Answered step by step

Verified Expert Solution

Question

1 Approved Answer

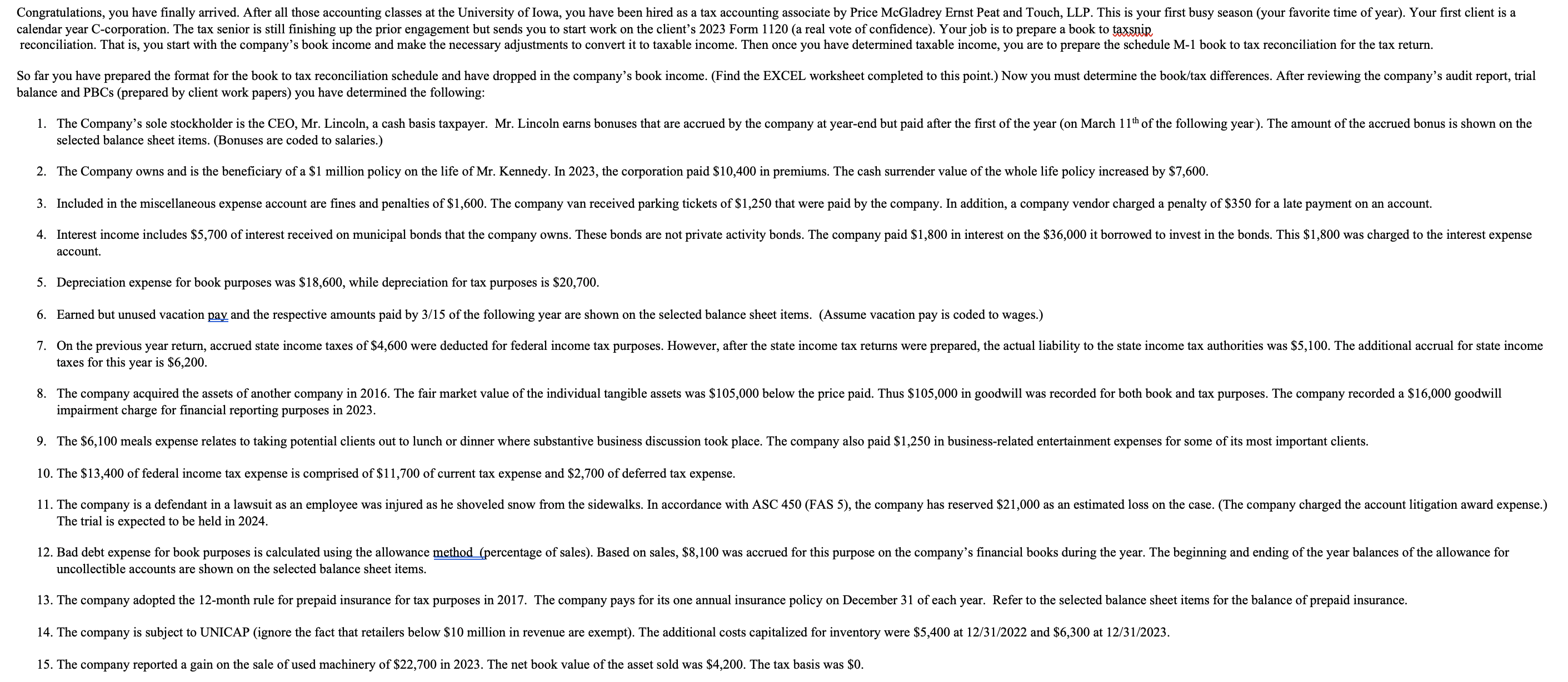

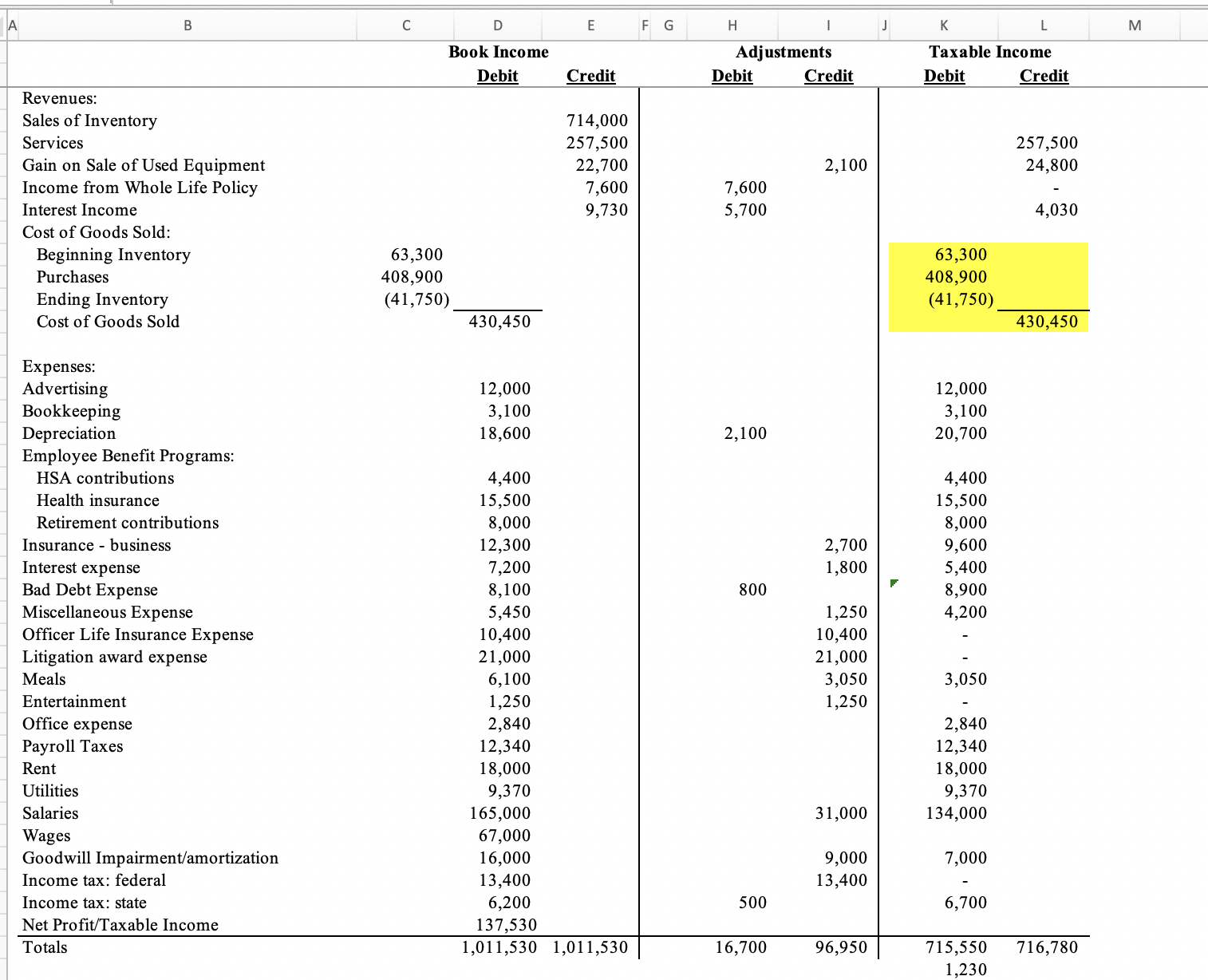

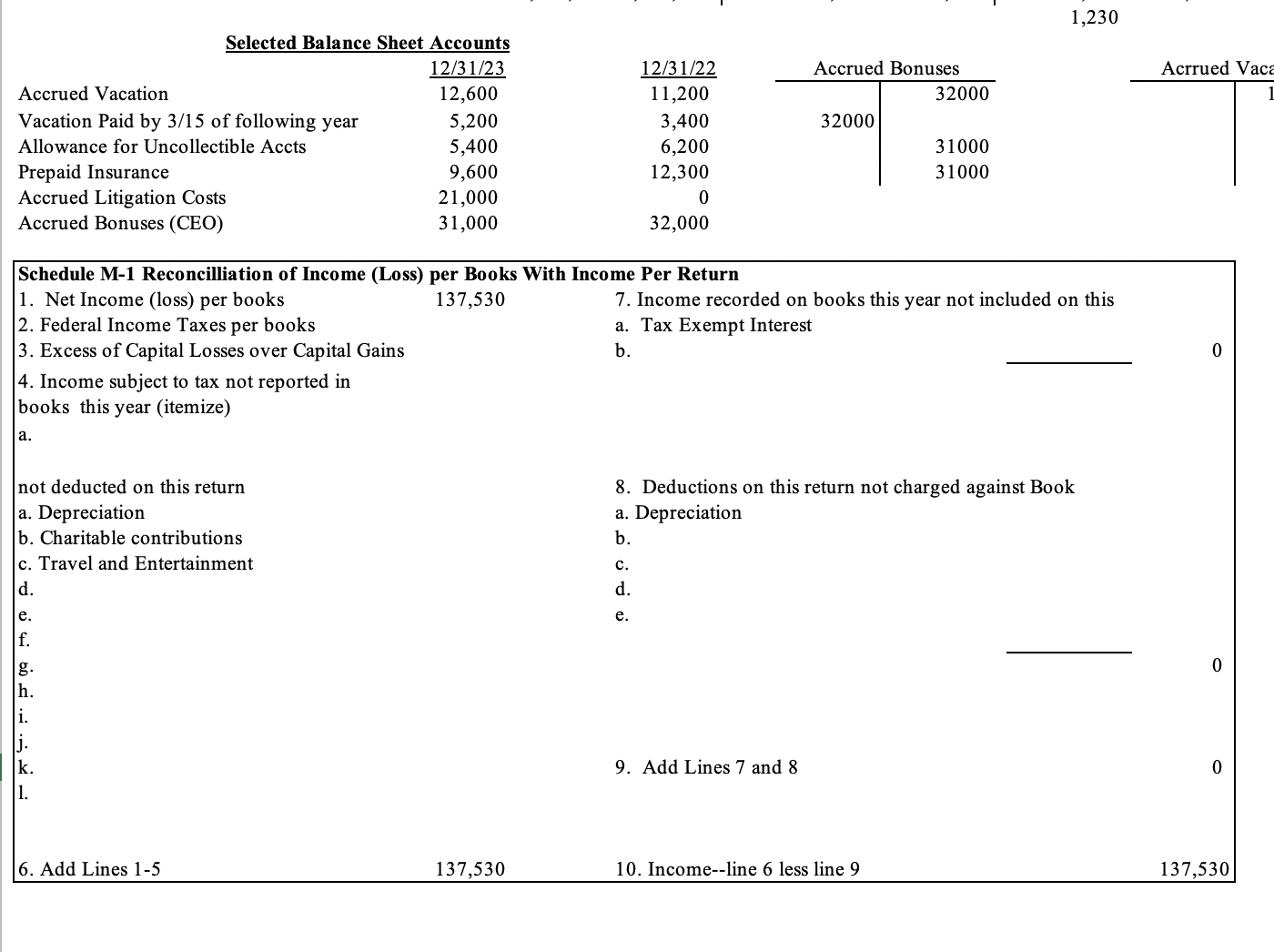

balance and PBCs (prepared by client work papers) you have determined the following: selected balance sheet items. (Bonuses are coded to salaries.) account. 5. Depreciation

balance and PBCs (prepared by client work papers) you have determined the following: selected balance sheet items. (Bonuses are coded to salaries.) account. 5. Depreciation expense for book purposes was $18,600, while depreciation for tax purposes is $20,700. 6. Earned but unused vacation pay and the respective amounts paid by 3/15 of the following year are shown on the selected balance sheet items. (Assume vacation pay is coded to wages.) taxes for this year is $6,200. impairment charge for financial reporting purposes in 2023. 10. The $13,400 of federal income tax expense is comprised of $11,700 of current tax expense and $2,700 of deferred tax expense. The trial is expected to be held in 2024. uncollectible accounts are shown on the selected balance sheet items. 15. The company reported a gain on the sale of used machinery of $22,700 in 2023 . The net book value of the asset sold was $4,200. The tax basis was $0. Selected Balance Sheet Accounts 12,60012/31/235,2005,4009,60021,00031,00011,20012/31/223,4006,20012,300032,000 1,230 Accrued Vacation Vacation Paid by 3/15 of following year Allowance for Uncollectible Accts Prepaid Insurance Accrued Litigation Costs Accrued Bonuses (CEO) Schedule M-1 Reconcilliation of Income (Loss) per Books With Income Per Return 1. Net Income (loss) per books 2. Federal Income Taxes per books 3. Excess of Capital Losses over Capital Gains 4. Income subject to tax not reported in books this year (itemize) a. not deducted on this return a. Depreciation b. Charitable contributions c. Travel and Entertainment d. e. f. g. h. i. j. k. 1. 137,530 7. Income recorded on books this year not included on this a. Tax Exempt Interest b. 8. Deductions on this return not charged against Book a. Depreciation b. c. d. e. 9. Add Lines 7 and 8 10. Income--line 6 less line 9 Acrrued Vace 31000 0 6. Add Lines 1-5 137,530 137,530 balance and PBCs (prepared by client work papers) you have determined the following: selected balance sheet items. (Bonuses are coded to salaries.) account. 5. Depreciation expense for book purposes was $18,600, while depreciation for tax purposes is $20,700. 6. Earned but unused vacation pay and the respective amounts paid by 3/15 of the following year are shown on the selected balance sheet items. (Assume vacation pay is coded to wages.) taxes for this year is $6,200. impairment charge for financial reporting purposes in 2023. 10. The $13,400 of federal income tax expense is comprised of $11,700 of current tax expense and $2,700 of deferred tax expense. The trial is expected to be held in 2024. uncollectible accounts are shown on the selected balance sheet items. 15. The company reported a gain on the sale of used machinery of $22,700 in 2023 . The net book value of the asset sold was $4,200. The tax basis was $0. Selected Balance Sheet Accounts 12,60012/31/235,2005,4009,60021,00031,00011,20012/31/223,4006,20012,300032,000 1,230 Accrued Vacation Vacation Paid by 3/15 of following year Allowance for Uncollectible Accts Prepaid Insurance Accrued Litigation Costs Accrued Bonuses (CEO) Schedule M-1 Reconcilliation of Income (Loss) per Books With Income Per Return 1. Net Income (loss) per books 2. Federal Income Taxes per books 3. Excess of Capital Losses over Capital Gains 4. Income subject to tax not reported in books this year (itemize) a. not deducted on this return a. Depreciation b. Charitable contributions c. Travel and Entertainment d. e. f. g. h. i. j. k. 1. 137,530 7. Income recorded on books this year not included on this a. Tax Exempt Interest b. 8. Deductions on this return not charged against Book a. Depreciation b. c. d. e. 9. Add Lines 7 and 8 10. Income--line 6 less line 9 Acrrued Vace 31000 0 6. Add Lines 1-5 137,530 137,530

balance and PBCs (prepared by client work papers) you have determined the following: selected balance sheet items. (Bonuses are coded to salaries.) account. 5. Depreciation expense for book purposes was $18,600, while depreciation for tax purposes is $20,700. 6. Earned but unused vacation pay and the respective amounts paid by 3/15 of the following year are shown on the selected balance sheet items. (Assume vacation pay is coded to wages.) taxes for this year is $6,200. impairment charge for financial reporting purposes in 2023. 10. The $13,400 of federal income tax expense is comprised of $11,700 of current tax expense and $2,700 of deferred tax expense. The trial is expected to be held in 2024. uncollectible accounts are shown on the selected balance sheet items. 15. The company reported a gain on the sale of used machinery of $22,700 in 2023 . The net book value of the asset sold was $4,200. The tax basis was $0. Selected Balance Sheet Accounts 12,60012/31/235,2005,4009,60021,00031,00011,20012/31/223,4006,20012,300032,000 1,230 Accrued Vacation Vacation Paid by 3/15 of following year Allowance for Uncollectible Accts Prepaid Insurance Accrued Litigation Costs Accrued Bonuses (CEO) Schedule M-1 Reconcilliation of Income (Loss) per Books With Income Per Return 1. Net Income (loss) per books 2. Federal Income Taxes per books 3. Excess of Capital Losses over Capital Gains 4. Income subject to tax not reported in books this year (itemize) a. not deducted on this return a. Depreciation b. Charitable contributions c. Travel and Entertainment d. e. f. g. h. i. j. k. 1. 137,530 7. Income recorded on books this year not included on this a. Tax Exempt Interest b. 8. Deductions on this return not charged against Book a. Depreciation b. c. d. e. 9. Add Lines 7 and 8 10. Income--line 6 less line 9 Acrrued Vace 31000 0 6. Add Lines 1-5 137,530 137,530 balance and PBCs (prepared by client work papers) you have determined the following: selected balance sheet items. (Bonuses are coded to salaries.) account. 5. Depreciation expense for book purposes was $18,600, while depreciation for tax purposes is $20,700. 6. Earned but unused vacation pay and the respective amounts paid by 3/15 of the following year are shown on the selected balance sheet items. (Assume vacation pay is coded to wages.) taxes for this year is $6,200. impairment charge for financial reporting purposes in 2023. 10. The $13,400 of federal income tax expense is comprised of $11,700 of current tax expense and $2,700 of deferred tax expense. The trial is expected to be held in 2024. uncollectible accounts are shown on the selected balance sheet items. 15. The company reported a gain on the sale of used machinery of $22,700 in 2023 . The net book value of the asset sold was $4,200. The tax basis was $0. Selected Balance Sheet Accounts 12,60012/31/235,2005,4009,60021,00031,00011,20012/31/223,4006,20012,300032,000 1,230 Accrued Vacation Vacation Paid by 3/15 of following year Allowance for Uncollectible Accts Prepaid Insurance Accrued Litigation Costs Accrued Bonuses (CEO) Schedule M-1 Reconcilliation of Income (Loss) per Books With Income Per Return 1. Net Income (loss) per books 2. Federal Income Taxes per books 3. Excess of Capital Losses over Capital Gains 4. Income subject to tax not reported in books this year (itemize) a. not deducted on this return a. Depreciation b. Charitable contributions c. Travel and Entertainment d. e. f. g. h. i. j. k. 1. 137,530 7. Income recorded on books this year not included on this a. Tax Exempt Interest b. 8. Deductions on this return not charged against Book a. Depreciation b. c. d. e. 9. Add Lines 7 and 8 10. Income--line 6 less line 9 Acrrued Vace 31000 0 6. Add Lines 1-5 137,530 137,530 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started