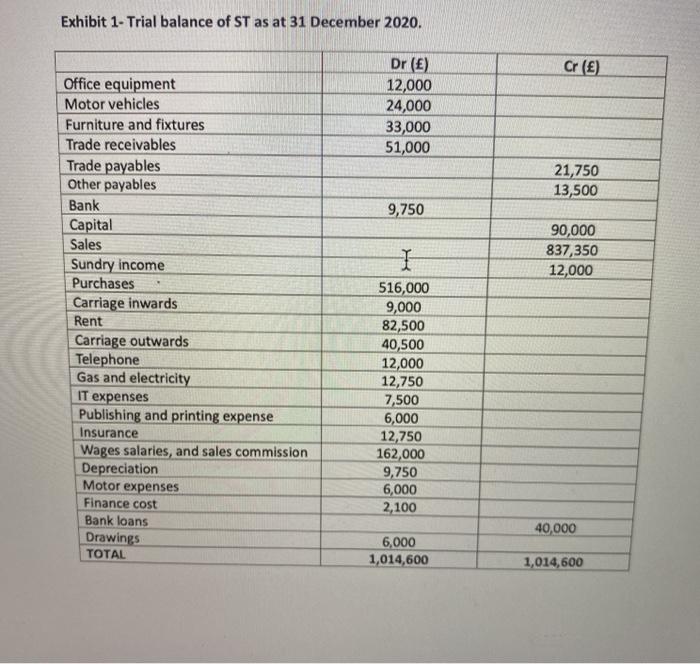

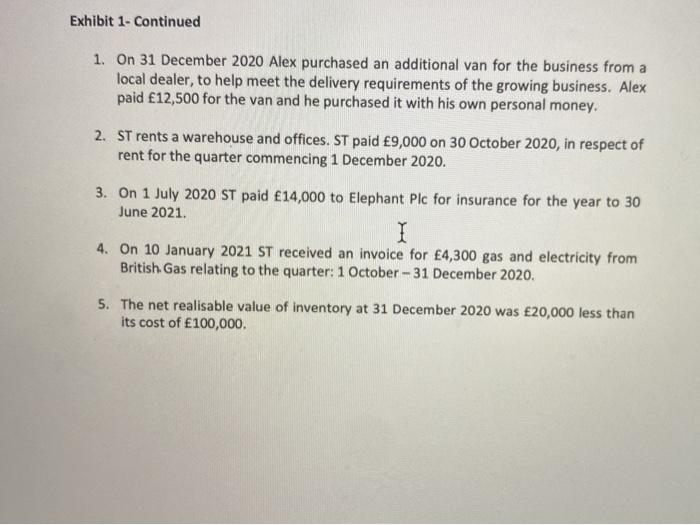

BACKGROUND Solent Trading (ST) is a small retail business, based in the UK, operating within the education sector. It specialises in sourcing IT equipment from a variety of local and international suppliers which it then sells on to universities in the UK to support the university teaching. ST was set up by Alex Collins in June 2019. Alex had previously spent 13 years working within educational supply businesses across Hampshire, and had decided to use his expertise, contacts and experience to strike out alone. Alex used 90,000 of his own savings, and 40,000 of bank financing from Lloyds Bank. The bank manager was happy to lend Alex the money based on a sound business case forecasting that ST would break-even within the first year of trading. Once the financing had been secured, Alex busied himself setting up the business. He found warehousing and office premises and set about securing supplier relationships so that he could source inventory. He also recruited a warehouse manager and an IT manager, together with a part-time office manager and a salesperson whom he intended to pay on a commission basis. As is common practice in this sector, revenues originate from a combination of online orders (via a business website designed by the IT manager) and a catalogue sent directly to universities. Alex's extensive contact list in the industry meant that the business could start with a healthy-looking customer database. I The initial start-up activities of ST were complete by the end of 2019 and ST commenced trading in January 2020. It is now the end of the first year of trading and Alex is keen to understand how the business has been doing financially. Alex freely admits that numbers are not his thing. The office manager has recorded all transactions throughout the year but is now seeking the help of an accountant to make sense of these numbers and perhaps give the business some advice on the way forward. You have been contacted by Alex to help with this. From the raw transaction data, you have produced a trial balance and the office manager has provided you with some further information. (Exhibit 1) REQUIREMENTS 1. Using Exhibit 1, prepare the statement of profit or loss and the statement of financial position for Solent Trading for the year ended 31 December 2020. (60 MARKS) Exhibit 1- Trial balance of ST as at 31 December 2020. Cr () Dr () 12,000 24,000 33,000 51,000 21,750 13,500 9,750 90,000 837,350 12,000 Office equipment Motor vehicles Furniture and fixtures Trade receivables Trade payables Other payables Bank Capital Sales Sundry income Purchases Carriage inwards Rent Carriage outwards Telephone Gas and electricity IT expenses Publishing and printing expense Insurance Wages salaries, and sales commission Depreciation Motor expenses Finance cost Bank loans Drawings TOTAL 1 516,000 9,000 82,500 40,500 12,000 12,750 7,500 6,000 12,750 162,000 9,750 6,000 2,100 40,000 6,000 1,014,600 1,014,600 Exhibit 1. Continued 1. On 31 December 2020 Alex purchased an additional van for the business from a local dealer, to help meet the delivery requirements of the growing business. Alex paid 12,500 for the van and he purchased it with his own personal money. 2. ST rents a warehouse and offices. ST paid 9,000 on 30 October 2020, in respect of rent for the quarter commencing 1 December 2020. 3. On 1 July 2020 ST paid 14,000 to Elephant Plc for insurance for the year to 30 June 2021. I 4. On 10 January 2021 ST received an invoice for 4,300 gas and electricity from British Gas relating to the quarter: 1 October - 31 December 2020. 5. The net realisable value of inventory at 31 December 2020 was 20,000 less than its cost of 100,000. BACKGROUND Solent Trading (ST) is a small retail business, based in the UK, operating within the education sector. It specialises in sourcing IT equipment from a variety of local and international suppliers which it then sells on to universities in the UK to support the university teaching. ST was set up by Alex Collins in June 2019. Alex had previously spent 13 years working within educational supply businesses across Hampshire, and had decided to use his expertise, contacts and experience to strike out alone. Alex used 90,000 of his own savings, and 40,000 of bank financing from Lloyds Bank. The bank manager was happy to lend Alex the money based on a sound business case forecasting that ST would break-even within the first year of trading. Once the financing had been secured, Alex busied himself setting up the business. He found warehousing and office premises and set about securing supplier relationships so that he could source inventory. He also recruited a warehouse manager and an IT manager, together with a part-time office manager and a salesperson whom he intended to pay on a commission basis. As is common practice in this sector, revenues originate from a combination of online orders (via a business website designed by the IT manager) and a catalogue sent directly to universities. Alex's extensive contact list in the industry meant that the business could start with a healthy-looking customer database. I The initial start-up activities of ST were complete by the end of 2019 and ST commenced trading in January 2020. It is now the end of the first year of trading and Alex is keen to understand how the business has been doing financially. Alex freely admits that numbers are not his thing. The office manager has recorded all transactions throughout the year but is now seeking the help of an accountant to make sense of these numbers and perhaps give the business some advice on the way forward. You have been contacted by Alex to help with this. From the raw transaction data, you have produced a trial balance and the office manager has provided you with some further information. (Exhibit 1) REQUIREMENTS 1. Using Exhibit 1, prepare the statement of profit or loss and the statement of financial position for Solent Trading for the year ended 31 December 2020. (60 MARKS) Exhibit 1- Trial balance of ST as at 31 December 2020. Cr () Dr () 12,000 24,000 33,000 51,000 21,750 13,500 9,750 90,000 837,350 12,000 Office equipment Motor vehicles Furniture and fixtures Trade receivables Trade payables Other payables Bank Capital Sales Sundry income Purchases Carriage inwards Rent Carriage outwards Telephone Gas and electricity IT expenses Publishing and printing expense Insurance Wages salaries, and sales commission Depreciation Motor expenses Finance cost Bank loans Drawings TOTAL 1 516,000 9,000 82,500 40,500 12,000 12,750 7,500 6,000 12,750 162,000 9,750 6,000 2,100 40,000 6,000 1,014,600 1,014,600 Exhibit 1. Continued 1. On 31 December 2020 Alex purchased an additional van for the business from a local dealer, to help meet the delivery requirements of the growing business. Alex paid 12,500 for the van and he purchased it with his own personal money. 2. ST rents a warehouse and offices. ST paid 9,000 on 30 October 2020, in respect of rent for the quarter commencing 1 December 2020. 3. On 1 July 2020 ST paid 14,000 to Elephant Plc for insurance for the year to 30 June 2021. I 4. On 10 January 2021 ST received an invoice for 4,300 gas and electricity from British Gas relating to the quarter: 1 October - 31 December 2020. 5. The net realisable value of inventory at 31 December 2020 was 20,000 less than its cost of 100,000