Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Badger Digging Company's year-end is August 31. Based on an analysis of the unadjusted trial balance at August 31, 2022, the following information was available

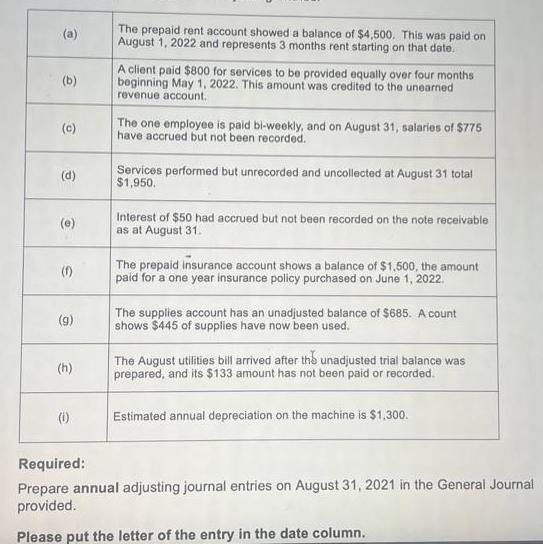

Badger Digging Company's year-end is August 31. Based on an analysis of the unadjusted trial balance at August 31, 2022, the following information was available for the preparation of adjusting entries:

The prepaid rent account showed a balance of $4,500. This was paid on August 1, 2022 and represents 3 months rent starting on that date. (a) A client paid $800 for services to be provided equally over four months beginning May 1, 2022. This amount was credited to the unearned revenue account. (b) The one employee is paid bi-weekly, and on August 31, salaries of $775 have accrued but not been recorded. (c) Services performed but unrecorded and uncollected at August 31 total $1,950. (d) Interest of $50 had accrued but not been recorded on the note receivable (e) as at August 31. The prepaid insurance account shows a balance of $1,500, the amount paid for a one year insurance policy purchased on June 1, 2022. The supplies account has an unadjusted balance of $685. A count shows $445 of supplies have now been used. (g) The August utilities bill arrived after ths unadjusted trial balance was prepared, and its $133 amount has not been paid or recorded. (h) (1) Estimated annual depreciation on the machine is $1,300. Required: Prepare annual adjusting journal entries on August 31, 2021 in the General Journal provided. Please put the letter of the entry in the date column.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry No Particulars Debit Credit 1 prepaid Insurance 4500 To Insurance expense 4500 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started