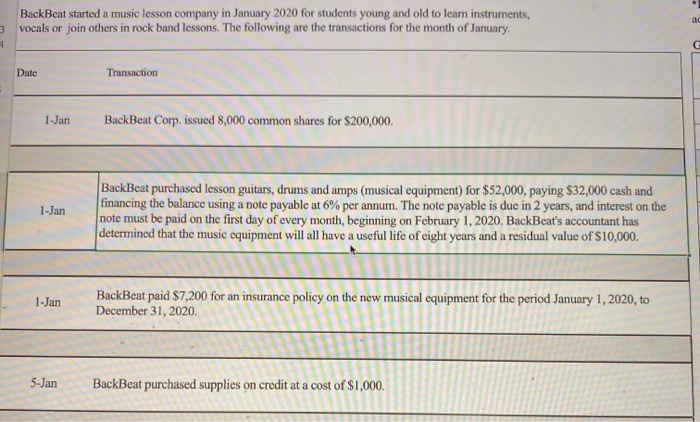

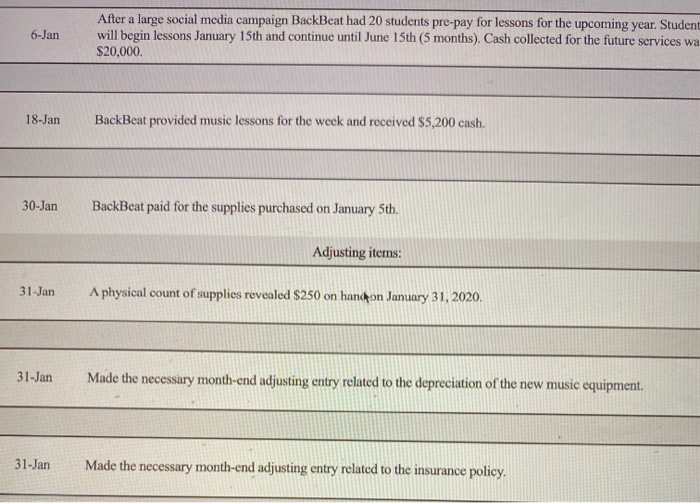

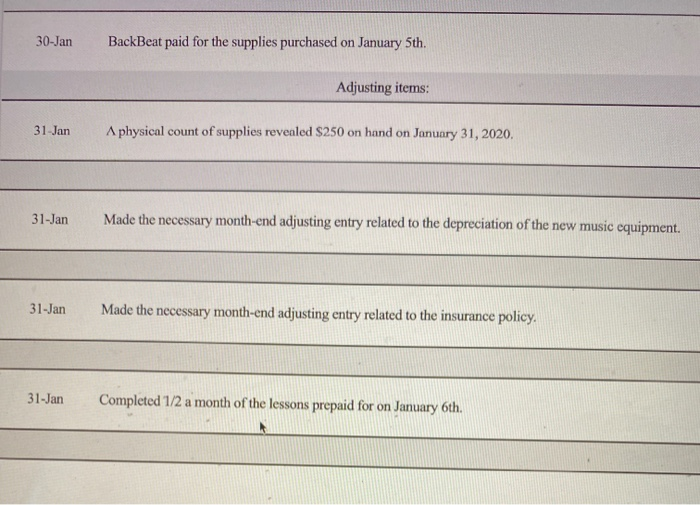

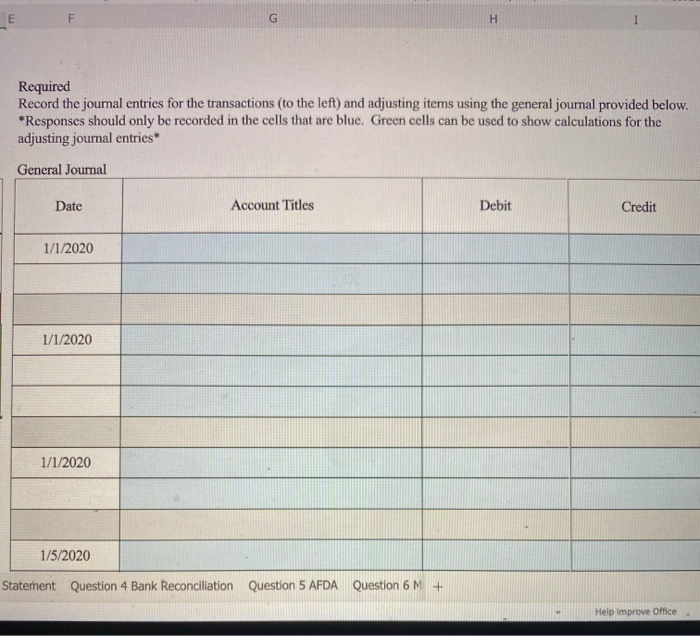

BackBeat started a music lesson company in January 2020 for students young and old to learn instruments, vocals or join others in rock band lessons. The following are the transactions for the month of January 3 4 G Date Transaction 1-Jan BackBeat Corp. issued 8,000 common shares for $200,000. 1-Jan BackBeat purchased lesson guitars, drums and amps (musical equipment) for $52,000, paying $32,000 cash and financing the balance using a note payable at 6% per annum. The note payable is due in 2 years, and interest on the note must be paid on the first day of every month, beginning on February 1, 2020. BackBeat's accountant has determined that the music equipment will all have a useful life of eight years and a residual value of $10,000. 1-Jan BackBeat paid $7,200 for an insurance policy on the new musical equipment for the period January 1, 2020, to December 31, 2020. 5-Jan BackBeat purchased supplies on credit at a cost of $1,000. 6-Jan After a large social media campaign BackBeat had 20 students pre-pay for lessons for the upcoming year. Student will begin lessons January 15th and continue until June 15th (5 months). Cash collected for the future services wa $20,000. 18-Jan BackBeat provided music lessons for the week and received $5,200 cash. 30-Jan BackBeat paid for the supplies purchased on January 5th. Adjusting items: 31-Jan A physical count of supplies revealed $250 on hand on January 31, 2020. 31-Jan Made the necessary month-end adjusting entry related to the depreciation of the new music equipment. 31-Jan Made the necessary month-end adjusting entry related to the insurance policy 30-Jan BackBeat paid for the supplies purchased on January 5th. Adjusting items: 31-Jan A physical count of supplies revealed $250 on hand on January 31, 2020. 31-Jan Made the necessary month-end adjusting entry related to the depreciation of the new music equipment. 31-Jan Made the necessary month-end adjusting entry related to the insurance policy. 31-Jan Completed 1/2 a month of the lessons prepaid for on January 6th. LE F G H Required Record the journal entries for the transactions to the left) and adjusting items using the general journal provided below. * Responses should only be recorded in the cells that are blue. Green cells can be used to show calculations for the adjusting journal entries General Journal Date Account Titles Debit Credit 1/1/2020 1/1/2020 1/1/2020 1/5/2020 Staternent Question 4 Bank Reconciliation Question 5 AFDA Question 6 M + Help Improve Office