Answered step by step

Verified Expert Solution

Question

1 Approved Answer

< Back CMAB021 Mid-Year Exa... Q QUESTION THREE [15 MARKS] Chamisa Ltd is a company operating in the retail sector, that has recently experienced

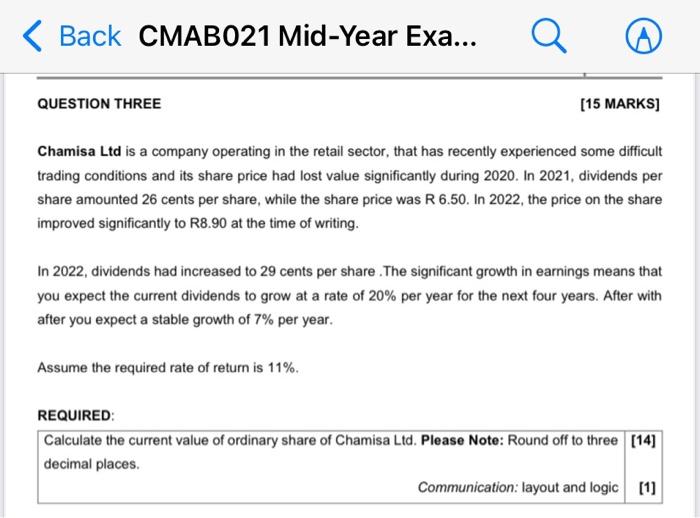

< Back CMAB021 Mid-Year Exa... Q QUESTION THREE [15 MARKS] Chamisa Ltd is a company operating in the retail sector, that has recently experienced some difficult trading conditions and its share price had lost value significantly during 2020. In 2021, dividends per share amounted 26 cents per share, while the share price was R 6.50. In 2022, the price on the share improved significantly to R8.90 at the time of writing. In 2022, dividends had increased to 29 cents per share. The significant growth in earnings means that you expect the current dividends to grow at a rate of 20% per year for the next four years. After with after you expect a stable growth of 7% per year. Assume the required rate of return is 11%. REQUIRED: Calculate the current value of ordinary share of Chamisa Ltd. Please Note: Round off to three [14] decimal places. Communication: layout and logic [1]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started