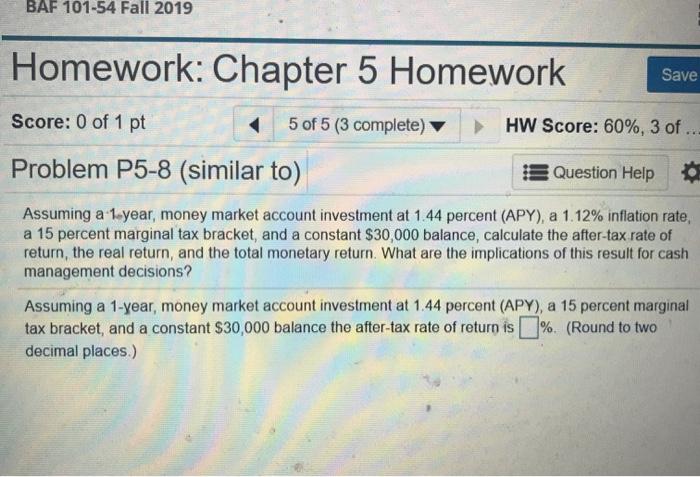

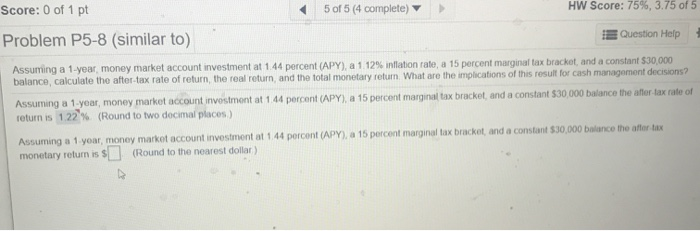

BAF 101-54 Fall 2019 Homework: Chapter 5 Homework Save Score: 0 of 1 pt HW Score: 60%, 3 of .. 5 of 5 (3 complete) Problem P5-8 (similar to) Question Help Assuming a 1eyear, money market account investment at 1.44 percent (APY), a 1.12% inflation rate, a 15 percent marginal tax bracket, and a constant $30,000 balance, calculate the after-tax.rate of return, the real return, and the total monetary return. What are the implications of this result for cash management decisions? Assuming a 1-year, money market account investment at 1.44 percent (APY), a 15 percent marginal %. (Round to two tax bracket, and a constant $30,000 balance the after-tax rate of return is decimal places.) HW Score: 75%, 3.75 of 5 Score: 0 of 1 pt 5 of 5 (4 complete) Question Help Problem P5-8 (similar to) Assuming a 1-year, money market account investment at 1.44 percent (APY), a 1.12 % inflation rate, a 15 percent marginal tax bracket, and a constant $30,000 balance, calculate the after-tax rate of return, the real return, and the total monetary return What are the implications of this result for cash managoment decisions? Assuming a 1-year, money market account investment at 1.44 percent (APY), a 15 percent marginal tax bracket, and a constant $30,000 balance the after lax rate of return is 1.22 % (Round to two decimal places) Assuming a 1 yoar, money market account investment at 1.44 percent (APY), a 15 percent marginal tax bracket, and a constant $30,000 balance the after tax monetary return is $ (Round to the nearest dollar) BAF 101-54 Fall 2019 Homework: Chapter 5 Homework Save Score: 0 of 1 pt HW Score: 60%, 3 of .. 5 of 5 (3 complete) Problem P5-8 (similar to) Question Help Assuming a 1eyear, money market account investment at 1.44 percent (APY), a 1.12% inflation rate, a 15 percent marginal tax bracket, and a constant $30,000 balance, calculate the after-tax.rate of return, the real return, and the total monetary return. What are the implications of this result for cash management decisions? Assuming a 1-year, money market account investment at 1.44 percent (APY), a 15 percent marginal %. (Round to two tax bracket, and a constant $30,000 balance the after-tax rate of return is decimal places.) HW Score: 75%, 3.75 of 5 Score: 0 of 1 pt 5 of 5 (4 complete) Question Help Problem P5-8 (similar to) Assuming a 1-year, money market account investment at 1.44 percent (APY), a 1.12 % inflation rate, a 15 percent marginal tax bracket, and a constant $30,000 balance, calculate the after-tax rate of return, the real return, and the total monetary return What are the implications of this result for cash managoment decisions? Assuming a 1-year, money market account investment at 1.44 percent (APY), a 15 percent marginal tax bracket, and a constant $30,000 balance the after lax rate of return is 1.22 % (Round to two decimal places) Assuming a 1 yoar, money market account investment at 1.44 percent (APY), a 15 percent marginal tax bracket, and a constant $30,000 balance the after tax monetary return is $ (Round to the nearest dollar)