Question

Background: Mesa Verde Construction is a US-based commercial construction company focused on building healthcare facilities in the southwest. The firm has been in business since

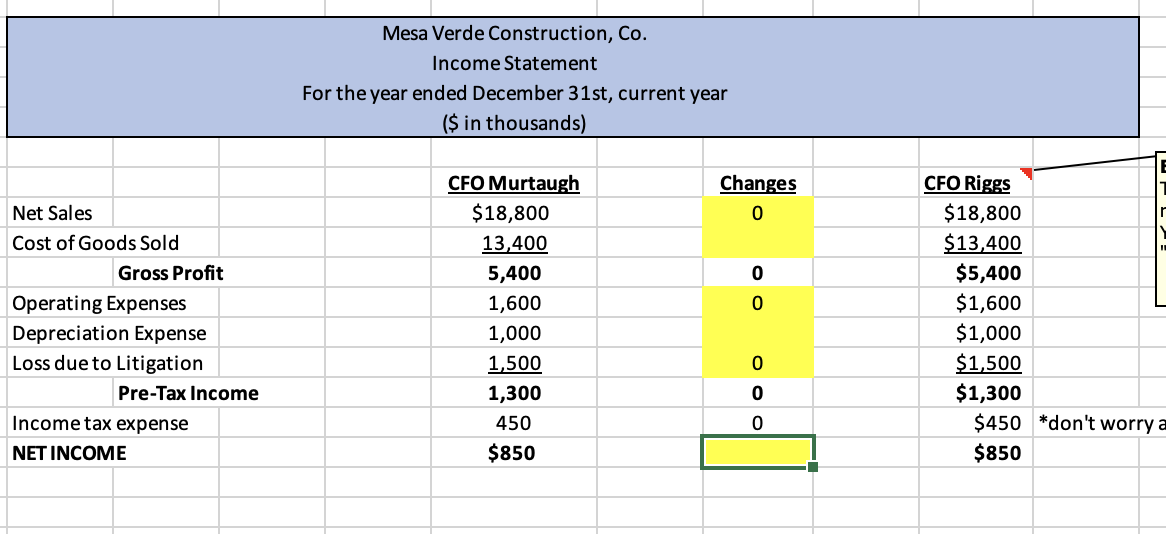

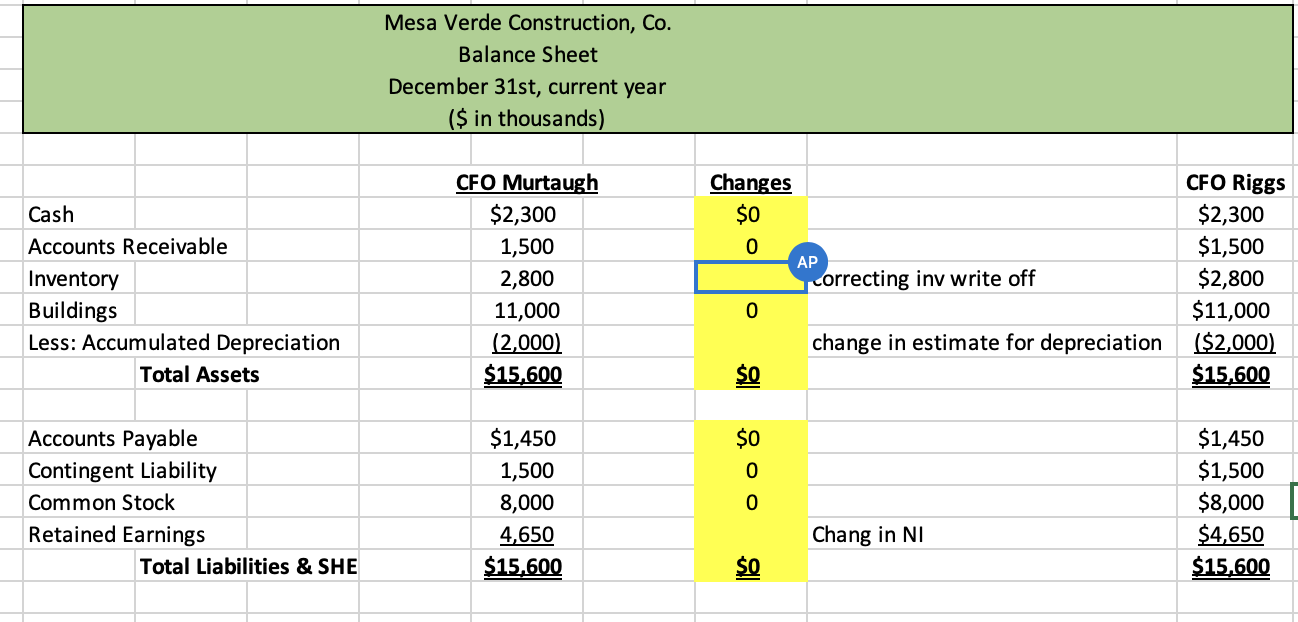

Background: Mesa Verde Construction is a US-based commercial construction company focused on building healthcare facilities in the southwest. The firm has been in business since 1989 when it was founded by the eccentric Jackson Travis. The current CFO of Mesa Verde is Roger Murtaugh but his retirement is effective as of December 31st of this year. CFO Murtaugh worked with his accounting team to complete preliminary financial statements for the current fiscal year prior to retiring on December 31st. CFO Murtaugh was well-respected for his conservative approach to financial reporting, kind demeanor, and attention to detail. The new CFO, Martine Riggs stands in stark contrast to her predecessor. Ms. Riggs is a young up-and-comer who feels she has much to prove as the CFO of Mesa Verde and needs to bring the company into the modern world with a more aggressive management style. CFO Riggs has made it clear that she is now the one in charge and changes will be made. The following tab lists three changes that CFO Riggs has proposed to make to the previously reported preliminary financial reports, prior to their submissiom to the SEC.

Proposed Changes:

1. At the end of the fiscal year, CFO Murtaugh estimated that future bad debts would be between 6% and 10% of accounts receivable. He decided to play it safe and recorded an allowance equal to 10% of accounts receivable. CFO Riggs proposes changing the estimate to be 6% of accounts receivable.

2. CFO Murtaugh reported a $200,000 write-down of inventory that decreased inventory by $200,000 and increased COGS by $200,000. CFO Riggs insists the write-down was not necessary because the decline in inventory value was only temporary. Therefore, she proposes eliminating this write-down.

3. Mesa Verde purchased a building on January 1st of last year for $11 million. CFO Murtaugh recorded last year's depreciation expense as $1 million. Depreciation for the current fiscal year was estimated as $1 million using the straight-line method over 10 years with an estimated salvage of $1 million. CFO Riggs proposes a change in estimate effective in the current fiscal year. She suggests depreciating the building over a life of 20 years with an estimated salvage of $500,000.

Could you help us fill in the effect the proposed changes would have on the Income Statement and Balance sheet? Only the yellow column needs to have changes inputed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started