Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice a non-cash amount to RM290,000. In payment for

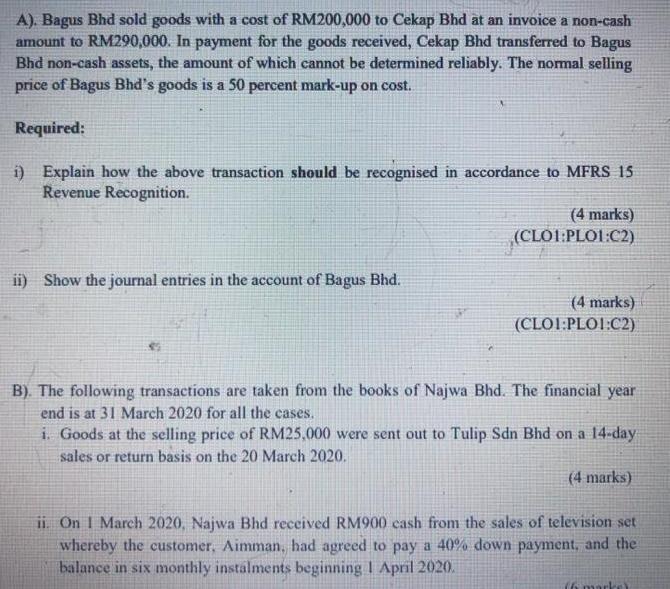

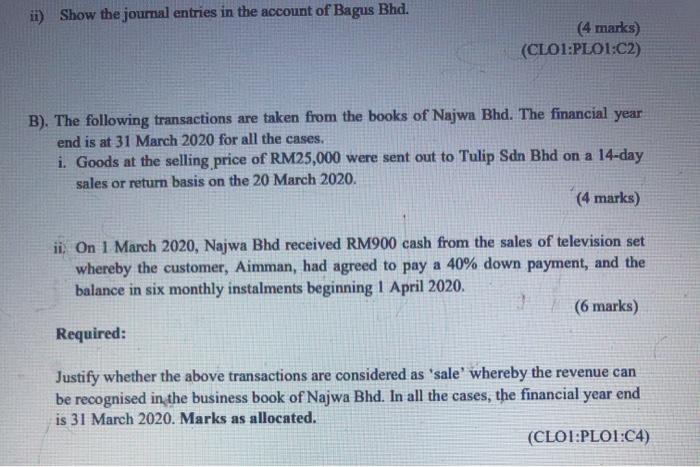

A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice a non-cash amount to RM290,000. In payment for the goods received, Cekap Bhd transferred to Bagus Bhd non-cash assets, the amount of which cannot be determined reliably. The nomal selling price of Bagus Bhd's goods is a 50 percent mark-up on cost. Required: i) Explain how the above transaction should be recognised in accordance to MFRS 15 Revenue Recognition. (4 marks) (CLO1:PLO1:C2) ii) Show the journal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii On I March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning I April 2020. 16 ke) ii) Show the jounal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii. On 1 March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning 1 April 2020. (6 marks) Required: Justify whether the above transactions are considered as 'sale whereby the revenue can be recognised in the business book of Najwa Bhd. In all the cases, the financial year end is 31 March 2020. Marks as allocated. (CLO1:PLO1:C4)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

B 1 Goods sent to Tulip Sdn Bhd on 20 march can be considered as sale interpret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started