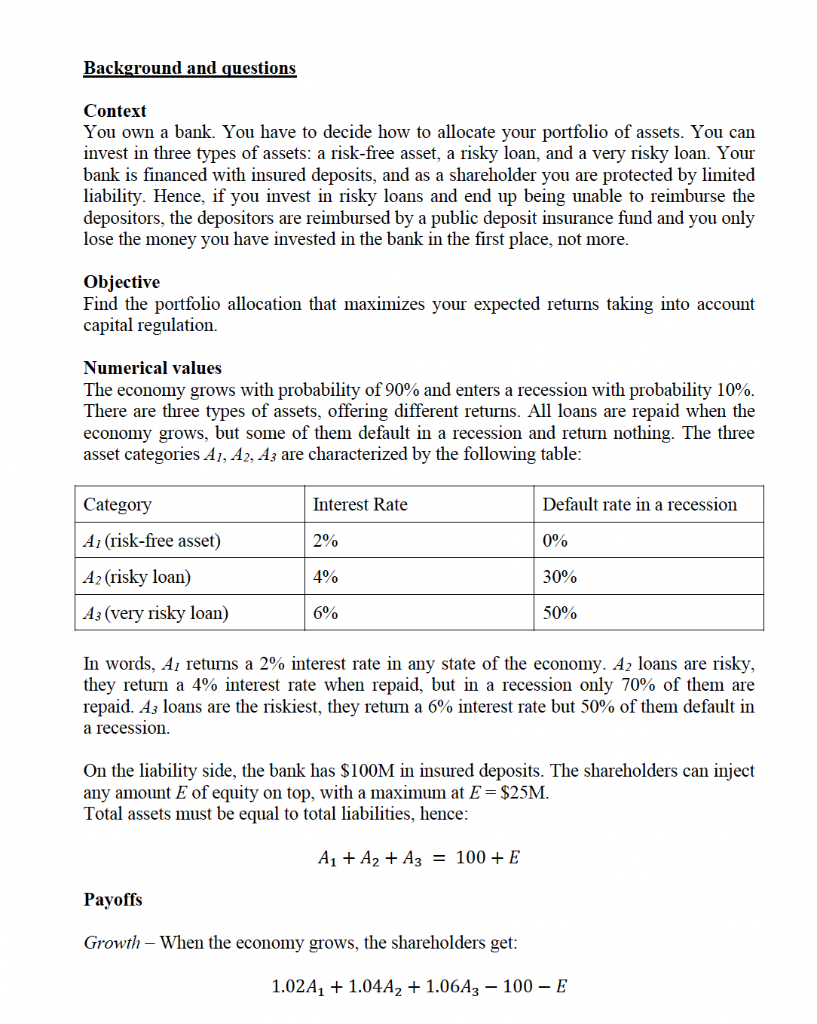

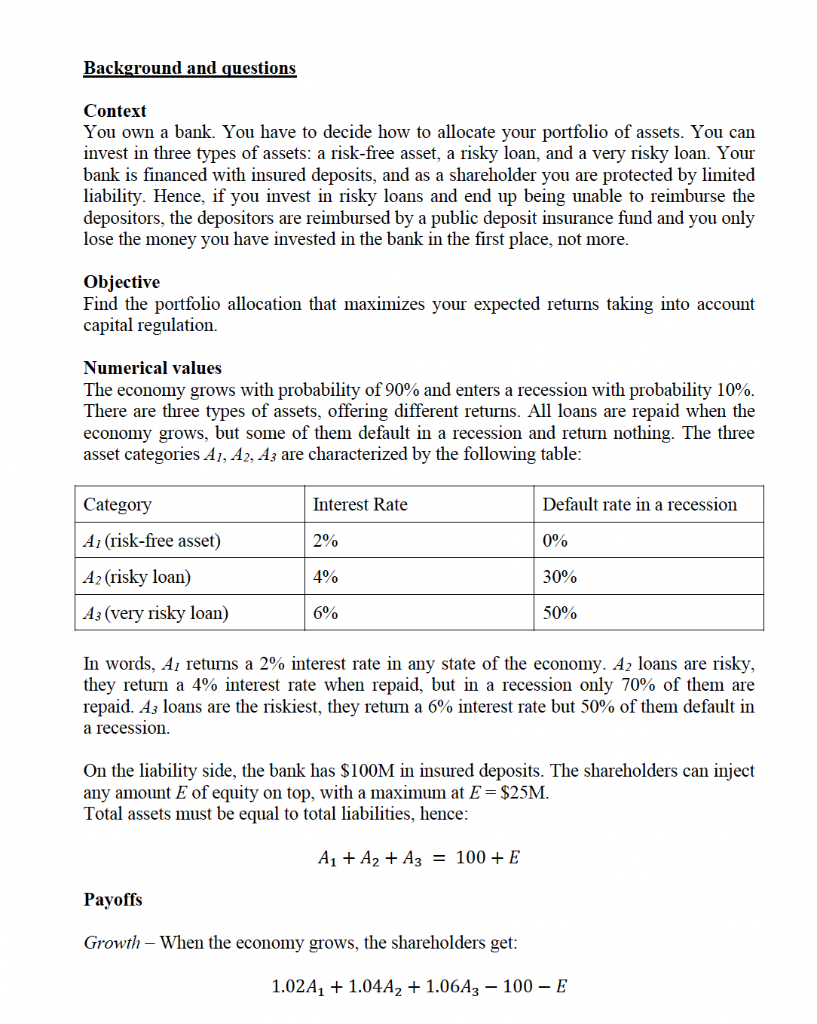

Background and questions Context You own a bank. You have to decide how to allocate your portfolio of assets. You can invest in three types of assets: a risk-free asset, a risky loan, and a very risky loan. Your bank is financed with insured deposits, and as a shareholder you are protected by limited liability. Hence, if you invest in risky loans and end up being unable to reimburse the depositors, the depositors are reimbursed by a public deposit insurance fund and you only lose the money you have invested in the bank in the first place, not more. Objective Find the portfolio allocation that maximizes your expected returns taking into account capital regulation. Numerical values The economy grows with probability of 90% and enters a recession with probability 10%. There are three types of assets, offering different returns. All loans are repaid when the economy grows, but some of them default in a recession and return nothing. The three asset categories A1, A2, A3 are characterized by the following table: Category Interest Rate Default rate in a recession Ai (risk-free asset) 2% 0% 4% 30% A2 (risky loan) A3 (very risky loan) 6% 50% In words, A; returns a 2% interest rate in any state of the economy. A2 loans are risky, they return a 4% interest rate when repaid, but in a recession only 70% of them are repaid. Az loans are the riskiest, they return a 6% interest rate but 50% of them default in a recession. On the liability side, the bank has $100M in insured deposits. The shareholders can inject any amount E of equity on top, with a maximum at E = $25M. Total assets must be equal to total liabilities, hence: A1 + A2 + Az = 100 + E Payoffs Growth - When the economy grows, the shareholders get: 1.02A1 + 1.04A, +1.06A3 100 - E Recession - When the economy enters a recession, two things can happen. . If 1.0242 + 0.70 x 1.04A, +0.50 x 1.06A3 8% A + A 4. Basel 2 Risk-weighted capital requirements (3 points): Capital requirements are now based on risk-weights. The variables A1, A2, A3, E need to satisfy the following constraint: E > 10% w141 + w2A2 + W3A3 with w= 0, W2 = 4, W3 = 7. For each scenario: how do you choose A1, A2, A3, E in order to maximize your total payoff? Briefly explain your answer. Background and questions Context You own a bank. You have to decide how to allocate your portfolio of assets. You can invest in three types of assets: a risk-free asset, a risky loan, and a very risky loan. Your bank is financed with insured deposits, and as a shareholder you are protected by limited liability. Hence, if you invest in risky loans and end up being unable to reimburse the depositors, the depositors are reimbursed by a public deposit insurance fund and you only lose the money you have invested in the bank in the first place, not more. Objective Find the portfolio allocation that maximizes your expected returns taking into account capital regulation. Numerical values The economy grows with probability of 90% and enters a recession with probability 10%. There are three types of assets, offering different returns. All loans are repaid when the economy grows, but some of them default in a recession and return nothing. The three asset categories A1, A2, A3 are characterized by the following table: Category Interest Rate Default rate in a recession Ai (risk-free asset) 2% 0% 4% 30% A2 (risky loan) A3 (very risky loan) 6% 50% In words, A; returns a 2% interest rate in any state of the economy. A2 loans are risky, they return a 4% interest rate when repaid, but in a recession only 70% of them are repaid. Az loans are the riskiest, they return a 6% interest rate but 50% of them default in a recession. On the liability side, the bank has $100M in insured deposits. The shareholders can inject any amount E of equity on top, with a maximum at E = $25M. Total assets must be equal to total liabilities, hence: A1 + A2 + Az = 100 + E Payoffs Growth - When the economy grows, the shareholders get: 1.02A1 + 1.04A, +1.06A3 100 - E Recession - When the economy enters a recession, two things can happen. . If 1.0242 + 0.70 x 1.04A, +0.50 x 1.06A3 8% A + A 4. Basel 2 Risk-weighted capital requirements (3 points): Capital requirements are now based on risk-weights. The variables A1, A2, A3, E need to satisfy the following constraint: E > 10% w141 + w2A2 + W3A3 with w= 0, W2 = 4, W3 = 7. For each scenario: how do you choose A1, A2, A3, E in order to maximize your total payoff? Briefly explain your