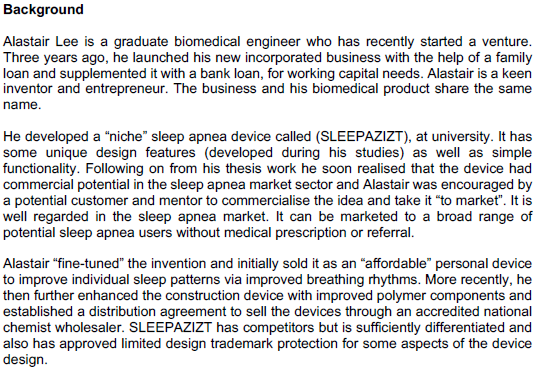

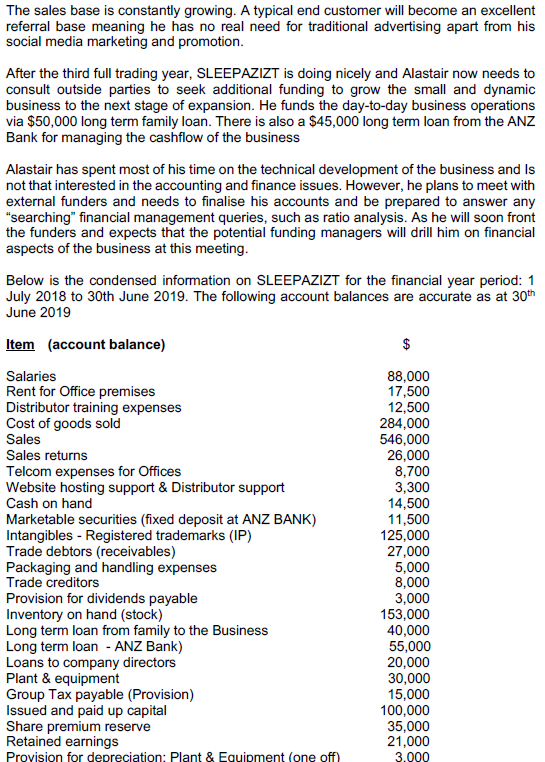

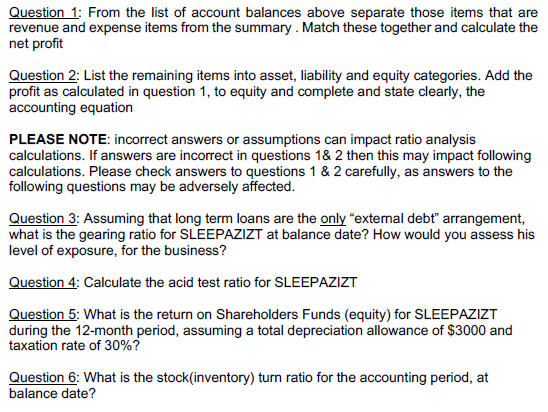

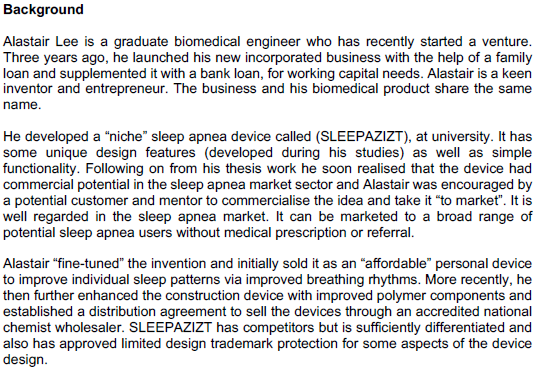

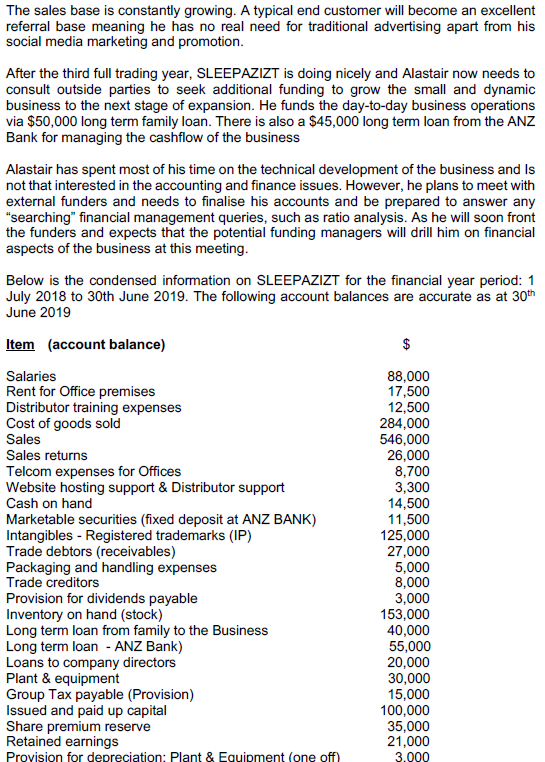

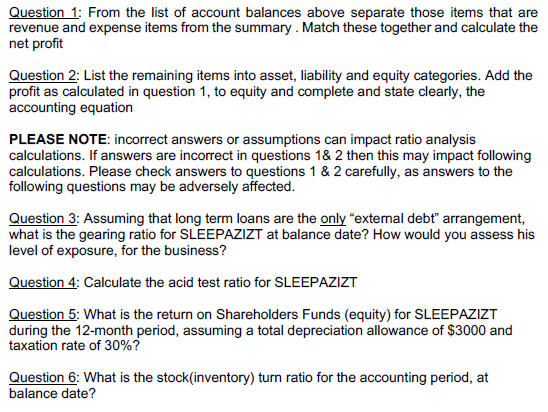

Background Alastair Lee is a graduate biomedical engineer who has recently started a venture. Three years ago, he launched his new incorporated business with the help of a family loan and supplemented it with a bank loan, for working capital needs. Alastair is a keen inventor and entrepreneur. The business and his biomedical product share the same name. He developed a "niche" sleep apnea device called (SLEEPAZIZT), at university. It has some unique design features (developed during his studies) as well as simple functionality. Following on from his thesis work he soon realised that the device had commercial potential in the sleep apnea market sector and Alastair was encouraged by a potential customer and mentor to commercialise the idea and take it to market". It is well regarded in the sleep apnea market. It can be marketed to a broad range of potential sleep apnea users without medical prescription or referral. Alastair "fine-tuned" the invention and initially sold it as an affordable personal device to improve individual sleep patterns via improved breathing rhythms. More recently, he then further enhanced the construction device with improved polymer components and established a distribution agreement to sell the devices through an accredited national chemist wholesaler. SLEEPAZIZT has competitors but is sufficiently differentiated and also has approved limited design trademark protection for some aspects of the device design. The sales base is constantly growing. A typical end customer will become an excellent referral base meaning he has no real need for traditional advertising apart from his social media marketing and promotion. After the third full trading year, SLEEPAZIZT is doing nicely and Alastair now needs to consult outside parties to seek additional funding to grow the small and dynamic business to the next stage of expansion. He funds the day-to-day business operations via $50,000 long term family loan. There is also a $45,000 long term loan from the ANZ Bank for managing the cashflow of the business Alastair has spent most of his time on the technical development of the business and is not that interested in the accounting and finance issues. However, he plans to meet with external funders and needs to finalise his accounts and be prepared to answer any "searching financial management queries, such as ratio analysis. As he will soon front the funders and expects that the potential funding managers will drill him on financial aspects of the business at this meeting. Below is the condensed information on SLEEPAZIZT for the financial year period: 1 July 2018 to 30th June 2019. The following account balances are accurate as at 30th June 2019 Item (account balance) Salaries Rent for Office premises Distributor training expenses Cost of goods sold Sales Sales returns Telcom expenses for Offices Website hosting support & Distributor support Cash on hand Marketable securities (fixed deposit at ANZ BANK) Intangibles - Registered trademarks (IP) Trade debtors (receivables) Packaging and handling expenses Trade creditors Provision for dividends payable Inventory on hand (stock) Long term loan from family to the Business Long term loan - ANZ Bank) Loans to company directors Plant & equipment Group Tax payable (Provision) Issued and paid up capital Share premium reserve Retained earnings Provision for depreciation: Plant & Equipment (one off) 88,000 17,500 12,500 284,000 546,000 26,000 8,700 3,300 14,500 11,500 125,000 27,000 5,000 8,000 3,000 153,000 40,000 55,000 20,000 30,000 15,000 100,000 35.000 21,000 3.000 Question 1: From the list of account balances above separate those items that are revenue and expense items from the summary. Match these together and calculate the net profit Question 2: List the remaining items into asset, liability and equity categories. Add the profit as calculated in question 1, to equity and complete and state clearly, the accounting equation PLEASE NOTE: incorrect answers or assumptions can impact ratio analysis calculations. If answers are incorrect in questions 1& 2 then this may impact following calculations. Please check answers to questions 1 & 2 carefully, as answers to the following questions may be adversely affected. Question 3: Assuming that long term loans are the only "external debt" arrangement, what is the gearing ratio for SLEEPAZIZT at balance date? How would you assess his level of exposure, for the business? Question 4: Calculate the acid test ratio for SLEEPAZIZT Question 5: What is the return on Shareholders Funds (equity) for SLEEPAZIZT during the 12-month period, assuming a total depreciation allowance of $3000 and taxation rate of 30%? Question 6: What is the stock(inventory) turn ratio for the accounting period, at balance date