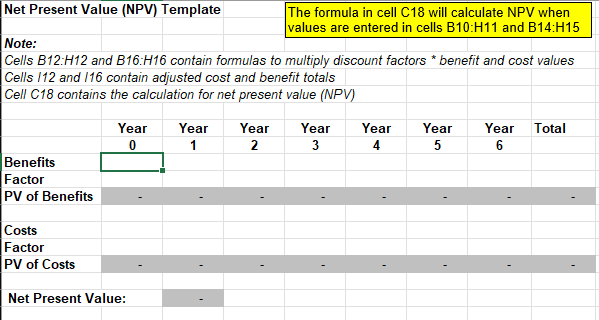

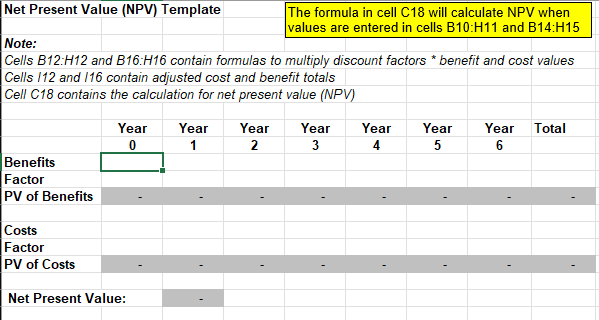

Background Mythos Associates is a consulting firm that hires temporary employees for part-time IT work They are now at the point where their current human resources and payroll system needs to be replaced. The project proposal is for a new cloud based system that will have a five-year life after implementation. Costs and benefits have been estimated for the project and you have been tasked with doing the financial analysis. The proposed system facts are as follows: - The system will take a nearly a year to develop (Year 0) but become operational near the end. $48,000 in development costs are experienced then and none in years beyond Year 0. - The Year 0 operational costs are $2,000 and $7,000 in benefits will be realized. - Year 1 operational costs will be $10,000 and will grow by 5% each year through Year 5 . - Year 1 benefits will be $30,000 and will grow by 12% each year through Year 5 . - It has been determined that a 10% discount rate will be used for NPV calculations. In your analysis, you should use the template worksheets that you downloaded from the Financial Analysis Templates folder under the Part C folder in Blackboard along with the discount rate table from Part C of the text (Figure C-9). Tasks 1. Determine when the payback period begins for this project. 2. What is the ROI for this project? 3. What is the NPV for this project? Do all three tasks. Upload your template files, so that they may be graded. You may choose to consolidate all three worksheets in a single Excel workbook(.xlsx), provide a .zip file containing the separate worksheet templates, or embed the worksheets within a Word file (.docx). Net Present Value (NPV) Template The formula in cell C18 will calculate NPV when values are entered in cells B10:H11 and B14:H15 Note: Cells B12:H12 and B16:H16 contain formulas to multiply discount factors benefit and cost values Cells 112 and 116 contain adjusted cost and benefit totals Cell C18 contains the calculation for net present value (NPV) Net Present Value: Payback Analysis Template Note: Cells C8: t14 and E8:E14 contain formulas to accumulate costs and benefits \begin{tabular}{|l|l|} Return on Investment (ROI) Template & The formula in cell C17 will calculate ROI when values are entered in cells B8:B14 and \\ \hline \end{tabular} Note: Cells C8:C14 and E8:E14 contain formulas to accumulate costs and benefits Cell C17 contains formula to calculate ROI ROI: #DIV/0! Background Mythos Associates is a consulting firm that hires temporary employees for part-time IT work They are now at the point where their current human resources and payroll system needs to be replaced. The project proposal is for a new cloud based system that will have a five-year life after implementation. Costs and benefits have been estimated for the project and you have been tasked with doing the financial analysis. The proposed system facts are as follows: - The system will take a nearly a year to develop (Year 0) but become operational near the end. $48,000 in development costs are experienced then and none in years beyond Year 0. - The Year 0 operational costs are $2,000 and $7,000 in benefits will be realized. - Year 1 operational costs will be $10,000 and will grow by 5% each year through Year 5 . - Year 1 benefits will be $30,000 and will grow by 12% each year through Year 5 . - It has been determined that a 10% discount rate will be used for NPV calculations. In your analysis, you should use the template worksheets that you downloaded from the Financial Analysis Templates folder under the Part C folder in Blackboard along with the discount rate table from Part C of the text (Figure C-9). Tasks 1. Determine when the payback period begins for this project. 2. What is the ROI for this project? 3. What is the NPV for this project? Do all three tasks. Upload your template files, so that they may be graded. You may choose to consolidate all three worksheets in a single Excel workbook(.xlsx), provide a .zip file containing the separate worksheet templates, or embed the worksheets within a Word file (.docx). Net Present Value (NPV) Template The formula in cell C18 will calculate NPV when values are entered in cells B10:H11 and B14:H15 Note: Cells B12:H12 and B16:H16 contain formulas to multiply discount factors benefit and cost values Cells 112 and 116 contain adjusted cost and benefit totals Cell C18 contains the calculation for net present value (NPV) Net Present Value: Payback Analysis Template Note: Cells C8: t14 and E8:E14 contain formulas to accumulate costs and benefits \begin{tabular}{|l|l|} Return on Investment (ROI) Template & The formula in cell C17 will calculate ROI when values are entered in cells B8:B14 and \\ \hline \end{tabular} Note: Cells C8:C14 and E8:E14 contain formulas to accumulate costs and benefits Cell C17 contains formula to calculate ROI ROI: #DIV/0