Question: Background Information Your audit firm, Hawk & Soar, PLLC, has been engaged to perform the annual audit of TealDeal, Inc. The Company manufactures and sells

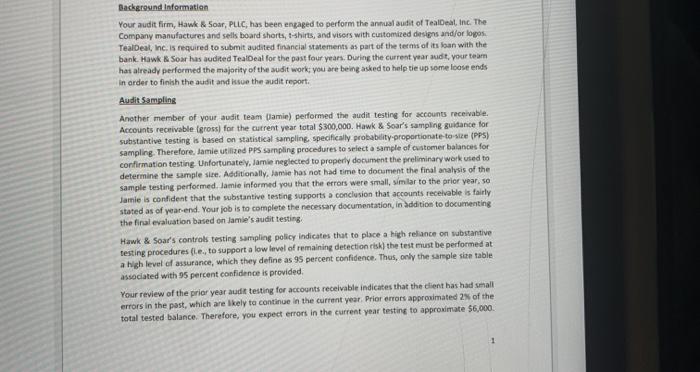

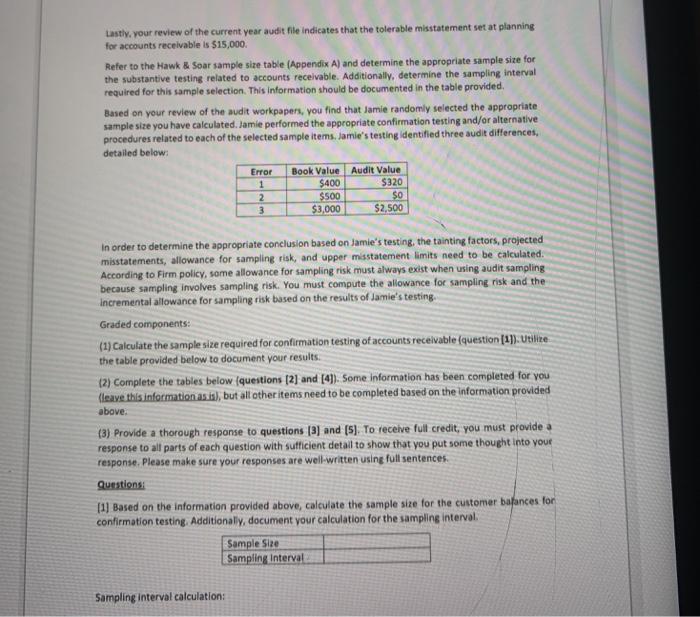

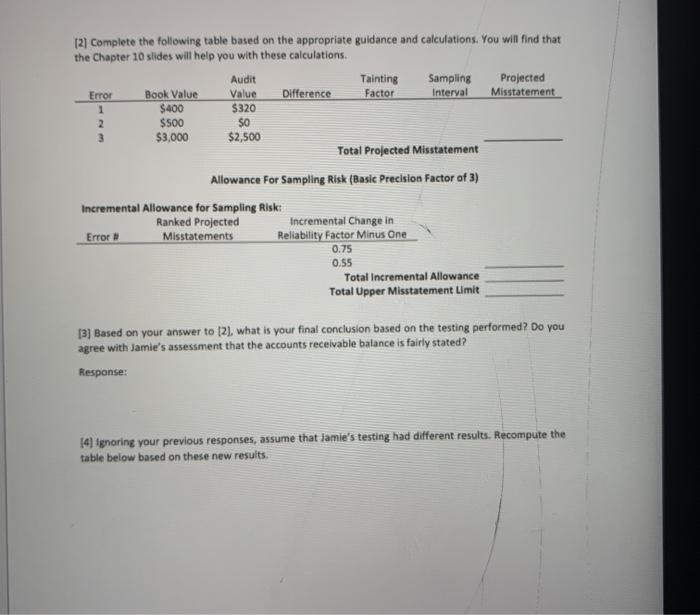

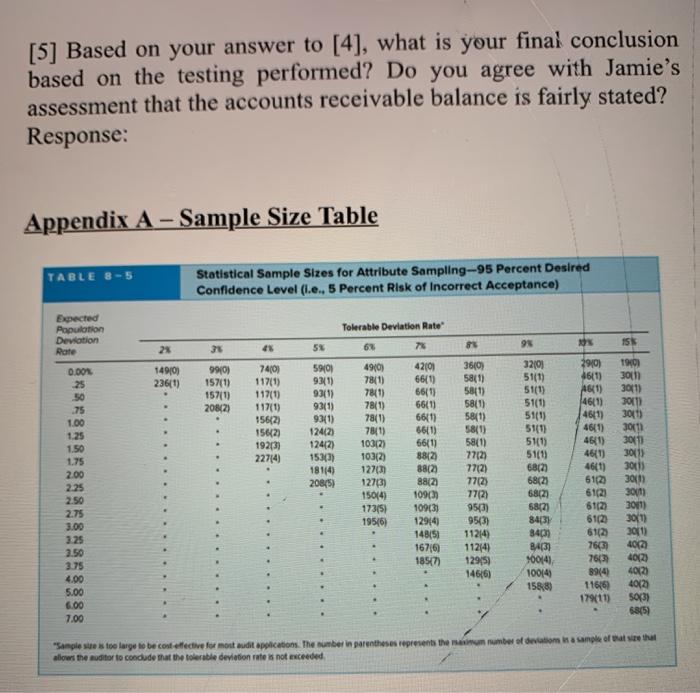

Background Information Your audit firm, Hawk & Soar, PLLC, has been engaged to perform the annual audit of TealDeal, Inc. The Company manufactures and sells board shorts, t-shirts, and visors with customized designs and/or logos TealDeal, Inc. is required to submit audited financial statements as part of the terms of its loan with the bank. Hawk & Soar has audited TealDeal for the past four years. During the current year audit, your team has already performed the majority of the audit works you are being asked to help tie up some loose ends in order to finish the audit and issue the audit report. Audit Sampling Another member of your audit team (lamie) performed the audit testing for accounts receivable. Accounts receivable gross) for the current year total $300,000. Hawk & Soar's sampling guidance for substantive testing is based on statistical sampling specifically probability proportionate-to-se (PPS) sampling. Therefore, Jamie utilized PPS sampling procedures to select a sample of customer balances for confirmation testing. Unfortunately, Jamie neglected to properly document the preliminary work used to determine the sample size. Additionally, Jamie has not had time to document the final analysis of the sample testing performed. Jamie informed you that the errors were small, similar to the prior year, so Jamie is confident that the substantive testing supports a conclusion that accounts receivable is fairly stated as of year end. Your job is to complete the necessary documentation, in addition to documenting the final evaluation based on Jamie's audit testing, Hawk & Soar's controls testing sampling policy indicates that to place a high reliance on substantive testing procedures (le, to support a low level of remaining detection risk) the test must be performed at a high level of assurance, which they define as 95 percent confidence. Thus, only the sample site table associated with 95 percent confidence is provided Your review of the prior year audit testing for accounts receivable indicates that the client has had small errors in the past, which are likely to continue in the current year. Prior errors approximated 2of the total tested balance. Therefore, you expect errors in the current year testing to approximate $6,000 Lastly, your review of the current year audit file indicates that the tolerable misstatement set at planning for accounts receivable is $15,000 Refer to the Hawk & Soar sample size table (Appendix A) and determine the appropriate sample size for the substantive testing related to accounts receivable. Additionally, determine the sampling interval required for this sample selection. This information should be documented in the table provided Based on your review of the audit workpapers, you find that Jamie randomly selected the appropriate sample size you have calculated. Jamie performed the appropriate confirmation testing and/or alternative procedures related to each of the selected sample items. Jamie's testing identified three audit differences, detailed below: Error Book Value Audit Value 1 $400 $320 $500 $0 $3,000 $2,500 2 3 In order to determine the appropriate conclusion based on Jamie's testing the tainting factors, projected misstatements, allowance for sampling risk, and upper misstatement limits need to be calculated. According to Firm policy, some allowance for sampling risk must always exist when using audit sampling because sampling involves sampling risk. You must compute the allowance for sampling risk and the Incremental allowance for sampling risk based on the results of Jamie's testing. Graded components: (1) Calculate the sample size required for confirmation testing of accounts receivable (question [17). Utilite the table provided below to document your results. 12) Complete the tables below (questions (2) and (43). Some Information has been completed for you (leave this information as is), but all other items need to be completed based on the information provided above (3) Provide a thorough response to questions (3) and [5]. To receive full credit, you must provide a response to all parts of each question with sufficient detail to show that you put some thought into your response. Please make sure your responses are well-written using full sentences Questions [1] Based on the information provided above, calculate the sample size for the customer batances for confirmation testing. Additionally, document your calculation for the sampling interval Sample Size Sampling Interval Sampling interval calculation: 1 2 12) Complete the following table based on the appropriate guidance and calculations. You will find that the Chapter 10 slides will help you with these calculations Audit Tainting Sampling Projected Error Book Value Value Difference Factor Interval Misstatement $400 $320 $500 $0 3 $3,000 $2,500 Total Projected Misstatement Allowance For Sampling Risk (Basic Precision Factor of 3) Incremental Allowance for Sampling Risk: Ranked Projected Incremental Change in Error # Misstatements Reliability Factor Minus One 0.75 0.55 Total Incremental Allowance Total Upper Misstatement Limit 13] Based on your answer to [2), what is your final conclusion based on the testing performed? Do you agree with Jamie's assessment that the accounts receivable balance is fairly stated? Response: mie's testing had different results. Recompute the (4) ignoring your previous responses, assume that table below based on these new results. [5] Based on your answer to [4], what is your final conclusion based on the testing performed? Do you agree with Jamie's assessment that the accounts receivable balance is fairly stated? Response: Appendix A - Sample Size Table TABLE 8-5 Statistical Sample Sizes for Attribute Sampling-95 Percent Desired Confidence Level (i.e., 5 Percent Risk of Incorrect Acceptance) Tolerable Deviation Rate Expected Population Devotion Rate 155 2x 35 51 63 83 98 14910) 236(1) 990) 1571) 15711) 20842) 0.00 25 50 .75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 740) 117(1) 117(0) 117(1) 156{2) 15642 192137 22714 5910 9341) 93(1) 93(1) 93(1) 12412) 1242) 153(3) 181/4) 20845) 49(0) 7811) 7841) 7811) 78(1) 7841) 103(2) 10312) 127(3) 127(3) 1504) 173151 1956) 76 42103 66[0) 6611 66(1) 66/1) 6611) 66(1) 8812) 88/23 88(2 1090 10963) 12914 14815) 16740 1857) 35(0) 5841) 5841) 58(1) 5841) 5841) 58(1) 7712) 7712) 77123 77(2) 953) 95431 112/4) 112/4) 12915) 1466) 32(0) 51(1) 51(1) 51(1) 5111) 51(1) 51(1) 51(1) 68122 68123 68[2 68127 8431 84031 8431 900141 100141 158,8) 2910) 46(1) A) 46/11) 4611) 4611) 4611) 460) 46(1) 6162 6102) 6112 6162 6102 7643 76677 8944) 11616 179(11) 190) 30111 3011) 30111 3041) 3011 3011 3011) 30415 3041) 30 301) 30(1) 300) 4012 40(2) 4012) 4012 5013) 68(5) 3.25 3.50 3.75 4.00 5.00 6.00 7.00 "Sample sue to large to be cost effective for most audit application. The number in parentheses represents the number of devetom a sample of teethal allows the auditor to condude that the tolerable deviation rate is not exceeded Background Information Your audit firm, Hawk & Soar, PLLC, has been engaged to perform the annual audit of TealDeal, Inc. The Company manufactures and sells board shorts, t-shirts, and visors with customized designs and/or logos TealDeal, Inc. is required to submit audited financial statements as part of the terms of its loan with the bank. Hawk & Soar has audited TealDeal for the past four years. During the current year audit, your team has already performed the majority of the audit works you are being asked to help tie up some loose ends in order to finish the audit and issue the audit report. Audit Sampling Another member of your audit team (lamie) performed the audit testing for accounts receivable. Accounts receivable gross) for the current year total $300,000. Hawk & Soar's sampling guidance for substantive testing is based on statistical sampling specifically probability proportionate-to-se (PPS) sampling. Therefore, Jamie utilized PPS sampling procedures to select a sample of customer balances for confirmation testing. Unfortunately, Jamie neglected to properly document the preliminary work used to determine the sample size. Additionally, Jamie has not had time to document the final analysis of the sample testing performed. Jamie informed you that the errors were small, similar to the prior year, so Jamie is confident that the substantive testing supports a conclusion that accounts receivable is fairly stated as of year end. Your job is to complete the necessary documentation, in addition to documenting the final evaluation based on Jamie's audit testing, Hawk & Soar's controls testing sampling policy indicates that to place a high reliance on substantive testing procedures (le, to support a low level of remaining detection risk) the test must be performed at a high level of assurance, which they define as 95 percent confidence. Thus, only the sample site table associated with 95 percent confidence is provided Your review of the prior year audit testing for accounts receivable indicates that the client has had small errors in the past, which are likely to continue in the current year. Prior errors approximated 2of the total tested balance. Therefore, you expect errors in the current year testing to approximate $6,000 Lastly, your review of the current year audit file indicates that the tolerable misstatement set at planning for accounts receivable is $15,000 Refer to the Hawk & Soar sample size table (Appendix A) and determine the appropriate sample size for the substantive testing related to accounts receivable. Additionally, determine the sampling interval required for this sample selection. This information should be documented in the table provided Based on your review of the audit workpapers, you find that Jamie randomly selected the appropriate sample size you have calculated. Jamie performed the appropriate confirmation testing and/or alternative procedures related to each of the selected sample items. Jamie's testing identified three audit differences, detailed below: Error Book Value Audit Value 1 $400 $320 $500 $0 $3,000 $2,500 2 3 In order to determine the appropriate conclusion based on Jamie's testing the tainting factors, projected misstatements, allowance for sampling risk, and upper misstatement limits need to be calculated. According to Firm policy, some allowance for sampling risk must always exist when using audit sampling because sampling involves sampling risk. You must compute the allowance for sampling risk and the Incremental allowance for sampling risk based on the results of Jamie's testing. Graded components: (1) Calculate the sample size required for confirmation testing of accounts receivable (question [17). Utilite the table provided below to document your results. 12) Complete the tables below (questions (2) and (43). Some Information has been completed for you (leave this information as is), but all other items need to be completed based on the information provided above (3) Provide a thorough response to questions (3) and [5]. To receive full credit, you must provide a response to all parts of each question with sufficient detail to show that you put some thought into your response. Please make sure your responses are well-written using full sentences Questions [1] Based on the information provided above, calculate the sample size for the customer batances for confirmation testing. Additionally, document your calculation for the sampling interval Sample Size Sampling Interval Sampling interval calculation: 1 2 12) Complete the following table based on the appropriate guidance and calculations. You will find that the Chapter 10 slides will help you with these calculations Audit Tainting Sampling Projected Error Book Value Value Difference Factor Interval Misstatement $400 $320 $500 $0 3 $3,000 $2,500 Total Projected Misstatement Allowance For Sampling Risk (Basic Precision Factor of 3) Incremental Allowance for Sampling Risk: Ranked Projected Incremental Change in Error # Misstatements Reliability Factor Minus One 0.75 0.55 Total Incremental Allowance Total Upper Misstatement Limit 13] Based on your answer to [2), what is your final conclusion based on the testing performed? Do you agree with Jamie's assessment that the accounts receivable balance is fairly stated? Response: mie's testing had different results. Recompute the (4) ignoring your previous responses, assume that table below based on these new results. [5] Based on your answer to [4], what is your final conclusion based on the testing performed? Do you agree with Jamie's assessment that the accounts receivable balance is fairly stated? Response: Appendix A - Sample Size Table TABLE 8-5 Statistical Sample Sizes for Attribute Sampling-95 Percent Desired Confidence Level (i.e., 5 Percent Risk of Incorrect Acceptance) Tolerable Deviation Rate Expected Population Devotion Rate 155 2x 35 51 63 83 98 14910) 236(1) 990) 1571) 15711) 20842) 0.00 25 50 .75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 740) 117(1) 117(0) 117(1) 156{2) 15642 192137 22714 5910 9341) 93(1) 93(1) 93(1) 12412) 1242) 153(3) 181/4) 20845) 49(0) 7811) 7841) 7811) 78(1) 7841) 103(2) 10312) 127(3) 127(3) 1504) 173151 1956) 76 42103 66[0) 6611 66(1) 66/1) 6611) 66(1) 8812) 88/23 88(2 1090 10963) 12914 14815) 16740 1857) 35(0) 5841) 5841) 58(1) 5841) 5841) 58(1) 7712) 7712) 77123 77(2) 953) 95431 112/4) 112/4) 12915) 1466) 32(0) 51(1) 51(1) 51(1) 5111) 51(1) 51(1) 51(1) 68122 68123 68[2 68127 8431 84031 8431 900141 100141 158,8) 2910) 46(1) A) 46/11) 4611) 4611) 4611) 460) 46(1) 6162 6102) 6112 6162 6102 7643 76677 8944) 11616 179(11) 190) 30111 3011) 30111 3041) 3011 3011 3011) 30415 3041) 30 301) 30(1) 300) 4012 40(2) 4012) 4012 5013) 68(5) 3.25 3.50 3.75 4.00 5.00 6.00 7.00 "Sample sue to large to be cost effective for most audit application. The number in parentheses represents the number of devetom a sample of teethal allows the auditor to condude that the tolerable deviation rate is not exceeded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts