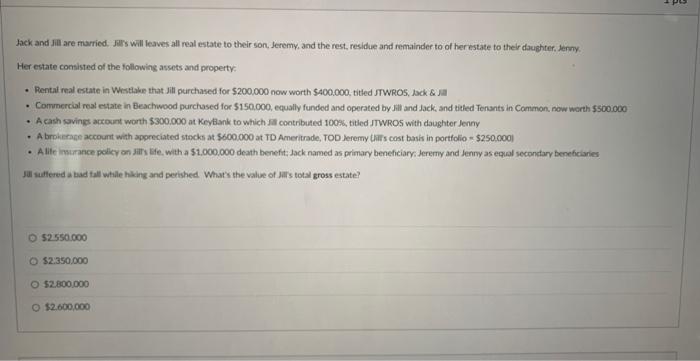

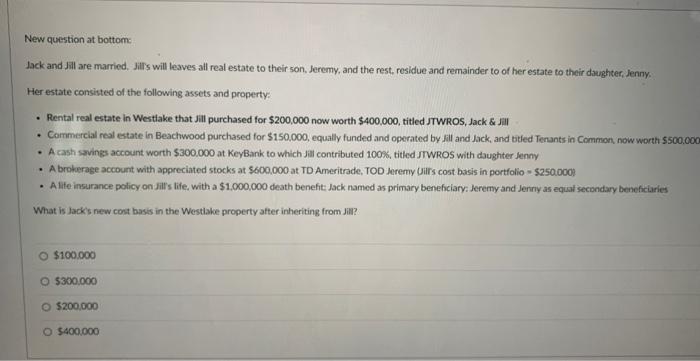

back and Jill are married. Jils will leaves all real estate to their son, Jeremy, and the rest, residue and remainder to of her estate to their daughter, kenmy: Her estate consisted of the followine assets and property: - Rental real estate in Westlake that Jill purchased for $200.000 now worth $400.000, titled JTWRO5, Jack \& Jal - Commercial reat estate in Beachwood purchased for 5150.000, equally funded and operated by Jill and Jack, and titled Tenants in Common, new worth 5500.000 - A cash savings actount worth $300.000 at Keytank to which Jat cootributed 1003k, tilied JTWROS with daughter Jenny - A brpkicrage account with appecciated strcks at $600.000 at TD Ameritrade, TOD Jeremy Uiils cost bashs in portfolio = $250,000. - A lile imurance policy on jilis life. with a $1.000,000 death benefit dack named as primary beneficiarys Jeremy and Jenny as equal seconctary beneficianies Jil sullered a kad tall whille hiking and perished What's the value of Jilis total gross estate? 52550000 $2.350.000 $2.800.000 12,600,000 New question at bottom: Jack and Jill are married. Jilis will leaves all real estate to their son, Jeremy, and the rest, residue and remainder to of her estate to their daughter, Jenny. Her estate consisted of the following assets and property: - Rental real estate in Westiake that Jill purchased for $200,000 now worth $400,000, titled JTWROS, Jack \& Jill * Commercial real estate in Beachwood purchased for $150,000, equally funded and operated by lill and Jack, and btied Tenants in Common, now worth 5500.00 - A cash savings account worth $300.000 at KeyBank to which Jili contributed 1008 , titled JTWROS with daughter Jenny - A broherage account with appreciated stocks at $600,000 at TD Ameritrade, TOD Jeremy (Jilrs cost basis in portfolio = $250.000. - A Iite insurance policy on Jills s life, with a $1,000,000 death benefit Jack named as primary beneficiary: Jeremy and Jenny as equal seciondary beneficiaries What is Jack's new cost basis in the Westiake property after inheriting from Jil? $100.000 $300000 5200,000