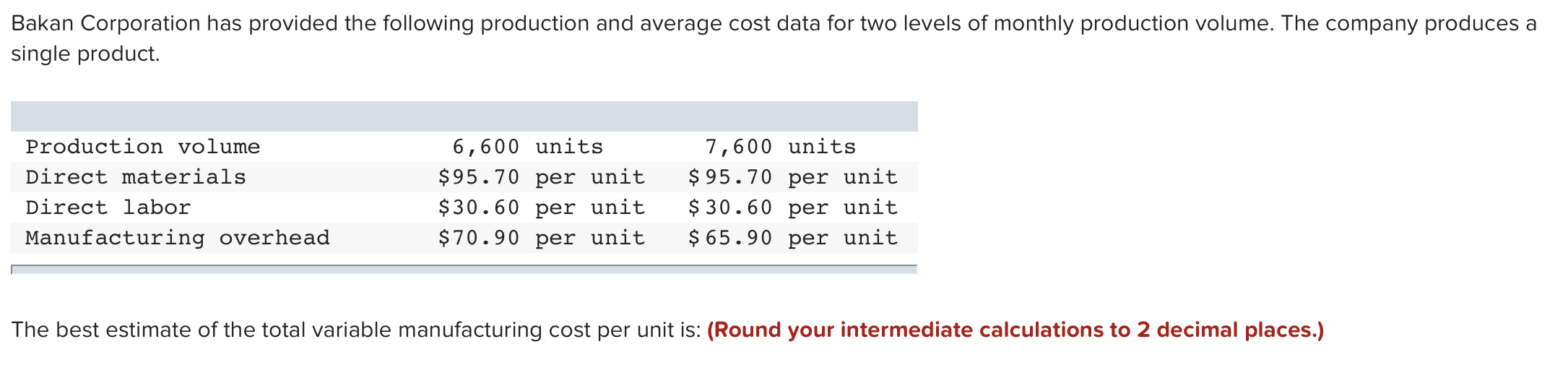

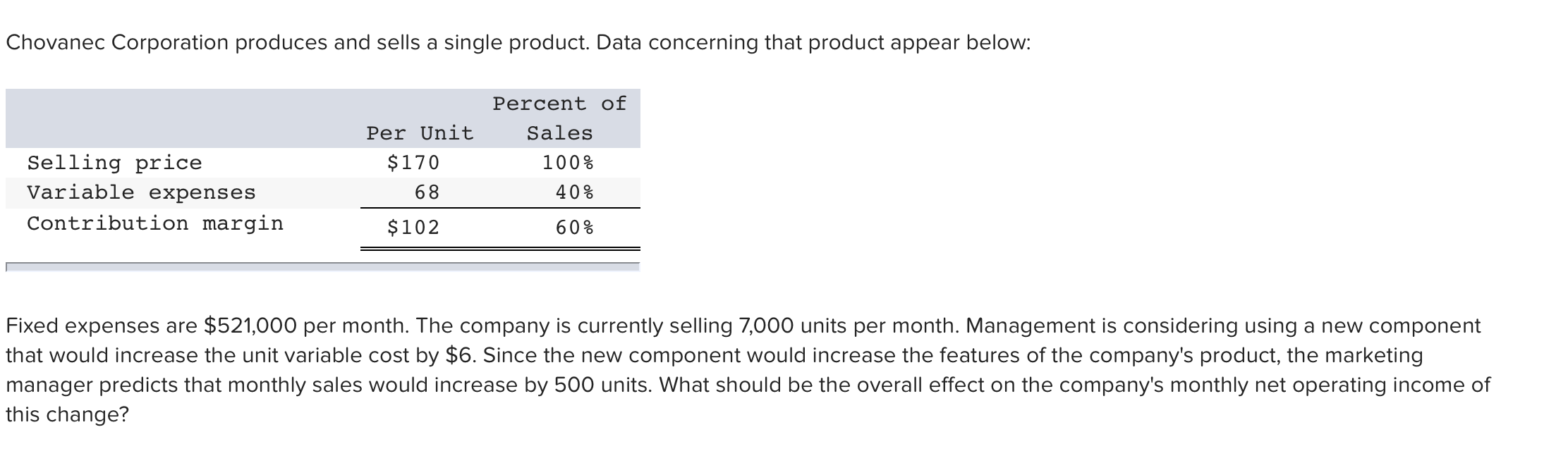

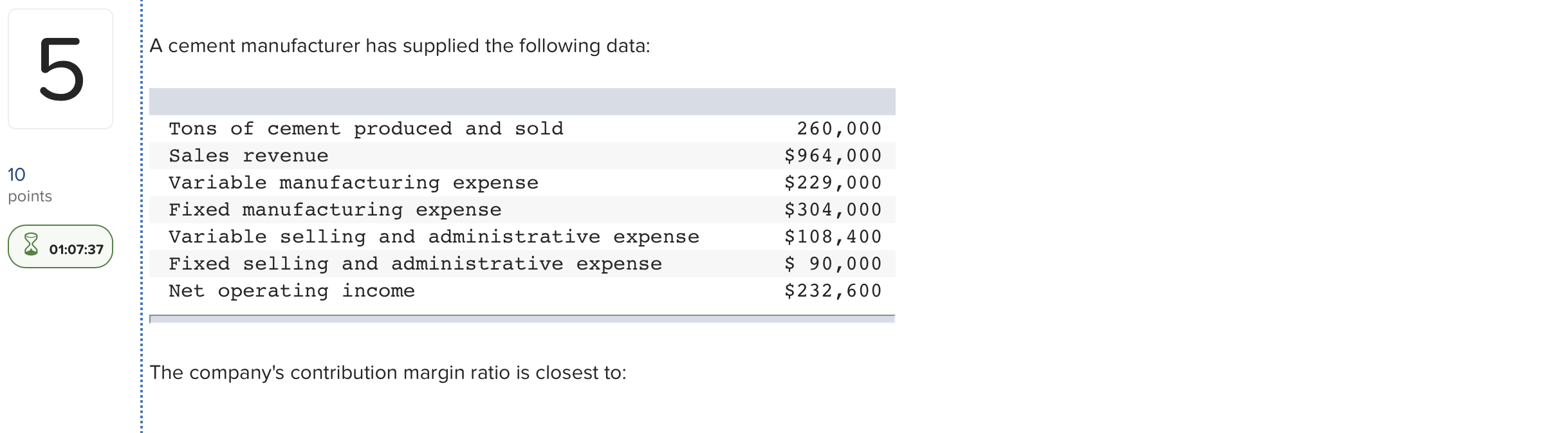

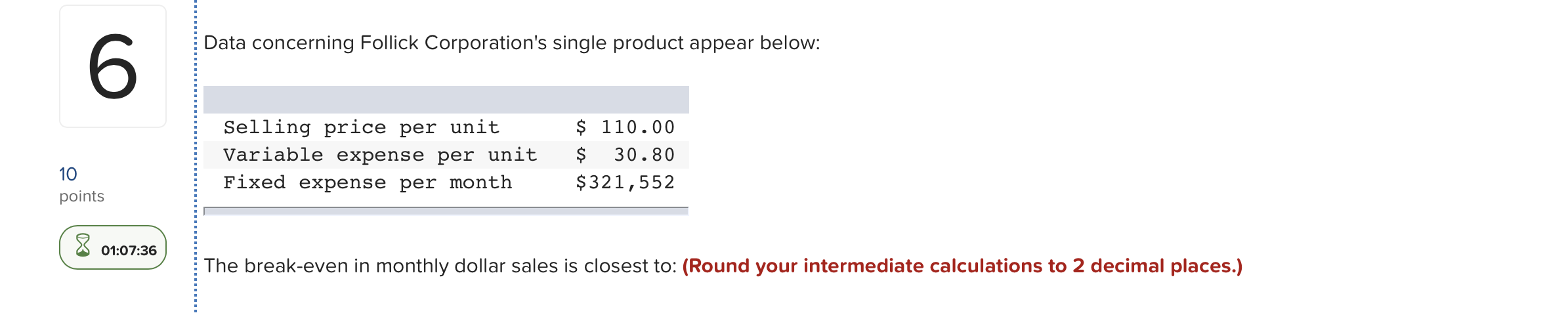

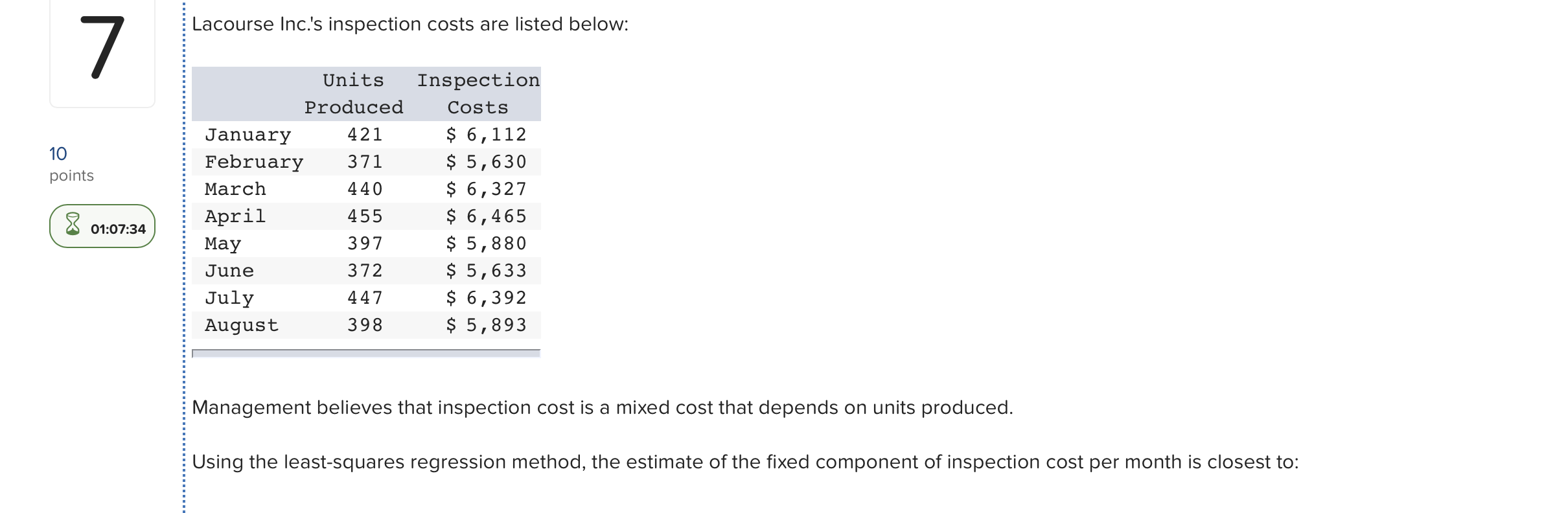

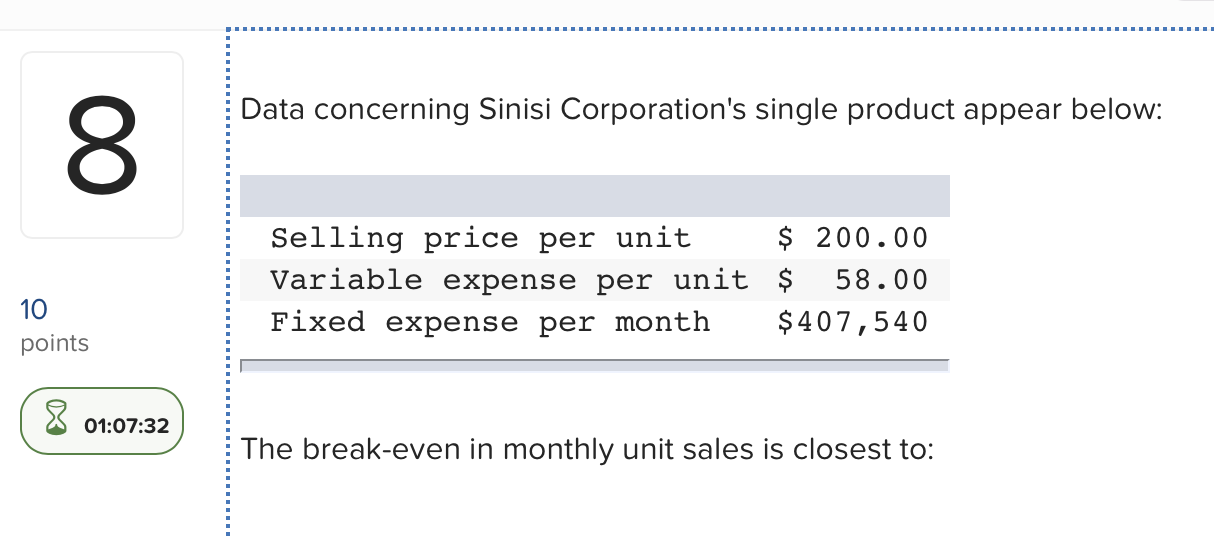

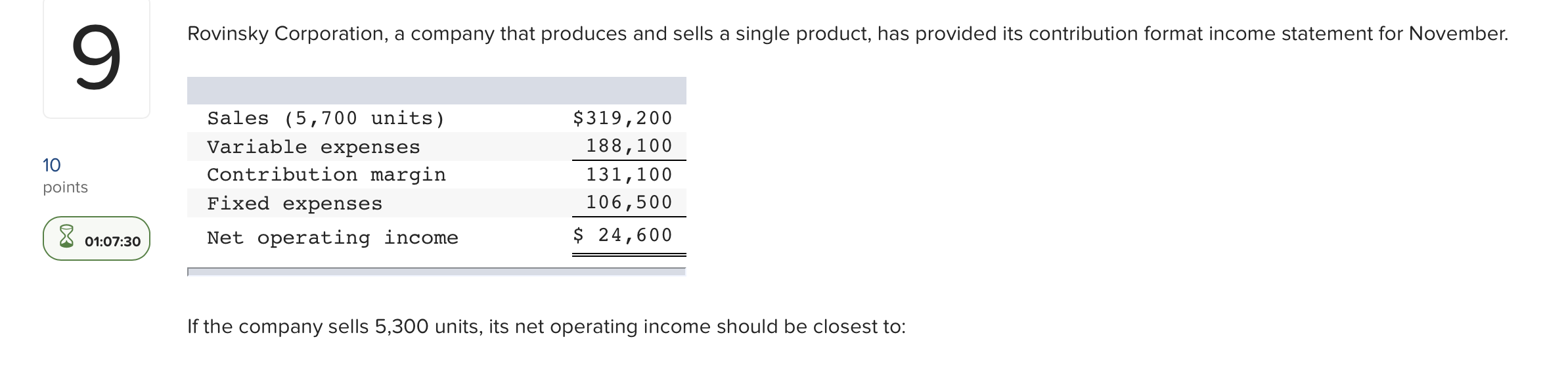

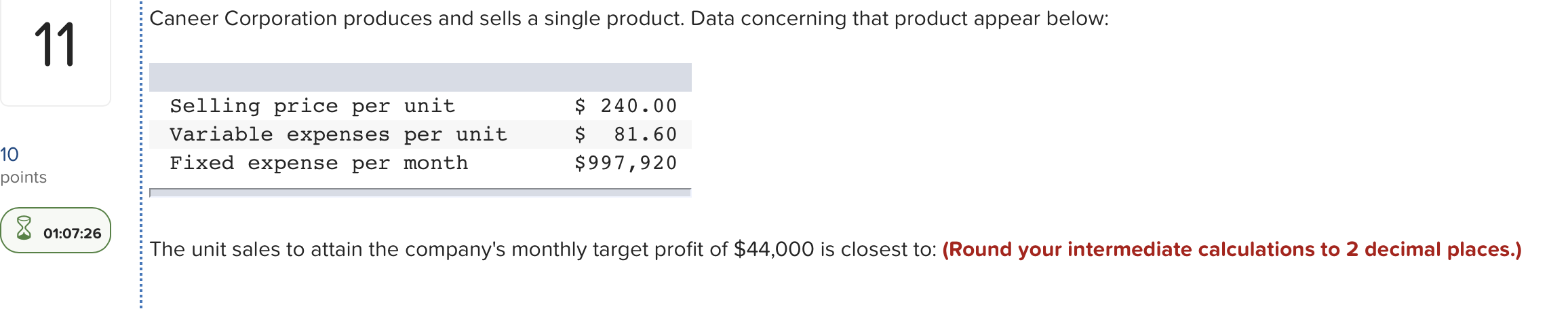

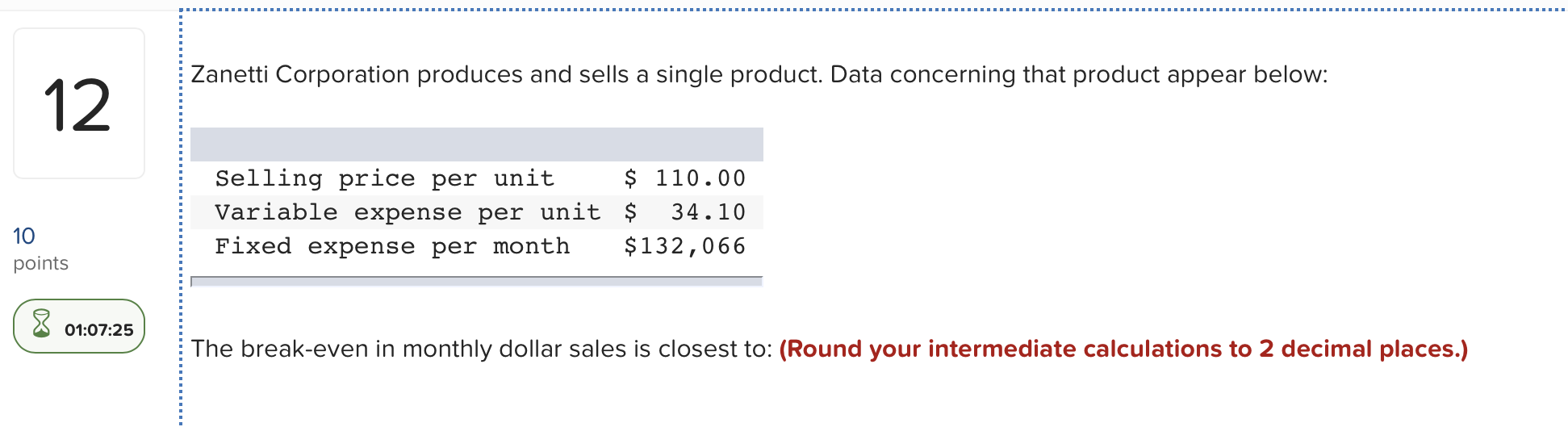

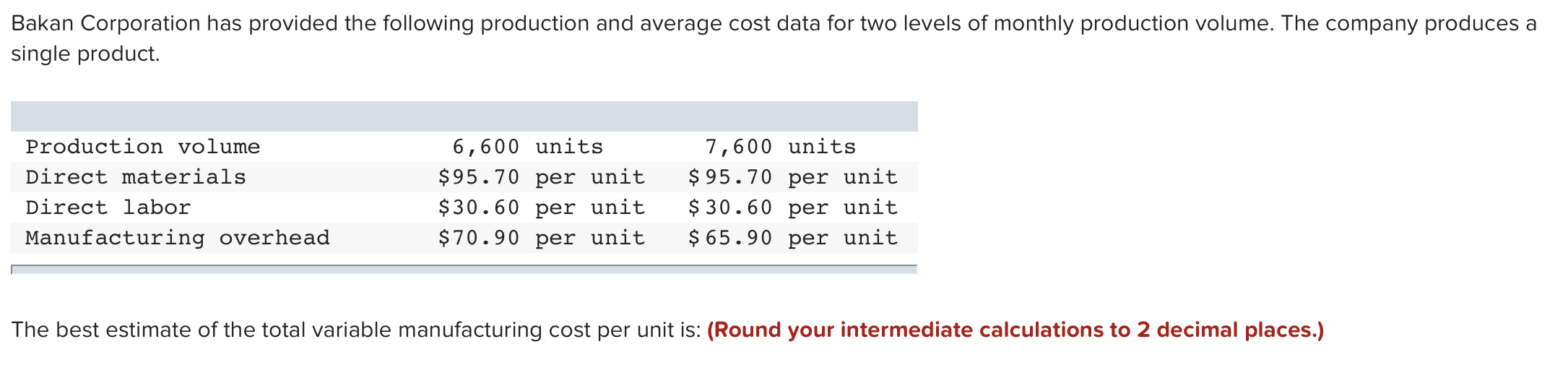

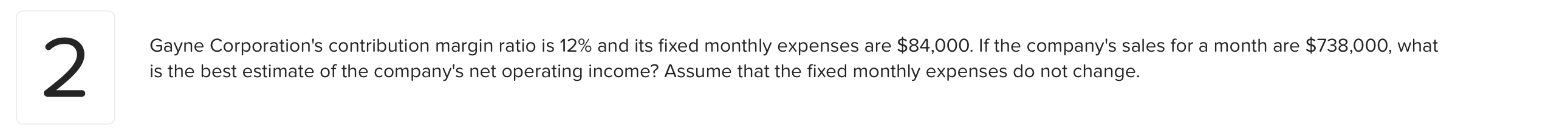

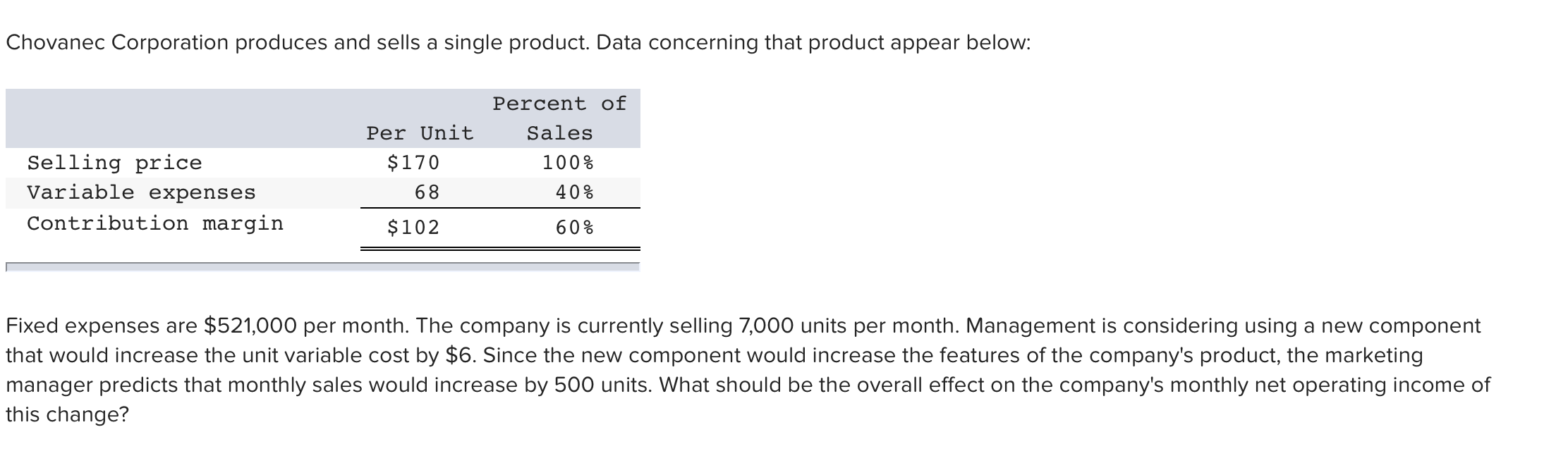

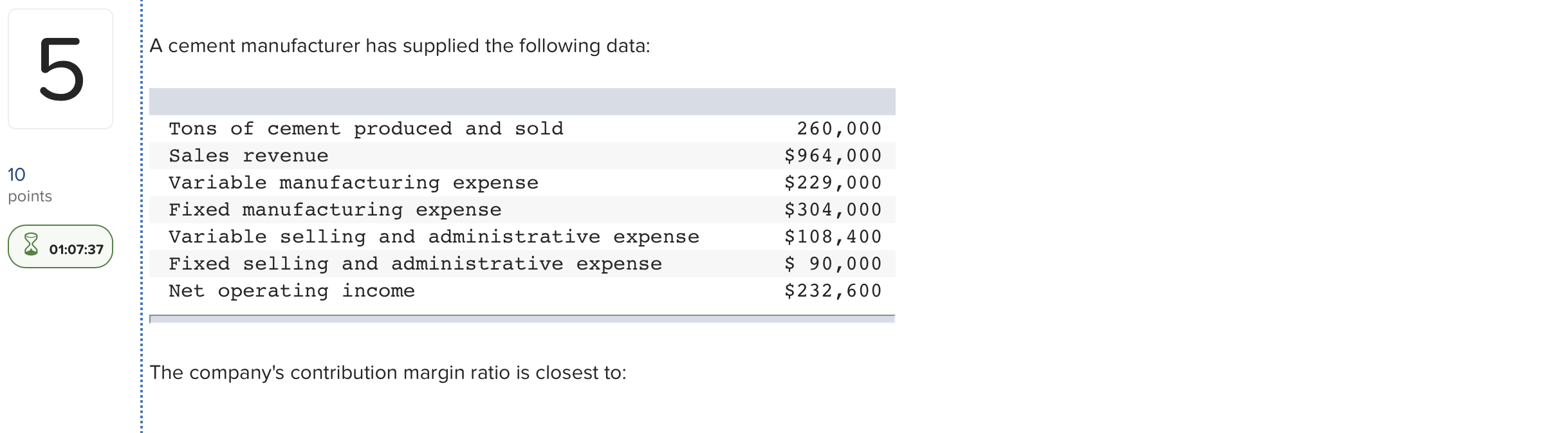

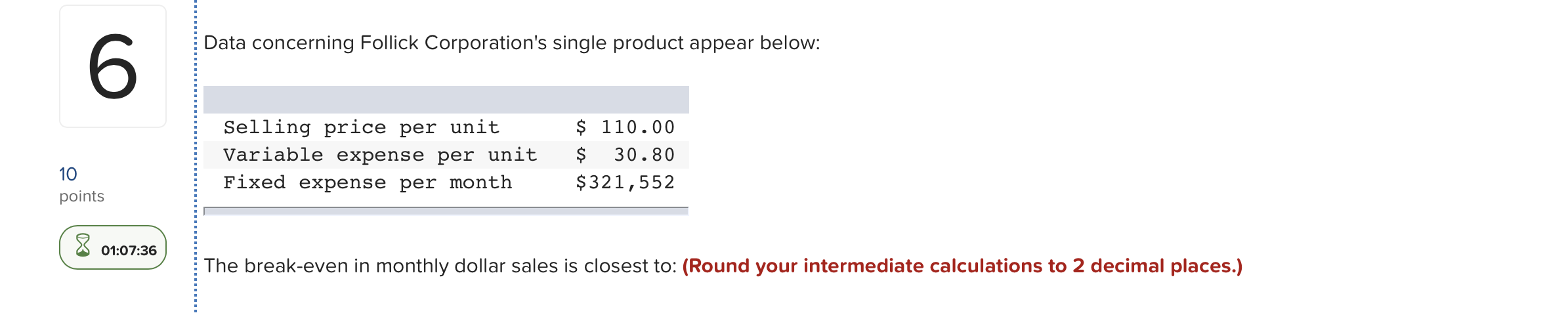

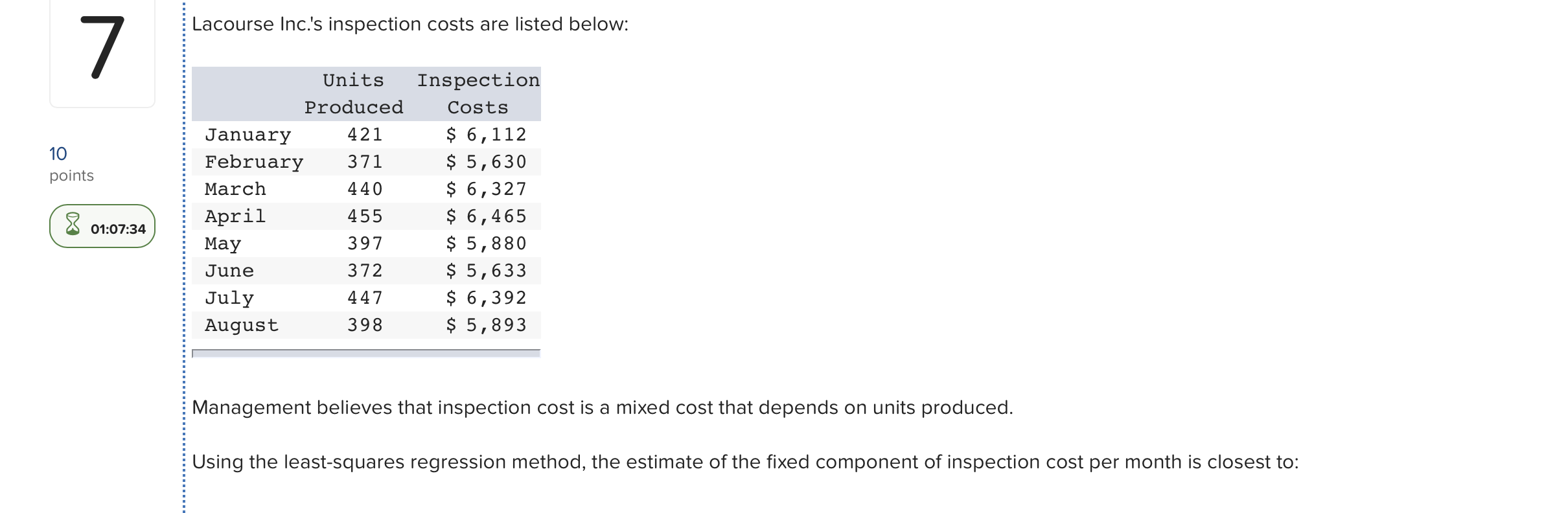

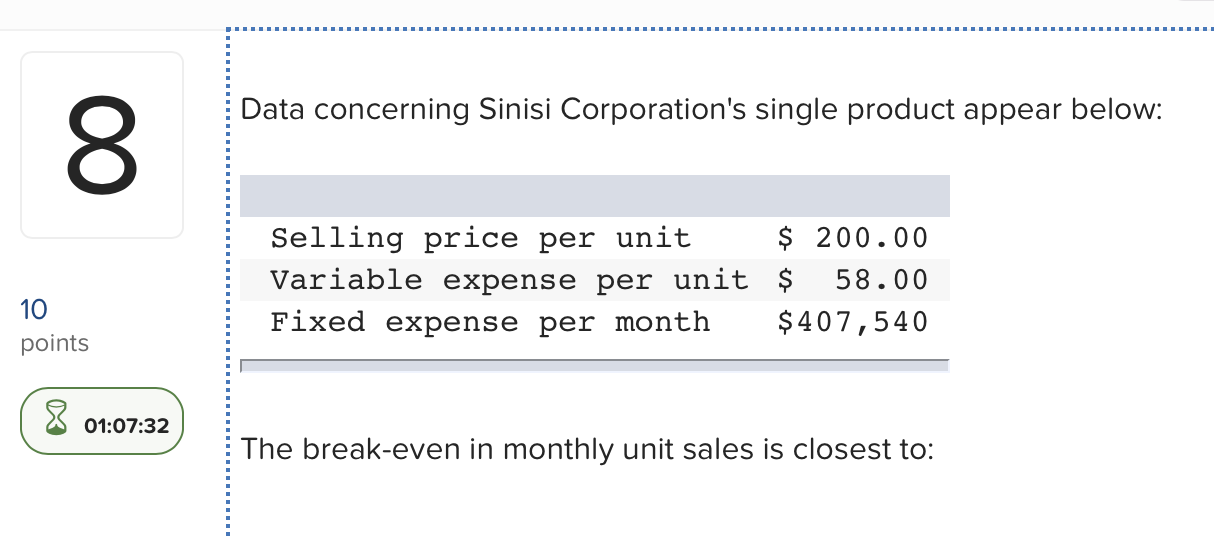

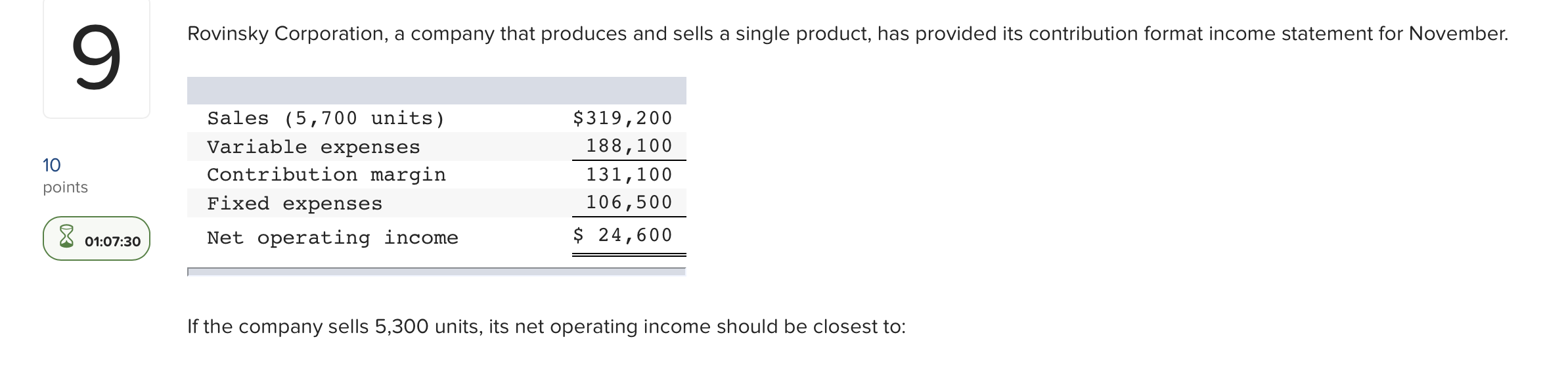

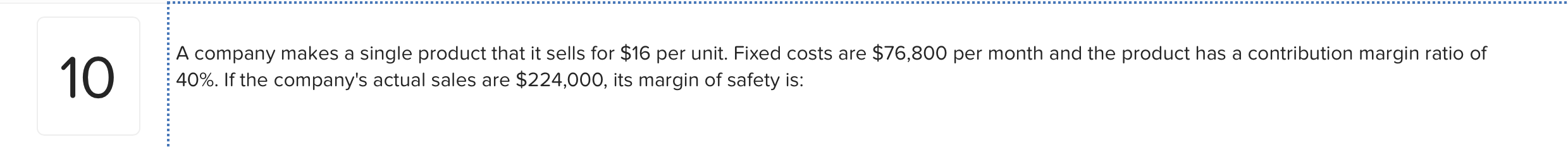

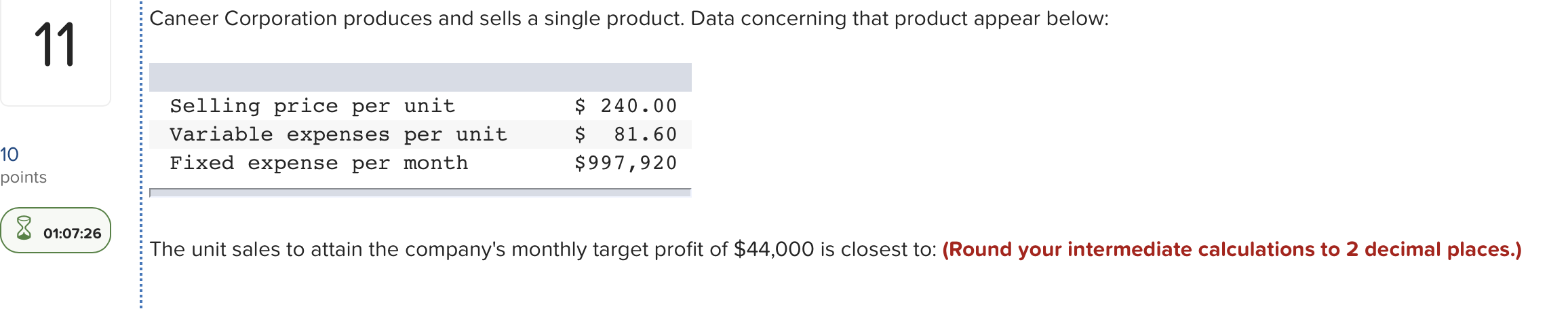

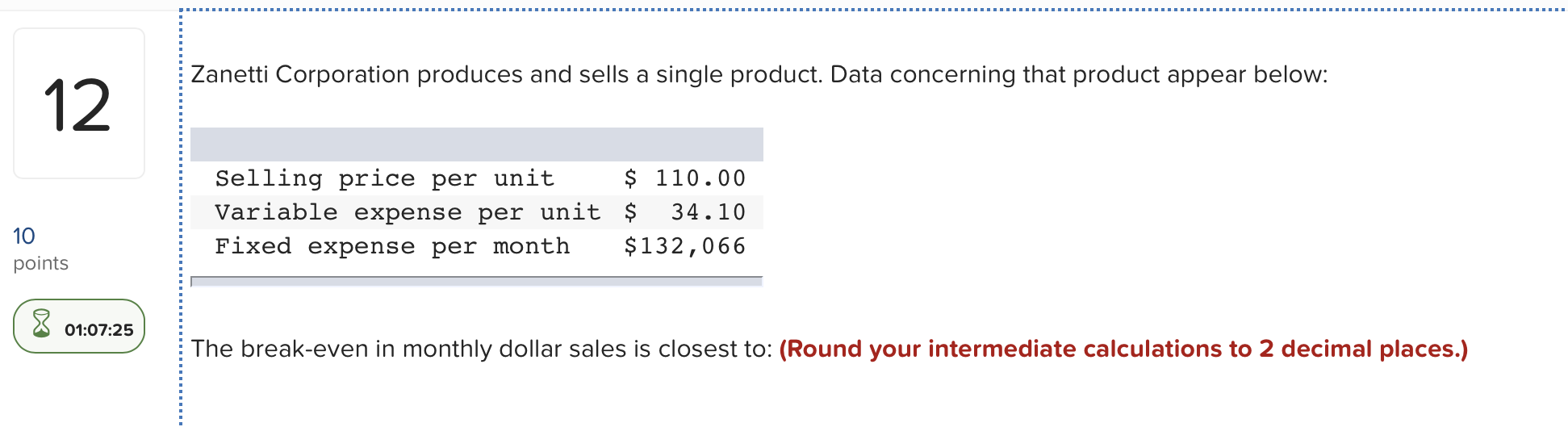

Bakan Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product. Production volume Direct materials Direct labor Manufacturing overhead 6,600 units $95.70 per unit $30.60 per unit $70.90 per unit 7,600 units $95.70 per unit $30.60 per unit $65.90 per unit The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.) Gayne Corporation's contribution margin ratio is 12% and its fixed monthly expenses are $84,000. If the company's sales for a month are $738,000, what is the best estimate of the company's net operating income? Assume that the fixed monthly expenses do not change. Chovanec Corporation produces and sells a single product. Data concerning that product appear below: Selling price Variable expenses Contribution margin Per Unit $170 68 $ 102 Percent of Sales 100% 40% 60% Fixed expenses are $521,000 per month. The company is currently selling 7,000 units per month. Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change? Bendel Inc. has an operating leverage of 5.8. If the company's sales increase by 12%, its net operating income should increase by about: A cement manufacturer has supplied the following data: 10 points Tons of cement produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income 260,000 $964,000 $229,000 $304,000 $108,400 $ 90,000 $ 232,600 ( 8 01:07:37 The company's contribution margin ratio is closest to: Data concerning Follick Corporation's single product appear below: Selling price per unit Variable expense per unit Fixed expense per month $ 110.00 $ 30.80 $321,552 10 points (8 01:07:36 The break-even in monthly dollar sales is closest to: (Round your intermediate calculations to 2 decimal places.) Lacourse Inc.'s inspection costs are listed below: 10 points Units Produced January 421 February 371 March 440 April 455 397 June 372 July 447 August 398 Inspection Costs $ 6,112 $ 5,630 $ 6,327 $ 6,465 $ 5,880 $ 5,633 $ 6,392 $ 5,893 ( 8 01:07:34 May Management believes that inspection cost is a mixed cost that depends on units produced. Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to: Data concerning Sinisi Corporation's single product appear below: Selling price per unit $ 200.00 Variable expense per unit $ 58.00 Fixed expense per month $407,540 10 points (8 01:07:32 The break-even in monthly unit sales is closest to: Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November. 10 Sales (5,700 units) Variable expenses Contribution margin Fixed expenses Net operating income $319,200 188,100 131,100 106,500 $ 24,600 points (8 01:07:30 If the company sells 5,300 units, its net operating income should be closest to: 10 A company makes a single product that it sells for $16 per unit. Fixed costs are $76,800 per month and the product has a contribution margin ratio of 40%. If the company's actual sales are $224,000, its margin of safety is: Caneer Corporation produces and sells a single product. Data concerning that product appear below: Selling price per unit Variable expenses per unit Fixed expense per month $ 240.00 $ 81.60 $997,920 10 points ( 8 01:07:26 The unit sales to attain the company's monthly target profit of $44,000 is closest to: (Round your intermediate calculations to 2 decimal places.) Zanetti Corporation produces and sells a single product. Data concerning that product appear below: 12 Selling price per unit $ 110.00 Variable expense per unit $ 34.10 Fixed expense per month $132,066 10 points ( 8 01:07:25 The break-even in monthly dollar sales is closest to: (Round your intermediate calculations to 2 decimal places.)