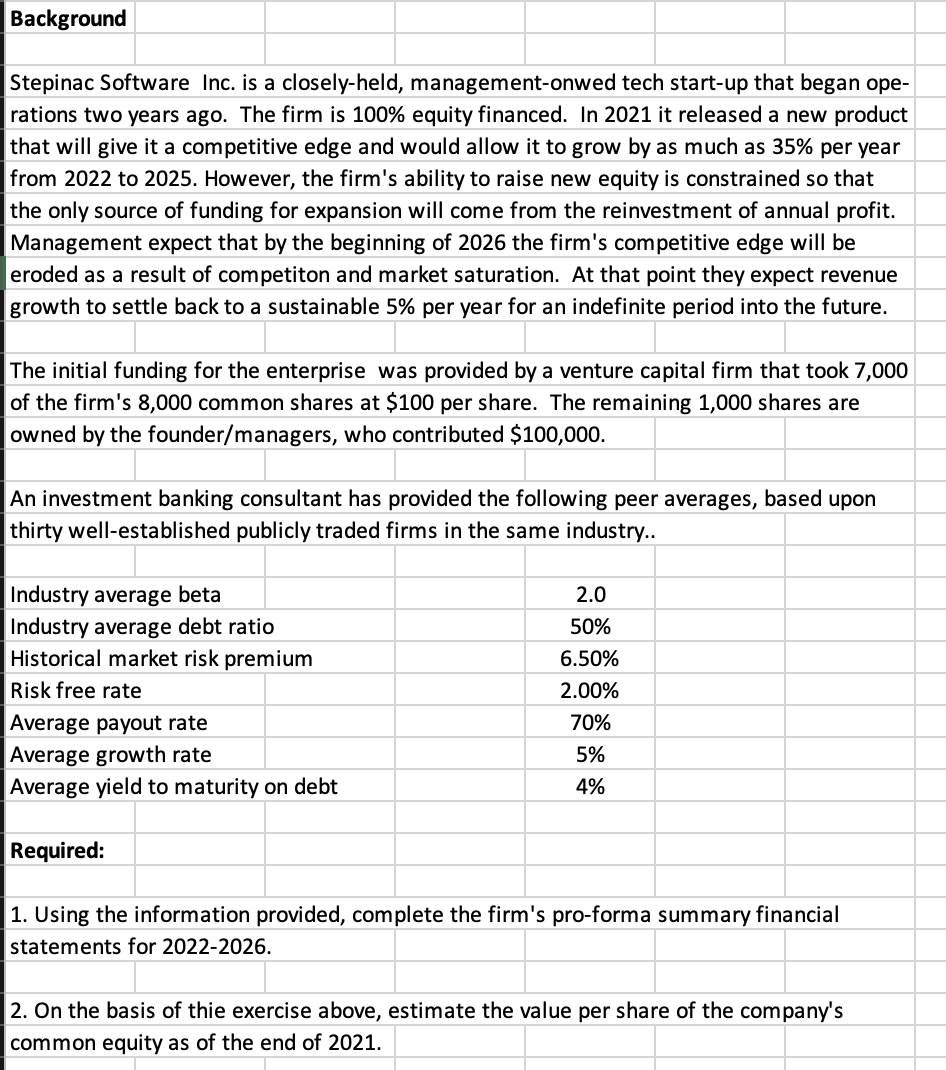

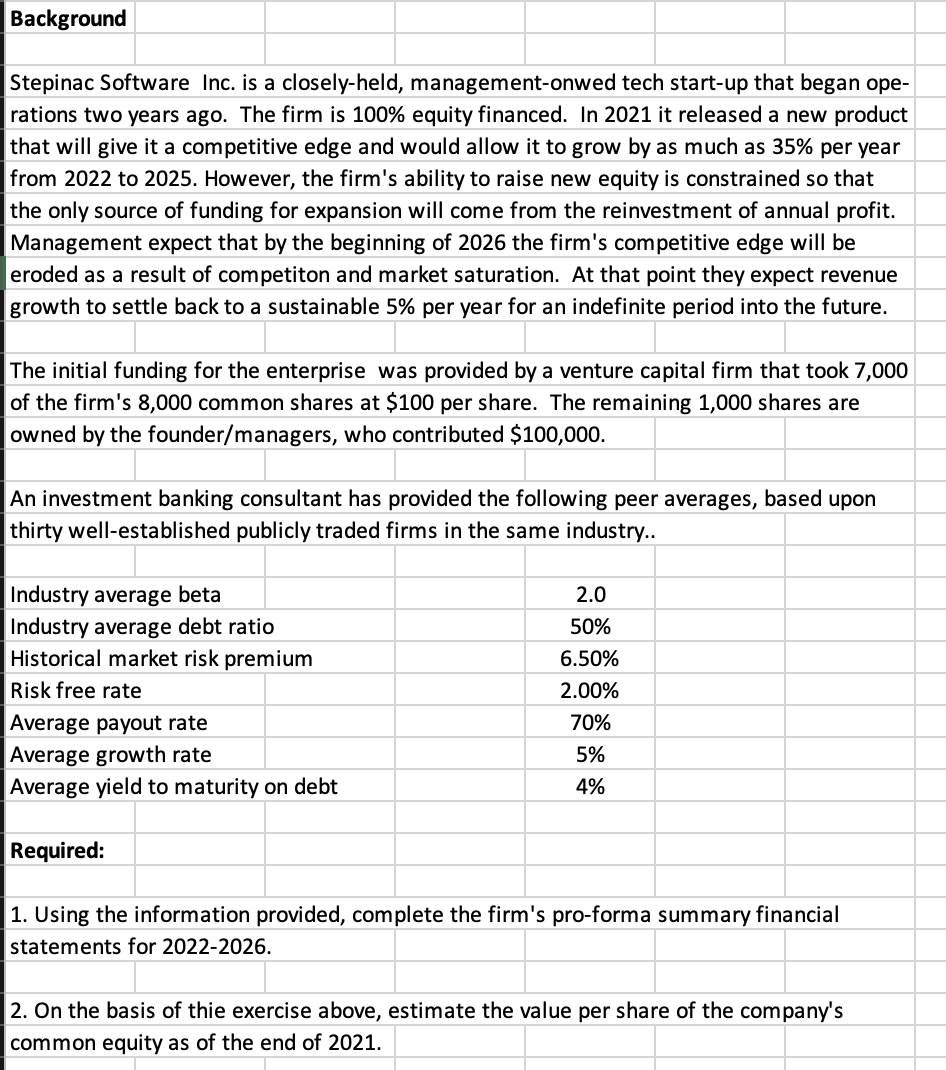

Background Stepinac Software Inc. is a closely-held, management-onwed tech start-up that began ope- rations two years ago. The firm is 100% equity financed. In 2021 it released a new product that will give it a competitive edge and would allow it to grow by as much as 35% per year from 2022 to 2025. However, the firm's ability to raise new equity is constrained so that the only source of funding for expansion will come from the reinvestment of annual profit. Management expect that by the beginning of 2026 the firm's competitive edge will be eroded as a result of competiton and market saturation. At that point they expect revenue growth to settle back to a sustainable 5% per year for an indefinite period into the future. The initial funding for the enterprise was provided by a venture capital firm that took 7,000 of the firm's 8,000 common shares at $100 per share. The remaining 1,000 shares are owned by the founder/managers, who contributed $100,000. An investment banking consultant has provided the following peer averages, based upon thirty well-established publicly traded firms in the same industry.. 2.0 50% Industry average beta Industry average debt ratio Historical market risk premium Risk free rate Average payout rate Average growth rate Average yield to maturity on debt 6.50% 2.00% 70% 5% 4% Required: 1. Using the information provided, complete the firm's pro-forma summary financial statements for 2022-2026. 2. On the basis of thie exercise above, estimate the value per share of the company's common equity as of the end of 2021. Background Stepinac Software Inc. is a closely-held, management-onwed tech start-up that began ope- rations two years ago. The firm is 100% equity financed. In 2021 it released a new product that will give it a competitive edge and would allow it to grow by as much as 35% per year from 2022 to 2025. However, the firm's ability to raise new equity is constrained so that the only source of funding for expansion will come from the reinvestment of annual profit. Management expect that by the beginning of 2026 the firm's competitive edge will be eroded as a result of competiton and market saturation. At that point they expect revenue growth to settle back to a sustainable 5% per year for an indefinite period into the future. The initial funding for the enterprise was provided by a venture capital firm that took 7,000 of the firm's 8,000 common shares at $100 per share. The remaining 1,000 shares are owned by the founder/managers, who contributed $100,000. An investment banking consultant has provided the following peer averages, based upon thirty well-established publicly traded firms in the same industry.. 2.0 50% Industry average beta Industry average debt ratio Historical market risk premium Risk free rate Average payout rate Average growth rate Average yield to maturity on debt 6.50% 2.00% 70% 5% 4% Required: 1. Using the information provided, complete the firm's pro-forma summary financial statements for 2022-2026. 2. On the basis of thie exercise above, estimate the value per share of the company's common equity as of the end of 2021