Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bagz-bags Corp. issued on March 31, 2032, 400,000 shares of its P12 par value ordinary shares, P40 market value per share, to acquire all

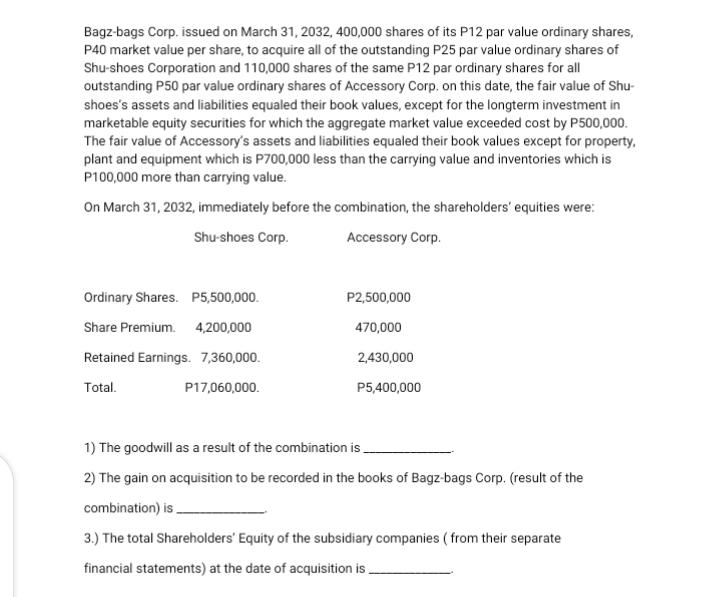

Bagz-bags Corp. issued on March 31, 2032, 400,000 shares of its P12 par value ordinary shares, P40 market value per share, to acquire all of the outstanding P25 par value ordinary shares of Shu-shoes Corporation and 110,000 shares of the same P12 par ordinary shares for all outstanding P50 par value ordinary shares of Accessory Corp. on this date, the fair value of Shu- shoes's assets and liabilities equaled their book values, except for the longterm investment in marketable equity securities for which the aggregate market value exceeded cost by P500,000. The fair value of Accessory's assets and liabilities equaled their book values except for property. plant and equipment which is P700,000 less than the carrying value and inventories which is P100,000 more than carrying value. On March 31, 2032, immediately before the combination, the shareholders' equities were: Shu-shoes Corp. Accessory Corp. Ordinary Shares. P5,500,000. Share Premium. 4,200,000 Retained Earnings. 7,360,000. Total. P17,060,000. P2,500,000 470,000 2,430,000 P5,400,000 1) The goodwill as a result of the combination is 2) The gain on acquisition to be recorded in the books of Bagz-bags Corp. (result of the combination) is_ 3.) The total Shareholders' Equity of the subsidiary companies (from their separate financial statements) at the date of acquisition is

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 The goodwill as a result of the combination ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started