Pure Sport ple was formed following the merger of Pure Limited and Sport Limited in 2016. Il is a listed company which designs, manufactures,

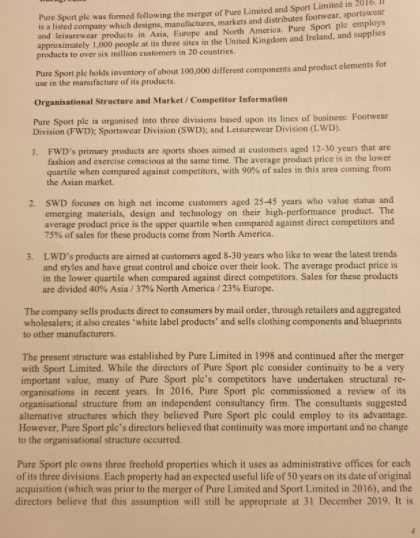

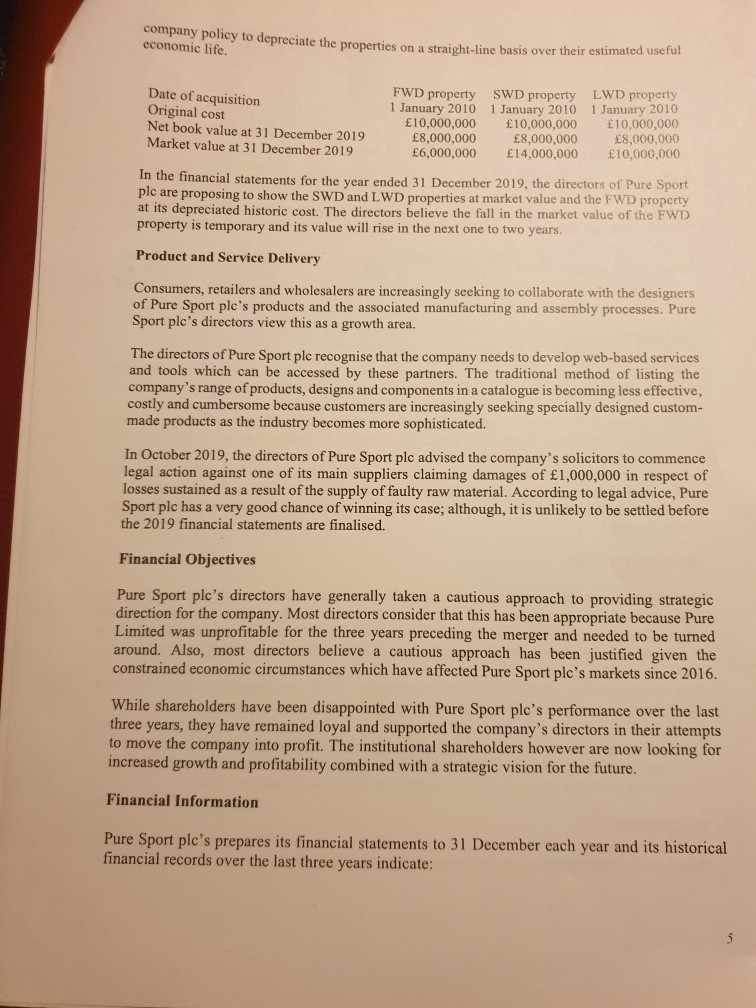

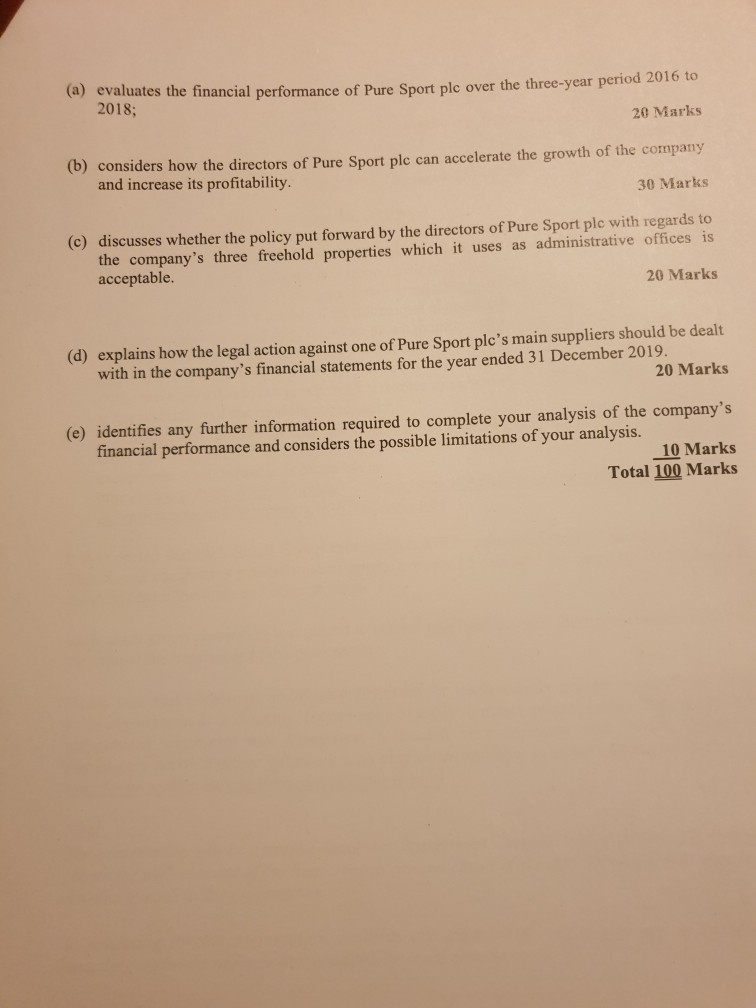

Pure Sport ple was formed following the merger of Pure Limited and Sport Limited in 2016. Il is a listed company which designs, manufactures, markets and distributes footwear, sportswear and leisurewear products in Asia, Europe and North America. Pure Sport ple employs approximately 1,000 people at its three sites in the United Kingdom and Ireland, and supplies products to over six million customers in 20 countries. Pure Sport ple holds inventory of about 100,000 different components and product elements for use in the manufacture of its products. Organisational Structure and Market/Competitor Information Pure Sport ple is organised into three divisions based upon its lines of business: Footwear Division (FWD); Sportswear Division (SWD); and Leisurewear Division (LWD). 1. FWD's primary products are sports shoes aimed at customers aged 12-30 years that are fashion and exercise conscious at the same time. The average product price is in the lower quartile when compared against competitors, with 90% of sales in this area coming from the Asian market. 2. SWD focuses on high net income customers aged 25-45 years who value status and emerging materials, design and technology on their high-performance product. The average product price is the upper quartile when compared against direct competitors and 75% of sales for these products come from North America. 3. LWD's products are aimed at customers aged 8-30 years who like to wear the latest trends and styles and have great control and choice over their look. The average product price is in the lower quartile when compared against direct competitors. Sales for these products are divided 40% Asia / 37% North America / 23% Europe. The company sells products direct to consumers by mail order, through retailers and aggregated. wholesalers; it also creates 'white label products and sells clothing components and blueprints to other manufacturers. The present structure was established by Pure Limited in 1998 and continued after the merger with Sport Limited. While the directors of Pure Sport ple consider continuity to be a very important value, many of Pure Sport ple's competitors have undertaken structural re- organisations in recent years. In 2016, Pure Sport ple commissioned a review of its organisational structure from an independent consultancy firm. The consultants suggested alternative structures which they believed Pure Sport ple could employ to its advantage. However, Pure Sport ple's directors believed that continuity was more important and no change to the organisational structure occurred. Pure Sport plc owns three freehold properties which it uses as administrative offices for each of its three divisions. Each property had an expected useful life of 50 years on its date of original acquisition (which was prior to the merger of Pure Limited and Sport Limited in 2016), and the directors believe that this assumption will still be appropriate at 31 December 2019. It is company policy to depreciate the properties on a straight-line basis over their estimated useful economic life. Date of acquisition Original cost Net book value at 31 December 2019 Market value at 31 December 2019 FWD property SWD property 1 January 2010 1 January 2010 10,000,000 10,000,000 8,000,000 8,000,000 6,000,000 14,000,000 LWD property 1 January 2010 10,000,000 8,000,000 10,000,000 In the financial statements for the year ended 31 December 2019, the directors of Pure Sport ple are proposing to show the SWD and LWD properties at market value and the FWD property at its depreciated historic cost. The directors believe the fall in the market value of the FWD property is temporary and its value will rise in the next one to two years. Product and Service Delivery Consumers, retailers and wholesalers are increasingly seeking to collaborate with the designers of Pure Sport ple's products and the associated manufacturing and assembly processes. Pure Sport ple's directors view this as a growth area. The directors of Pure Sport plc recognise that the company needs to develop web-based services and tools which can be accessed by these partners. The traditional method of listing the company's range of products, designs and components in a catalogue is becoming less effective, costly and cumbersome because customers are increasingly seeking specially designed custom- made products as the industry becomes more sophisticated. In October 2019, the directors of Pure Sport plc advised the company's solicitors to commence legal action against one of its main suppliers claiming damages of 1,000,000 in respect of losses sustained as a result of the supply of faulty raw material. According to legal advice, Pure Sport plc has a very good chance of winning its case; although, it is unlikely to be settled before the 2019 financial statements are finalised. Financial Objectives Pure Sport plc's directors have generally taken a cautious approach to providing strategic direction for the company. Most directors consider that this has been appropriate because Pure Limited was unprofitable for the three years preceding the merger and needed to be turned around. Also, most directors believe a cautious approach has been justified given the constrained economic circumstances which have affected Pure Sport plc's markets since 2016. While shareholders have been disappointed with Pure Sport ple's performance over the last three years, they have remained loyal and supported the company's directors in their attempts to move the company into profit. The institutional shareholders however are now looking for increased growth and profitability combined with a strategic vision for the future. Financial Information Pure Sport ple's prepares its financial statements to 31 December each year and its historical financial records over the last three years indicate: 5 Revenue Operating profit Profit for the year Earnings per share Dividend per share Performance Review Revenue Operating profit FWD Division million 2018 million 212 20 620 39 21 11.7 pence 5.8 pence 2017 million 433 20 9 SWD Division million 284 5 pence 0 Pure Sport ple's three divisions have been profitable throughout the last three years. The revenue and operating profit of the three divisions of Pure Sport plc for 2018 were as follows: LWD Division million 2016 million 124 13 360 13 5 2.8 pence 0 Total million 620 39 Capital Budgeting Pure Sport plc has an internal audit department. The Chief Internal Auditor, who leads this department, reports directly to the Pure Sport ple's Finance Director. Investigation by the Internal Audit department has revealed that managers with responsibility for capital expenditure have often paid little attention to expenditure authorisation levels approved by the company's directors. They have justified overspending on the grounds that the original budgets were inadequate and in order not to jeopardise the capital projects, the overspends were necessary. It is perceived by the designers and most staff members that the need to allow a great deal of customisation on products leads to difficultly in predicting costs being incurred. Strategic Planning Pure Sport plc applies a traditional rational model in carrying out its strategic planning process. This encompasses an annual exercise to review the previous plan, creation of a revenue and capital budget for the next five years and instruction to managers within Pure Sport plc to maintain their expenditure within the budget limits approved by the company's directors. The directors of Pure Sport plc stated in the company's 2018 annual report, published in March 2019, that the overall strategic aim of the company is to: 'Achieve growth and increase shareholder returns by continuing to design produce and distribute high quality clothing and footwear products and components and develop our international presence through expansion into new overseas markets.' Requirement Based on the information provided, prepare a presentation which: 6 (a) evaluates the financial performance of Pure Sport plc over the three-year period 2016 to 2018; 20 Marks (b) considers how the directors of Pure Sport plc can accelerate the growth of the company and increase its profitability. 30 Marks (c) discusses whether the policy put forward by the directors of Pure Sport plc with regards to the company's three freehold properties which it uses as administrative offices is acceptable. 20 Marks (d) explains how the legal action against one of Pure Sport ple's main suppliers should be dealt with in the company's financial statements for the year ended 31 December 2019. 20 Marks (e) identifies any further information required to complete your analysis of the company's financial performance and considers the possible limitations of your analysis. 10 Marks Total 100 Marks

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided prepare a presentation which a evaluates the financial performance of Pure Sport plc over the threeyear period 2016 to 2018 20 Marks It can be seen from the given inf...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started