Answered step by step

Verified Expert Solution

Question

1 Approved Answer

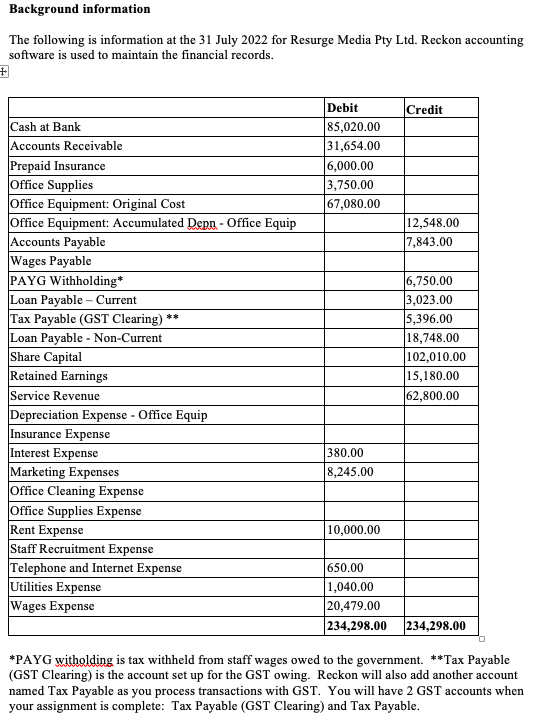

Background information The following is information at the 31 July 2022 for Resurge Media Pty Ltd. Reckon accounting software is used to maintain the financial

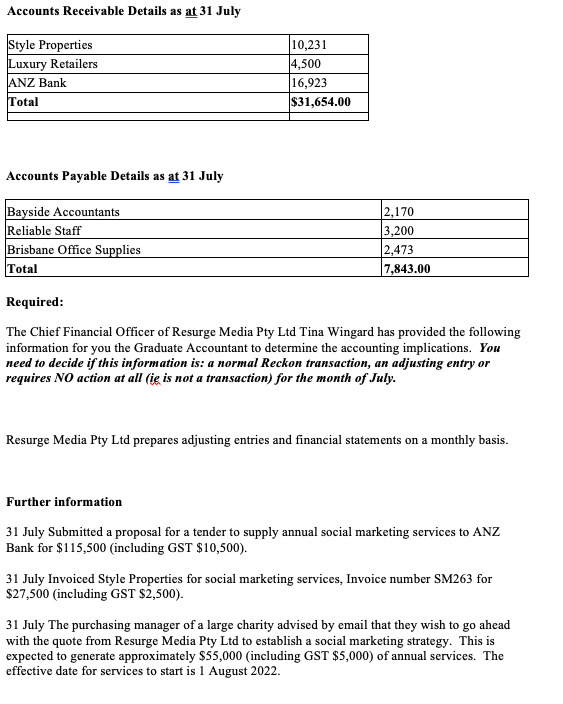

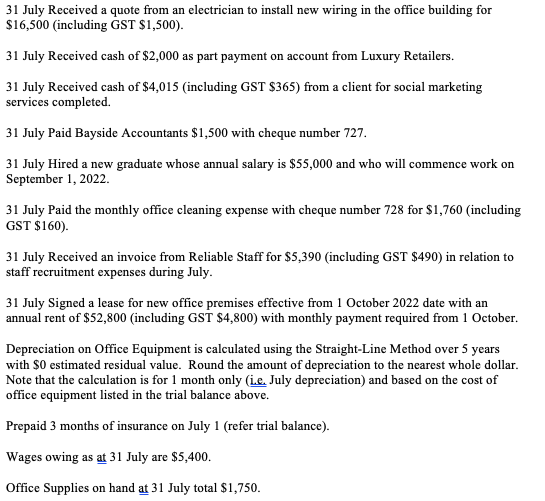

Background information The following is information at the 31 July 2022 for Resurge Media Pty Ltd. Reckon accounting software is used to maintain the financial records. - PA Y U winglaing is tax witnned Irom start wages owea to the government. T 1 ax rayable (GST Clearing) is the account set up for the GST owing. Reckon will also add another account named Tax Payable as you process transactions with GST. You will have 2 GST accounts when your assignment is complete: Tax Payable (GST Clearing) and Tax Payable. Accounts Receivable Details as at 31July Accounts Payable Details as at 31 July [11Bequired: The Chief Financial Officer of Resurge Media Pty Ltd Tina Wingard has provided the following information for you the Graduate Accountant to determine the accounting implications. You need to decide if this information is: a normal Reckon transaction, an adjusting entry or requires NO action at all (ie is not a transaction) for the month of July. Resurge Media Pty Ltd prepares adjusting entries and financial statements on a monthly basis. Further information 31 July Submitted a proposal for a tender to supply annual social marketing services to ANZ Bank for $115,500 (including GST $10,500 ). 31 July Invoiced Style Properties for social marketing services, Invoice number SM263 for $27,500 (including GST $2,500 ). 31 July The purchasing manager of a large charity advised by email that they wish to go ahead with the quote from Resurge Media Pty Ltd to establish a social marketing strategy. This is expected to generate approximately $55,000 (including GST $5,000 ) of annual services. The effective date for services to start is 1 August 2022. 31 July Received a quote from an electrician to install new wiring in the office building for $16,500 (including GST \$1,500). 31 July Received cash of $2,000 as part payment on account from Luxury Retailers. 31 July Received cash of $4,015 (including GST \$365) from a client for social marketing services completed. 31 July Paid Bayside Accountants $1,500 with cheque number 727. 31 July Hired a new graduate whose annual salary is $55,000 and who will commence work on September 1, 2022. 31 July Paid the monthly office cleaning expense with cheque number 728 for $1,760 (including GST \$160). 31 July Received an invoice from Reliable Staff for $5,390 (including GST $490 ) in relation to staff recruitment expenses during July. 31 July Signed a lease for new office premises effective from 1 October 2022 date with an annual rent of $52,800 (including GST $4,800 ) with monthly payment required from 1 October. Depreciation on Office Equipment is calculated using the Straight-Line Method over 5 years with $0 estimated residual value. Round the amount of depreciation to the nearest whole dollar. Note that the calculation is for 1 month only (i.e. July depreciation) and based on the cost of office equipment listed in the trial balance above. Prepaid 3 months of insurance on July 1 (refer trial balance). Wages owing as at 31 July are $5,400. Background information The following is information at the 31 July 2022 for Resurge Media Pty Ltd. Reckon accounting software is used to maintain the financial records. - PA Y U winglaing is tax witnned Irom start wages owea to the government. T 1 ax rayable (GST Clearing) is the account set up for the GST owing. Reckon will also add another account named Tax Payable as you process transactions with GST. You will have 2 GST accounts when your assignment is complete: Tax Payable (GST Clearing) and Tax Payable. Accounts Receivable Details as at 31July Accounts Payable Details as at 31 July [11Bequired: The Chief Financial Officer of Resurge Media Pty Ltd Tina Wingard has provided the following information for you the Graduate Accountant to determine the accounting implications. You need to decide if this information is: a normal Reckon transaction, an adjusting entry or requires NO action at all (ie is not a transaction) for the month of July. Resurge Media Pty Ltd prepares adjusting entries and financial statements on a monthly basis. Further information 31 July Submitted a proposal for a tender to supply annual social marketing services to ANZ Bank for $115,500 (including GST $10,500 ). 31 July Invoiced Style Properties for social marketing services, Invoice number SM263 for $27,500 (including GST $2,500 ). 31 July The purchasing manager of a large charity advised by email that they wish to go ahead with the quote from Resurge Media Pty Ltd to establish a social marketing strategy. This is expected to generate approximately $55,000 (including GST $5,000 ) of annual services. The effective date for services to start is 1 August 2022. 31 July Received a quote from an electrician to install new wiring in the office building for $16,500 (including GST \$1,500). 31 July Received cash of $2,000 as part payment on account from Luxury Retailers. 31 July Received cash of $4,015 (including GST \$365) from a client for social marketing services completed. 31 July Paid Bayside Accountants $1,500 with cheque number 727. 31 July Hired a new graduate whose annual salary is $55,000 and who will commence work on September 1, 2022. 31 July Paid the monthly office cleaning expense with cheque number 728 for $1,760 (including GST \$160). 31 July Received an invoice from Reliable Staff for $5,390 (including GST $490 ) in relation to staff recruitment expenses during July. 31 July Signed a lease for new office premises effective from 1 October 2022 date with an annual rent of $52,800 (including GST $4,800 ) with monthly payment required from 1 October. Depreciation on Office Equipment is calculated using the Straight-Line Method over 5 years with $0 estimated residual value. Round the amount of depreciation to the nearest whole dollar. Note that the calculation is for 1 month only (i.e. July depreciation) and based on the cost of office equipment listed in the trial balance above. Prepaid 3 months of insurance on July 1 (refer trial balance). Wages owing as at 31 July are $5,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started