Background:

Kyrie has always wanted to become a consultant. Rather than wait for a company

to hire him, he decides to start up his own consulting business. With $5,000 of cash savings, he

decides to fund Kyries Consulting Group, otherwise known as KCG. Kyrie took MGT 11A, so

he decides to put his Accounting knowledge to work. The following is a list of activities that

Kyrie performs for KCG. When accounting for his business, Kyrie remembers that not all

activities translate into Journal Entries on the date they occur.

Month of January

1/1/20XX

KCG prepays 1 year of Insurance for $2,400 Cash ($200/month)

1/1/20XX

KCG prepays 2 months of Rent in an office for $2,000 Cash ($1,000/month)

1/1/20XX

KCG prepays 2 months of Advertising for $200 Cash ($100/month)

1/5/20XX

KCG buys Supplies in the form of 10 notebooks at $5/each. Each notebook is

meant to be completely used up during each Consulting session. Supplies were paid in Cash

1/10/20XX

Customer 1 prepays KCG for 5 Consulting sessions at $300/consultation

1

/17/20XX

KCG hires an assistant, who has a weekly wage of $100. As a business policy, KCG

pays wages at the first of every month.

1/30/20XX

KCG provides one Consulting session for Customer 2 for $300. Given that its the

end of the week, KCG will bill Customer 2 in the first week of February

1/31/20XX

It is the end of the month, and Kyrie looks back at his notes: He realizes he

provided Customer 1 with one Consulting session in the month of January, and he needs to

account for that, given that they prepaid for Consulting sessions. He also checks his Supplies

cabinet and notices that he now has 8 notebooks. He realizes he should adjust for that as well,

given that he needs to account for used Supplies. He then realizes there were other things that

lapsed in the month of January that he should make Adjustments for to ensure Januarys

Financial Statements are correct under Accrual Basis Accounting

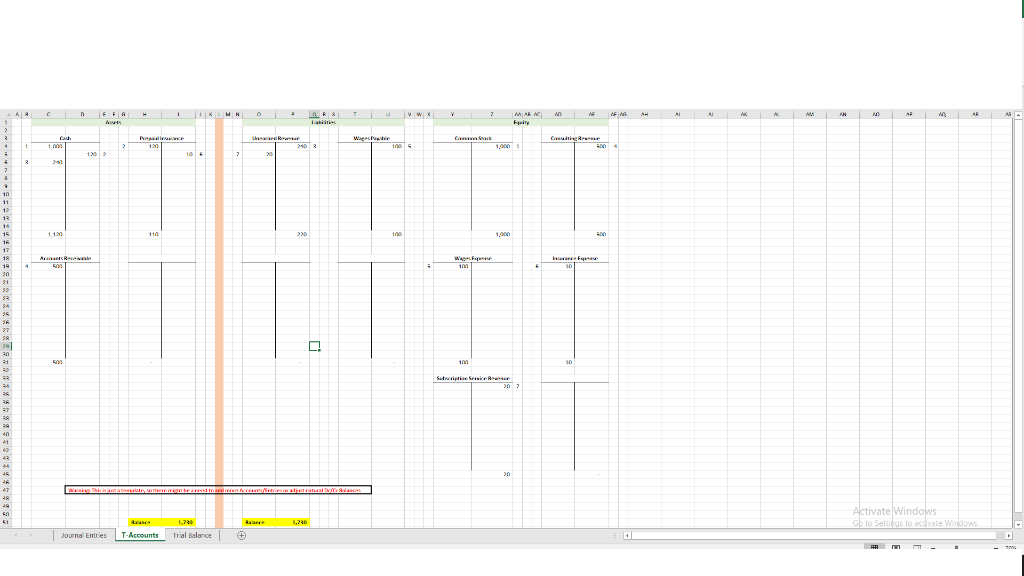

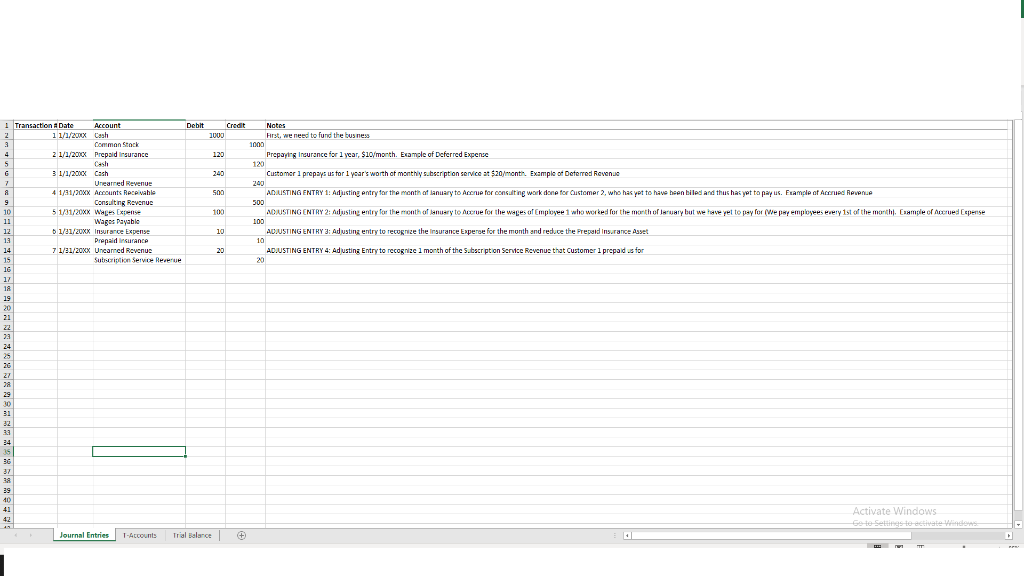

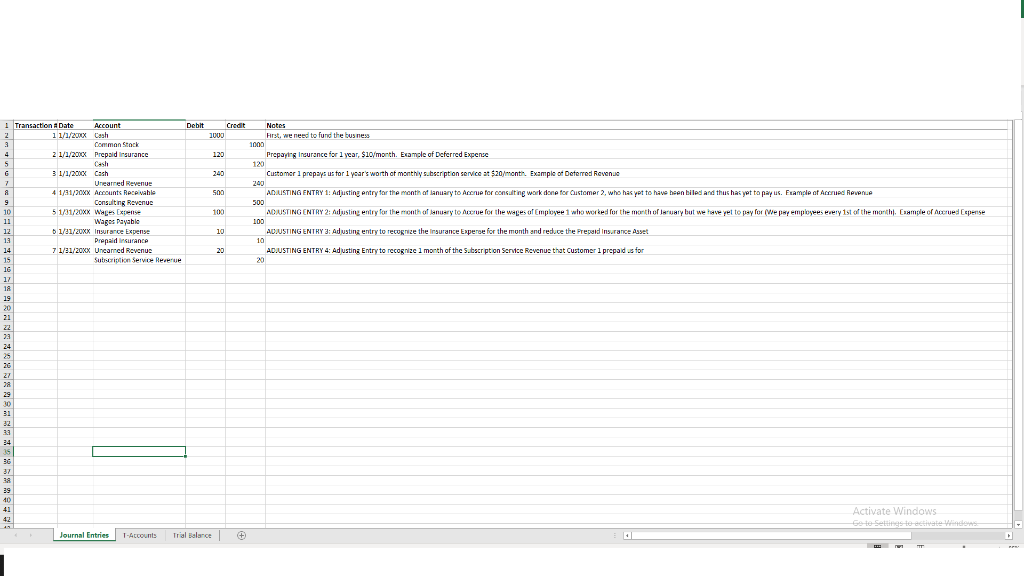

Objective 1:

What are the Debit/Credit Journal Entries recorded for the business during the

month of January, and what are the Adjustment Journal Entries at the end of the month?

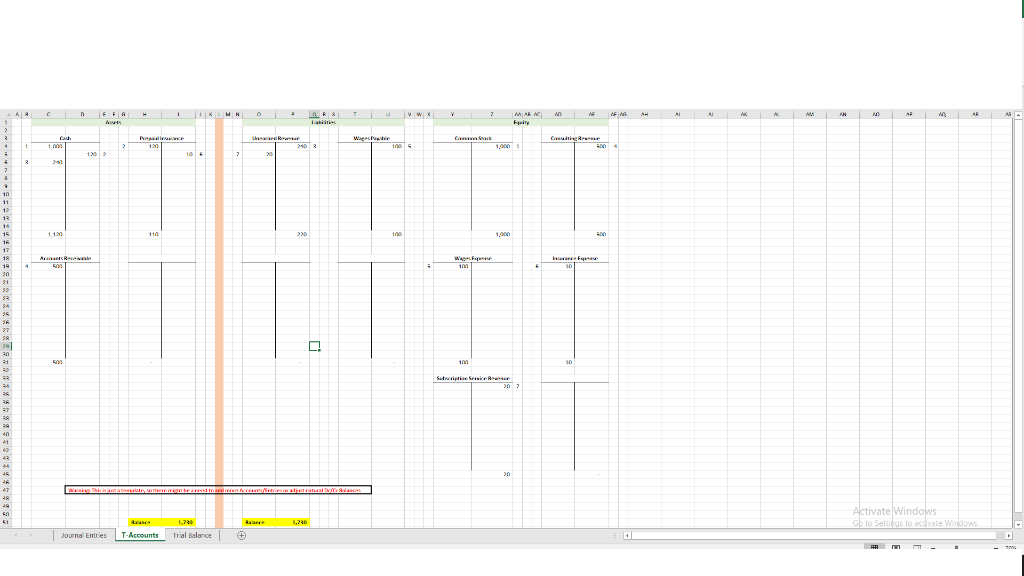

Objective 2:

Post the Journal Entries to the Ledger T-Accounts and note the ending balances of

each Account. Make sure to use T-Accounts and properly post the amounts in the proper Dr/Cr

columns.

NOTE:

There will definitely be more T-Accounts than whats provided in the Week 3-

2.xlsx Excel file. Make sure you make proper adjustments for them

Objective 3:

Construct the Adjusted Trial Balance for the month of January

Hint:

There should be 13 Journal Entries total, inclusive of Adjustments

Background: Kyrie has always wanted to become a consultant. Rather than wait for a company to hire him, he decides to start up his own consulting business. With $5,000 of cash savings, he decides to fund "Kyrie's Consulting Group, otherwise known as KCG. Kyrie took MGT 11A, 50 he decides to put his Accounting, knowledge to work. The following is a list of activities that Kyrie performs for KCG. When accounting for his business, Kyrie remembers that not all activities translate into lournal Entries on the date they occur. Month of January 1/1/20XX KCG prepays 1 year of Insurance for $2,400 Cash ($200/month) 1/1/20XX - KCG prepays 2 months of Rent in an office for $2,000 Cash ($1,000/month) 1/1/20XX - KCG prepays 2 months of Advertising for $200 Cash ($100/month) 1/5/20XX - KCG buys Supplies in the form of 10 notebooks at $5/each. Each notebook is meant to be completely used up during each Consulting session. Supplies were paid in Cash 1/10/20XX - Customer 1 prepays KCG for 5 Consulting sessions at $300/consultation 1/17/20XX - KCG hires an assistant, who has a weekly wage of $100. As a business policy, KCG pays wages at the first of every month. 1/30/20XX - KCG provides one Consulting session for Customer 2 for $300. Given that it's the end of the week, KCG will bill Customer 2 in the first week of February 1/31/20XX - It is the end of the month, and Kyrie looks back at his notes:lle realizes he provided Customer 1 with one Consulting session in the month of lanuary, and he needs to account for that, given that they prepaid for Consulting sessions. He also checks his Supplies cabinet and notices that he now has 8 notebooks. He realizes he should adjust for that as well, kiven that he needs to account for used Supplies. He then realizes there were other things that lapsed in the month of January that he should make Adjustments for to ensure January's Financial Statements are correct under Accrual Basis Accounting. Thankfully, he took MGI 11A. Objective 1: What are the Debit/Credit Journal Entries recorded for the business during the month of January, and what are the Adjustment Journal Entries at the end of the month? Objective 2: Post the Journal Entries to the Ledger T-Accounts and note the ending balances of each Account. Make sure to use T-Accounts and properly post the amounts in the proper Dr/Cr colurrins. NOTE: There will definitely be more T-Accounts than what's provided in the Week 3- 2.xlsx Excel file. Make sure you make proper adjustments for them Objective 3: Construct the Adjusted Trial Balarice for the month of January Hint: There should be 13 Journal Entries total, inclusive of Adjustments NO ARAT MARC D 6 FARA- AMMAPA ARA Activate Windows Go to Settings to acvate Windows CP 1.790 Journal Entries T-Accounts Trial Balance + Debit Credit i Transaction Date 1 1/1/20XX Account Cash Common Stock Prepaid insurance Notes First, we need to fund the busness 1000 Prepaying Insurance for 1 year, $10/month. Example of Deferred Expense 2 1/1/2000% Customer 1 prepays us for 1 year's worth of monthly subscription service at $20/month. Example of Deferred Revenue ADIUSTING ENTRY 1: Adjusting entry for the month of lanuary to Acene for consulting work done for Gistemer 2 who has yet to have been biled and thus has yet to pay us. Example of Acne Reven 3 1/1/2000 Cash Unearned Revenue 4 1/1/20XX Accounts Receivable Consulting Revenue 5 1/31/20XX Waces Expense Wages Payable 1/11/20XX Insurance Expense Prepaid insurance 7 1/21/20XX Uncarred Revenue Subscription Service Revenue ADIUSTING ENTRY 2: Adjusting entry for the month of musry to Accrue for the wages of Employee who worked for the month of January but we have yet to pay for We pay employees every 1st of the month sample of Accrued Cepense ADJUSTING ENTRY 3: Adusting entry to recognize the insurance Expers for the month and reduce the Prepaid insurance Asset ADJUSTING ENTRY 4: Adjusting Entry to recognize 1 month of the Subscription Service Revenue that customer 1 prepaid us for Activate Windows Journal Entries Accounts Trial Balance Trial Balances January 31, 20XX Unadjusted Tral Balance Debit Credit 1,740 Adjustments Debit Credit Adjusted Tidal Balance Debit Credit 1,210 170 120 120 10 500 500 240 Account 7 Cash B Prepaid Insurance 9 Accounts Receivable 10 Unearned Revenue 11 Wages Payable 12 Comron Stock 13 Consulting Revenue 14 Subscription Service Revenue 15 Wages Expense 16 Insurance Expense 17 Totals 240 100 1,000 500 100 100 1,360 1.360 622 1.990 1,990 Transactions 1-3 Transactions 4-7 Transactions 1-7 Activate Windows Santiader ente PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing Credit 1000 Transaction # Date Account Debit 1 1/1/20XX Cash Common Stock 2 1/1/20XX Prepaid Insurance Cash 3 1/1/20XX Cash Unearned Revenue 4 1/31/20xx Accounts Receivable Consulting Revenue 5 1/31/20XX Wages Expense Wages Payable 6 1/31/20xx Insurance Expense Prepaid Insurance 7 1/31/20XX Unearned Revenue Subscription Service Revenue Notes First, we need to fund the business 1000 Prepaying Insurance for 1 year, $10/month. Exam 120 Customer 1 prepays us for 1 year's worth of month 240 ADJUSTING ENTRY 1: Adjusting entry for the month 500 ADJUSTING ENTRY 2: Adjusting entry for the month 100 ADJUSTING ENTRY 3: Adjusting entry to recognize the ADJUSTING ENTRY 4: Adjusting Entry to recognize 1 m Home Insert Page Layout Formulas Data Review View Help ROTECTED VIEW Be carefu les from the Internet can contain viruses. Unless you need to det e r to stay in Protected view Enable Editing Z AA AB AC AD AE AF AG AHL ELMO Consulting Revenue Wagas para . 110 . Subscription Service Revenue Journal tries T-Accounts Trial Balance Trillane Trial Balances January 31, 20XX Unadjusted Trial Balance Credit Debit 1,240 120 Debit Adjustments Credit 120 Account Cash Prepaid Insurance 9 Accounts Receivable 10 Unearned Revenue 11 Wages Payable 12 Common Stock 13 Consulting Revenue 14 Subscription Service Revenue 15 Wages Expense 16 Insurance Expense 17 Totals Adjusted Trial Balance Debit Credit 120 240 500 1,240 120 500 20 1,000 240 100 1,000 500 1,360 1,360 630 Transactions 1-3 Transactions 4-7 1.990 Transactions 1-7 Background: Kyrie has always wanted to become a consultant. Rather than wait for a company to hire him, he decides to start up his own consulting business. With $5,000 of cash savings, he decides to fund "Kyrie's Consulting Group, otherwise known as KCG. Kyrie took MGT 11A, 50 he decides to put his Accounting, knowledge to work. The following is a list of activities that Kyrie performs for KCG. When accounting for his business, Kyrie remembers that not all activities translate into lournal Entries on the date they occur. Month of January 1/1/20XX KCG prepays 1 year of Insurance for $2,400 Cash ($200/month) 1/1/20XX - KCG prepays 2 months of Rent in an office for $2,000 Cash ($1,000/month) 1/1/20XX - KCG prepays 2 months of Advertising for $200 Cash ($100/month) 1/5/20XX - KCG buys Supplies in the form of 10 notebooks at $5/each. Each notebook is meant to be completely used up during each Consulting session. Supplies were paid in Cash 1/10/20XX - Customer 1 prepays KCG for 5 Consulting sessions at $300/consultation 1/17/20XX - KCG hires an assistant, who has a weekly wage of $100. As a business policy, KCG pays wages at the first of every month. 1/30/20XX - KCG provides one Consulting session for Customer 2 for $300. Given that it's the end of the week, KCG will bill Customer 2 in the first week of February 1/31/20XX - It is the end of the month, and Kyrie looks back at his notes:lle realizes he provided Customer 1 with one Consulting session in the month of lanuary, and he needs to account for that, given that they prepaid for Consulting sessions. He also checks his Supplies cabinet and notices that he now has 8 notebooks. He realizes he should adjust for that as well, kiven that he needs to account for used Supplies. He then realizes there were other things that lapsed in the month of January that he should make Adjustments for to ensure January's Financial Statements are correct under Accrual Basis Accounting. Thankfully, he took MGI 11A. Objective 1: What are the Debit/Credit Journal Entries recorded for the business during the month of January, and what are the Adjustment Journal Entries at the end of the month? Objective 2: Post the Journal Entries to the Ledger T-Accounts and note the ending balances of each Account. Make sure to use T-Accounts and properly post the amounts in the proper Dr/Cr colurrins. NOTE: There will definitely be more T-Accounts than what's provided in the Week 3- 2.xlsx Excel file. Make sure you make proper adjustments for them Objective 3: Construct the Adjusted Trial Balarice for the month of January Hint: There should be 13 Journal Entries total, inclusive of Adjustments NO ARAT MARC D 6 FARA- AMMAPA ARA Activate Windows Go to Settings to acvate Windows CP 1.790 Journal Entries T-Accounts Trial Balance + Debit Credit i Transaction Date 1 1/1/20XX Account Cash Common Stock Prepaid insurance Notes First, we need to fund the busness 1000 Prepaying Insurance for 1 year, $10/month. Example of Deferred Expense 2 1/1/2000% Customer 1 prepays us for 1 year's worth of monthly subscription service at $20/month. Example of Deferred Revenue ADIUSTING ENTRY 1: Adjusting entry for the month of lanuary to Acene for consulting work done for Gistemer 2 who has yet to have been biled and thus has yet to pay us. Example of Acne Reven 3 1/1/2000 Cash Unearned Revenue 4 1/1/20XX Accounts Receivable Consulting Revenue 5 1/31/20XX Waces Expense Wages Payable 1/11/20XX Insurance Expense Prepaid insurance 7 1/21/20XX Uncarred Revenue Subscription Service Revenue ADIUSTING ENTRY 2: Adjusting entry for the month of musry to Accrue for the wages of Employee who worked for the month of January but we have yet to pay for We pay employees every 1st of the month sample of Accrued Cepense ADJUSTING ENTRY 3: Adusting entry to recognize the insurance Expers for the month and reduce the Prepaid insurance Asset ADJUSTING ENTRY 4: Adjusting Entry to recognize 1 month of the Subscription Service Revenue that customer 1 prepaid us for Activate Windows Journal Entries Accounts Trial Balance Trial Balances January 31, 20XX Unadjusted Tral Balance Debit Credit 1,740 Adjustments Debit Credit Adjusted Tidal Balance Debit Credit 1,210 170 120 120 10 500 500 240 Account 7 Cash B Prepaid Insurance 9 Accounts Receivable 10 Unearned Revenue 11 Wages Payable 12 Comron Stock 13 Consulting Revenue 14 Subscription Service Revenue 15 Wages Expense 16 Insurance Expense 17 Totals 240 100 1,000 500 100 100 1,360 1.360 622 1.990 1,990 Transactions 1-3 Transactions 4-7 Transactions 1-7 Activate Windows Santiader ente PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing Credit 1000 Transaction # Date Account Debit 1 1/1/20XX Cash Common Stock 2 1/1/20XX Prepaid Insurance Cash 3 1/1/20XX Cash Unearned Revenue 4 1/31/20xx Accounts Receivable Consulting Revenue 5 1/31/20XX Wages Expense Wages Payable 6 1/31/20xx Insurance Expense Prepaid Insurance 7 1/31/20XX Unearned Revenue Subscription Service Revenue Notes First, we need to fund the business 1000 Prepaying Insurance for 1 year, $10/month. Exam 120 Customer 1 prepays us for 1 year's worth of month 240 ADJUSTING ENTRY 1: Adjusting entry for the month 500 ADJUSTING ENTRY 2: Adjusting entry for the month 100 ADJUSTING ENTRY 3: Adjusting entry to recognize the ADJUSTING ENTRY 4: Adjusting Entry to recognize 1 m Home Insert Page Layout Formulas Data Review View Help ROTECTED VIEW Be carefu les from the Internet can contain viruses. Unless you need to det e r to stay in Protected view Enable Editing Z AA AB AC AD AE AF AG AHL ELMO Consulting Revenue Wagas para . 110 . Subscription Service Revenue Journal tries T-Accounts Trial Balance Trillane Trial Balances January 31, 20XX Unadjusted Trial Balance Credit Debit 1,240 120 Debit Adjustments Credit 120 Account Cash Prepaid Insurance 9 Accounts Receivable 10 Unearned Revenue 11 Wages Payable 12 Common Stock 13 Consulting Revenue 14 Subscription Service Revenue 15 Wages Expense 16 Insurance Expense 17 Totals Adjusted Trial Balance Debit Credit 120 240 500 1,240 120 500 20 1,000 240 100 1,000 500 1,360 1,360 630 Transactions 1-3 Transactions 4-7 1.990 Transactions 1-7