Question

Auto Parts, Inc. (the Company) manufactures automobile subassemblies marketed primarily to the big three U.S. automakers. The publicly held Company's unaudited financial statements for the

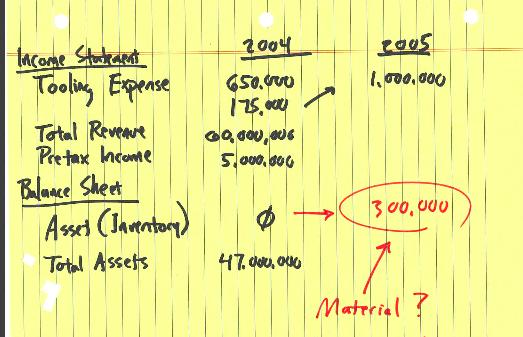

Auto Parts, Inc. ("the Company") manufactures automobile subassemblies marketed primarily to the "big three U.S. automakers. The publicly held Company's unaudited financial statements for the year ended December 31, 2005, reflect total assets of $56 million, total revenues of approximately $73 million, and pre-tax income of $6 million. The Company's audited financial statements for the year ended December 31, 2004, reflected total assets of $47 million, total revenues of approximately $60 million, and pre-tax income of $5 million. Earnings per share have increased steadily over the past five years, with a cumulative return of 140% over that period During 2005, the Company significantly expanded its plant and fixed asset spending to accommodate increased orders received by its brake valve division. The company also accumulated significant levels of tooling inventory, which primarily consists of drill bits and machine parts utilized in the manufacturing process. The nature of the tooling inventory is such that the parts wear out relatively quickly and require continual replacement. In prior years, the Company expensed tooling supplies as they were purchased. However, at the beginning of fiscal 2005 the controller and chief financial officer (CFO) determined that capitalization of the tooling inventory would be the preferable method of accounting, The Company changed its accounting policy accordingly and began to include the tooling supplies inventory in other current assets" until the inventory is placed into service, at which time the Company transfers the inventory to expense. During the prior year, 2004, the Company incurred roughly $650,000 of tooling expense and held approximately $175,000 of the inventory on hand at year- end (the on-hand inventory was not included in assets on Auto Parts' balance sheet at December 31, 2005). The unaudited financial statements for the year-ended December 31, 2005 reflect $1,000,000 of tooling expense on the income statement and $300,000 of tooling inventory as current assets on the balance sheet. Given that the $175,000 of inventory on-hand at the end of last year was expensed in fiscal 2005 under the old accounting policy, those costs were not included in the $1,000,000 tooling expense recorded in 2005 Because your accounting firm serves as external auditor for Auto Parts, the CFO and the controller asked your firm for advice on whether the Company would be required to account for and disclose the accounting policy change as a change in accounting principle. In the client's opinion, the change is not material to the financial statements and, therefore, would not require disclosure in the 2005 financial statements. The client strongly prefers to not make any disclosure related to the policy change.

1) Describe the change in accounting principle and why you think capitalization of the tooling inventory is the wrong method of accounting for Auto Parts, Inc.?

2) In general, how do you develop an estimate for planning materiality? What is your preliminary estimate of financial statement materiality as it relates to this case? Is that $300,000 material based on the 5% earnings threshold?

3) Suppose you disagree with managements assessment that the accounting change is immaterial and, therefore, requires no disclosure. Why would you disagree?

4)What are qualitative factors that have impacted your decision to disagree with mangement about the materiality of the accounting treatment and the related disclosure?

Income Statement Tooling Expense Total Reveaue Pretax Income Balance Sheet Asset (Inventory) Total Assets 2004 650.000 175.000 60,000,006 5.000.000 47.000.000 2005 1,000,000 300,000 Material?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1The change in accounting principle adopted by Auto Parts Inc involves capitalizing the tooling inventory instead of expensing it as it was purchased ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started