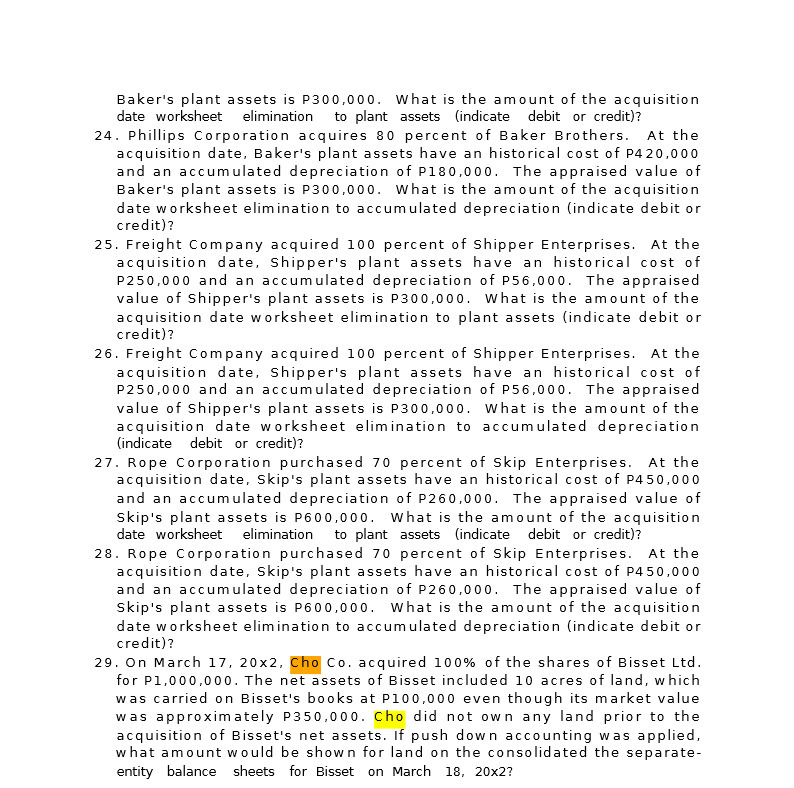

Baker's plant assets is P300,000. What is the amount of the acquisition date worksheet elimination to plant assets (indicate debit or credit)? 24. Phillips Corporation acquires 80 percent of Baker Brothers. At the acquisition date, Baker's plant assets have an historical cost of P420,000 and an accumulated depreciation of P180,000. The appraised value of Baker's plant assets is P300,000. What is the amount of the acquisition date worksheet elimination to accumulated depreciation (indicate debit or credit)? 25. Freight Company acquired 100 percent of Shipper Enterprises. At the acquisition date, Shipper's plant assets have an historical cost of P250,000 and an accumulated depreciation of P56,000. The appraised value of Shipper's plant assets is P300,000. What is the amount of the acquisition date worksheet elimination to plant assets (indicate debit or credit)? 26. Freight Company acquired 100 percent of Shipper Enterprises. At the acquisition date, Shipper's plant assets have an historical cost of P250,000 and an accumulated depreciation of P56,000. The appraised value of Shipper's plant assets is P300,000. What is the amount of the acquisition date worksheet elimination to accumulated depreciation (indicate debit or credit)? 27. Rope Corporation purchased 70 percent of Skip Enterprises. At the acquisition date, Skip's plant assets have an historical cost of P450,000 and an accumulated depreciation of P260,000. The appraised value of Skip's plant assets is P600,000. What is the amount of the acquisition date worksheet elimination to plant assets (indicate debit or credit)? 28. Rope Corporation purchased 70 percent of Skip Enterprises. At the acquisition date, Skip's plant assets have an historical cost of P450,000 and an accumulated depreciation of P260,000. The appraised value of Skip's plant assets is P600,000. What is the amount of the acquisition date worksheet elimination to accumulated depreciation (indicate debit or credit)? 29. On March 17, 20x2, Cho Co. acquired 100% of the shares of Bisset Ltd. for P1,000,000. The net assets of Bisset included 10 acres of land, which was carried on Bisset's books at P100,000 even though its market value was approximately P350,000. Cho did not own any land prior to the acquisition of Bisset's net assets. If push down accounting was applied, what amount would be shown for land on the consolidated the separate- entity balance sheets for Bisset on March 18, 20x2