Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Badlands Inc. Prior to 2024, Badlands Inc. (Badlands) provided all employees with a cellular phone for use in carrying out their employment duties. In

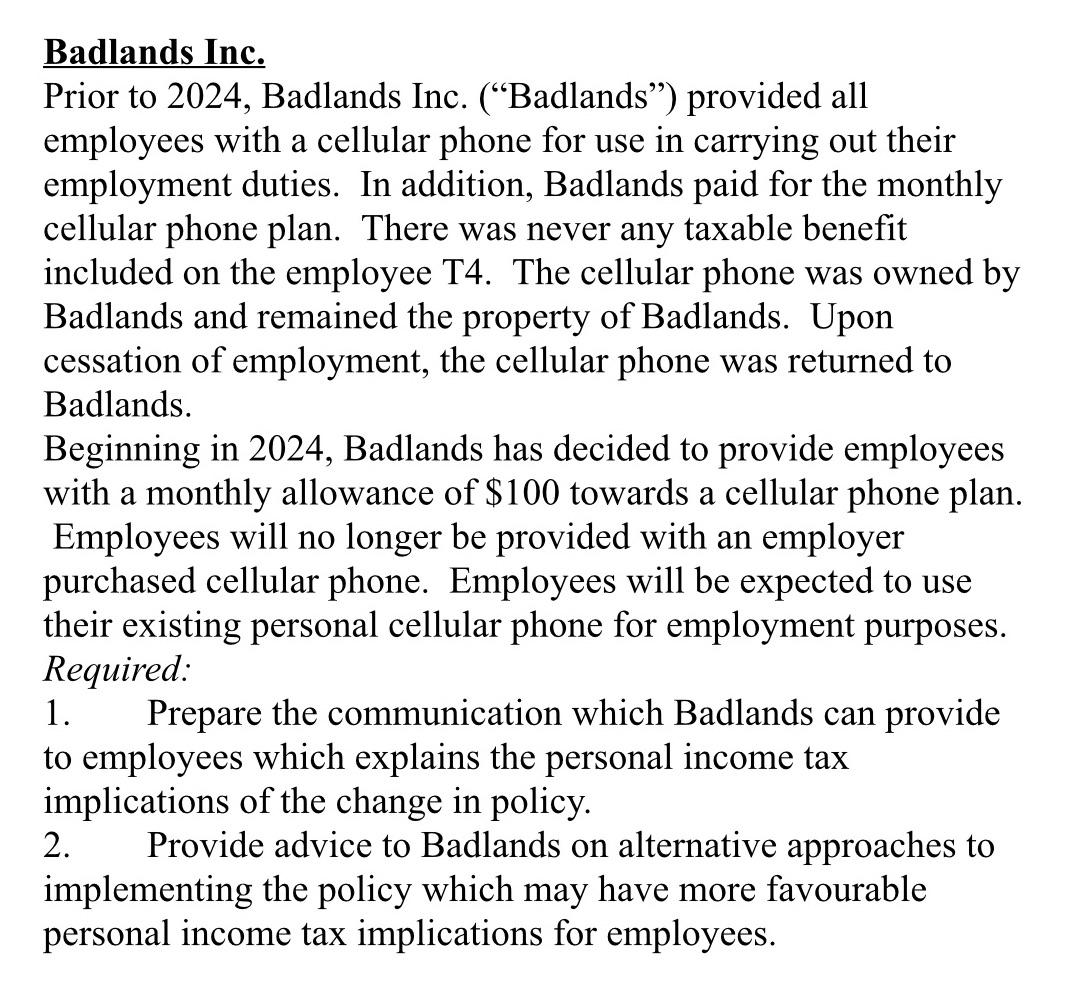

Badlands Inc. Prior to 2024, Badlands Inc. ("Badlands") provided all employees with a cellular phone for use in carrying out their employment duties. In addition, Badlands paid for the monthly cellular phone plan. There was never any taxable benefit included on the employee T4. The cellular phone was owned by Badlands and remained the property of Badlands. Upon cessation of employment, the cellular phone was returned to Badlands. Beginning in 2024, Badlands has decided to provide employees with a monthly allowance of $100 towards a cellular phone plan. Employees will no longer be provided with an employer purchased cellular phone. Employees will be expected to use their existing personal cellular phone for employment purposes. Required: 1. Prepare the communication which Badlands can provide to employees which explains the personal income tax implications of the change in policy. Provide advice to Badlands on alternative approaches to implementing the policy which may have more favourable personal income tax implications for employees. 2.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Badlands Inc Cellular Phone Policy Update Subject Changes to Cellular Phone Policy Dear Employees This communication outlines an update to Badlands Incs cellular phone policy effective Start Date Prev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started