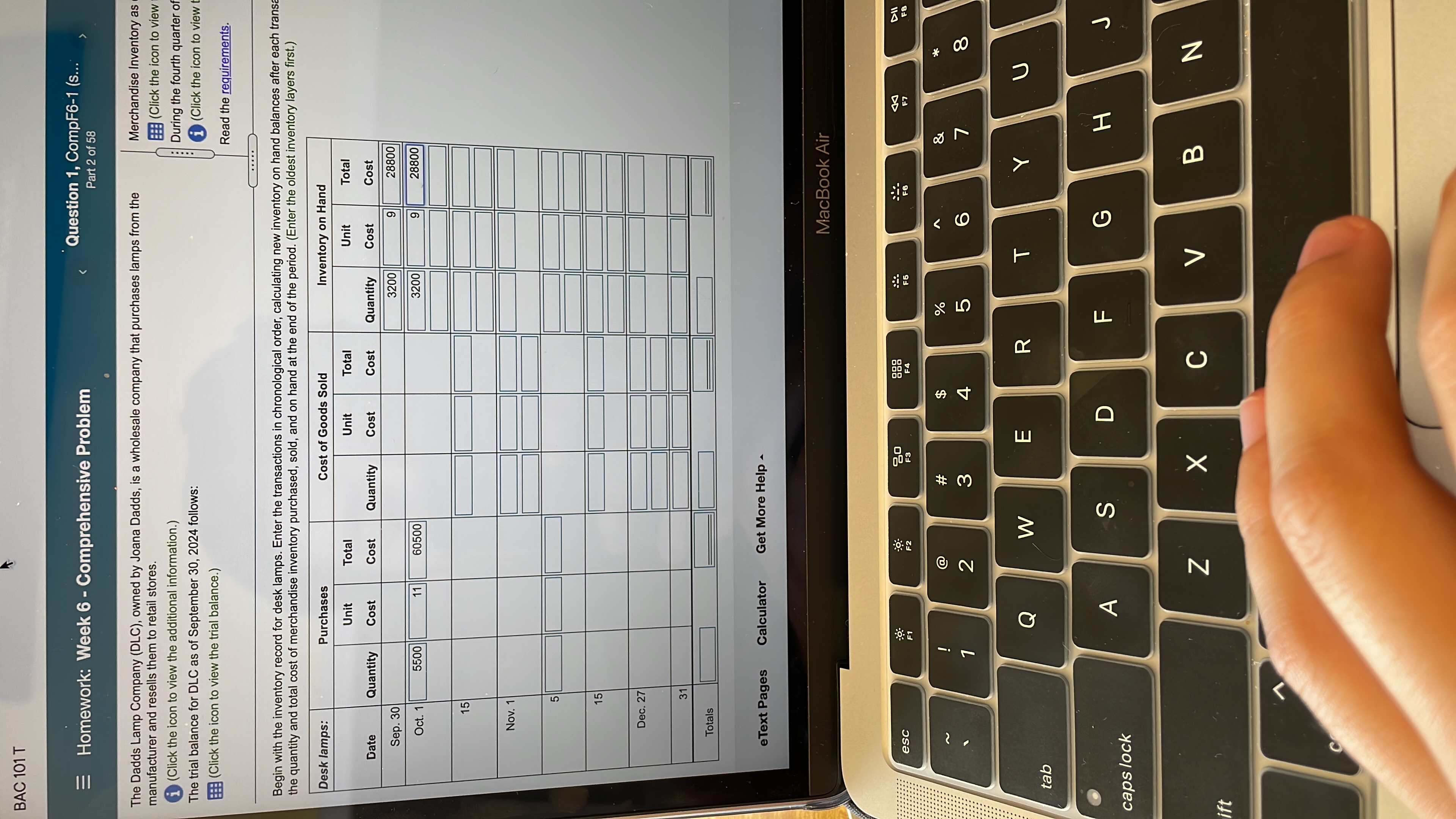

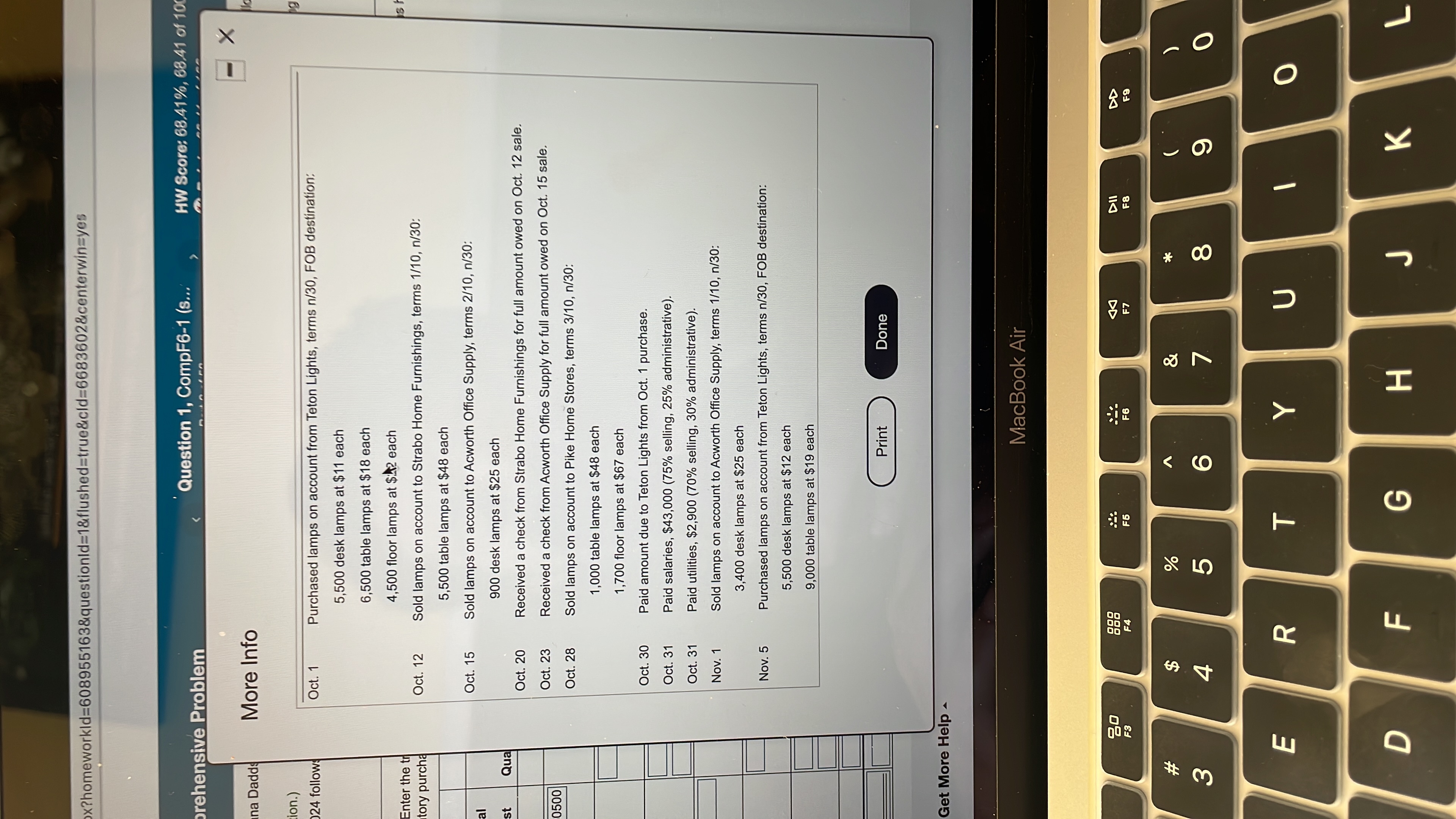

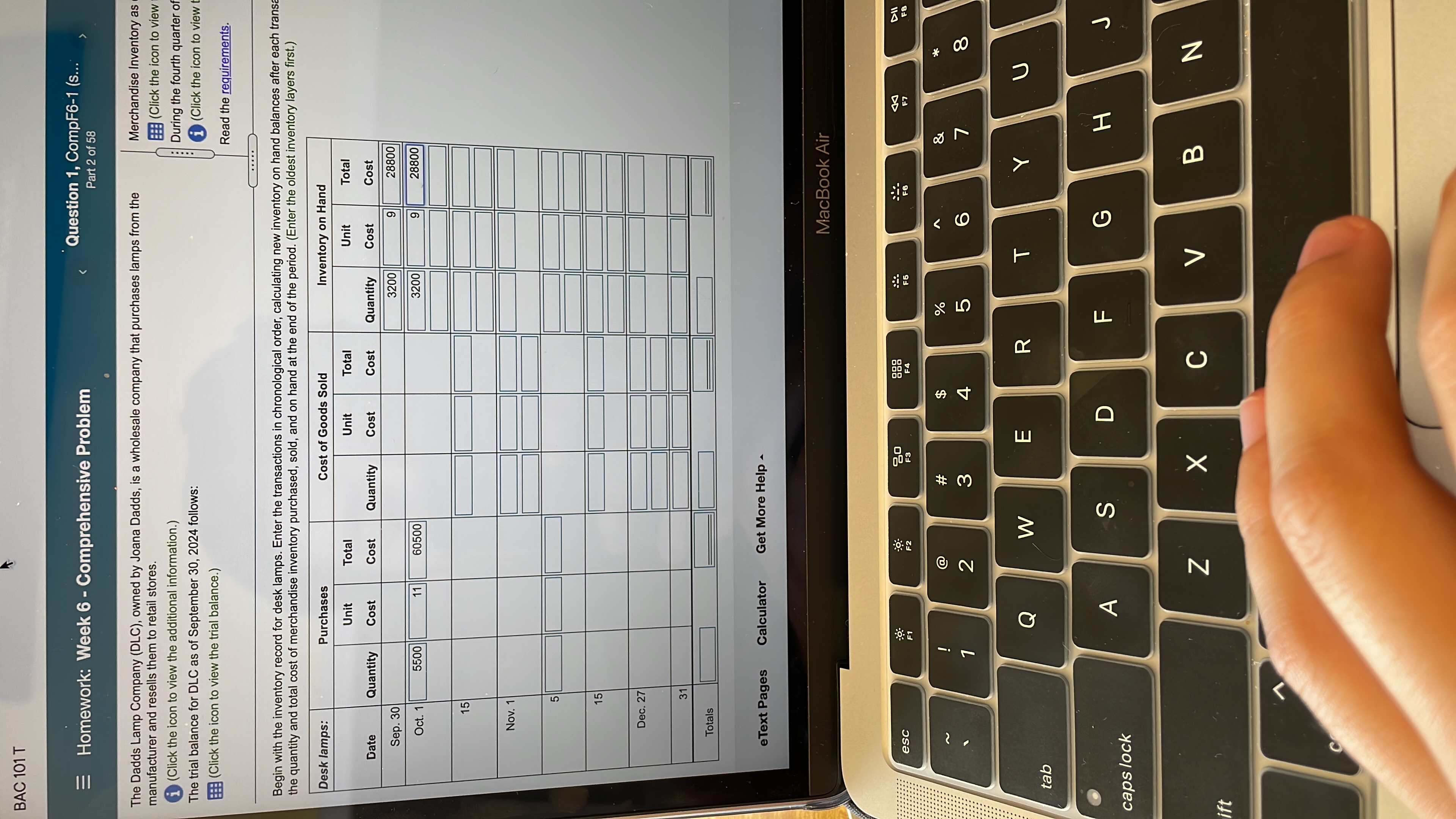

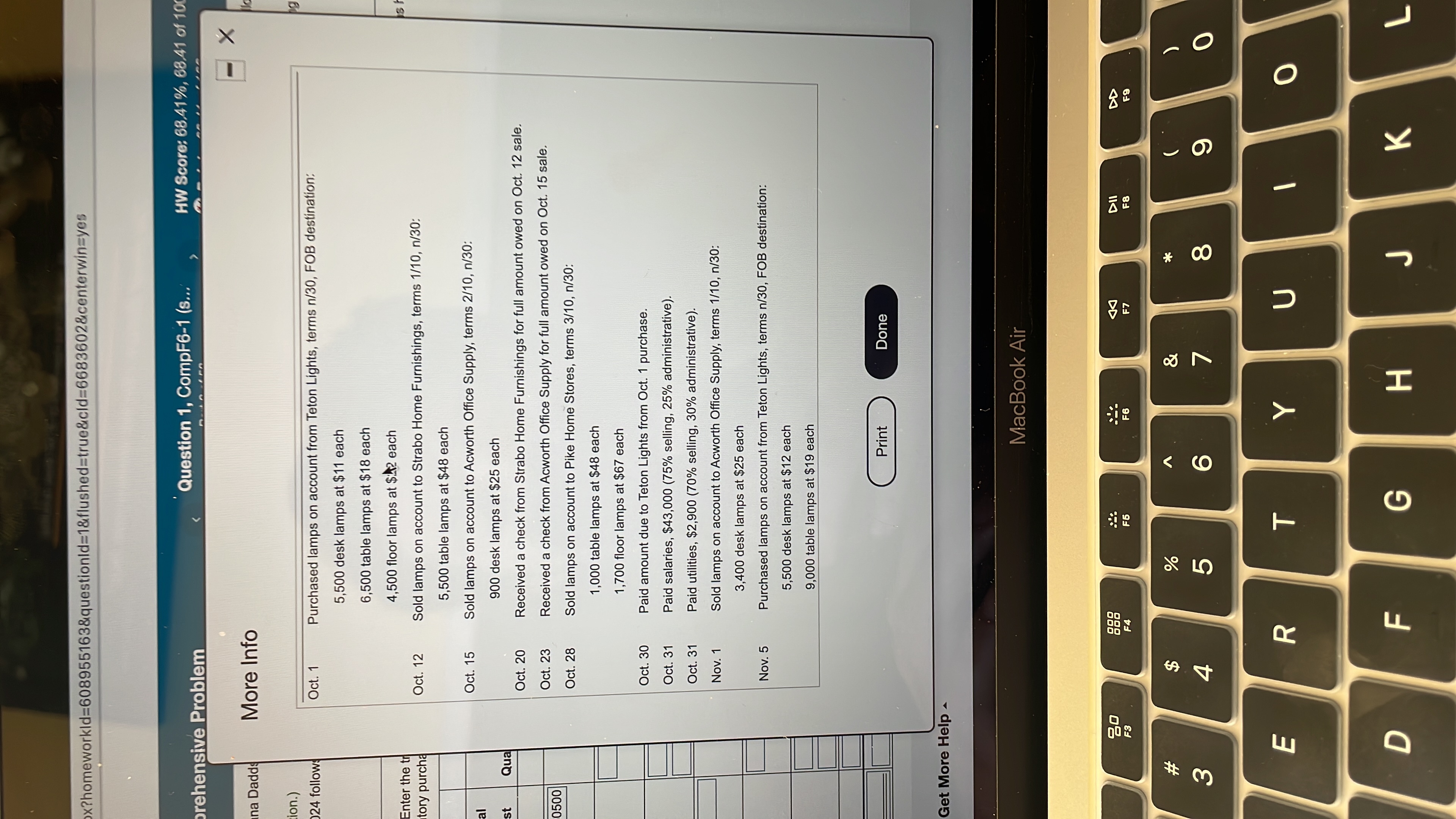

BAC 101 T Homework: Week 6 - Comprehensive Problem Question 1, CompF6-1 (s... Part 2 of 58 The Dadds Lamp Company (DLC), owned by Joana Dadds, is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. i (Click the icon to view the additional information.) The trial balance for DLC as of September 30, 2024 follows: 2 (Click the icon to view the trial balance.) Merchandise Inventory as (Click the icon to view During the fourth quarter of i (Click the icon to view t Read the requirements. Begin with the inventory record for desk lamps. Enter the transactions in chronological order, calculating new inventory on hand balances after each transa the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Desk lamps: Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Sep. 30 3200 9 28800 Oct. 1 5500 11 60500 3200 9 28800 15 Nov. 1 5 15 Dec. 27 31 Totals e Text Pages Calculator Get More Help A MacBook Air 80 a F7 Dll F8 esc F2 F1 F3 F6 F4 F6 @ ! # % & 9 S. $ 4 O1 ) > * 2 1 3 5 7 8 Q W E R T T Y U tab A S D D F G I J caps lock Z x X C V B N ift 7 C x?homeworkld=608955163&questionid=1&flushed=true&cid=66836028centerwin=yes Question 1, CompF6-1 (s... HW Score: 68.41%, 68.41 of 100 prehensive Problem FA na Dadda More Info la pg zion.) 24 follow 18 Enter the to tory purcha al st Qual 0500 Oct. 1 Purchased lamps on account from Teton Lights, terms n/30, FOB destination: 5,500 desk lamps at $11 each 6,500 table lamps at $18 each 4,500 floor lamps at $12 each Oct. 12 Sold lamps on account to Strabo Home Furnishings, terms 1/10, n/30: 5,500 table lamps at $48 each Oct. 15 Sold lamps on account to Acworth Office Supply, terms 2/10, n/30: 900 desk lamps at $25 each Oct. 20 Received a check from Strabo Home Furnishings for full amount owed on Oct. 12 sale. Oct. 23 Received a check from Acworth Office Supply for full amount owed on Oct. 15 sale. Oct. 28 Sold lamps on account to Pike Home Stores, terms 3/10, n/30: 1,000 table lamps at $48 each 1,700 floor lamps at $67 each Oct. 30 Paid unt due to Teton Lights from Oct. 1 purchase. Oct. 31 Paid salaries, $43,000 (75% selling, 25% administrative). Oct. 31 Paid utilities, $2,900 (70% selling, 30% administrative). Nov. 1 Sold lamps on account to Acworth Office Supply, terms 1/10, n/30: 3,400 desk lamps at $25 each Nov. 5 Purchased lamps on account from Teton Lights, terms n/30, FOB destination: 5,500 desk lamps at $12 each 9,000 table lamps at $19 each Print Done Get More Help MacBook Air 80 DII F8 F3 F4 F6 F6 F7 F9 # $ % A & DO * 3 4 5 6 7. 8 9 0 E R T Y U I o O D F G H J K L BAC 101 T Homework: Week 6 - Comprehensive Problem Question 1, CompF6-1 (s... Part 2 of 58 The Dadds Lamp Company (DLC), owned by Joana Dadds, is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. i (Click the icon to view the additional information.) The trial balance for DLC as of September 30, 2024 follows: 2 (Click the icon to view the trial balance.) Merchandise Inventory as (Click the icon to view During the fourth quarter of i (Click the icon to view t Read the requirements. Begin with the inventory record for desk lamps. Enter the transactions in chronological order, calculating new inventory on hand balances after each transa the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Desk lamps: Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Sep. 30 3200 9 28800 Oct. 1 5500 11 60500 3200 9 28800 15 Nov. 1 5 15 Dec. 27 31 Totals e Text Pages Calculator Get More Help A MacBook Air 80 a F7 Dll F8 esc F2 F1 F3 F6 F4 F6 @ ! # % & 9 S. $ 4 O1 ) > * 2 1 3 5 7 8 Q W E R T T Y U tab A S D D F G I J caps lock Z x X C V B N ift 7 C x?homeworkld=608955163&questionid=1&flushed=true&cid=66836028centerwin=yes Question 1, CompF6-1 (s... HW Score: 68.41%, 68.41 of 100 prehensive Problem FA na Dadda More Info la pg zion.) 24 follow 18 Enter the to tory purcha al st Qual 0500 Oct. 1 Purchased lamps on account from Teton Lights, terms n/30, FOB destination: 5,500 desk lamps at $11 each 6,500 table lamps at $18 each 4,500 floor lamps at $12 each Oct. 12 Sold lamps on account to Strabo Home Furnishings, terms 1/10, n/30: 5,500 table lamps at $48 each Oct. 15 Sold lamps on account to Acworth Office Supply, terms 2/10, n/30: 900 desk lamps at $25 each Oct. 20 Received a check from Strabo Home Furnishings for full amount owed on Oct. 12 sale. Oct. 23 Received a check from Acworth Office Supply for full amount owed on Oct. 15 sale. Oct. 28 Sold lamps on account to Pike Home Stores, terms 3/10, n/30: 1,000 table lamps at $48 each 1,700 floor lamps at $67 each Oct. 30 Paid unt due to Teton Lights from Oct. 1 purchase. Oct. 31 Paid salaries, $43,000 (75% selling, 25% administrative). Oct. 31 Paid utilities, $2,900 (70% selling, 30% administrative). Nov. 1 Sold lamps on account to Acworth Office Supply, terms 1/10, n/30: 3,400 desk lamps at $25 each Nov. 5 Purchased lamps on account from Teton Lights, terms n/30, FOB destination: 5,500 desk lamps at $12 each 9,000 table lamps at $19 each Print Done Get More Help MacBook Air 80 DII F8 F3 F4 F6 F6 F7 F9 # $ % A & DO * 3 4 5 6 7. 8 9 0 E R T Y U I o O D F G H J K L