Answered step by step

Verified Expert Solution

Question

1 Approved Answer

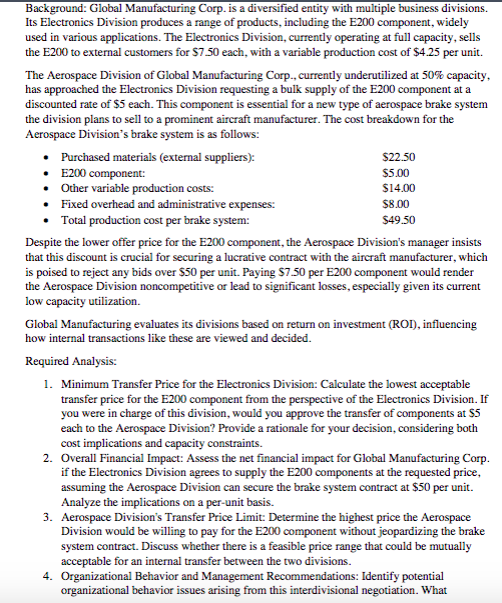

Background: Global Manufacturing Corp. is a diversified entity with multiple business divisions. Its Electronics Division produces a range of products, including the E 2 0

Background: Global Manufacturing Corp. is a diversified entity with multiple business divisions.

Its Electronics Division produces a range of products, including the E component, widely

used in various applications. The Electronics Division, currently operating at full capacity, sells

the E to external customers for $ each, with a variable production cost of $ per unit.

The Aerospace Division of Global Manufacturing Corp., currently underutilized at capacity,

has approached the Electronics Division requesting a bulk supply of the E component at a

discounted rate of $ each. This component is essential for a new type of aerospace brake system

the division plans to sell to a prominent aircraft manufacturer. The cost breakdown for the

Aerospace Division's brake system is as follows:

Purchased materials external suppliers:

E component:

$

Other variable production costs:

$

Fixed overhead and administrative expenses:

$

Total production cost per brake system:

$

Despite the lower offer price for the E component, the Aerospace Division's manager insists

that this discount is crucial for securing a lucrative contract with the aircraft manufacturer, which

is poised to reject any bids over $ per unit. Paying $ per E component would render

the Aerospace Division noncompetitive or lead to significant losses, especially given its current

low capacity utilization.

Global Manufacturing evaluates its divisions based on return on investment ROI influencing

how internal transactions like these are viewed and decided.

Required Analysis:

Minimum Transfer Price for the Electronics Division: Calculate the lowest acceptable

transfer price for the E component from the perspective of the Electronics Division. If

you were in charge of this division, would you approve the transfer of components at $

each to the Aerospace Division? Provide a rationale for your decision, considering both

cost implications and capacity constraints.

Overall Financial Impact: Assess the net financial impact for Global Manufacturing Corp.

if the Electronics Division agrees to supply the E components at the requested price,

assuming the Aerospace Division can secure the brake system contract at $ per unit.

Analyze the implications on a perunit basis.

Aerospace Division's Transfer Price Limit: Determine the highest price the Aerospace

Division would be willing to pay for the E component without jeopardizing the brake

system contract. Discuss whether there is a feasible price range that could be mutually

acceptable for an internal transfer between the two divisions.

Organizational Behavior and Management Recommendations: Identify potential

organizational behavior issues arising from this interdivisional negotiation. What

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started