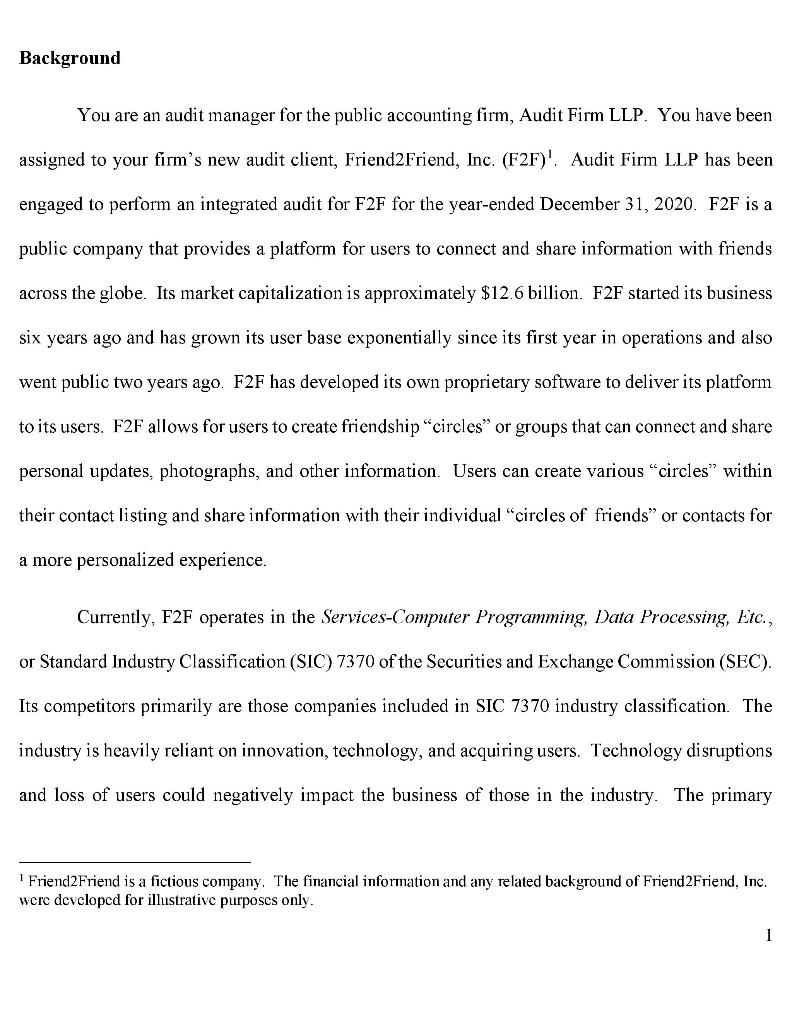

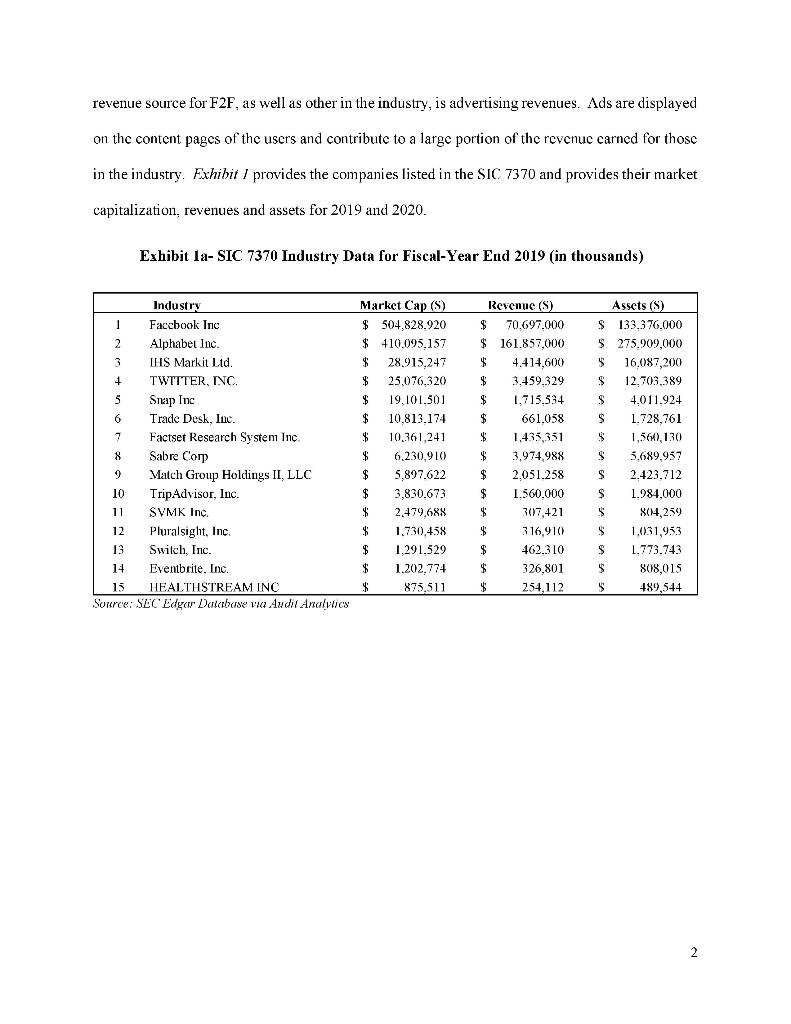

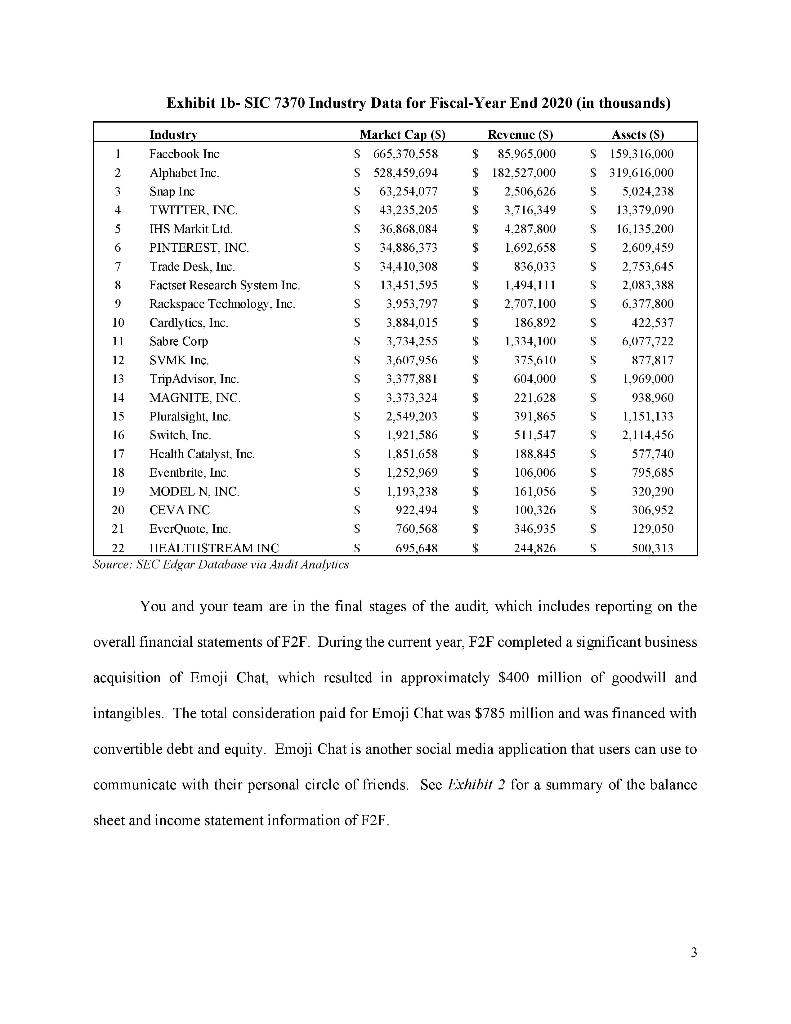

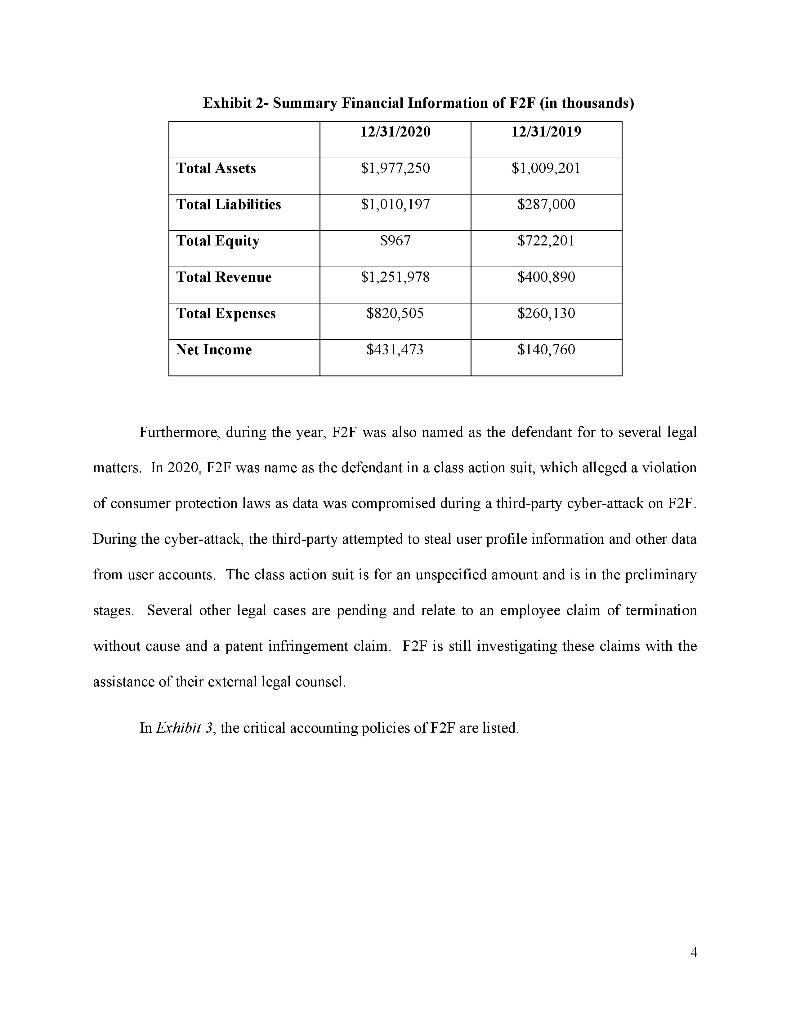

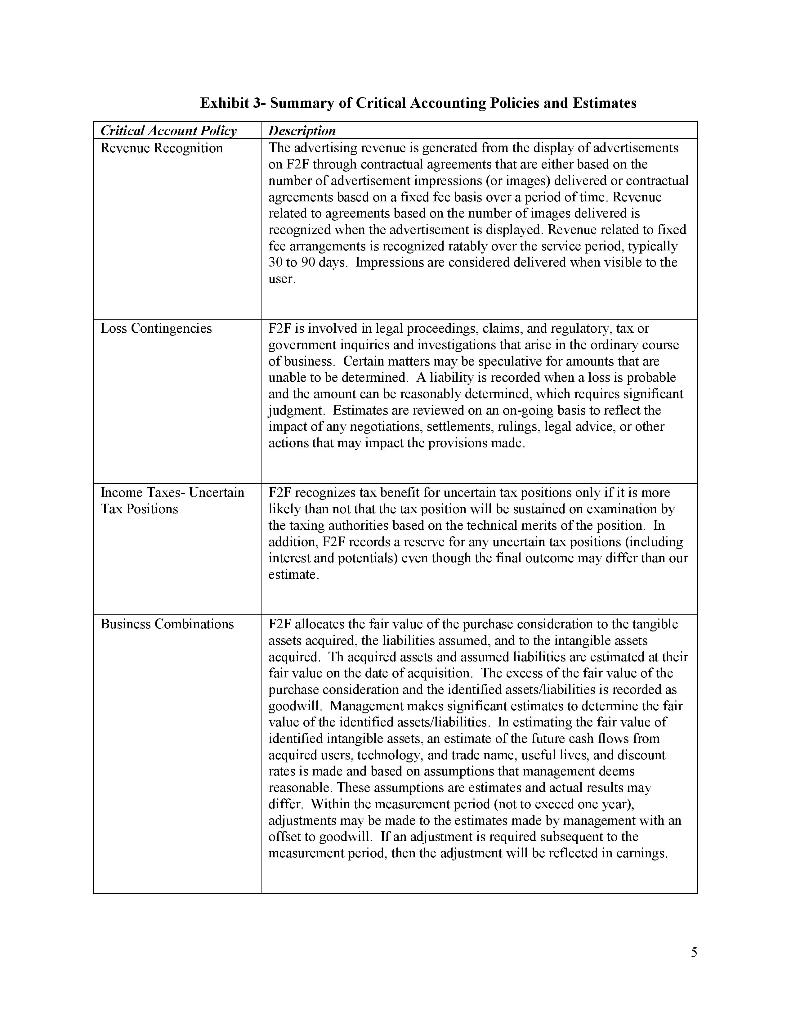

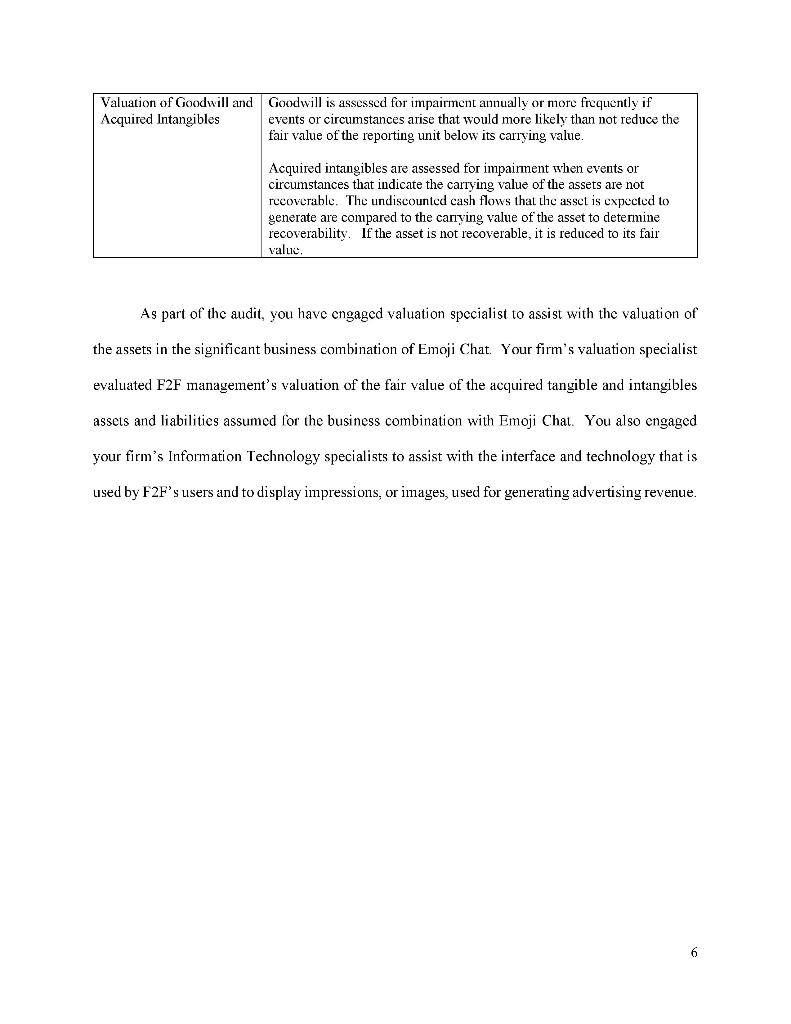

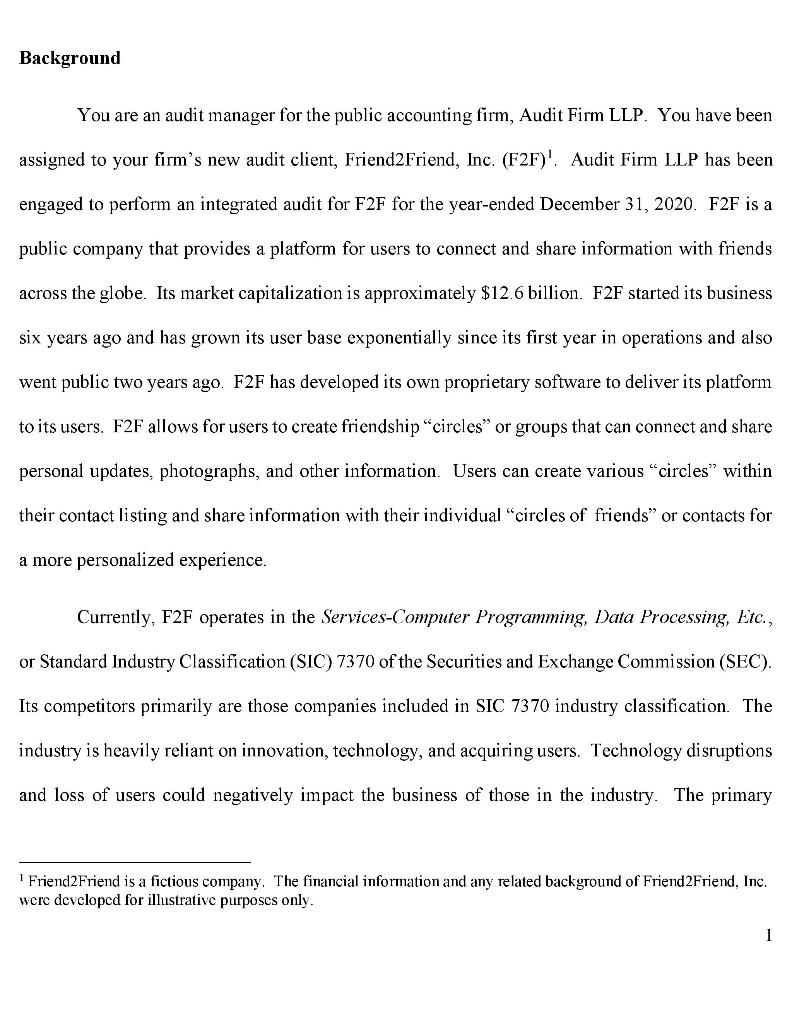

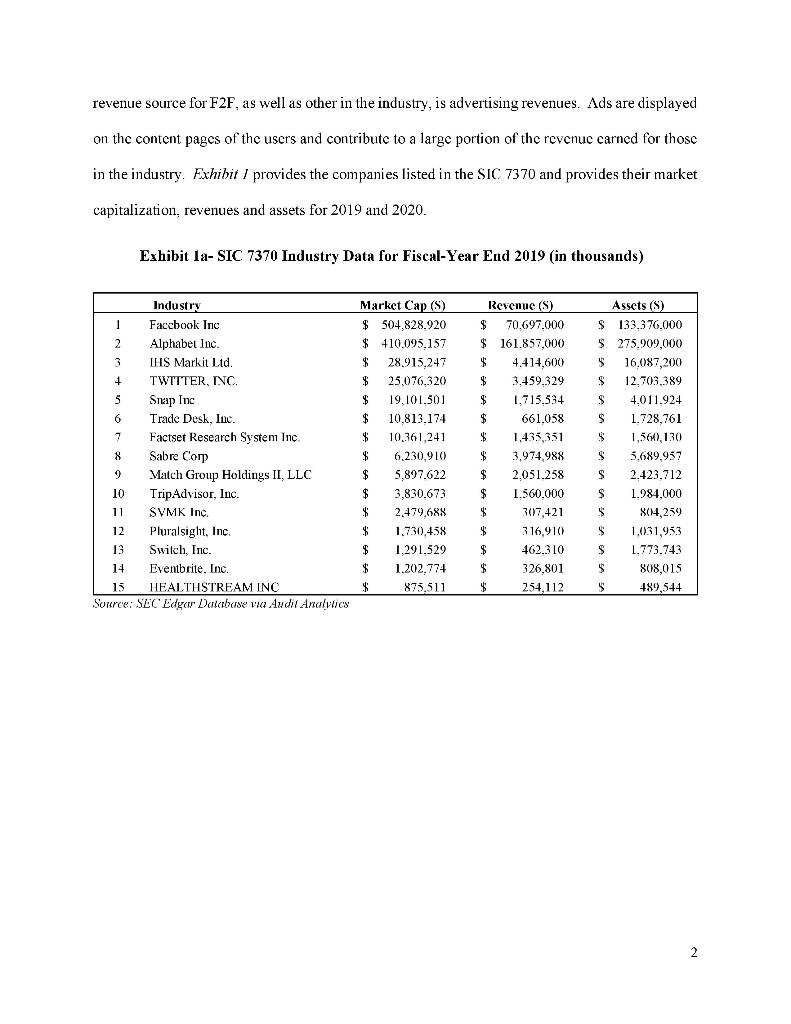

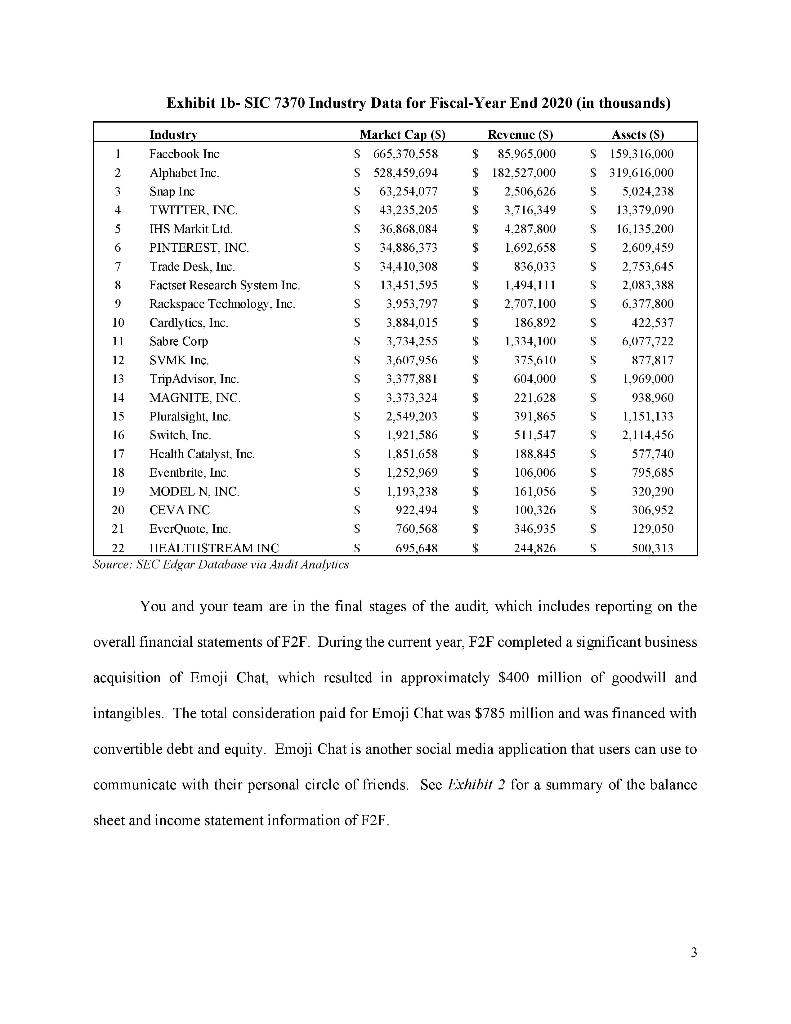

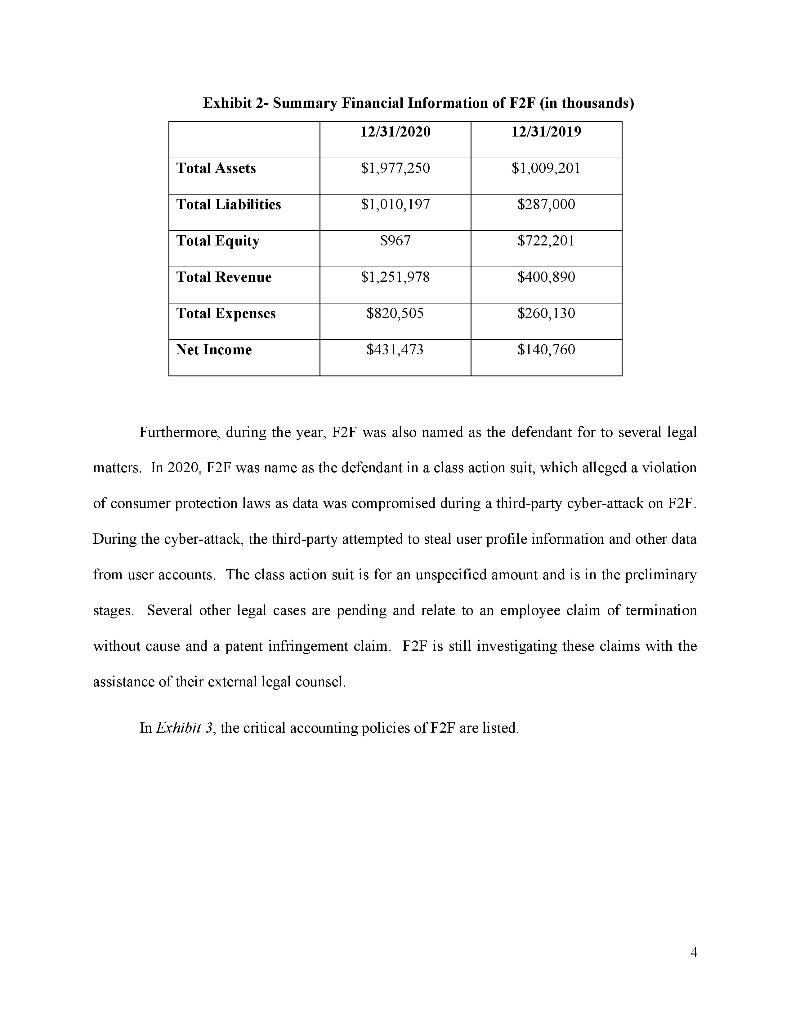

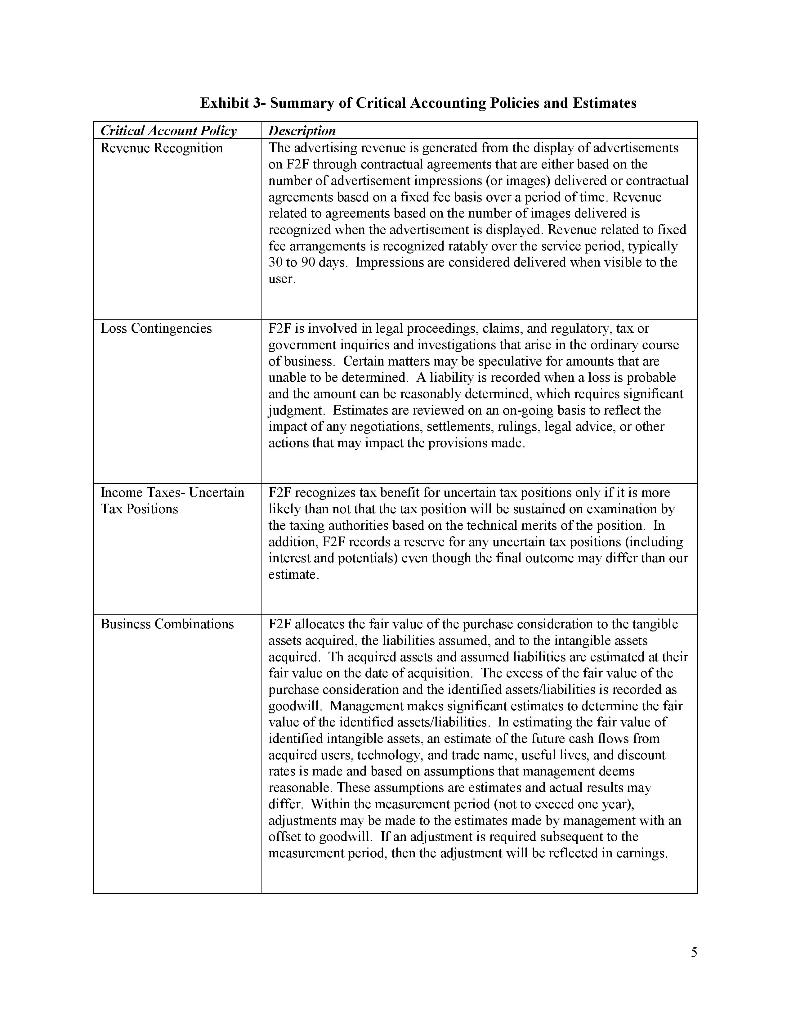

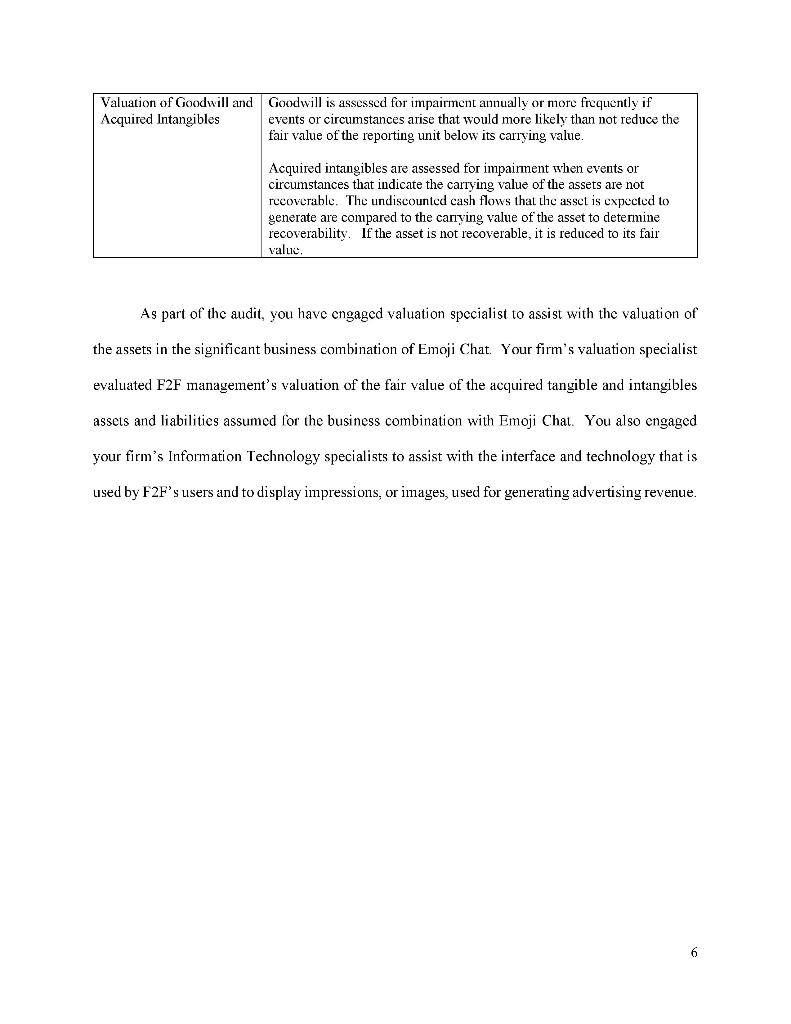

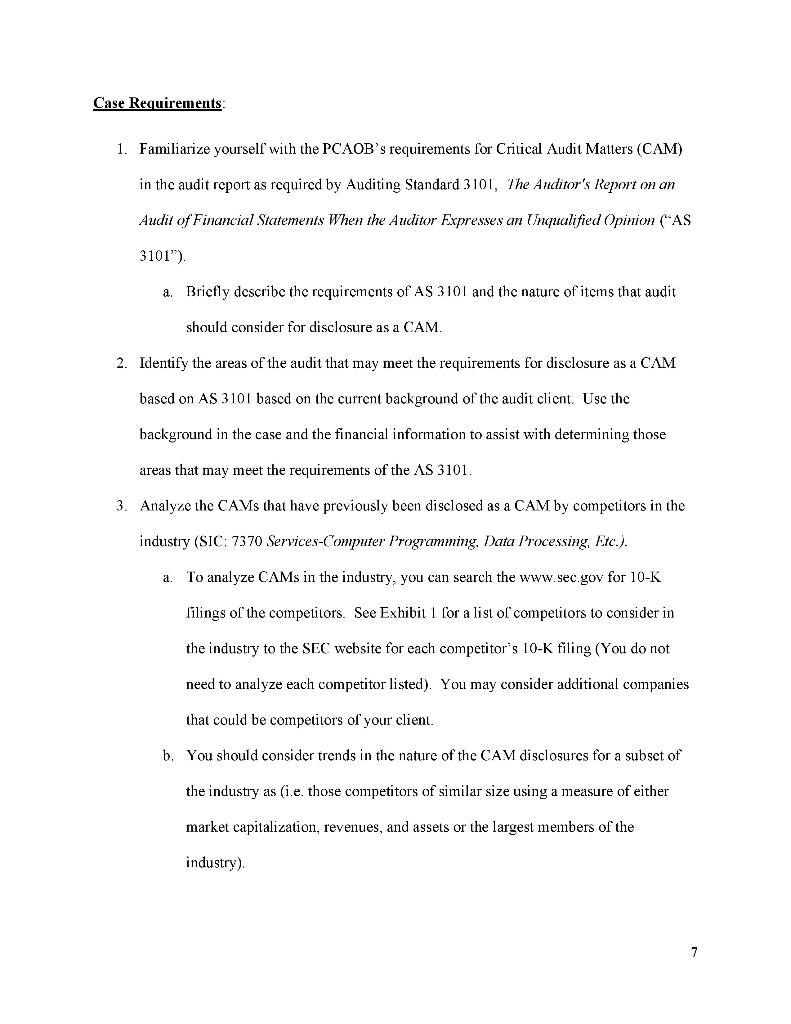

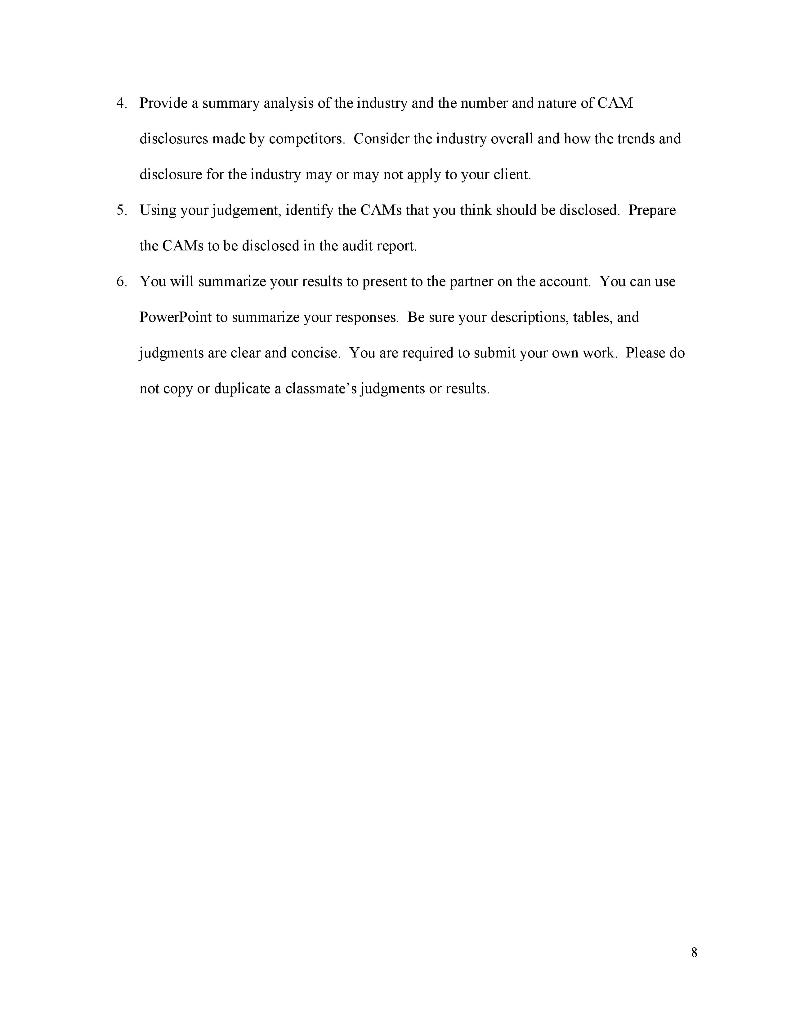

Background You are an audit manager for the public accounting firm, Audit Firm LLP. You have been assigned to your firm's new audit client, Friend2Friend, Inc. (F2F)! Audit Firm LLP has been engaged to perform an integrated audit for F2F for the year-ended December 31, 2020. F2F is a public company that provides a platform for users to connect and share information with friends across the globe. Its market capitalization is approximately $12.6 billion. F2F started its business six years ago and has grown its user base exponentially since its first year in operations and also went public two years ago. F2F has developed its own proprietary software to deliver its platform to its users. F2F allows for users to create friendship circles" or groups that can connect and share personal updates, photographs, and other information. Users can create various circles" within their contact listing and share information with their individual "circles of friends or contacts for a more personalized experience. Currently, F2F operates in the Services Computer Programming, Data Processing, Etc., or Standard Industry Classification (SIC) 7370 of the Securities and Exchange Commission (SEC). Its competitors primarily are those companies included SIC 7370 industry classification. The industry is heavily reliant on innovation, technology, and acquiring users. Technology disruptions and loss of users could negatively impact the business of those in the industry. The primary FriendFriend is a fictious company. The financial information and any related background of FriendFriend, Inc. were developed for illustrative purposes only. 1 revenue source for F2F, as well as other in the industry, is advertising revenues. Ads are displayed on the content pages of the users and contribute to a large portion of the revenuc carned for those in the industry. Exhibit / provides the companies listed in the SIC 7370 and provides their market capitalization, revenues and assets for 2019 and 2020. Exhibit la- SIC 7370 Industry Data for Fiscal Year End 2019 (in thousands) + Industry 1 Facebook Inc 2 Alphabet Inc. 3 IHS Markit Ltd. TWITTER, INC. 5 Snap Inc 6 Trade Desk, Inc. 7 Factset Research System Inc. 8 Sabre Corp 9 Match Group Holdings II, LLC 10 TripAdvisor, Inc. 11 SVMK Inc. 12 Pluralsight, Inc 13 Switch, Inc. 14 Eventbrite, Inc. 15 HEALTHSTREAM INC Source: SZC'Edgar Database wa Audit Analytics Market Cap (S) $ 504,828.920 $ 410,095.157 $ 28.915,247 $ 25.076,320 $ 19,101.501 $ 10,813.174 . $ 10.361,241 $ 6,230,910 $ 5,897.622 $ 3,830.673 $ 2.479,688 $ 1.730,458 $ 1.291.529 $ 1.202.774 $ 875,511 Revenue (S) $ 70.697.000 $ 161,857,000 $ 4.414,600 $ 3,459,329 $ 1.715,534 $ 661,058 $ 1.435,351 $ 3,974,988 $ 2.051.258 $ 1.560,000 $ 307,421 $ 316,91(1) $ 462.310 $ 326,801 $ 254.112 Assets (S) $ 133,376,000 S 275.909,000 $ 16,087,200 $ 12,703,389 $ 4.011.924 $ 1.728,761 S 1,564), 130 S 5,689,957 $ 2.423.712 S 1.984,000 $ 8614,259 S 1,031,953 S 1.773.743 5 808.015 S 489.544 2 Exhibit lb-SIC 7370 Industry Data for Fiscal Year End 2020 (in thousands) Industry Market Cap (S) 1 Facebook Inc S 665.370,558 2 Alphabet Inc. S528.459,694 3 Snap Inc S 63.254,077 4 TWITTER, INC. S 43.235,205 5 IHS Markit Ltd. S 36.868.084 6 PINTEREST. INC. S 34.886,373 7 Trade Desk, Inc. S 34.410,308 8 Factset Rescarch System Inc. S 13,451,595 9 Rackspace Technology, Inc. S 3.953.797 10 Cardlytics, Inc. S 3.884,015 11 Sabre Corp S 3,734,255 12 SVMK Inc. S 3,607,956 13 TripAdvisor, Inc. S 3.377,881 14 MAGNITE, INC. S 3.373,324 15 Pluralsight, Inc. S 2,549,203 16 Switch, Inc. S 1.921.586 17 Health Catalyst, Inc. S 1.851.658 18 Eventbrite, Inc. S 1.252.969 19 MODEL N. INC. S 1,193.238 20 CEVA INC S 922,494 21 EverQuote, Inc. S 760.568 22 TIEALTISTREAM INC S 695.648 Source: SZC Edgar Database via Audit Analytics Revenue (S) $ 85.965,000 $ 182.527.000 $ 2.506,626 $ 3.716.349 $ 4.287.800 $ 1.692.658 $ 836,033 $ 1,494,111 $ 2.707.100 $ 186,892 $ 1,334,100 $ 375,610 $ 604.000 $ 221.628 $ 391,865 $ 511.547 $ 188.845 $ 106.006 $ 161,056 $ 100,326 $ 346.935 $ 244,826 Assets (S) S 159.316,000 S 319.616,000 S 5.024,238 S 13,379.090 S 16.135.200 S 2.609.459 S 2.753,645 S 2,083,388 S 6.377.800 S 422.537 S 6,0877,722 S 877,817 S 1.969.000 S 938,960 S 1,151,133 S 2.114.456 S 577.740 S 795,685 S 320,290 S 306,952 S 129,050 S 500),313 You and your team are in the final stages of the audit, which includes reporting on the overall financial statements of F2F. During the current year. F2F completed a significant business acquisition of Emoji Chat, which resulted in approximately $400 million of goodwill and intangibles. The total consideration paid for Emoji Chat was $785 million and was financed with convertible debt and equity. Emoji Chat is another social media application that users can use to communicate with their personal circle of friends. See Exhibit 2 for a summary of the balance sheet and income statement information of F2F. 3 Exhibit 2- Summary Financial Information of F2F (in thousands) 12/31/2020 12/31/2019 Total Assets $1,977,250 $1,009,201 Total Liabilities $1,010,197 $287,000 Total Equity S967 $722,201 Total Revenue $1,251,978 $400,890 Total Expenses $820,505 $260,130 Net Income $431,473 $140,760 Furthermore, during the year, F2F was also named as the defendant for to several legal matters. In 2020, F2F was name as the defendant in a class action suit, which alleged a violation of consumer protection laws as data was compromised during a third-party cyber-attack on F2F. During the cyber-attack, the third-party attempted to steal user profile information and other data from user accounts. The class action suit is for an unspecified amount and is in the preliminary stages. Several other legal cases are pending and relate to an employee claim of termination without cause and a patent infringement claim. F2F is still investigating these claims with the assistance of their external legal counsel. In Exhibit 3, the critical accounting policies of F2F are listed. 4 Exhibit 3- Summary of Critical Accounting Policies and Estimates Critical Account Policy Description Revenue Recognition The advertising revenue is generated from the display of advertisements on F2F through contractual agreements that are either based on the number of advertisement impressions (or images) delivered or contractual agreements based on a fixed foc basis over a period of time. Revenuc related to agreements based on the number of images delivered is recognized when the advertisement is displayed. Revenue related to fixed fee arrangements is recognized ratably over the service period, typically 30 to 90 days. Impressions are considered delivered when visible to the user Loss Contingencies F2F is involved in legal proceedings. claims, and regulatory, tax or government inquirics and investigations that arise in the ordinary course of business. Certain matters may be speculative for amounts that are unable to be determined. A liability is recorded when a loss is probable and the amount can be reasonably determined, which requires significant judgment. Estimates are reviewed on an on-going basis to reflect the impact of any negotiations, settlements, rulings, legal advice, or other actions that may impact the provisions made. Income Taxes- Uncertain Tax Positions F2F recognizes tax benefit for uncertain tax positions only if it is more likely than not that the lax position will be sustained on examination by the taxing authorities based on the technical merits of the position. In addition, F2F records a rescive for any uncertain tax positions (including interest and potenlials) cven though the final outcome unay differ than our estimate. Business Combinations F2F allocates the fair valuc of the purchase consideration to the tangible assets acquired, the liabilities assumed, and to the intangible assets acquired. Th acquired assets and assumed liabilities are estimated at their fair valuc on the date of acquisition. The excess of the fair valuc of the purchase consideration and the identified assets:liabilities is recorded as goodwill. Management makes significant estimates to determine the fair value of the identificd assets/liabilities. In estimating the fair value of identified intangible assets, an estimate of the future cash flows from acquired users, technology, and trade name, useful lives, and discount rates is made and based on assumptions that management deems reasonable. These assumptions are estimates and actual results may differ. Within the masurement period (not to exceed one year), adjustments may be made to the estimates made by management with an offset to goodwill. If an adjustinent is required subsequent to the mcasurement period, then the adjustment will be reflected in carnings. Valuation of Goodwill and Goodwill is assessed for impairment annually or more frequently if Acquired Intangibles events or circumstances arise that would more likely than not reduce the fair value of the reporting unit below its carrying value. Acquired intangibles are assessed for impairment when events or circumstances that indicate the carrying value of the assets are not recoverablc. The undiscounted cash flows that the asset is expected to generate are compared to the canying value of the asset to determine recoverability. If the asset is not recoverable, it is reduced to its fair value. As part of the audit, you have engaged valuation specialist to assist with the valuation of the assets in the significant business combination of Emoji Chat. Your firm's valuation specialist evaluated F2F management's valuation of the fair value of the acquired tangible and intangibles assets and liabilities assumed for the business combination with Emoji Chat. You also engaged your firm's Information Technology specialists to assist with the interface and technology that is used by F2F's users and to display impressions, or images, used for generating advertising revenue. 6 Case Requirements 1. Familiarize yourself with the PCAOB's requirements for Critical Audit Matters (CAM) in the audit report as required by Auditing Standard 3101, The Auditor's Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion ("AS 3101"). a. Brictly describe the requirements of AS 3101 and the nature of items that audit should consider for disclosure as a CAM. 2. Identify the areas of the audit that may meet the requirements for disclosure as a CAM based on AS 3101 based on the current background of the audit client. Use the background in the case and the financial information to assist with determining those areas that may meet the requirements of the AS 3101. 3. Analyze the CAMs that have previously been disclosed as a CAM by competitors in the industry (SIC: 7370 Services-Computer Programming, Data Processing, Etc.). a To analyze CAMs in the industry, you can search the www.sec.gov for 10-K lilings of the competitors. See Exhibit 1 for a list of competitors to consider in the industry to the SEC website for each competitor's 10-K filing (You do not need to analyze each competitor listed). You may consider additional companies that could be competitors of your client. b. You should consider trends in the nature of the CAM disclosures for a subset of the industry as (.e. those competitors of similar size using a measure of either market capitalization, revenues, and assets or the largest members of the industry) 7 4. Provide a summary analysis of the industry and the number and nature of CAM disclosures made by competitors. Consider the industry overall and how the trends and disclosure for the industry may or may not apply to your client. 5. Using your judgement, identify the CAMs that you think should be disclosed. Prepare the CAMs to be disclosed in the audit report. 6. You will summarize your results to present to the partner on the account. You can use PowerPoint to summarize your responses. Be sure your descriptions, tables, and judgments are clear and concise. You are required to submit your own work. Please do not copy or duplicate a classmate's judgments or results. 8 Background You are an audit manager for the public accounting firm, Audit Firm LLP. You have been assigned to your firm's new audit client, Friend2Friend, Inc. (F2F)! Audit Firm LLP has been engaged to perform an integrated audit for F2F for the year-ended December 31, 2020. F2F is a public company that provides a platform for users to connect and share information with friends across the globe. Its market capitalization is approximately $12.6 billion. F2F started its business six years ago and has grown its user base exponentially since its first year in operations and also went public two years ago. F2F has developed its own proprietary software to deliver its platform to its users. F2F allows for users to create friendship circles" or groups that can connect and share personal updates, photographs, and other information. Users can create various circles" within their contact listing and share information with their individual "circles of friends or contacts for a more personalized experience. Currently, F2F operates in the Services Computer Programming, Data Processing, Etc., or Standard Industry Classification (SIC) 7370 of the Securities and Exchange Commission (SEC). Its competitors primarily are those companies included SIC 7370 industry classification. The industry is heavily reliant on innovation, technology, and acquiring users. Technology disruptions and loss of users could negatively impact the business of those in the industry. The primary FriendFriend is a fictious company. The financial information and any related background of FriendFriend, Inc. were developed for illustrative purposes only. 1 revenue source for F2F, as well as other in the industry, is advertising revenues. Ads are displayed on the content pages of the users and contribute to a large portion of the revenuc carned for those in the industry. Exhibit / provides the companies listed in the SIC 7370 and provides their market capitalization, revenues and assets for 2019 and 2020. Exhibit la- SIC 7370 Industry Data for Fiscal Year End 2019 (in thousands) + Industry 1 Facebook Inc 2 Alphabet Inc. 3 IHS Markit Ltd. TWITTER, INC. 5 Snap Inc 6 Trade Desk, Inc. 7 Factset Research System Inc. 8 Sabre Corp 9 Match Group Holdings II, LLC 10 TripAdvisor, Inc. 11 SVMK Inc. 12 Pluralsight, Inc 13 Switch, Inc. 14 Eventbrite, Inc. 15 HEALTHSTREAM INC Source: SZC'Edgar Database wa Audit Analytics Market Cap (S) $ 504,828.920 $ 410,095.157 $ 28.915,247 $ 25.076,320 $ 19,101.501 $ 10,813.174 . $ 10.361,241 $ 6,230,910 $ 5,897.622 $ 3,830.673 $ 2.479,688 $ 1.730,458 $ 1.291.529 $ 1.202.774 $ 875,511 Revenue (S) $ 70.697.000 $ 161,857,000 $ 4.414,600 $ 3,459,329 $ 1.715,534 $ 661,058 $ 1.435,351 $ 3,974,988 $ 2.051.258 $ 1.560,000 $ 307,421 $ 316,91(1) $ 462.310 $ 326,801 $ 254.112 Assets (S) $ 133,376,000 S 275.909,000 $ 16,087,200 $ 12,703,389 $ 4.011.924 $ 1.728,761 S 1,564), 130 S 5,689,957 $ 2.423.712 S 1.984,000 $ 8614,259 S 1,031,953 S 1.773.743 5 808.015 S 489.544 2 Exhibit lb-SIC 7370 Industry Data for Fiscal Year End 2020 (in thousands) Industry Market Cap (S) 1 Facebook Inc S 665.370,558 2 Alphabet Inc. S528.459,694 3 Snap Inc S 63.254,077 4 TWITTER, INC. S 43.235,205 5 IHS Markit Ltd. S 36.868.084 6 PINTEREST. INC. S 34.886,373 7 Trade Desk, Inc. S 34.410,308 8 Factset Rescarch System Inc. S 13,451,595 9 Rackspace Technology, Inc. S 3.953.797 10 Cardlytics, Inc. S 3.884,015 11 Sabre Corp S 3,734,255 12 SVMK Inc. S 3,607,956 13 TripAdvisor, Inc. S 3.377,881 14 MAGNITE, INC. S 3.373,324 15 Pluralsight, Inc. S 2,549,203 16 Switch, Inc. S 1.921.586 17 Health Catalyst, Inc. S 1.851.658 18 Eventbrite, Inc. S 1.252.969 19 MODEL N. INC. S 1,193.238 20 CEVA INC S 922,494 21 EverQuote, Inc. S 760.568 22 TIEALTISTREAM INC S 695.648 Source: SZC Edgar Database via Audit Analytics Revenue (S) $ 85.965,000 $ 182.527.000 $ 2.506,626 $ 3.716.349 $ 4.287.800 $ 1.692.658 $ 836,033 $ 1,494,111 $ 2.707.100 $ 186,892 $ 1,334,100 $ 375,610 $ 604.000 $ 221.628 $ 391,865 $ 511.547 $ 188.845 $ 106.006 $ 161,056 $ 100,326 $ 346.935 $ 244,826 Assets (S) S 159.316,000 S 319.616,000 S 5.024,238 S 13,379.090 S 16.135.200 S 2.609.459 S 2.753,645 S 2,083,388 S 6.377.800 S 422.537 S 6,0877,722 S 877,817 S 1.969.000 S 938,960 S 1,151,133 S 2.114.456 S 577.740 S 795,685 S 320,290 S 306,952 S 129,050 S 500),313 You and your team are in the final stages of the audit, which includes reporting on the overall financial statements of F2F. During the current year. F2F completed a significant business acquisition of Emoji Chat, which resulted in approximately $400 million of goodwill and intangibles. The total consideration paid for Emoji Chat was $785 million and was financed with convertible debt and equity. Emoji Chat is another social media application that users can use to communicate with their personal circle of friends. See Exhibit 2 for a summary of the balance sheet and income statement information of F2F. 3 Exhibit 2- Summary Financial Information of F2F (in thousands) 12/31/2020 12/31/2019 Total Assets $1,977,250 $1,009,201 Total Liabilities $1,010,197 $287,000 Total Equity S967 $722,201 Total Revenue $1,251,978 $400,890 Total Expenses $820,505 $260,130 Net Income $431,473 $140,760 Furthermore, during the year, F2F was also named as the defendant for to several legal matters. In 2020, F2F was name as the defendant in a class action suit, which alleged a violation of consumer protection laws as data was compromised during a third-party cyber-attack on F2F. During the cyber-attack, the third-party attempted to steal user profile information and other data from user accounts. The class action suit is for an unspecified amount and is in the preliminary stages. Several other legal cases are pending and relate to an employee claim of termination without cause and a patent infringement claim. F2F is still investigating these claims with the assistance of their external legal counsel. In Exhibit 3, the critical accounting policies of F2F are listed. 4 Exhibit 3- Summary of Critical Accounting Policies and Estimates Critical Account Policy Description Revenue Recognition The advertising revenue is generated from the display of advertisements on F2F through contractual agreements that are either based on the number of advertisement impressions (or images) delivered or contractual agreements based on a fixed foc basis over a period of time. Revenuc related to agreements based on the number of images delivered is recognized when the advertisement is displayed. Revenue related to fixed fee arrangements is recognized ratably over the service period, typically 30 to 90 days. Impressions are considered delivered when visible to the user Loss Contingencies F2F is involved in legal proceedings. claims, and regulatory, tax or government inquirics and investigations that arise in the ordinary course of business. Certain matters may be speculative for amounts that are unable to be determined. A liability is recorded when a loss is probable and the amount can be reasonably determined, which requires significant judgment. Estimates are reviewed on an on-going basis to reflect the impact of any negotiations, settlements, rulings, legal advice, or other actions that may impact the provisions made. Income Taxes- Uncertain Tax Positions F2F recognizes tax benefit for uncertain tax positions only if it is more likely than not that the lax position will be sustained on examination by the taxing authorities based on the technical merits of the position. In addition, F2F records a rescive for any uncertain tax positions (including interest and potenlials) cven though the final outcome unay differ than our estimate. Business Combinations F2F allocates the fair valuc of the purchase consideration to the tangible assets acquired, the liabilities assumed, and to the intangible assets acquired. Th acquired assets and assumed liabilities are estimated at their fair valuc on the date of acquisition. The excess of the fair valuc of the purchase consideration and the identified assets:liabilities is recorded as goodwill. Management makes significant estimates to determine the fair value of the identificd assets/liabilities. In estimating the fair value of identified intangible assets, an estimate of the future cash flows from acquired users, technology, and trade name, useful lives, and discount rates is made and based on assumptions that management deems reasonable. These assumptions are estimates and actual results may differ. Within the masurement period (not to exceed one year), adjustments may be made to the estimates made by management with an offset to goodwill. If an adjustinent is required subsequent to the mcasurement period, then the adjustment will be reflected in carnings. Valuation of Goodwill and Goodwill is assessed for impairment annually or more frequently if Acquired Intangibles events or circumstances arise that would more likely than not reduce the fair value of the reporting unit below its carrying value. Acquired intangibles are assessed for impairment when events or circumstances that indicate the carrying value of the assets are not recoverablc. The undiscounted cash flows that the asset is expected to generate are compared to the canying value of the asset to determine recoverability. If the asset is not recoverable, it is reduced to its fair value. As part of the audit, you have engaged valuation specialist to assist with the valuation of the assets in the significant business combination of Emoji Chat. Your firm's valuation specialist evaluated F2F management's valuation of the fair value of the acquired tangible and intangibles assets and liabilities assumed for the business combination with Emoji Chat. You also engaged your firm's Information Technology specialists to assist with the interface and technology that is used by F2F's users and to display impressions, or images, used for generating advertising revenue. 6 Case Requirements 1. Familiarize yourself with the PCAOB's requirements for Critical Audit Matters (CAM) in the audit report as required by Auditing Standard 3101, The Auditor's Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion ("AS 3101"). a. Brictly describe the requirements of AS 3101 and the nature of items that audit should consider for disclosure as a CAM. 2. Identify the areas of the audit that may meet the requirements for disclosure as a CAM based on AS 3101 based on the current background of the audit client. Use the background in the case and the financial information to assist with determining those areas that may meet the requirements of the AS 3101. 3. Analyze the CAMs that have previously been disclosed as a CAM by competitors in the industry (SIC: 7370 Services-Computer Programming, Data Processing, Etc.). a To analyze CAMs in the industry, you can search the www.sec.gov for 10-K lilings of the competitors. See Exhibit 1 for a list of competitors to consider in the industry to the SEC website for each competitor's 10-K filing (You do not need to analyze each competitor listed). You may consider additional companies that could be competitors of your client. b. You should consider trends in the nature of the CAM disclosures for a subset of the industry as (.e. those competitors of similar size using a measure of either market capitalization, revenues, and assets or the largest members of the industry) 7 4. Provide a summary analysis of the industry and the number and nature of CAM disclosures made by competitors. Consider the industry overall and how the trends and disclosure for the industry may or may not apply to your client. 5. Using your judgement, identify the CAMs that you think should be disclosed. Prepare the CAMs to be disclosed in the audit report. 6. You will summarize your results to present to the partner on the account. You can use PowerPoint to summarize your responses. Be sure your descriptions, tables, and judgments are clear and concise. You are required to submit your own work. Please do not copy or duplicate a classmate's judgments or results. 8