Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background FENG Ltd is a group of companies, listed on the Southland Securities Exchange, which owns and operates a range of hotels across the country

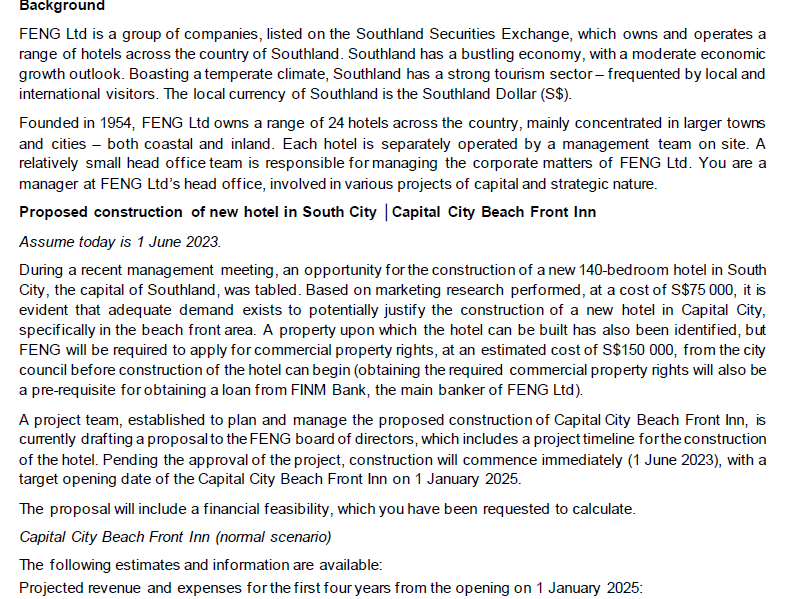

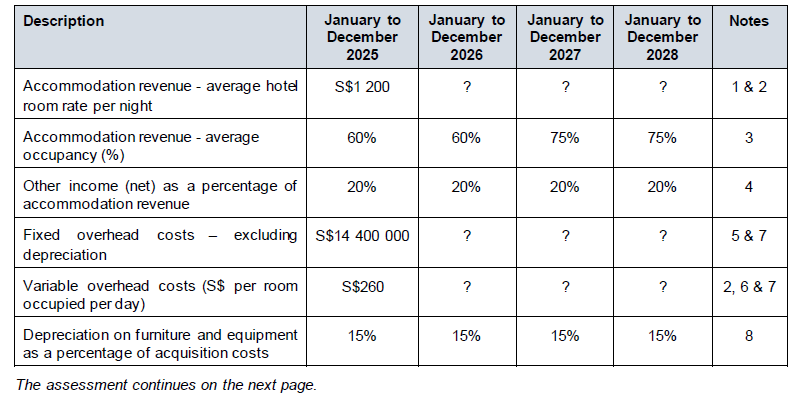

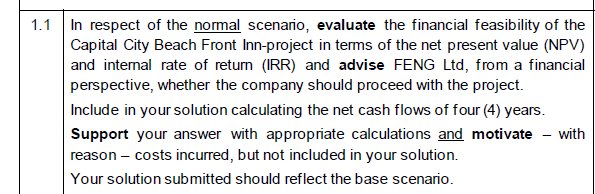

Background FENG Ltd is a group of companies, listed on the Southland Securities Exchange, which owns and operates a range of hotels across the country of Southland. Southland has a bustling economy, with a moderate economic growth outlook. Boasting a temperate climate, Southland has a strong tourism sector - frequented by local and international visitors. The local currency of Southland is the Southland Dollar (S$). Founded in 1954, FENG Ltd owns a range of 24 hotels across the country, mainly concentrated in larger towns and cities - both coastal and inland. Each hotel is separately operated by a management team on site. A relatively small head office team is responsible for managing the corporate matters of FENG Ltd. You are a manager at FENG Ltd's head office, involved in various projects of capital and strategic nature. Proposed construction of new hotel in South City | Capital City Beach Front Inn Assume today is 1 June 2023. During a recent management meeting, an opportunity for the construction of a new 140-bedroom hotel in South City, the capital of Southland, was tabled. Based on marketing research performed, at a cost of $75000, it is evident that adequate demand exists to potentially justify the construction of a new hotel in Capital City, specifically in the beach front area. A property upon which the hotel can be built has also been identified, but FENG will be required to apply for commercial property rights, at an estimated cost of S$150000, from the city council before construction of the hotel can begin (obtaining the required commercial property rights will also be a pre-requisite for obtaining a loan from FINM Bank, the main banker of FENG Ltd). A project team, established to plan and manage the proposed construction of Capital City Beach Front Inn, is currently drafting a proposal to the FENG board of directors, which includes a project timeline forthe construction of the hotel. Pending the approval of the project, construction will commence immediately (1 June 2023), with a target opening date of the Capital City Beach Front Inn on 1 January 2025. The proposal will include a financial feasibility, which you have been requested to calculate. Capital City Beach Front Inn (normal scenario) The following estimates and information are available: Projected revenue and expenses for the first four years from the opening on 1 January 2025 : \begin{tabular}{|l|c|c|c|c|c|} \hline Description & JanuarytoDecember2025 & JanuarytoDecember2026 & JanuarytoDecember2027 & JanuarytoDecember2028 & Notes \\ \hline Accommodationrevenue-averagehotelroomratepernight & S\$1 $00 & ? & ? & ? & 1&2 \\ \hline Accommodationrevenue-averageoccupancy(%) & 60% & 60% & 75% & 75% & 3 \\ \hline Otherincome(net)asapercentageofaccommodationrevenue & 20% & 20% & 20% & 20% & 4 \\ \hline Fixedoverheadcosts-excludingdepreciation & S$14400000 & ? & ? & ? & 5&7 \\ \hline Variableoverheadcosts(Sperroomoccupiedperday) & S$260 & ? & ? & ? & 2,6&7 \\ \hline Depreciationonfurnitureandequipmentasapercentageofacquisitioncosts & 15% & 15% & 15% & 15% & 8 \\ \hline \end{tabular} The assessment continues on the next page. Notes and additional information 1. The total capacity of Capital City Beach Front Inn will be 140 rooms. It is estimated that the average hotel room rate will increase annually with 7% per year from 1 January 2026 onwards. 2. For purposes of the feasibility, you can assume a year has 365 operating days. 3. The occupancy rate indicates the portion of the hotel accommodation, expressed as a percentage of the total rooms, which are occupied by guests during a period, and from which accommodation income is received. 4. Other income includes net revenue generated from the sale of food and beverages, hosting conferences and rental of meeting rooms. 5. Fixed overhead costs relating to the operations of Capital City Beach Front Inn (excluding depreciation) include salaries, property related costs (such as rates, taxes and maintenance), security, insurance and marketing expenses. 6. Variable overhead costs include utility costs, cleaning services, bed linen and towels and guest amenities. 7. It is estimated that the inflation rate on fixed and variable overhead costs will be 6% per year from 1 January 2026 onwards. 8. On average, fumiture and equipment are depreciated at a straight-line rate of 15% per year - calculated on the total cost amount of furniture and equipment acquired as at 1 January 2025 (refer not 10 below). The following additional information is also provided: 9. Based on a report from quantity surveyors, the estimated total construction and other project related costs of the hotel is $108 million, excluding furniture and equipment (note 10 below) and application fees for commercial property rights. 10. In addition to the construction and other project related costs, furniture and equipment to the value of S$22 million will be acquired to furnish and equip the hotel. 11. The market value (terminal value) of the Capital City Beach Front Inn is estimated at S$142 million on 31 December 2028. 12. FENG Ltd's investment policy requires that investments made yield a minimum return of 18% to be deemed as financially feasible. 13. A loan from FINM Bank to the value of $110 million will be secured to finance the bulk of the project costs. The loan is deemed to carry interest at 9% per year, compounded monthly, for the duration of the loan. The loan is fully repayable in equal monthly instalments over 10 years, with the first payment to be made on 31 January 2025. 14. Income tax of 25% applies to the operations of the company. You may assume that Southland applies the same tax principles than South Africa. The tax implications of "Wear and Tear" and "scrapping" allowances, Value Added Tax and Capital Gains Tax can be ignored. \begin{tabular}{|l|l|} \hline 1.1 & In respect of the normal scenario, evaluate the financial feasibility of the \end{tabular} Capital City Beach Front Inn-project in terms of the net present value (NPV) and internal rate of return (IRR) and advise FENG Ltd, from a financial perspective, whether the company should proceed with the project. Include in your solution calculating the net cash flows of four (4) years. Support your answer with appropriate calculations and motivate - with reason - costs incurred, but not included in your solution. Your solution submitted should reflect the base scenario. Background FENG Ltd is a group of companies, listed on the Southland Securities Exchange, which owns and operates a range of hotels across the country of Southland. Southland has a bustling economy, with a moderate economic growth outlook. Boasting a temperate climate, Southland has a strong tourism sector - frequented by local and international visitors. The local currency of Southland is the Southland Dollar (S$). Founded in 1954, FENG Ltd owns a range of 24 hotels across the country, mainly concentrated in larger towns and cities - both coastal and inland. Each hotel is separately operated by a management team on site. A relatively small head office team is responsible for managing the corporate matters of FENG Ltd. You are a manager at FENG Ltd's head office, involved in various projects of capital and strategic nature. Proposed construction of new hotel in South City | Capital City Beach Front Inn Assume today is 1 June 2023. During a recent management meeting, an opportunity for the construction of a new 140-bedroom hotel in South City, the capital of Southland, was tabled. Based on marketing research performed, at a cost of $75000, it is evident that adequate demand exists to potentially justify the construction of a new hotel in Capital City, specifically in the beach front area. A property upon which the hotel can be built has also been identified, but FENG will be required to apply for commercial property rights, at an estimated cost of S$150000, from the city council before construction of the hotel can begin (obtaining the required commercial property rights will also be a pre-requisite for obtaining a loan from FINM Bank, the main banker of FENG Ltd). A project team, established to plan and manage the proposed construction of Capital City Beach Front Inn, is currently drafting a proposal to the FENG board of directors, which includes a project timeline forthe construction of the hotel. Pending the approval of the project, construction will commence immediately (1 June 2023), with a target opening date of the Capital City Beach Front Inn on 1 January 2025. The proposal will include a financial feasibility, which you have been requested to calculate. Capital City Beach Front Inn (normal scenario) The following estimates and information are available: Projected revenue and expenses for the first four years from the opening on 1 January 2025 : \begin{tabular}{|l|c|c|c|c|c|} \hline Description & JanuarytoDecember2025 & JanuarytoDecember2026 & JanuarytoDecember2027 & JanuarytoDecember2028 & Notes \\ \hline Accommodationrevenue-averagehotelroomratepernight & S\$1 $00 & ? & ? & ? & 1&2 \\ \hline Accommodationrevenue-averageoccupancy(%) & 60% & 60% & 75% & 75% & 3 \\ \hline Otherincome(net)asapercentageofaccommodationrevenue & 20% & 20% & 20% & 20% & 4 \\ \hline Fixedoverheadcosts-excludingdepreciation & S$14400000 & ? & ? & ? & 5&7 \\ \hline Variableoverheadcosts(Sperroomoccupiedperday) & S$260 & ? & ? & ? & 2,6&7 \\ \hline Depreciationonfurnitureandequipmentasapercentageofacquisitioncosts & 15% & 15% & 15% & 15% & 8 \\ \hline \end{tabular} The assessment continues on the next page. Notes and additional information 1. The total capacity of Capital City Beach Front Inn will be 140 rooms. It is estimated that the average hotel room rate will increase annually with 7% per year from 1 January 2026 onwards. 2. For purposes of the feasibility, you can assume a year has 365 operating days. 3. The occupancy rate indicates the portion of the hotel accommodation, expressed as a percentage of the total rooms, which are occupied by guests during a period, and from which accommodation income is received. 4. Other income includes net revenue generated from the sale of food and beverages, hosting conferences and rental of meeting rooms. 5. Fixed overhead costs relating to the operations of Capital City Beach Front Inn (excluding depreciation) include salaries, property related costs (such as rates, taxes and maintenance), security, insurance and marketing expenses. 6. Variable overhead costs include utility costs, cleaning services, bed linen and towels and guest amenities. 7. It is estimated that the inflation rate on fixed and variable overhead costs will be 6% per year from 1 January 2026 onwards. 8. On average, fumiture and equipment are depreciated at a straight-line rate of 15% per year - calculated on the total cost amount of furniture and equipment acquired as at 1 January 2025 (refer not 10 below). The following additional information is also provided: 9. Based on a report from quantity surveyors, the estimated total construction and other project related costs of the hotel is $108 million, excluding furniture and equipment (note 10 below) and application fees for commercial property rights. 10. In addition to the construction and other project related costs, furniture and equipment to the value of S$22 million will be acquired to furnish and equip the hotel. 11. The market value (terminal value) of the Capital City Beach Front Inn is estimated at S$142 million on 31 December 2028. 12. FENG Ltd's investment policy requires that investments made yield a minimum return of 18% to be deemed as financially feasible. 13. A loan from FINM Bank to the value of $110 million will be secured to finance the bulk of the project costs. The loan is deemed to carry interest at 9% per year, compounded monthly, for the duration of the loan. The loan is fully repayable in equal monthly instalments over 10 years, with the first payment to be made on 31 January 2025. 14. Income tax of 25% applies to the operations of the company. You may assume that Southland applies the same tax principles than South Africa. The tax implications of "Wear and Tear" and "scrapping" allowances, Value Added Tax and Capital Gains Tax can be ignored. \begin{tabular}{|l|l|} \hline 1.1 & In respect of the normal scenario, evaluate the financial feasibility of the \end{tabular} Capital City Beach Front Inn-project in terms of the net present value (NPV) and internal rate of return (IRR) and advise FENG Ltd, from a financial perspective, whether the company should proceed with the project. Include in your solution calculating the net cash flows of four (4) years. Support your answer with appropriate calculations and motivate - with reason - costs incurred, but not included in your solution. Your solution submitted should reflect the base scenario

Background FENG Ltd is a group of companies, listed on the Southland Securities Exchange, which owns and operates a range of hotels across the country of Southland. Southland has a bustling economy, with a moderate economic growth outlook. Boasting a temperate climate, Southland has a strong tourism sector - frequented by local and international visitors. The local currency of Southland is the Southland Dollar (S$). Founded in 1954, FENG Ltd owns a range of 24 hotels across the country, mainly concentrated in larger towns and cities - both coastal and inland. Each hotel is separately operated by a management team on site. A relatively small head office team is responsible for managing the corporate matters of FENG Ltd. You are a manager at FENG Ltd's head office, involved in various projects of capital and strategic nature. Proposed construction of new hotel in South City | Capital City Beach Front Inn Assume today is 1 June 2023. During a recent management meeting, an opportunity for the construction of a new 140-bedroom hotel in South City, the capital of Southland, was tabled. Based on marketing research performed, at a cost of $75000, it is evident that adequate demand exists to potentially justify the construction of a new hotel in Capital City, specifically in the beach front area. A property upon which the hotel can be built has also been identified, but FENG will be required to apply for commercial property rights, at an estimated cost of S$150000, from the city council before construction of the hotel can begin (obtaining the required commercial property rights will also be a pre-requisite for obtaining a loan from FINM Bank, the main banker of FENG Ltd). A project team, established to plan and manage the proposed construction of Capital City Beach Front Inn, is currently drafting a proposal to the FENG board of directors, which includes a project timeline forthe construction of the hotel. Pending the approval of the project, construction will commence immediately (1 June 2023), with a target opening date of the Capital City Beach Front Inn on 1 January 2025. The proposal will include a financial feasibility, which you have been requested to calculate. Capital City Beach Front Inn (normal scenario) The following estimates and information are available: Projected revenue and expenses for the first four years from the opening on 1 January 2025 : \begin{tabular}{|l|c|c|c|c|c|} \hline Description & JanuarytoDecember2025 & JanuarytoDecember2026 & JanuarytoDecember2027 & JanuarytoDecember2028 & Notes \\ \hline Accommodationrevenue-averagehotelroomratepernight & S\$1 $00 & ? & ? & ? & 1&2 \\ \hline Accommodationrevenue-averageoccupancy(%) & 60% & 60% & 75% & 75% & 3 \\ \hline Otherincome(net)asapercentageofaccommodationrevenue & 20% & 20% & 20% & 20% & 4 \\ \hline Fixedoverheadcosts-excludingdepreciation & S$14400000 & ? & ? & ? & 5&7 \\ \hline Variableoverheadcosts(Sperroomoccupiedperday) & S$260 & ? & ? & ? & 2,6&7 \\ \hline Depreciationonfurnitureandequipmentasapercentageofacquisitioncosts & 15% & 15% & 15% & 15% & 8 \\ \hline \end{tabular} The assessment continues on the next page. Notes and additional information 1. The total capacity of Capital City Beach Front Inn will be 140 rooms. It is estimated that the average hotel room rate will increase annually with 7% per year from 1 January 2026 onwards. 2. For purposes of the feasibility, you can assume a year has 365 operating days. 3. The occupancy rate indicates the portion of the hotel accommodation, expressed as a percentage of the total rooms, which are occupied by guests during a period, and from which accommodation income is received. 4. Other income includes net revenue generated from the sale of food and beverages, hosting conferences and rental of meeting rooms. 5. Fixed overhead costs relating to the operations of Capital City Beach Front Inn (excluding depreciation) include salaries, property related costs (such as rates, taxes and maintenance), security, insurance and marketing expenses. 6. Variable overhead costs include utility costs, cleaning services, bed linen and towels and guest amenities. 7. It is estimated that the inflation rate on fixed and variable overhead costs will be 6% per year from 1 January 2026 onwards. 8. On average, fumiture and equipment are depreciated at a straight-line rate of 15% per year - calculated on the total cost amount of furniture and equipment acquired as at 1 January 2025 (refer not 10 below). The following additional information is also provided: 9. Based on a report from quantity surveyors, the estimated total construction and other project related costs of the hotel is $108 million, excluding furniture and equipment (note 10 below) and application fees for commercial property rights. 10. In addition to the construction and other project related costs, furniture and equipment to the value of S$22 million will be acquired to furnish and equip the hotel. 11. The market value (terminal value) of the Capital City Beach Front Inn is estimated at S$142 million on 31 December 2028. 12. FENG Ltd's investment policy requires that investments made yield a minimum return of 18% to be deemed as financially feasible. 13. A loan from FINM Bank to the value of $110 million will be secured to finance the bulk of the project costs. The loan is deemed to carry interest at 9% per year, compounded monthly, for the duration of the loan. The loan is fully repayable in equal monthly instalments over 10 years, with the first payment to be made on 31 January 2025. 14. Income tax of 25% applies to the operations of the company. You may assume that Southland applies the same tax principles than South Africa. The tax implications of "Wear and Tear" and "scrapping" allowances, Value Added Tax and Capital Gains Tax can be ignored. \begin{tabular}{|l|l|} \hline 1.1 & In respect of the normal scenario, evaluate the financial feasibility of the \end{tabular} Capital City Beach Front Inn-project in terms of the net present value (NPV) and internal rate of return (IRR) and advise FENG Ltd, from a financial perspective, whether the company should proceed with the project. Include in your solution calculating the net cash flows of four (4) years. Support your answer with appropriate calculations and motivate - with reason - costs incurred, but not included in your solution. Your solution submitted should reflect the base scenario. Background FENG Ltd is a group of companies, listed on the Southland Securities Exchange, which owns and operates a range of hotels across the country of Southland. Southland has a bustling economy, with a moderate economic growth outlook. Boasting a temperate climate, Southland has a strong tourism sector - frequented by local and international visitors. The local currency of Southland is the Southland Dollar (S$). Founded in 1954, FENG Ltd owns a range of 24 hotels across the country, mainly concentrated in larger towns and cities - both coastal and inland. Each hotel is separately operated by a management team on site. A relatively small head office team is responsible for managing the corporate matters of FENG Ltd. You are a manager at FENG Ltd's head office, involved in various projects of capital and strategic nature. Proposed construction of new hotel in South City | Capital City Beach Front Inn Assume today is 1 June 2023. During a recent management meeting, an opportunity for the construction of a new 140-bedroom hotel in South City, the capital of Southland, was tabled. Based on marketing research performed, at a cost of $75000, it is evident that adequate demand exists to potentially justify the construction of a new hotel in Capital City, specifically in the beach front area. A property upon which the hotel can be built has also been identified, but FENG will be required to apply for commercial property rights, at an estimated cost of S$150000, from the city council before construction of the hotel can begin (obtaining the required commercial property rights will also be a pre-requisite for obtaining a loan from FINM Bank, the main banker of FENG Ltd). A project team, established to plan and manage the proposed construction of Capital City Beach Front Inn, is currently drafting a proposal to the FENG board of directors, which includes a project timeline forthe construction of the hotel. Pending the approval of the project, construction will commence immediately (1 June 2023), with a target opening date of the Capital City Beach Front Inn on 1 January 2025. The proposal will include a financial feasibility, which you have been requested to calculate. Capital City Beach Front Inn (normal scenario) The following estimates and information are available: Projected revenue and expenses for the first four years from the opening on 1 January 2025 : \begin{tabular}{|l|c|c|c|c|c|} \hline Description & JanuarytoDecember2025 & JanuarytoDecember2026 & JanuarytoDecember2027 & JanuarytoDecember2028 & Notes \\ \hline Accommodationrevenue-averagehotelroomratepernight & S\$1 $00 & ? & ? & ? & 1&2 \\ \hline Accommodationrevenue-averageoccupancy(%) & 60% & 60% & 75% & 75% & 3 \\ \hline Otherincome(net)asapercentageofaccommodationrevenue & 20% & 20% & 20% & 20% & 4 \\ \hline Fixedoverheadcosts-excludingdepreciation & S$14400000 & ? & ? & ? & 5&7 \\ \hline Variableoverheadcosts(Sperroomoccupiedperday) & S$260 & ? & ? & ? & 2,6&7 \\ \hline Depreciationonfurnitureandequipmentasapercentageofacquisitioncosts & 15% & 15% & 15% & 15% & 8 \\ \hline \end{tabular} The assessment continues on the next page. Notes and additional information 1. The total capacity of Capital City Beach Front Inn will be 140 rooms. It is estimated that the average hotel room rate will increase annually with 7% per year from 1 January 2026 onwards. 2. For purposes of the feasibility, you can assume a year has 365 operating days. 3. The occupancy rate indicates the portion of the hotel accommodation, expressed as a percentage of the total rooms, which are occupied by guests during a period, and from which accommodation income is received. 4. Other income includes net revenue generated from the sale of food and beverages, hosting conferences and rental of meeting rooms. 5. Fixed overhead costs relating to the operations of Capital City Beach Front Inn (excluding depreciation) include salaries, property related costs (such as rates, taxes and maintenance), security, insurance and marketing expenses. 6. Variable overhead costs include utility costs, cleaning services, bed linen and towels and guest amenities. 7. It is estimated that the inflation rate on fixed and variable overhead costs will be 6% per year from 1 January 2026 onwards. 8. On average, fumiture and equipment are depreciated at a straight-line rate of 15% per year - calculated on the total cost amount of furniture and equipment acquired as at 1 January 2025 (refer not 10 below). The following additional information is also provided: 9. Based on a report from quantity surveyors, the estimated total construction and other project related costs of the hotel is $108 million, excluding furniture and equipment (note 10 below) and application fees for commercial property rights. 10. In addition to the construction and other project related costs, furniture and equipment to the value of S$22 million will be acquired to furnish and equip the hotel. 11. The market value (terminal value) of the Capital City Beach Front Inn is estimated at S$142 million on 31 December 2028. 12. FENG Ltd's investment policy requires that investments made yield a minimum return of 18% to be deemed as financially feasible. 13. A loan from FINM Bank to the value of $110 million will be secured to finance the bulk of the project costs. The loan is deemed to carry interest at 9% per year, compounded monthly, for the duration of the loan. The loan is fully repayable in equal monthly instalments over 10 years, with the first payment to be made on 31 January 2025. 14. Income tax of 25% applies to the operations of the company. You may assume that Southland applies the same tax principles than South Africa. The tax implications of "Wear and Tear" and "scrapping" allowances, Value Added Tax and Capital Gains Tax can be ignored. \begin{tabular}{|l|l|} \hline 1.1 & In respect of the normal scenario, evaluate the financial feasibility of the \end{tabular} Capital City Beach Front Inn-project in terms of the net present value (NPV) and internal rate of return (IRR) and advise FENG Ltd, from a financial perspective, whether the company should proceed with the project. Include in your solution calculating the net cash flows of four (4) years. Support your answer with appropriate calculations and motivate - with reason - costs incurred, but not included in your solution. Your solution submitted should reflect the base scenario Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started