Question

Baking Company uses an automated process to produce a baking product. For March , the company had the following activities in the pounding department, which

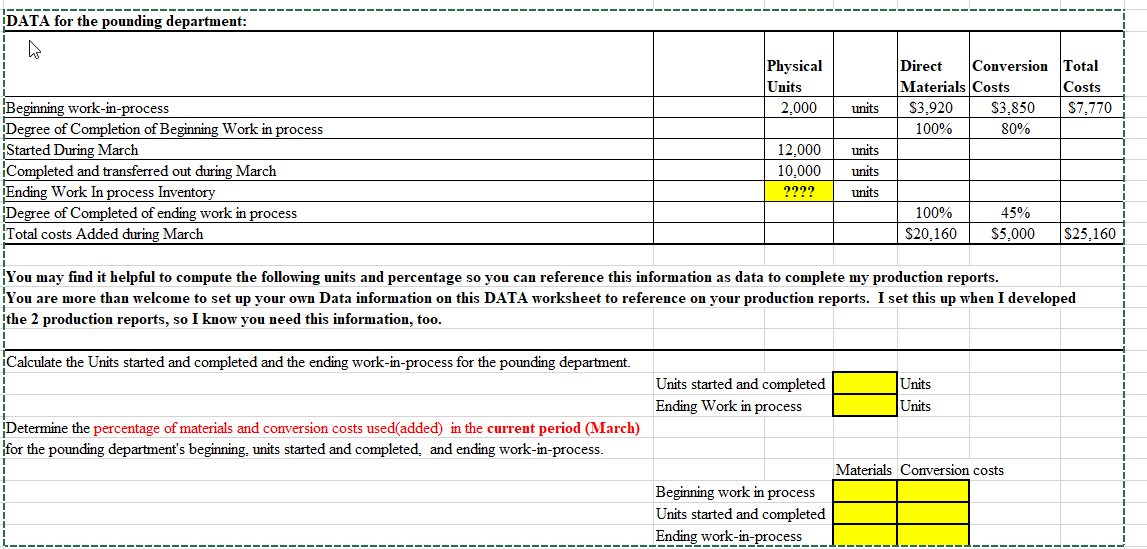

Baking Company uses an automated process to produce a baking product. For March, the company had the following activities in the pounding department, which is followed by the mixing department: Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process. After the pounding process is done the costs and the next production department is the mixing department. The pounding process is the first department in the process.

Needed

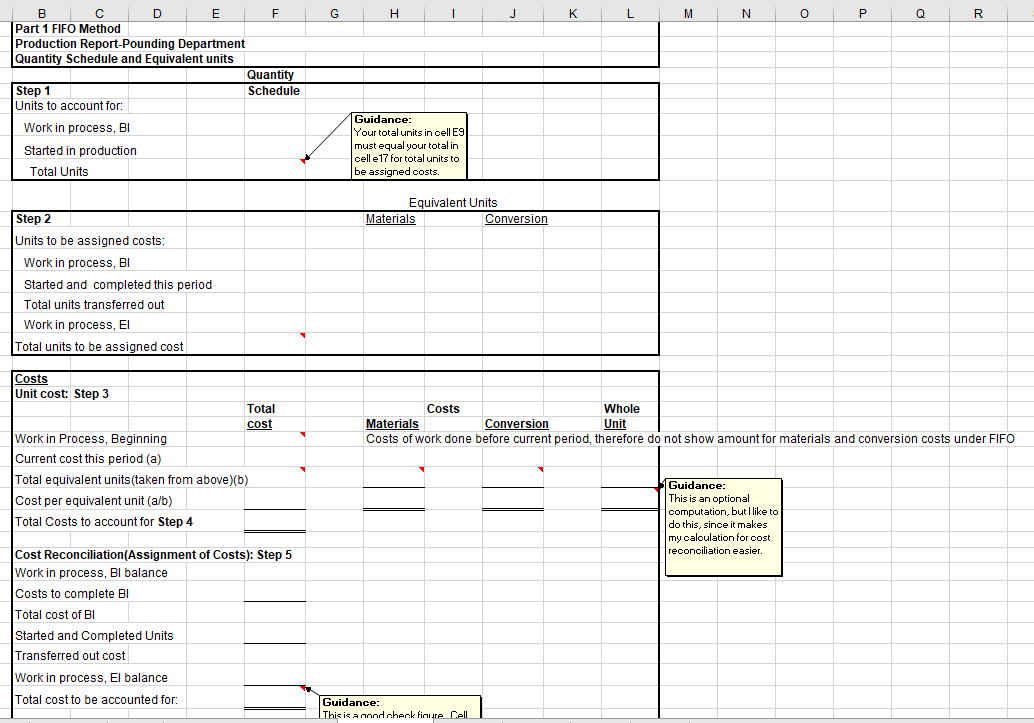

1. Production report for the pounding department using FIFO.

2. Journal entry to show the costs flowing from the pounding department to the mixing department.

------ DATA for the pounding department: Physical Units 2,000 Direct Conversion Materials Costs $3.920 $3,850 100% 80% Total Costs $7,770 units Beginning work-in-process Degree of Completion of Beginning Work in process Started During March Completed and transferred out during March Ending Work In process Inventory Degree of Completed of ending work in process Total costs Added during March 12.000 10.000 ???? units units units 100% $20,160 45% $5,000 $25.1601 You may find it helpful to compute the following units and percentage so you can reference this information as data to complete my production reports. You are more than welcome to set up your own Data information on this DATA worksheet to reference on your production reports. I set this up when I developed the 2 production reports, so I know you need this information, too. Calculate the Units started and completed and the ending work-in-process for the pounding department Units started and completed Ending Work in process Units Units Determine the percentage of materials and conversion costs used(added) in the current period (March) for the pounding department's beginning, units started and completed, and ending work-in-process. Materials Conversion costs Beginning work in process Units started and completed Ending work-in-process G H I J K L M N O P Q R B C D E F Part 1 FIFO Method Production Report-Pounding Department Quantity Schedule and Equivalent units Quantity Step 1 Schedule Units to account for: Work in process, BI Started in production Total Units Guidance: Your total units in cell E9 must equal your total in cell e17 for total units to be assigned costs. Equivalent Units Materials Conversion Step 2 Units to be assigned costs: Work in process, BI Started and completed this period Total units transferred out Work in process, El Total units to be assigned cost Costs Whole Materials Conversion Unit Costs of work done before current period, therefore do not show amount for materials and conversion costs under FIFO Costs Unit cost: Step 3 Total cost Work in Process, Beginning Current cost this period (a) Total equivalent units(taken from above)(b) Cost per equivalent unit (a/b) Total Costs to account for Step 4 Guidance: This is an optional computation, but I like to do this, since it makes my calculation for cost reconciliation easier. Cost Reconciliation(Assignment of Costs): Step 5 Work in process, Bl balance Costs to complete BI Total cost of BI Started and Completed Units Transferred out cost Work in process, El balance Total cost to be accounted for: Guidance: This is annod check finure Cell

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started