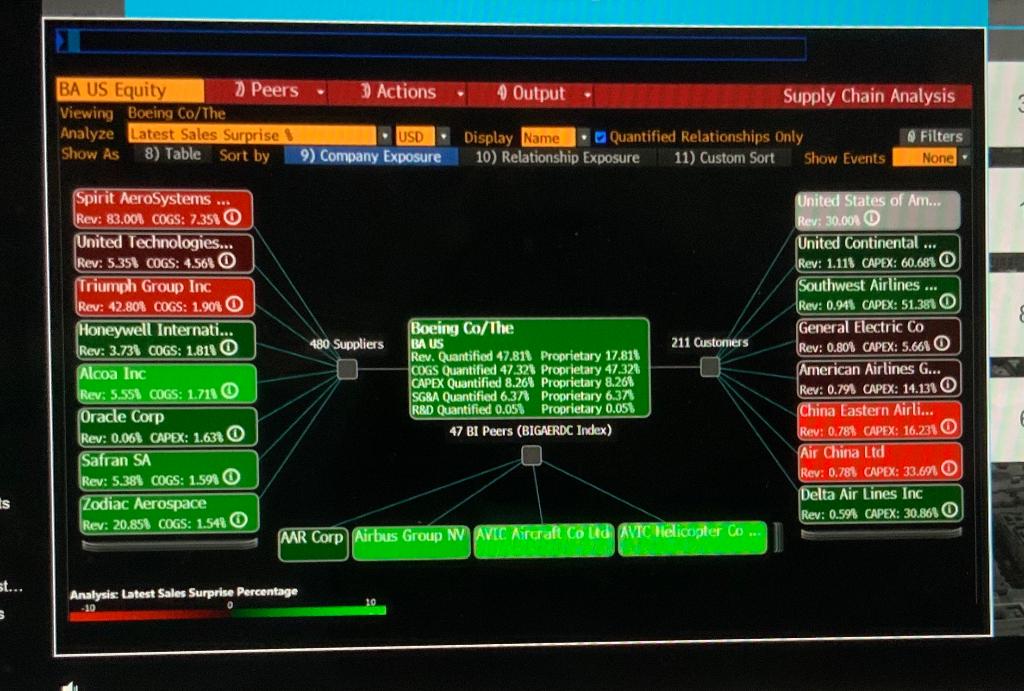

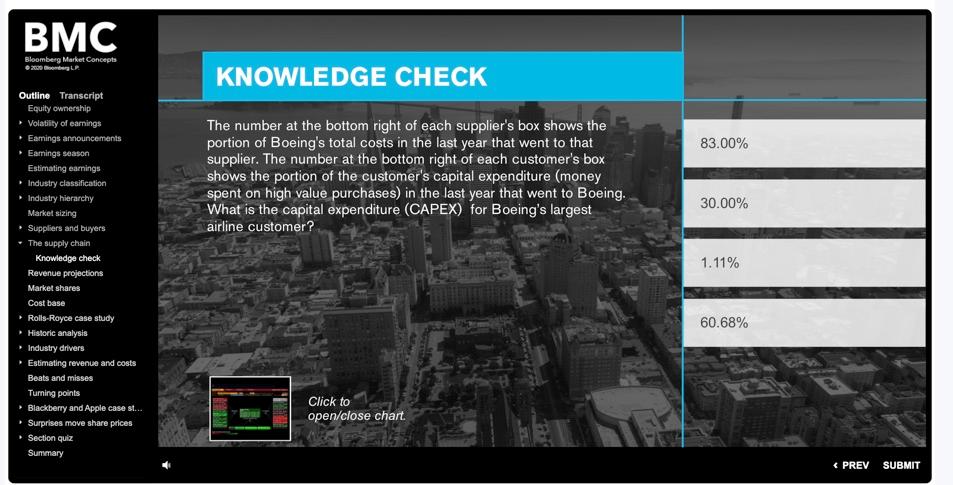

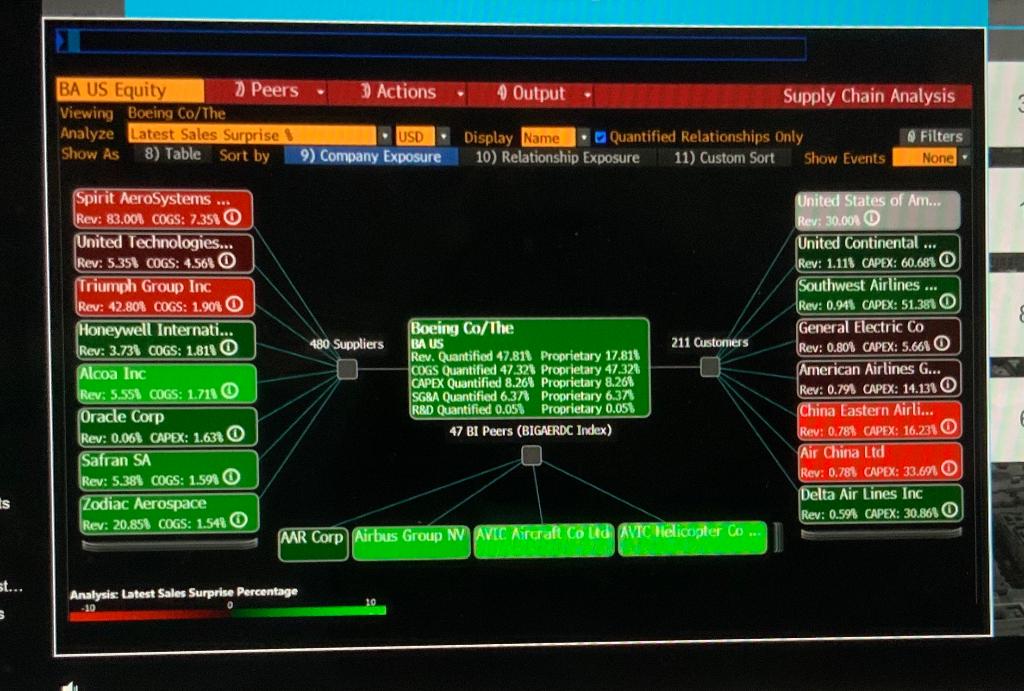

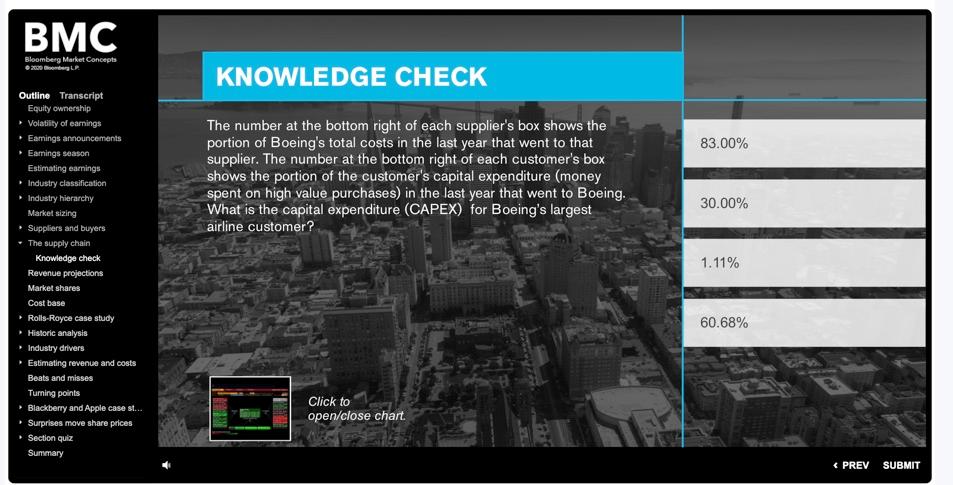

BA US Equity o Peers 3 Actions 4 Output Supply Chain Analysis Viewing Boeing Co/The Analyze Latest Sales Surprise USD Display Name Quantified Relationships Only Filters Show As 8) Table Sort by 9) Company Exposure 10) Relationship Exposure 11) Custom Sort Show Events None 480 Suppliers 211 Customers Spirit AeroSystems ... Rev: 83.001 COGS: 7.351 United Technologies... Rev: 5.351 COGS: 4.561 O Triumph Group Inc Rev: 42.804 COGS: 1.904 0 Honeywell Internati... Rev: 3.731 COGS: 1.811 0 Alcoa Inc Rev: 5.558 COGS: 1711 Oracle Corp Rev: 0.068 CAPEX: 1.631 0 Safran SA Rev: 5.38% COGS: 1.591 0 Zodiac Aerospace Rev: 20.858 COGS: 1.54 Boeing Co/The BA US Rev. Quantified 47.811 Proprietary 17,81% COGS Quantified 47.326 Proprietary 47.328 CAPEX Quantified 8.264 Proprietary 8.26% SGRA Quantified 6.37 Proprietary 6.37 R&D Quantified 0.05% Proprietary 0.05) 47 BI Peers (BIGAERDC Index) United States of Am... Rev: 30.000 United Continental ... Rev: 1.118 CAPEX: 60.681 O Southwest Airlines ... Rev: 0.911 CAPEX: 51.381 0 General Electric Co Rev: 0,80% CAPEX: 5.661 0 American Airlines G... Rev: 0.791 CAPEX: 14.131 0 China Eastern Airli... Rev: 0.781 CAPEX: 16.231 Air China Ltd Rev: 0.781 CAPEX: 33.691 O Delta Air Lines Inc Rev: 0.59% CAPEX: 30.865 0 is MR Corp Airbus Group NV AVIC Aircraft Co Ltd AVTC Helicopter Co... st... Analysis: Latest Sales Surprise Percentage 10 3 BMC Bloomberg Market Concepts KNOWLEDGE CHECK 83.00% The number at the bottom right of each supplier's box shows the portion of Boeing's total costs in the last year that went to that supplier. The number at the bottom right of each customer's box shows the portion of the customer's capital expenditure (money spent on high value purchases) in the last year that went to Boeing. What is the capital expenditure (CAPEX) for Boeing's largest airline customer? 30.00% 1.11% Outline Transcript Equity ownership Volatility of earings Eamings announcements Earnings season Estimating earnings Industry classification Industry hierarchy Market sizing Suppliers and buyers The supply chain Knowledge check Revenue projections Market shares Cost base Rolls-Royce case study Historic analysis Industry drivers Estimating revenue and costs Beats and misses Turning points Blackberry and Apple case st... Surprises move share prices Section quiz Summary 60.68% Click to open/close chart