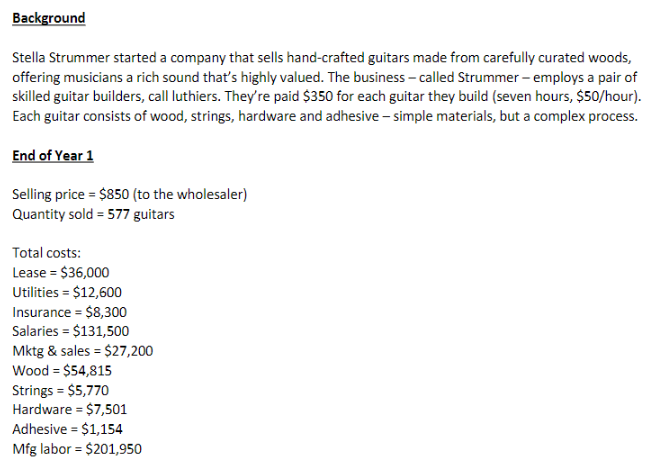

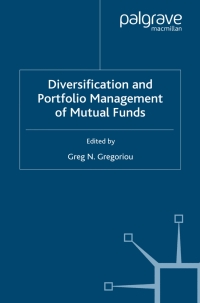

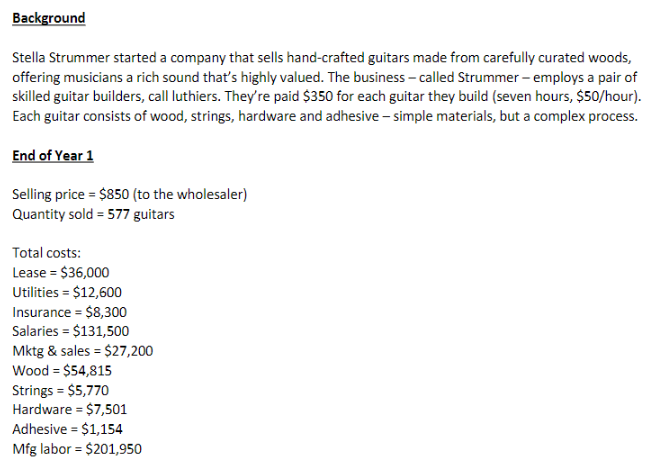

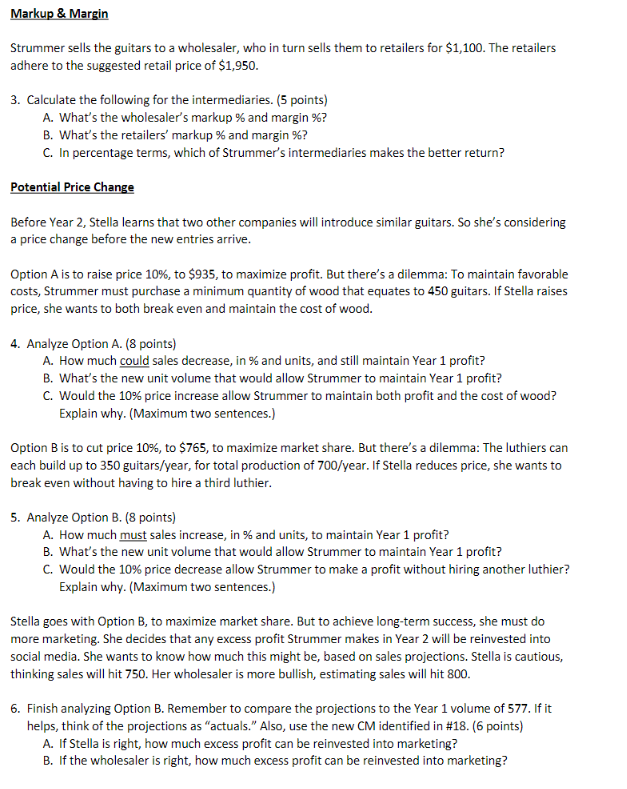

Background Stella Strummer started a company that sells hand-crafted guitars made from carefully curated woods, offering musicians a rich sound that's highly valued. The business - called Strummer - employs a pair of skilled guitar builders, call luthiers. They're paid $350 for each guitar they build (seven hours, $50/hour). Each guitar consists of wood, strings, hardware and adhesive - simple materials, but a complex process. End of Year 1 Selling price = $850 (to the wholesaler) Quantity sold = 577 guitars Total costs: Lease = $36,000 Utilities = $12,600 Insurance = $8,300 Salaries = $131,500 Mktg & sales = $27,200 Wood = $54,815 Strings = $5,770 Hardware = $7,501 Adhesive = $1,154 Mfg labor = $201,950 Markup & Margin Strummer sells the guitars to a wholesaler, who in turn sells them to retailers for $1,100. The retailers adhere to the suggested retail price of $1,950. 3. Calculate the following for the intermediaries. (5 points) A. What's the wholesaler's markup % and margin %? B. What's the retailers' markup % and margin %? C. In percentage terms, which of Strummer's intermediaries makes the better return? Potential Price Change Before Year 2, Stella learns that two other companies will introduce similar guitars. So she's considering a price change before the new entries arrive. Option A is to raise price 10%, to $935, to maximize profit. But there's a dilemma: To maintain favorable costs, Strummer must purchase a minimum quantity of wood that equates to 450 guitars. If Stella raises price, she wants to both break even and maintain the cost of wood. 4. Analyze Option A. (8 points) A. How much could sales decrease, in % and units, and still maintain Year 1 profit? B. What's the new unit volume that would allow Strummer to maintain Year 1 profit? C. Would the 10% price increase allow Strummer to maintain both profit and the cost of wood? Explain why. (Maximum two sentences.) Option Bis to cut price 10%, to $765, to maximize market share. But there's a dilemma: The luthiers can each build up to 350 guitars/year, for total production of 700/year. If Stella reduces price, she wants to break even without having to hire a third luthier. 5. Analyze Option B. (8 points) A. How much must sales increase, in % and units, to maintain Year 1 profit? B. What's the new unit volume that would allow Strummer to maintain Year 1 profit? C. Would the 10% price decrease allow Strummer to make a profit without hiring another luthier? Explain why. (Maximum two sentences.) Stella goes with Option B, to maximize market share. But to achieve long-term success, she must do more marketing. She decides that any excess profit Strummer makes in Year 2 will be reinvested into social media. She wants to know how much this might be, based on sales projections. Stella is cautious, thinking sales will hit 750. Her wholesaler is more bullish, estimating sales will hit 800. 6. Finish analyzing Option B. Remember to compare the projections to the Year 1 volume of 577. If it helps, think of the projections as "actuals." Also, use the new CM identified in #18. (6 points) A. If Stella is right, how much excess profit can be reinvested into marketing? B. If the wholesaler is right, how much excess profit can be reinvested into marketing? Background Stella Strummer started a company that sells hand-crafted guitars made from carefully curated woods, offering musicians a rich sound that's highly valued. The business - called Strummer - employs a pair of skilled guitar builders, call luthiers. They're paid $350 for each guitar they build (seven hours, $50/hour). Each guitar consists of wood, strings, hardware and adhesive - simple materials, but a complex process. End of Year 1 Selling price = $850 (to the wholesaler) Quantity sold = 577 guitars Total costs: Lease = $36,000 Utilities = $12,600 Insurance = $8,300 Salaries = $131,500 Mktg & sales = $27,200 Wood = $54,815 Strings = $5,770 Hardware = $7,501 Adhesive = $1,154 Mfg labor = $201,950 Markup & Margin Strummer sells the guitars to a wholesaler, who in turn sells them to retailers for $1,100. The retailers adhere to the suggested retail price of $1,950. 3. Calculate the following for the intermediaries. (5 points) A. What's the wholesaler's markup % and margin %? B. What's the retailers' markup % and margin %? C. In percentage terms, which of Strummer's intermediaries makes the better return? Potential Price Change Before Year 2, Stella learns that two other companies will introduce similar guitars. So she's considering a price change before the new entries arrive. Option A is to raise price 10%, to $935, to maximize profit. But there's a dilemma: To maintain favorable costs, Strummer must purchase a minimum quantity of wood that equates to 450 guitars. If Stella raises price, she wants to both break even and maintain the cost of wood. 4. Analyze Option A. (8 points) A. How much could sales decrease, in % and units, and still maintain Year 1 profit? B. What's the new unit volume that would allow Strummer to maintain Year 1 profit? C. Would the 10% price increase allow Strummer to maintain both profit and the cost of wood? Explain why. (Maximum two sentences.) Option Bis to cut price 10%, to $765, to maximize market share. But there's a dilemma: The luthiers can each build up to 350 guitars/year, for total production of 700/year. If Stella reduces price, she wants to break even without having to hire a third luthier. 5. Analyze Option B. (8 points) A. How much must sales increase, in % and units, to maintain Year 1 profit? B. What's the new unit volume that would allow Strummer to maintain Year 1 profit? C. Would the 10% price decrease allow Strummer to make a profit without hiring another luthier? Explain why. (Maximum two sentences.) Stella goes with Option B, to maximize market share. But to achieve long-term success, she must do more marketing. She decides that any excess profit Strummer makes in Year 2 will be reinvested into social media. She wants to know how much this might be, based on sales projections. Stella is cautious, thinking sales will hit 750. Her wholesaler is more bullish, estimating sales will hit 800. 6. Finish analyzing Option B. Remember to compare the projections to the Year 1 volume of 577. If it helps, think of the projections as "actuals." Also, use the new CM identified in #18. (6 points) A. If Stella is right, how much excess profit can be reinvested into marketing? B. If the wholesaler is right, how much excess profit can be reinvested into marketing