Question

Bags Galore buy and sell a limited range of imitation leather bags. The following information was extracted from their financial records for the year ended

Bags Galore buy and sell a limited range of imitation leather bags. The following information

was extracted from their financial records for the year ended 28 February 2021:

Additional information:

1. Inventory on hand at 28 February 2020 was as follows:

1 109 bags at R175 = R194 075

2. 97 bags at R115 were returned to suppliers and the necessary credit notes were

received. However, this has not yet been recorded.

3. Additional transport costs on purchases of R4 200 were incurred. This was paid by EFT but not yet recorded.

4. Additional import duties of R3 400 must still be recorded and paid.

5. Total sales for the year is as follows;

• 1 March 2020 to 28 February 2021; (Total number of bags sold = 5 300):

Sold 2 100 bags at R165 each; and

Sold 3 200 bags at R175 each.

6. Bags Wholesalers use the periodic inventory system to record their trading stock.

Required:

4.1 Prepare the trading section of the statement of profit or loss and other and other comprehensive income for the year ended 28 February 2021. (10)

4.2 List at least two disadvantages of the Periodic Inventory System. (2)

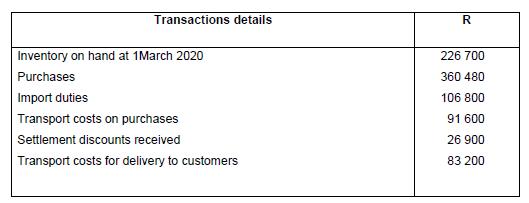

Transactions details Inventory on hand at 1March 2020 Purchases Import duties Transport costs on purchases Settlement discounts received Transport costs for delivery to customers R 226 700 360 480 106 800 91 600 26 900 83 200

Step by Step Solution

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Trading account for the year ending February 28 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started