Question

Background Charles was always a hands-on type of person. Within a couple of years of graduating from college, he started his own business. After some

Background

Charles was always a hands-on type of person. Within a couple of years of graduating from college, he started his own business. After some 20 years, it has grown significantly. He owns and operates Pro-Fence, Inc. in the Metroplex, specializing in custom-made metal and stone fencing for commercial and residential sites. For some time, Charles has thought he should expand into a new geographic region, with the target area being another large metropolitan area about 500 miles north, called Victoria.

Pro-Fence is privately owned by Charles; therefore, the question of how to finance such an expansion has been, and still is, the major challenge. Debt financing would not be a problem in that the Victoria Bank has already offered a loan of up to $2 million. Taking capital from the retained earnings of Pro-Fence is a second possibility, but taking too much will jeopardize the current business, especially if the expansion were not an economic success and Pro-Fence were stuck with a large loan to repay.

This is where you come in as a long-time friend of Charles. He knows you are quite economically oriented and that you understand the rudiments of debt and equity financing and economic analysis. He wants you to advise him on the balance between using Pro-Fence funds and borrowed funds. You have agreed to help him, as much as you can.

Information

Charles has collected some information that he shares with you. Between his accountant and a small market survey of the business opportunities in Victoria, the following generalized estimates seem reasonable:

Initial capital investment = $1.5 million

Annual gross income = $700,000

Annual operating expenses = $100,000

Effective income tax rate for Pro-Fence = 35%

Five-year MACRS depreciation for all $1.5 million investment

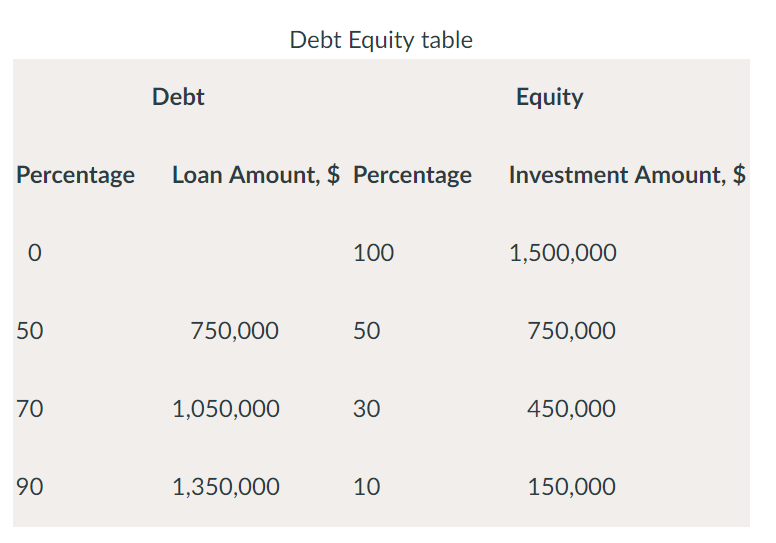

The terms of the Victoria Bank loan would be 6% per year simple interest based on the initial loan principal. Repayment would be in five equal payments of interest and principal. Charles comments that this is not the best loan arrangement he hopes to get, but it is a good worst-case scenario upon which to base the debt portion of the analysis. A range of D-E mixes should be analyzed. Between Charles and yourself, you have developed the following viable options:

1.Case Study Exercises For each funding option, perform a spreadsheet analysis that shows the total CFAT and its present worth over a 6-year period, the time it will take to realize the full advantage of MACRS depreciation. An after-tax return of 10% is expected. Which funding option is best for Pro-Fence? (Hint:For the spreadsheet, sample column headings are: year, GI OE, loan interest, loan principal, equity investment, depreciation rate, depreciation, book value, TI, taxes, and CFAT.)

2.Observe the changes in the total 6-year CFAT as the D-E percentages change. If the time value of money is neglected, what is the constant amount by which this sum changes for every 10% increase in equity funding?

3.Charles noticed that the CFAT total and PW values go in opposite directions as the equity percentage increases. He wants to know why this phenomenon occurs. How should you explain this to Charles?

4.After deciding on the 50-50 split of debt and equity financing, Charles wants to know what additional bottom-line contributions to the economic worth of the company may be added by the new Victoria site. What are the best estimates at this time?

Debt Equity table Debt Equity Percentage Loan Amount, $ Percentage Investment Amount,$ 0 100 1,500,000 50 750,000 50 750,000 70 1,050,000 30 450,000 90 1,350,000 10 150,000 Debt Equity table Debt Equity Percentage Loan Amount, $ Percentage Investment Amount,$ 0 100 1,500,000 50 750,000 50 750,000 70 1,050,000 30 450,000 90 1,350,000 10 150,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started