Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Babytime, Inc., manufactures two products, Piglets and Rattles. Piglets are the more complex of the two products, requiring more direct labor time and more

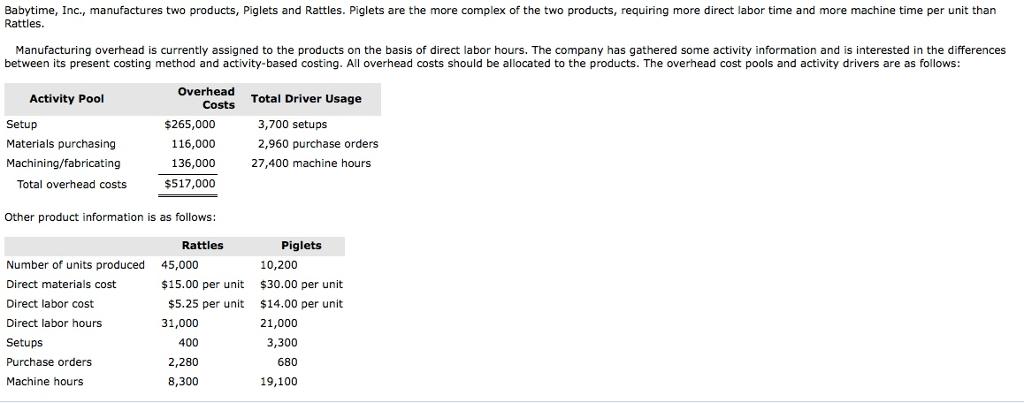

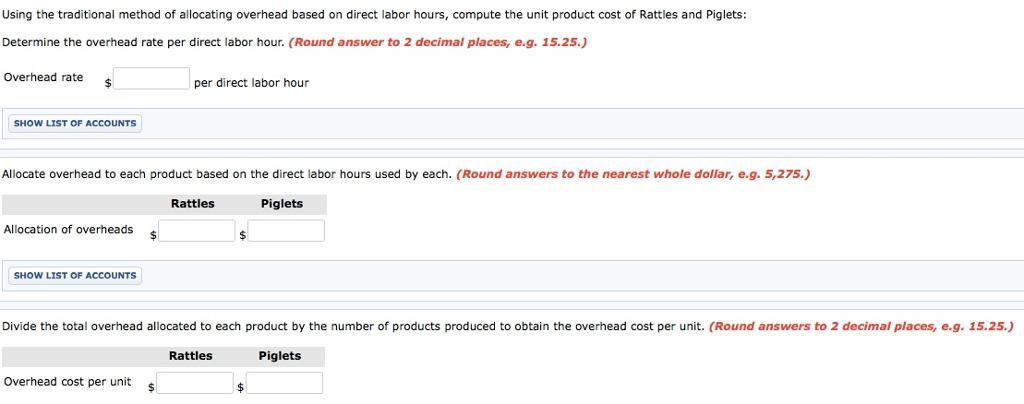

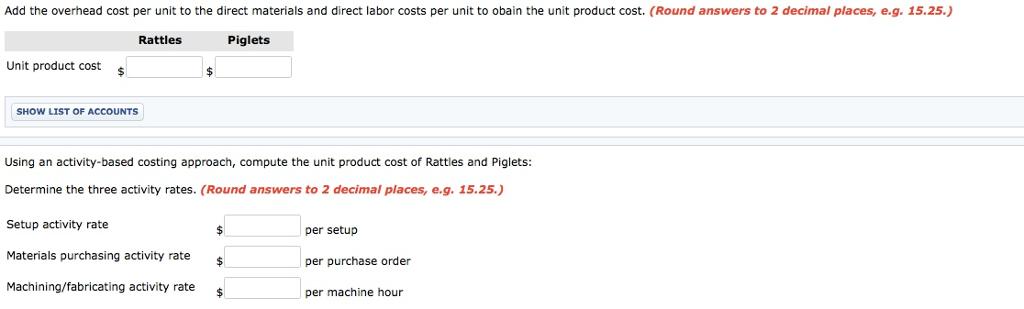

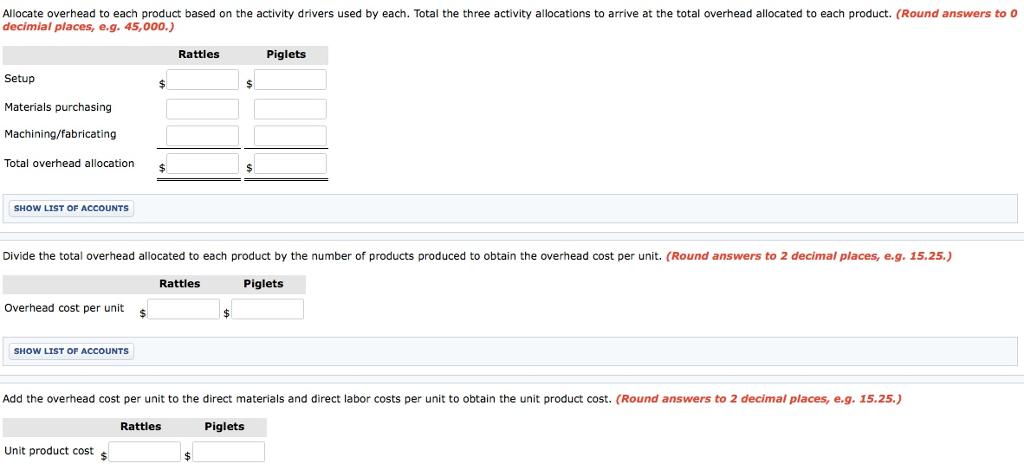

Babytime, Inc., manufactures two products, Piglets and Rattles. Piglets are the more complex of the two products, requiring more direct labor time and more machine time per unit than Rattles. Manufacturing overhead is currently assigned to the products on the basis of direct labor hours. The company has gathered some activity information and is interested in the differences between its present costing method and activity-based costing. All overhead costs should be allocated to the products. The overhead cost pools and activity drivers are as follows: Overhead Activity Pool Total Driver Usage Costs Setup $265,000 3,700 setups Materials purchasing 116,000 2,960 purchase orders Machining/fabricating 136,000 27,400 machine hours Total overhead costs $517,000 Other product information is as follows: Rattles Piglets Number of units produced 45,000 10,200 Direct materials cost $15.00 per unit $30.00 per unit Direct labor cost $5.25 per unit $14.00 per unit Direct labor hours 31,000 21,000 Setups 400 3,300 Purchase orders 2,280 680 Machine hours 8,300 19,100 Using the traditional method of allocating overhead based on direct labor hours, compute the unit product cost of Rattles and Piglets: Determine the overhead rate per direct labor hour. (Round answer to 2 decimal places, e.g. 15.25.) Overhead rate $ per direct labor hour SHOW LIST OF ACCOUNTS Allocate overhead to each product based on the direct labor hours used by each. (Round answers to the nearest whole dollar, e.g. 5,275.) Rattles Piglets Allocation of overheads SHOW LIST OF ACCOUNTS Divide the total overhead allocated to each product by the number of products produced to obtain the overhead cost per unit. (Round answers to 2 decimal places, e.g. 15.25.) Rattles Piglets Overhead cost per unit Add the overhead cost per unit to the direct materials and direct labor costs per unit to obain the unit product cost. (Round answers to 2 decimal places, e.g. 15.25.) Rattles Piglets Unit product cost SHOW LIST OF ACCOUNTS Using an activity-based costing approach, compute the unit product cost of Rattles and Piglets: Determine the three activity rates. (Round answers to 2 decimal places, e.g. 15.25.) Setup activity rate $4 per setup Materials purchasing activity rate $4 per purchase order Machining/fabricating activity rate 24 per machine hour Allocate overhead to each product based on the activity drivers used by each. Total the three activity allocations to arrive at the total overhead allocated to each product. (Round answers to 0 decimial places, e.g. 45,000.) Rattles Piglets Setup %24 Materials purchasing Machining/fabricating Total overhead allocation SHOW LIST OF ACCOUNTS Divide the total overhead allocated to each product by the number of products produced to obtain the overhead cost per unit. (Round answers to 2 decimal places, e.g. 15.25.) Rattles Piglets Overhead cost per unit SHOW LIST OF ACCOUNTS Add the overhead cost per unit to the direct materials and direct labor costs per unit to obtain the unit product cost. (Round answers to 2 decimal places, e.g. 15.25.) Rattles Piglets Unit product cost

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Traditional Costing System Answer 1 Overhead rate per direct labour hour Total Overhead cost Total d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started